You just wrapped a job—cleared the line, replaced the heater, maybe even patched a nasty leak. But now you’ve got to stop, sit down, and figure out how to bill it. If your invoicing system is a mess (or mostly in your head), getting paid turns into another job in itself.

For plumbing contractors, the back office can’t afford to be an afterthought. Invoicing needs to be quick, clear, and buttoned up—whether it’s for a one-hour fix or a multi-day install. This guide discusses all you need to know about cleaning up your invoicing game, including:

- 10 key components of plumbing invoices

- When should you send a plumbing invoice?

- Types of plumbing invoice templates and when to use each

- Top plumbing invoicing software for different types of contractors

- 10 plumbing invoicing best practices to help you avoid common mistakes

Before you can fix your invoicing process, you’ve got to know what a plumbing invoice actually needs to do. It’s not just a bill—it’s proof of the work, a record of the job, and your shot at getting paid without the back-and-forth. Let’s start by breaking down what a plumbing invoice is and why getting it right matters. For insights tailored to field techs, check out our separate guide to the 16 best plumbing invoice templates.

10 key components of plumbing invoices

A solid plumbing invoice clears up confusion, prevents delays, and helps you get paid without the follow-up dance. Plumbing jobs can involve permits, emergency service fees, material markups, and labor across multiple visits—so your invoice needs to reflect the full picture.

Here are 10 essentials every plumbing invoice should include:

- Business info – Add your company name, phone number, address, license number, and email so your client knows who it came from and how to reach you.

- Customer details – List the client’s name, job site address, and contact info. This clears up who the bill is for and where the work was done.

- Invoice number – Use a unique ID for each invoice. Makes it easy to reference the job later if questions pop up.

- Invoice and due dates – Include when the invoice was sent and when payment is due. Keeps expectations clear from the start.

- Work performed – Spell out exactly what was done. Whether it’s snaking a drain, installing a tankless heater, or repairing a burst pipe—list each task clearly.

- Materials used – Include any parts or fixtures installed: copper pipe, fittings, valves, water heaters, etc. Add quantities and unit prices so everything’s transparent.

- Labor charges – Break down labor costs. If you bill by the hour or by the job, make it obvious how time was billed.

- Totals and taxes – Add up the subtotal, taxes, and final total. Make it easy for clients to see how you got to the final amount.

- Payment terms – Let the customer know how to pay, when to pay, and what happens if they don’t (like late fees or discounts for early payment).

- Extra notes – Use this area for anything else: warranty details, permit numbers, inspection follow-ups, or even a thank-you note.

A clear, detailed invoice does more than just speed up payments—it helps avoid disputes, builds trust with clients, and keeps your plumbing business running tight. Now that the foundation’s covered, let’s look at when to actually send your invoice to keep the money moving and the work flowing.

When should you send a plumbing invoice?

Billing at the right time can keep your cash flow steady and reduce the chances of a payment dragging out. Too soon, and it gets lost in the shuffle. Too late, and you’re chasing it down. The best time to invoice depends on the type of plumbing work—but there’s data that points to a clear window.

Expert Tip

Based on industry research on the invoicing sweet spot, plumbing contractors who send invoices within 7 days of completing the job get paid up to 70% faster than those who wait longer. That speed matters—especially when you’ve got parts on order, payroll to meet, or more jobs lined up.

Here’s a breakdown of when to hit “send” after the job, depending on the work:

- 0–10 Days: This is your best bet for most plumbing jobs—think leak repairs, fixture swaps, or water heater installs. The job’s fresh in your client’s mind, the urgency is still there, and you're less likely to get pushback. Make sure the invoice clearly lists materials, labor, and any added charges like emergency rates or permit fees.

- 10–20 Days: This can still work for larger installs or multi-day commercial jobs, especially when billing is tied to job phases. But the longer you wait, the harder it is to avoid confusion. If you're using milestone billing, spell it out in the estimate and stick to those checkpoints.

- 20+ Days: Unless you're under contract with net-30 terms, waiting this long increases the chances of late payments—or no payment. Invoices get buried or questioned, even if the work was solid. If you're regularly invoicing this late, it's time to clean up the process.

Set a consistent practice: invoice the day the job wraps or by week’s end. It helps you stay on top of billing—even when the schedule gets slammed.

Get paid faster without the back-and-forth?

BuildOps helps plumbers reduce errors and improve efficiency when billing.

Recurring invoices for service contracts

For long-term maintenance work or service agreements, recurring invoices save time and keep your billing consistent. Instead of sending a new invoice after every visit, set a schedule—monthly, quarterly, or annually—based on your contract terms. This gives your client a predictable payment schedule and keeps your revenue steady. Recurring billing works well for:

- Preventive maintenance programs

- Multi-property commercial clients

- Service agreements that span several months or more

Use plumbing invoice software that automates these recurring invoices, so you’re not stuck recreating the same document every time. Just set the interval, review it once, and let the system take care of the rest.

When to invoice upfront in plumbing work

There are times when billing before the job protects your time and resources—especially if you're locking in labor or ordering specialty parts. If the job requires prep or upfront investment, don’t wait to invoice. Send an invoice ahead when:

- You’re ordering custom, non-refundable materials

- A deposit is required to get on the schedule

- You’ve booked subcontractors or blocked out a specific time

Be clear with clients from the start. Include billing expectations in your estimate, then follow up with an invoice once they approve the job. It sets the tone early and helps avoid delays or disputes when the work begins.

Types of plumbing invoice templates and when to use each

Different plumbing jobs call for different invoice formats. Whether you’re handling a one-time emergency or billing across multiple phases, the template you use can make or break how fast you get paid. For a visual breakdown of how each type looks, check out our full list of the best plumbing invoice examples.

1. Service invoice

Used for routine calls like clogged drains, leaky faucets, or quick fixture swaps. These are usually wrapped up in a single visit. The invoice should clearly show what was done, how long it took, and what parts were used. Most are sent right after the job—either on-site or digitally.

2. Repair invoice

Covers work where diagnostics are part of the process—think slab leaks, cracked pipes, or water heater issues. These invoices need to outline the problem found, steps taken to fix it, materials replaced, and labor involved. Clarity matters here, especially if follow-up work or warranty issues come up later.

3. Installation

Applies to larger installs like new bathroom plumbing, repiping a property, or installing a tankless system. These invoices should include all equipment, fixtures, permit costs, and labor. If the install was based on an estimate, make sure the final invoice lines up with that scope of work.

4. Project-based invoice

Used for bigger commercial or residential projects that span multiple days or weeks. These are typically sent in phases—rough-in, top-out, final. Each invoice should tie directly to a project milestone and reflect progress, labor, and materials used to date. Always include the payment terms and milestone reference for transparency.

5. Maintenance invoice

Built for scheduled contract work like backflow testing, water softener maintenance, or grease trap cleaning. These are recurring and usually follow a monthly, quarterly, or annual schedule. The invoice should include the recurring tasks completed, notes from the tech, and any suggested future work.

6. Emergency or after-hours invoice

Sent when you respond to urgent calls outside of normal business hours—like a burst pipe in the middle of the night or sewage backup on a weekend. These invoices need to highlight emergency rates, any travel fees, and premium labor charges to justify the cost.

7. Time and materials (T&M) invoice

Best for open-ended jobs where you can’t fully scope the work in advance. This format charges based on actual hours worked and parts used. It should include hourly rates, itemized materials, and detailed notes from the field. T&M invoices offer full transparency and help reduce billing disputes when things change mid-job.

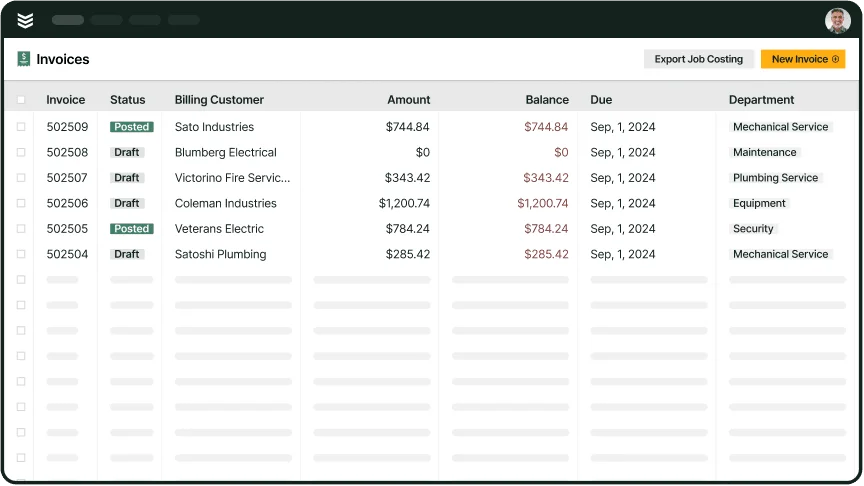

Top plumbing invoicing software for different types of contractors

Plumbing businesses run on different rhythms. What works for a high-volume commercial team probably won’t fit a solo residential plumber—and the other way around. The way you invoice should match how you work in the field. Whether you’re billing by milestone, sending invoices right after a repair, or managing recurring contracts, your software needs to support that workflow—not slow it down. Here are three invoicing tools that stand out for different types of plumbing contractors.

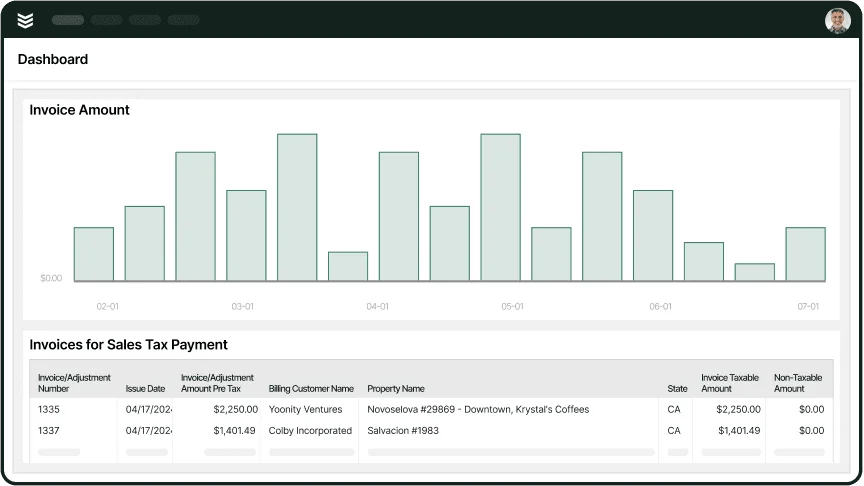

1. Best for commercial contractors: BuildOps

BuildOps was designed specifically for commercial subcontractors managing complex plumbing jobs, tight schedules, and large teams. It connects your techs in the field with your office staff in real time, so invoices reflect exactly what’s happening on-site. From progress billing to logging time, labor, and material usage, BuildOps handles it all—without missing a beat.

What sets this apart for plumbing invoicing: BuildOps links your invoices to job stages, technician activity, and materials used, so billing is based on actual work completed—not guesswork. But it doesn’t stop at invoicing. BuildOps brings together scheduling, dispatching, quoting, reporting, customer history, and asset tracking into one platform. Everything syncs automatically, keeping your back office tight and your crew focused. It’s built for commercial plumbing teams who can’t afford delays or missing documentation.

BuildOps invoicing software for plumbers

Tighten up billing to keep jobs running on time.

2. Best for residential contractors: Jobber

Image Source: Jobber

Jobber is ideal for residential plumbing shops that need something fast, simple, and easy to use on the go. Whether it’s quick service work, drain cleanings, or small installs, Jobber lets you create and send invoices straight from your phone. Its clean layout and automation features make it a great fit for solo plumbers or small teams. That said, it may fall short for larger crews or shops that need deeper reporting and job tracking across multiple locations.

What sets this apart for plumbing invoicing: Jobber makes it easy to invoice the moment the job is done—no need to head back to the office. You can automate reminders and follow-ups, cutting down the time spent chasing payments. While it’s great for speed and mobility, larger teams or shops with complex jobs may find it lacking in customization or deeper reporting tools.

Looking for something mobile that just works? Explore how Jobber’s invoicing software helps plumbing businesses stay organized and get paid faster—without a steep learning curve.

3. Best for general contractors: QuickBooks Online

Image Source: QuickBooks

QuickBooks Online is a solid all-in-one accounting platform used across industries—and that includes plumbing contractors who want everything under one roof. If you’re already using it for bookkeeping or payroll, adding invoicing keeps everything centralized. Still, because it’s not built for the trades, it lacks field-specific features like technician scheduling or service history tracking.

What sets this apart for plumbing invoicing: QuickBooks lets you handle your finances and invoicing from the same dashboard, making it easier to track profitability and cash flow. It’s a great fit for shops that care just as much about the books as they do the billing. Just note—it’s not plumbing-specific, so it lacks features like technician tracking or job-phase billing.

Curious how it compares? See how QuickBooks Online invoice software stacks up for plumbing contractors who need financial tools and invoicing in one place.

10 plumbing invoicing best practices to help you avoid common mistakes

Dialing in your invoicing process doesn’t just speed up payments—it keeps your jobs running smooth, protects your team from confusion, and helps clients trust your business. Below are 10 best practices every plumbing contractor should follow to avoid delays, miscommunication, and preventable billing issues.

1. Be specific with your job descriptions

Avoid vague terms like “plumbing labor” or “service call.” Spell out exactly what was done—whether that’s replacing a water heater, snaking a main line, or repairing a slab leak. Mention labor time, any unusual site conditions, and clearly list tasks completed. It helps justify the cost and clears up any client questions later.

2. Break down all materials with cost and quantity

Leaving out small parts like fittings, valves, or pipe sections can cost you. Itemize everything with unit price and quantity. Clients appreciate transparency—and so do commercial approval teams. A clear material list speeds up internal sign-offs and gives your invoice more weight if it’s ever questioned.

3. State payment terms clearly from the start

If your invoice doesn’t include payment terms, you’re setting yourself up for delays. Add direct language like “Net 15,” “Due on receipt,” or “50% upfront, balance on completion.” You can also include late fees or discounts for early payment to encourage faster turnaround. For commercial clients, always get terms approved in writing before sending the first invoice.

4. Send invoices as soon as the job wraps

The longer you wait, the harder it is to collect. Aim to invoice the same day or within 48 hours while the work is still fresh. Field teams using invoicing software can trigger billing from the job site—no delays, no bottlenecks.

5. Stick to one invoice format across your team

Jumping between templates or letting each tech “do their own thing” causes confusion and slows down approvals. Use a single, professional layout with your logo, job breakdown, and payment terms. It builds consistency, saves admin time, and keeps commercial clients from rejecting or questioning your invoices.

6. Double-check every total—no exceptions

Wrong totals, miscalculated tax, or skipped labor hours are some of the top reasons invoices get rejected. Before you hit send, review every line. Better yet, use software that auto-calculates based on labor rates and parts lists. It protects your paycheck and shows your client you run a tight ship.

7. Include extra notes or job-specific info

Use the notes section to add details that matter—warranty coverage, permit numbers, future inspection dates, or reminders for follow-ups. For example, if you replaced a water heater with a 6-year warranty, write that in. These details show you’re organized, reduce callbacks, and give your invoice more value.

8. Attach documentation when needed

For commercial or multi-phase work, always back your invoice with paperwork—signed work orders, delivery slips, permits, or job photos. GCs and facility managers often need backup before they can cut a check. Save them the hassle and get ahead of the process by including it from the start.

9. Follow up with purpose—not passively

Consistent follow-up is a major factor in long-term business growth. According to plumbing company growth data, shops that tighten up their back-office processes—especially around collections and invoicing—see higher margins and better year-over-year performance. If a payment hasn’t come through by the due date, don’t just wait. Send a polite reminder with the original invoice attached and restate the terms. Still no response? Call. Having a process to track and follow up on unpaid invoices ensures nothing falls through the cracks and keeps your revenue on pace.

10. Use invoicing tools that match your workflow

Don’t force your process to fit into clunky software. Choose a platform that works the way you do—whether that means dispatch-to-invoice from the field, milestone billing, or scheduling follow-ups automatically. The right tool should match your business, not slow it down.

Invoicing Toolkit for Contractors

Learn how to execute plumbing invoicing faster with our business toolkit.

Invoicing doesn’t need to be the part of the job that slows everything down. When it’s done right, it keeps your books tight, your team paid, and your customers clear on what they’re getting. Whether you're handling same-day repairs, contract maintenance, or multi-phase commercial builds, the way you invoice should match the way you run your shop.

From timing to templates to tools, dialing in your process makes a real difference. And if you're running a commercial plumbing operation, using an all-in-one platform that ties together scheduling, dispatching, job tracking, and invoicing can help you stay ahead—without the back-and-forth between systems.

Demo BuildOps invoicing tool

Get an inside look at how we can help you invoice smarter and get paid quicker.