Creating estimates and invoices shouldn’t slow you down. The right estimate and invoice app helps contractors and small business owners generate quotes, convert them into invoices, and get paid—fast. Instead of juggling paperwork, you can handle everything from your phone or tablet.

For businesses managing jobs in the field, integrating invoicing with field service management keeps operations running smoothly. The best apps do more than just send invoices—they connect with scheduling, dispatching, and payment systems to streamline your workflow. In this guide, we’ll break down everything you need to know about choosing the best estimate and invoice app for contractors, including:

- Choosing the right invoice maker and estimate app

- 6 key features to look for in an estimate and invoice app

- Types of estimate invoice apps and what they can do

- 6 best estimate and invoice apps for contractors

- 5 benefits of using an app for estimates and invoices

- 4 common FAQs about invoice maker and estimate apps

Up next, we’ll break down how to pick the right estimate and invoice app for your business and provide a detailed overview of the features and benefits that these apps can offer.

Choosing the right invoice maker and estimate app

The right estimate and invoice app should fit seamlessly into your workflow, making it easier to create estimates, send invoices, and get paid—without extra hassle. Here’s what to consider before making your choice:

- Ease of use – Can you create and send estimates or invoices in just a few taps? Does the app have an intuitive design that won’t slow you down? Will your team need extensive training, or can they start using it right away?

- Mobile accessibility – Does the app work smoothly on smartphones and tablets? Can you create estimates and invoices in the field without needing a computer? Does it offer cloud syncing, so you never lose important data?

- Integration – Will it sync with accounting software like QuickBooks or Xero? Can it connect to field service management platforms, scheduling tools, and CRMs to keep everything organized? Does it eliminate double data entry between different systems?

- Payment processing – Can customers pay directly through the invoice using credit cards, ACH, or mobile wallets? Does it offer automated payment reminders to reduce late payments? Are transaction fees reasonable, or will they eat into your profits?

- Customization – Does the app allow you to add your company logo, adjust invoice templates, and include detailed line items for labor and materials? Can you save custom pricing lists to speed up future estimates? Does it let you convert estimates into invoices with one click?

- Key features – Does it support automation for recurring invoices, tax calculations, and customer follow-ups? Can you track outstanding payments and send reminders? Does it provide reporting tools to help you analyze revenue trends and cash flow?

Next, we’ll break down the must-have features in an estimate and invoice app.

6 key features to look for in an estimate and invoice app

The best estimate and invoice app for contractors simplifies how technicians quote jobs, track approvals, and get paid. Without the right tools, field service teams waste valuable time chasing paperwork, manually entering data, or waiting on office approvals. These are the six must-have features that make this process smooth, efficient, and profitable:

1. Mobile accessibility for on-site invoicing

A reliable estimate and invoice app should work seamlessly on any mobile device, allowing technicians to create estimates, generate invoices, and collect payments from the field. This eliminates unnecessary office visits and speeds up the entire process.

Let’s say an HVAC technician just wrapped up a routine maintenance call. Instead of heading back to the office to finalize paperwork, they pull up a field service app with estimating and invoicing, add labor costs, and send an invoice before even leaving the customer’s driveway. No delays, no missed charges—just quick, accurate invoicing.

2. CRM integration for customer history & job tracking

A powerful app connects with customer relationship management (CRM) tools to store service history, past invoices, and customer preferences in one place. This ensures that every estimate and invoice is based on accurate, up-to-date information.

Consider a roofing contractor visiting a repeat customer for an inspection. Instead of asking for details, they check their CRM platform with estimating and invoicing and see the customer’s last repair invoice. With this info, they recommend the next steps, provide an estimate instantly, and move forward without delay.

3. Automated payments for faster cash flow

An estimate and invoice app should include built-in payment processing, allowing customers to pay directly through invoices via credit card, ACH transfer, or mobile wallet. This reduces late payments and keeps cash flow steady.

Picture a general contractor wrapping up a small remodeling job. Instead of waiting weeks for a check, they generate an invoice in their payment solution with invoicing and give the client the option to pay on the spot. The payment is processed immediately, and the job is officially closed out—no chasing down overdue balances.

4. Dispatching and scheduling for job coordination

Seamless scheduling and dispatching integration allows contractors to assign jobs, track progress, and keep technicians updated in real-time—all from within the same app.

For example, an electrical technician is assigned a last-minute emergency call. Instead of waiting for a call from dispatch, they get a notification from their dispatch system with estimating and invoicing, see job details, and head straight to the site. No miscommunication, no wasted time—just efficient service.

5. Reporting and job performance insights

A top-tier app should include reporting tools that track revenue, outstanding invoices, and technician efficiency, helping businesses make smarter financial decisions.

Imagine a fire protection company noticing a pattern—certain jobs are taking longer than expected. With insights from their reporting dashboard for estimating and invoicing, they pinpoint the bottlenecks, adjust technician schedules, and improve job turnaround times.

6. Service agreements for recurring work

For businesses handling maintenance contracts, an app should support automated service agreements, ensuring that scheduled visits are never missed and invoices go out on time.

Say a refrigeration contractor manages maintenance for restaurant chains. Instead of manually tracking service dates, their service agreement software with estimating and invoicing automatically schedules the next visit, notifies the customer, and generates an invoice as soon as the job is complete—no missed services, no billing delays.

Other useful features for an estimate & invoice app

Beyond the core functions, some invoice maker and estimate apps offer additional tools that enhance efficiency and accuracy. Here are three more features that can make a big impact:

- Route optimization & fleet tracking – A built-in fleet tracking system helps track technician locations, optimize routes, and reduce fuel costs.

- Time tracking & labor management – A time tracking software lets technicians log hours directly into invoices, ensuring accurate billing for labor.

- Pipeline & job progress tracking – A tool for lead generation helps monitor job statuses, from initial estimate approvals to final invoice payments.

Get paid fast and on time

Close more deals and speed up payments with reliable, accurate estimating and billing.

These extra features streamline workflows, improve accuracy, and help businesses stay on top of their finances. The best apps for estimates and invoices aren’t just about convenience—they’re about improving efficiency, reducing delays, and keeping operations running smoothly. Next, we’ll dive into the different types of invoice maker and estimate apps and how they fit various business needs.

Types of estimate invoice apps and what they can do

Invoice maker and estimate apps come in different formats, each designed to suit specific business needs and workflows. The best choice depends on how mobile your team is, what features you require, and how well the app integrates with your existing systems.

Here are the three main types:

- Desktop software: These apps are installed on office computers and typically offer robust accounting and invoicing features. They’re ideal for contractors who handle estimates and invoices from a fixed location but may not be the best fit for teams needing real-time access in the field.

- Cloud-based solutions: These apps store data online, allowing technicians and office staff to access invoices and estimates from anywhere with an internet connection. They’re perfect for businesses that require mobility, real-time syncing, and integration with dispatch and payment systems.

- Mobile invoicing and payment apps: Designed for technicians on the go, these apps enable instant estimates, digital signatures, and on-site payment collection. They streamline job completion by allowing field teams to generate invoices and process payments without returning to the office.

Each type of invoice maker and estimate app serves a unique purpose. Whether you need a full-service platform with accounting features, a flexible cloud solution for remote access, or a mobile app for technicians in the field, choosing the right tool ensures smoother operations and faster payments.

6 best estimate and invoice apps for contractors

These are our top choices for the best invoice maker and estimate apps available. Each app caters to different business needs, offering unique features that help streamline estimating, invoicing, and payment collection. We’ve labeled them based on what makes them stand out—so you can find the best fit for your business.

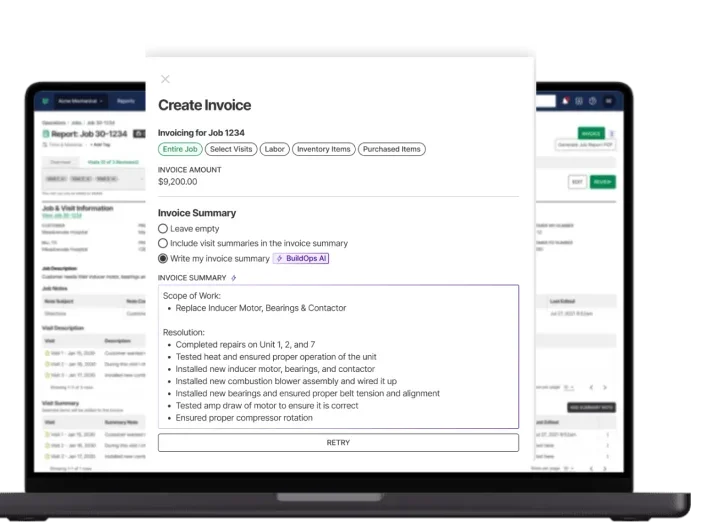

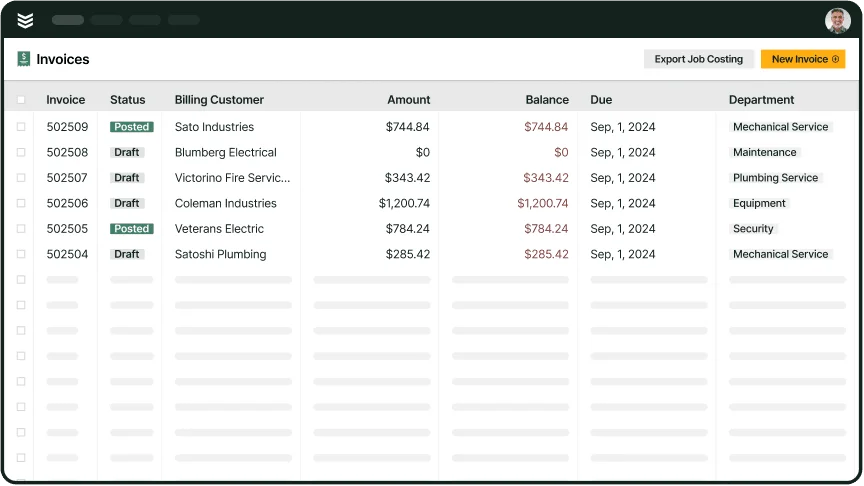

1. Best for commercial contractors: BuildOps

BuildOps is a cloud-based invoice maker and estimate app designed specifically for commercial contractors. It enables technicians to create estimates, convert them into invoices in real-time, and collect payments on-site—all while syncing seamlessly with service management systems. Its powerful features make it a top choice for contractors handling large projects, high-volume service calls, and complex job pricing.

App type: Cloud-based solution

How pricing works: BuildOps offers personalized demos and tailored solutions to match your business needs.

Features beyond invoicing:

- Real-time job tracking and scheduling

- On-site estimate-to-invoice conversion with automatic data syncing

- Centralized customer information for easy access

What sets it apart for commercial: BuildOps is built to handle the demands of commercial contractors by integrating estimating and invoicing with dispatch, scheduling, and CRM tools. It helps streamline multi-location projects, improve workflow efficiency, and reduce administrative headaches.

Make sure jobs run smoothly

Provide commercial contractors estimate and invoice jobs faster.

2. Best for residential contractors: Kickserv

Image Source: Kickserv

Kickserv is built for small residential contractors who need a simple way to manage estimates, invoicing, and payments. It offers an intuitive interface, making it easy to generate estimates, track jobs, and send invoices—all while on the go. However, its features may not be robust enough for larger businesses handling complex commercial projects.

App type: Cloud-based solution

How pricing works: Kickserv offers tiered pricing plans based on business size and needs, with higher-tier plans unlocking additional features.

Features beyond invoicing:

- Built-in scheduling and client communication tools

- Mobile-friendly estimating and invoicing

- Integration with QuickBooks and Stripe

What sets it apart: Kickserv’s "Customer Center" allows homeowners to manage invoices, approve estimates, and make payments, giving residential contractors more time to focus on their jobs.

3. Best for freelancers & solo contractors: Invoice2go

Image Source: Invoice2go

Invoice2go is a lightweight estimating and invoicing app designed for self-employed professionals and small service providers. It allows users to create invoices and estimates in minutes, making it a great choice for freelancers. However, it lacks advanced job tracking and scheduling features, which may not be ideal for growing businesses.

App type: Cloud-based solution

How pricing works: Invoice2go offers a subscription model with different pricing tiers based on the number of invoices sent per year.

Features beyond invoicing:

- Quick invoice and estimate creation

- Mobile-friendly design for on-the-go invoicing

- Simple expense tracking

What sets it apart: Invoice2go is designed for independent contractors who need an easy way to manage basic invoicing without extra complexity.

4. Best for integrated accounting: QuickBooks Online

Image Source: QuickBooks Online

QuickBooks Online is an all-in-one accounting and invoicing solution that works well for businesses needing financial management tools alongside estimating and invoicing. However, its advanced features come with a learning curve, and it may be overkill for businesses that only need a straightforward estimate and invoice tool.

App type: Cloud-based solution

How pricing works: QuickBooks Online offers subscription plans that vary in pricing based on features like payroll and advanced reporting.

Features beyond invoicing:

- Full accounting suite with financial reports

- Automated tax calculations and expense tracking

- Integration with payroll and payment processing tools

What sets it apart: QuickBooks Online is ideal for businesses that need comprehensive bookkeeping and invoicing tools in one platform.

5. Best for on-site payments: Square Invoices

Image Source: Square

Square Invoices is a mobile-first solution for businesses that need fast, secure on-site payments. It integrates seamlessly with Square’s payment ecosystem, making it easy for technicians to send invoices and accept credit card payments instantly. However, it lacks advanced job tracking and field service management tools.

App type: Cloud-based solution

How pricing works: Square Invoices offers a free plan with transaction-based fees and premium plans for advanced features.

Features beyond invoicing:

- Instant payment collection via credit card and digital wallets

- Automated payment reminders

- Recurring invoicing for service contracts

What sets it apart: Square Invoices is best for businesses that prioritize quick and easy payment collection while on-site.

6. Best free estimate & invoice app: Wave

Image Source: Wave

Wave is a free invoicing solution for small businesses that need basic estimating and invoicing without monthly fees. It’s a great budget-friendly option, but it lacks advanced features like job scheduling and automation, which can be limiting for growing businesses.

App type: Cloud-based solution

How pricing works: Wave is free to use for invoicing, with optional paid add-ons for payroll and payment processing.

Features beyond invoicing:

- Unlimited invoicing with custom branding

- Online payment acceptance via credit cards and bank transfers

- Simple financial reporting tools

What sets it apart: Wave is one of the best free invoicing apps for small businesses that need basic invoicing without extra costs.

This list covers a range of estimate and invoice apps, each suited for different business needs. Whether you need a simple invoicing tool or a full-service commercial estimating platform, choosing the right app can help streamline operations, improve cash flow, and reduce administrative headaches.

5 benefits of using an app for estimates and invoices

A powerful invoice and estimate app directly impacts job efficiency, cash flow, and customer satisfaction. Field service teams that rely on manual invoicing or disconnected systems often face delays, missed payments, and disorganized job tracking. With the right mobile app, technicians can generate estimates on-site, convert them into invoices, and collect payments instantly—all without extra back-and-forth with the office. Here’s how an estimate and invoice app can transform field service operations:

1. Faster payments and reduced delays

Manually creating invoices at the end of the day—or worse, at the end of the week—causes payment delays and disrupts cash flow. A mobile app ensures invoices are generated and sent immediately after a job is completed, allowing customers to pay on the spot. Built-in digital payment options further eliminate the hassle of waiting for checks or bank transfers.

Deep Dive

To see how timing impacts payments and learn best practices for improving your invoicing process, check out this in-depth report: The Invoicing Sweet Spot: How Timing Impacts How Fast You Get Paid.

2. Improved job scheduling and organization

When estimates and invoices are tied to a scheduling system, technicians always have the most up-to-date job details. This means no more double bookings, lost estimates, or miscommunication about job scope. Real-time updates ensure the entire team—from field techs to office staff—stays on the same page, reducing unnecessary job site visits.

3. Reduced admin workload for technicians

Technicians shouldn't have to spend extra hours filling out invoices manually or calling the office for payment details. A mobile app streamlines this process by auto-filling job information, pulling in approved estimates, and calculating costs instantly. This frees up more time for actual service work instead of paperwork.

4. Fewer invoicing errors and disputes

Handwritten invoices and manual data entry often lead to mistakes—incorrect totals, missing service details, or forgotten materials. With a mobile app, technicians can create detailed, accurate invoices that automatically include labor, parts, and taxes. Customers receive clear breakdowns, reducing disputes and the need for follow-ups.

5. Seamless connection between field and office teams

While an estimate and invoice app keeps technicians efficient in the field, contractor estimate and invoice software helps the office team track invoices, manage payments, and ensure nothing slips through the cracks. The software side focuses on financial reporting, batch invoicing, and customer records—while the mobile app keeps field teams productive and cash flow steady.

A well-integrated estimate and invoice app eliminates inefficiencies, ensures faster payments, and gives field service teams the tools they need to complete jobs without administrative headaches.

4 common FAQs about invoice maker and estimate apps

Field service businesses rely on efficiency, and a Scheduling and Invoicing App helps eliminate unnecessary delays, manual errors, and administrative headaches. But with so many options available, contractors often have questions about how these tools work and what to look for. Here are four key FAQs answered.

1. What is an estimate and invoice app?

An estimate and invoice app is a mobile & cloud-based tool that allows businesses to create, send, and manage job estimates and invoices. It helps field technicians generate accurate pricing for services, convert estimates into invoices with a single tap, and collect payments on-site or online.

2. How does an estimate and invoice app help field service teams?

Field service teams benefit from these apps by reducing paperwork, eliminating invoicing delays, and ensuring accurate job pricing. Technicians can quickly generate estimates, adjust pricing based on job scope, and get customer approvals in real-time—without having to call the office or return for manual invoicing.

3. Can an estimate and invoice app integrate with other business tools?

Yes, most modern apps integrate with accounting software, scheduling tools, and payment processors. This allows for seamless data flow between field technicians and office staff, reducing errors and improving efficiency across operations.

4. What should I look for when choosing an estimate and invoice app?

Key factors to consider include mobile accessibility, real-time syncing with dispatch and scheduling, integration with accounting tools, and automated payment processing. The best apps also offer customization for branding, tax calculations, and reporting features to keep your business organized and profitable.

The right estimate and invoice app is more than just a billing tool—it’s a game-changer for field service teams. By streamlining estimates, automating invoices, and ensuring faster payments, these apps eliminate unnecessary paperwork and help technicians focus on what they do best. Whether you need real-time job tracking, seamless customer approvals, or on-the-go payment collection, choosing the right solution can make all the difference in efficiency and cash flow.

For commercial contractors handling complex projects and high-volume service calls, an all-in-one platform like BuildOps brings estimating, invoicing, scheduling, and dispatching into a single system. With everything connected, teams can create estimates, send invoices, and track payments without juggling multiple tools.

Want to see how BuildOps works?

Simplify estimating and invoicing while keeping your ops running smoothly.