Subcontractors handle the hard stuff—installing systems, managing field crews, finishing jobs on tight deadlines. But when it’s time to collect payment, things get messy. Invoices sit in folders. Details get missed. Crews move on to the next site before the last one gets billed. That delay? It drags cash flow and throws off your whole operation.

Subcontractor payment software changes that. These platforms give you control—so every completed job turns into a bill, every bill gets tracked, and nothing falls through the cracks. Whether you handle HVAC installs, low-voltage wiring, plumbing rough-ins, or fire protection upgrades, a solid payment system makes sure the work gets paid—fast and clean.

Many of these tools also connect with field service management systems. That way, everything from labor hours to job notes flows straight into the invoice—without double entry or delays.

Here’s what we’ll cover in this guide to help subcontractors choose the best tools to stay cash-positive:

- Choosing the best subcontractor payment software for your business

- 6 key features every subcontractor payment software should include

- 5 best subcontractor payment software tools and platforms

- 7 benefits of using subcontractor payment software

- 4 important FAQs about subcontractor payment software answered

The right subcontractor payment solution matches how you work in the field—fast-paced, deadline-driven, and always moving forward. Up next, we’ll cover how to choose one that fits your workflow.

Choosing the best subcontractor payment software for your business

Subcontractors in the field know this: work doesn’t end when the job wraps—it ends when the payment clears. But if you're still tracking payments with manual logs, mismatched spreadsheets, or outdated systems, you're leaking time and money. Every delay in billing or approval slows your cash flow and hurts your team’s ability to move forward.

That’s why payment software for subcontractors is critical—not just for accounting, but for how your field teams operate. You need tools that link payment workflows directly to job activity. Whether you're issuing progress payments, collecting deposits, or handling retainage, the system needs to match how your team gets work done—on-site, on schedule, and in sync with the office.

Before choosing a subcontractor payment solution, look at how it handles daily field demands. Here’s what to evaluate:

- Ease of use – Can your field and office teams pick it up without a steep learning curve? Can project managers or admins log payments and approvals from the jobsite? Does the layout let teams handle multiple active jobs without losing track? Can techs and foremen view payment status without calling the back office?

- Payment speed – How quickly can you move from completed work to money in the bank? Can payments trigger automatically based on work completed or milestones hit? Does the system support partial payments, deposits, or retainage? Are ACH, card, or mobile payment options available for faster turnaround?

- Integration with jobs – How well does it connect to what’s happening in the field? Does it sync with your time tracking, job costing, or scheduling platform? Can payment status update as techs submit labor hours or job photos? Does the system reduce double entry and manual reconciliation?

- Visibility and control – Does it give you full oversight of who’s paid, pending, or overdue? Can you track payments by job, phase, or customer account? Are alerts and reminders built in for missed approvals or outstanding invoices? Can teams see what’s paid and what’s still pending—without needing a spreadsheet?

- Features – What extra tools give this subcontractor payment software an edge? Does it support multi-tier approvals, pay app workflows, or lien waivers? Can you add custom fields for compliance or client-specific data? Does it give mobile access to field supervisors and foremen?

The subcontractor payment software you choose should align with how your teams work in the real world—where deadlines are tight, projects move fast, and money needs to flow without roadblocks. Up next, we’ll break down the key features every payment software for subcontractors should include to keep your operation running sharp.

6 key features every subcontractor payment software should include

Subcontractor payment software should work like your crew—fast, direct, and fully in sync with what’s happening on-site. For field service subcontractors, staying on top of payments means keeping tight control of billing, approvals, job progress, and hours worked. The software needs to fit your day-to-day—without forcing you to babysit it.

Here are six essential features every payment software for subcontractors should include to stay on schedule and keep cash moving.

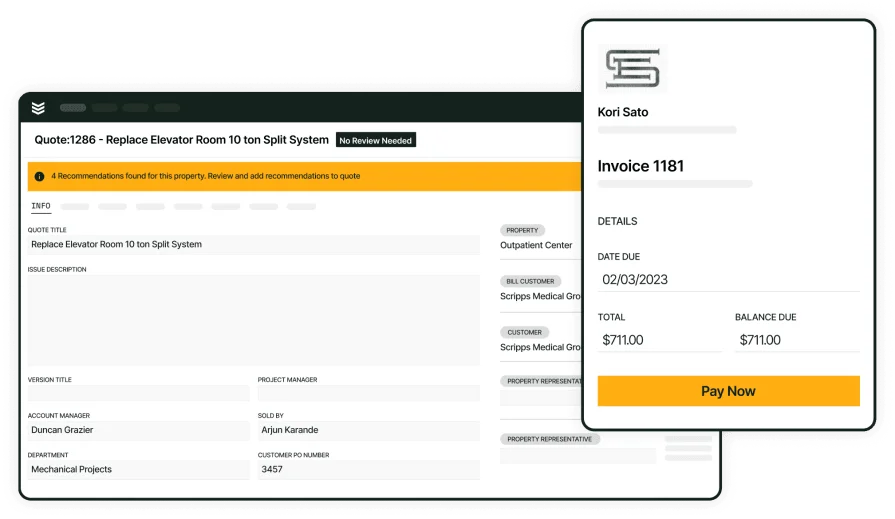

1. Field-ready invoicing tools

When the job wraps, the invoice should already be in motion. With field service invoicing tools, you can generate bills based on completed work, logged hours, and approved materials—without retyping the same info twice. These tools keep the billing process connected to actual job activity.

Let’s say your HVAC crew finishes a rooftop install by mid-afternoon. Instead of waiting for office staff to piece together the invoice later that week, your tech logs the final work order, and the system immediately pushes out the bill with every detail already filled in. That keeps your payments on track and your client communication sharp.

2. Integrated time tracking

Tracking labor hours across multiple jobs and crews used to be a paperwork nightmare. Now, time tracking tools feed hours directly into your subcontractor payment software. That means no disconnect between payroll, job costing, and what actually happened on-site.

Say you’ve got a plumbing crew working two shifts across separate commercial sites. One team clocks in at 6 a.m. while the other wraps up late-night maintenance. Because hours log in automatically, the payment system already knows what to bill—and which shift needs to be paid—without chasing anyone down.

3. Project-based scheduling sync

Payments don’t move until the work does. Scheduling software for field service gives subcontractors the visibility to tie payments directly to task completion and crew assignments. When jobs get pushed, payments adjust with them.

Consider a subcontractor installing fire suppression systems on a hospital build. When one phase gets delayed due to inspection reschedules, the schedule updates automatically and payment milestones shift to match. No need to redo timelines—or risk invoicing before the work’s approved.

4. Real-time technician mobile access

Crews in the field need to handle payment steps without relying on back-office approval. Mobile technician apps give your techs the ability to submit job data, capture signatures, and view payment status right from the jobsite.

For example, your electrical crew completes a panel upgrade at a commercial kitchen. Instead of calling dispatch to confirm, the foreman pulls out the app, logs completion, snaps a photo of the signed work order, and confirms that billing has already kicked in. That tightens the payment loop without slowing down the team.

5. Job pipeline visibility

Your subcontractor payment solution should let you track where every job stands—from kickoff to final payment. With project pipeline tracking, you can see progress at every stage and prep billing steps in advance.

Imagine, during a busy retrofit season, your mechanical services crew takes on 12 projects across three cities. Some jobs are in design review, others are wrapping up. With a pipeline dashboard, your accounting team knows when to prep invoices, when to flag outstanding pay apps, and which clients need follow-ups before closeout.

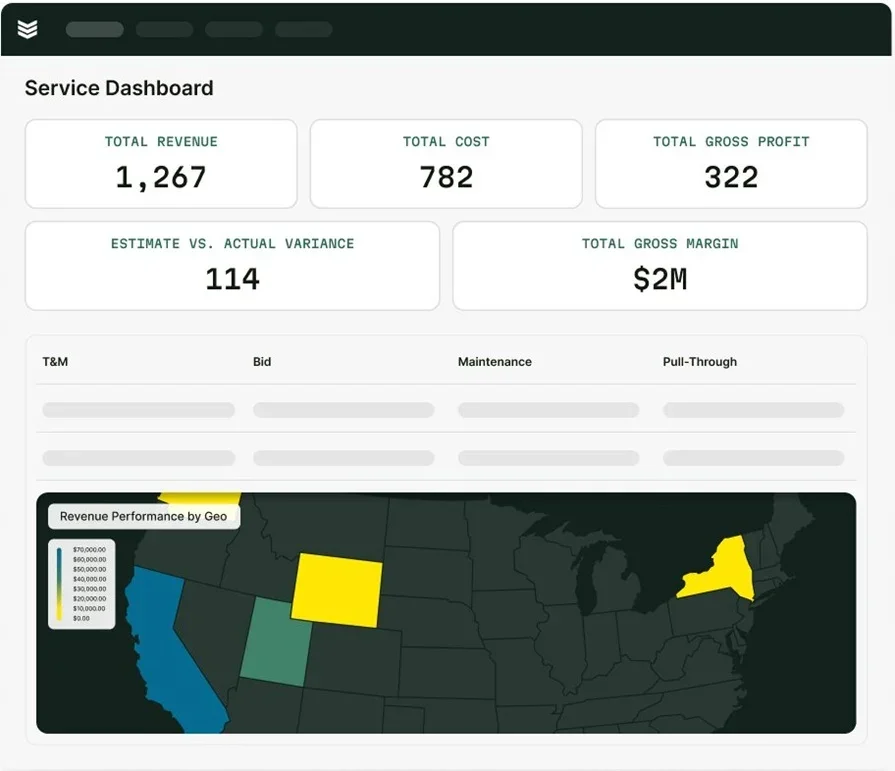

6. Reporting and payment tracking dashboards

Without live visibility, payments fall behind. Reporting software built into your payment software for subcontractors shows exactly what’s been billed, collected, or overdue. It helps you prevent leaks before they turn into cash flow problems.

Let’s say your refrigeration subcontractor team just closed out a food warehouse install. With reporting tools, you see right away that two invoices have cleared, one is pending approval, and another bounced due to a client-side error. Instead of chasing it down blind, you act fast, fix the issue, and stay ahead of any hold-up.

Explore our payment processing tool

Don’t just get jobs done on time—invoice fast to speed up payments.

Other valuable payment features for subcontractors

While the core of any strong payment software for subcontractors is built on accurate invoicing, job tracking, and real-time reporting, there are a few supporting tools that help tighten up operations across the board. These features aren’t must-haves for every team, but when they sync with your subcontractor payment solution, they offer solid backup across field and office functions.

- CRM tools for subcontractors - Customer relationship management tools help you track past jobs, manage client communication, and follow up on outstanding payments. CRM data keeps billing accurate and customer records tied to every transaction.

- Service agreement tracking - Service agreement software makes it easier to manage long-term contracts and recurring jobs. It connects repeat visits directly to payment cycles and helps ensure that nothing slips through the cracks.

- Fleet management support - Fleet tracking tools give you insight into where your vehicles are, how efficiently they’re moving, and how fuel costs impact your jobs. This data can support job costing inside your subcontractor payment software.

- Dispatch coordination - Dispatching software helps you get the right crews to the right job without overlaps. Better coordination means fewer missed time entries and cleaner payroll data flowing into the system.

- Job quoting support - Quoting software for subcontractors helps you create faster, more consistent estimates tied to actual labor and materials. Once the quote is accepted, the system can link directly into invoicing within your subcontractor payment solution.

Now that we’ve covered the essential features and supporting tools, let’s take a look at the platforms that bring them all together. The best subcontractor payment software ties fieldwork, billing, and financial tracking into one smooth system. Below, we’ll walk through the top payment software for subcontractors and how each one helps crews get paid faster while staying focused on the work.

5 best subcontractor payment software tools and platforms

For subcontractors managing field service operations, staying on top of payments can mean the difference between finishing strong or getting buried under unpaid invoices. Your payment software needs to work where your crews do—on job sites, in trucks, and across active projects.

The best subcontractor payment software connects billing, time tracking, and job workflows into one platform. From invoicing to approvals to field updates, these tools give subcontractors control over every dollar moving through the business. Let’s break down five top solutions contractors are using to stay organized and paid.

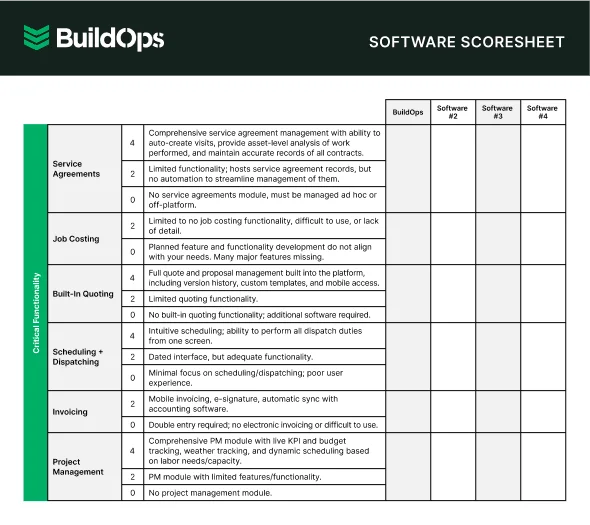

1. Best for commercial subcontractors: BuildOps

BuildOps gives commercial subcontractors a full system that ties payment workflows directly to what happens in the field. From tracking labor to submitting invoices, BuildOps automates the process so crews and admins always stay aligned. You get real-time sync between scheduling, work orders, billing, and reporting—without bouncing between apps. This makes it especially valuable for subcontractors working on multi-crew jobs or projects with complex billing phases.

How pricing works: BuildOps uses a custom quote based on the subcontractor’s size, project load, and workflow needs—ensuring you only pay for what supports your field and payment process.

Features beyond payments:

- Real-time billing tied to job activity

- Automated labor and invoice generation

- Field-ready mobile workflows and reporting

What sets it apart for subcontractors: BuildOps centers everything on field-driven payment execution. From mobile submissions to back-office billing, it offers subcontractors a clear path to faster payment with fewer handoffs.

Take a closer look at BuildOps

We link job completion with fast, accurate payouts—no delays or guesswork.

2. Best for residential subcontractors: Papaya Global

Image Source: Papaya

Papaya Global is a global payroll and contractor payment platform designed to handle multi-country compliance and large team payouts. For residential subcontractors working with distributed or international vendors, Papaya makes it easier to handle bulk payments and keep payroll aligned with local regulations. Its automation tools help reduce admin time and support recurring payment cycles. However, Papaya Global may not be ideal for subcontractors who rely on job-level visibility or need tight integration with scheduling and field activity.

How pricing works: Tiered pricing varies depending on contractor volume and country of operation.

Features beyond payments:

- International contractor management

- Compliance support across global jurisdictions

- Automated recurring payments and invoicing

What sets it apart for subcontractors: Papaya simplifies contractor payments on a global scale, making it well-suited for subcontractors handling cross-border work or remote back-office teams.

3. Best for general subcontractors: Remote

Image Source: Remote

Remote gives subcontractors a centralized platform for handling contractor payments, compliance, and onboarding—especially for general subs juggling multiple vendors. It’s designed with flexibility in mind, allowing small teams to scale across countries without building local infrastructure. You can easily send payments, generate tax forms, and track project-based payout schedules. That said, Remote lacks deep integrations with field-based workflows, which can limit its fit for subcontractors needing jobsite coordination or dispatch tools.

How pricing works: Transparent monthly pricing with contractor management built in; pay per worker added.

Features beyond payments:

- Tax form automation (W-9s, 1099s)

- Custom contractor onboarding

- Multi-country payment processing

What sets it apart for subcontractors: Remote works well for subs who handle freelancers or contractors globally but still want oversight on payment timelines and legal compliance.

4. Best for small to mid-sized businesses: Buildern

Image Source: Buildern

Buildern gives small and mid-sized subcontractors access to practical payment tools that sync with budgeting, purchase orders, and billing in one workspace. The platform includes basic invoice generation, payment approvals, and vendor billing controls—good for contractors who need something beyond spreadsheets but don’t want an enterprise-level system. For subcontractors with larger crews or multiple concurrent jobs, Buildern may feel limited when it comes to mobile access or integration with field scheduling.

How pricing works: Simple plan tiers based on business size and number of users.

Features beyond payments:

- Purchase order tracking

- Vendor billing workflows

- Job cost budgeting and forecasting

What sets it apart for subcontractors: Buildern strikes a balance between cost control and payment automation, keeping small crews and project managers in sync without overloading them.

5. Best for independent subcontractors: QuickBooks Contractor Payments

Image Source: QuickBooks

QuickBooks Contractor Payments is ideal for independent subs or small teams that need a fast way to pay 1099 contractors. It offers simple automation for scheduling payouts, generating tax forms, and linking payments to client invoices. The platform is especially useful if you’re already using QuickBooks for accounting and want to extend payment tools into your workflow. For field service subcontractors managing multiple projects or dispatch teams, QuickBooks may lack the field-specific tracking or real-time job syncing needed at scale.

How pricing works: Flat monthly fee per contractor, with pay-as-you-go options.

Features beyond payments:

- 1099 e-filing and contractor tax tracking

- Direct deposit payment scheduling

- Sync with QuickBooks accounting tools

What sets it apart for subcontractors: It’s a go-to solution for small, nimble subs who handle their own books and want to streamline contractor payments without diving into a full operations suite.

Get the software scoreshee

Compare the top tools at a glance with our easy-to-use scoresheet.

7 benefits of using subcontractor payment software

Subcontractors move fast. You’ve got crews on-site, materials landing at odd hours, and deadlines packed tight. When payments stall, everything backs up—job schedules, payroll, and client trust. That’s why having a solid subcontractor payment solution goes beyond just sending invoices. It’s about keeping your field and back office in lockstep. Here are seven key benefits of using payment software for subcontractors—and how it impacts every part of your business:

1. Faster billing after job completion

One of the biggest slowdowns in getting paid is the gap between when a job finishes and when the invoice goes out. Subcontractor payment software closes that gap by letting field techs log completed tasks, materials used, and photos—right from the jobsite. As soon as the work is signed off, billing can kick off automatically. For example, instead of waiting for a foreman to hand in notes days later, the system already has the data it needs to build and send the invoice within hours. This shortens the payment cycle and strengthens your cash flow without adding extra admin work.

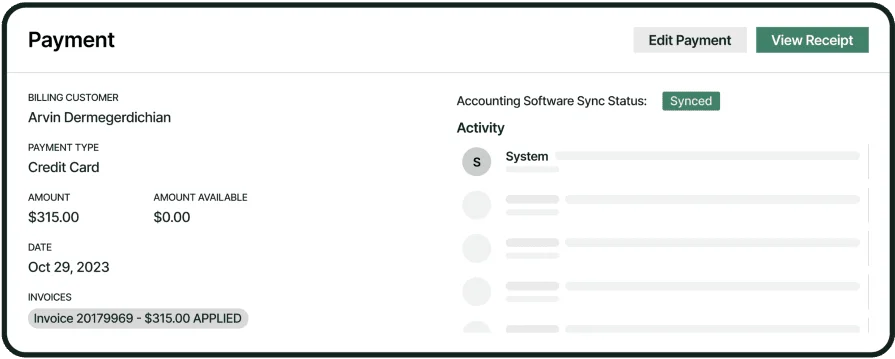

2. Fewer delays from field to back office

When your payment software syncs with your subcontractor project management system, everything flows faster. Job progress updates, task approvals, and payment triggers are all tied to real-time activity in the field. That means no more email chains or calls to confirm job status. Admins can see which tasks are complete, which are pending, and when it’s time to bill—all without chasing paperwork or second-guessing crew updates.

3. Clearer cash flow across active jobs

Subcontractors managing multiple jobs need to see where money’s coming in and where it’s stuck. With a subcontractor payment solution in place, you get a full view of each project’s financial health. You can spot unpaid invoices, track overdue balances, and stay ahead of revenue dips. This makes it easier to shift crews, prioritize faster-paying jobs, or follow up with late clients—giving you control over where your money’s going and how fast it’s coming back in.

4. Fewer errors from manual entry

Mistakes in billing cost you money—and time. Payment software for subcontractors pulls real job data directly from field reports, labor logs, and purchase records to build accurate invoices without double entry. Even better, when paired with accounting software for subcontractors, everything from payroll to vendor payments stays organized, reconciled, and audit-ready. That means fewer corrections, less rework, and tighter books across the board.

5. Stronger forecasting for upcoming work

You can’t plan the next job if you don’t know where you stand today. By tying payment data to your subcontractor estimating software, you can see how closely actual payments align with your projected costs.

This helps subcontractors plan better—both for materials and manpower. If a client is late on payments, you’ll know not to overcommit crews. If one job closes out ahead of plan, you can move faster on the next opportunity.

6. Easier oversight of techs in the field

Payment tracking isn’t just about numbers—it’s about accountability. With subcontractor payment software linked to field service software, you can verify who completed the work, how long it took, and whether it met the contract terms. That gives you a clear line between labor, performance, and payout. No more relying on scattered notes or unclear work orders. You’ll have proof tied to every payment.

7. Payments linked to job schedules

Timing is everything on a jobsite. When your scheduling software for subcontractors links directly to your payment process, invoices follow the schedule—not the other way around. As soon as a task hits “complete” in the schedule, your payment software gets triggered to start billing or prep pay apps. This keeps payments predictable, reduces lag, and keeps your back office in rhythm with what’s happening on-site.

4 important FAQs about subcontractor payment software answered

Subcontractors manage crew schedules, client approvals, vendor payments, and job documentation—often across several active sites. That’s why having subcontractor payment software built for field service is crucial. These tools bridge the gap between the office and the field, keeping payments accurate and on time without slowing the work down. If you're evaluating payment software for subcontractors, these common questions can help you understand how these platforms really work and what to expect once you implement one.

1. What is subcontractor payment software?

Subcontractor payment software helps field service crews track labor hours, materials used, job completion, and turn that information into accurate, billable events. It’s designed to streamline payment processes like invoicing, approvals, and contractor payouts—while syncing with field operations in real time.

These platforms often include mobile tools for techs, approval workflows for the office, and dashboards to manage billing status across multiple jobs. When used correctly, they reduce the lag between doing the work and getting paid—helping subcontractors stay cash-flow positive and project-focused.

2. How does subcontractor payment software work?

Payment software for subcontractors pulls data from your field service tools—like time tracking, job logs, and materials—and uses that info to generate invoices, approve pay apps, and manage contractor disbursements. It automates what used to be slow, manual steps, allowing your back office to keep up with your field teams without needing constant updates.

Most platforms also integrate with accounting systems, so everything from payables to receivables stays aligned. Crews do the work, log their progress, and the payment system handles the rest.

3. Who should use subcontractor payment software?

Any subcontractor managing field-based jobs across electrical, plumbing, HVAC, mechanical, or fire protection trades can benefit. If you're coordinating crews, working with tight schedules, and issuing progress payments or managing retainage, a dedicated subcontractor payment solution keeps everything organized.

It's especially helpful for subcontractors working across multiple sites or managing multiple vendors—eliminating the need to bounce between spreadsheets, email threads, and phone calls just to figure out who’s been paid and what’s still pending.

4. What are some best practices for using subcontractor payment software?

To get the most value from subcontractor payment software, both field and office teams need to follow daily habits that keep the system updated and accurate. These best practices help ensure that payments move quickly, errors stay low, and everyone knows where things stand.

- Log job completion as soon as work wraps in the field

- Sync time tracking tools with your payment platform daily

- Link invoices to specific jobs, phases, or cost codes

- Use automated reminders for approval and billing deadlines

- Upload receipts or materials to match with invoices in real time

- Review and approve progress payments based on verified site updates

- Enable mobile access for field leads to track payment status

- Keep client billing terms saved within the software for faster turnaround

- Reconcile outstanding balances weekly to avoid end-of-month surprises

- Run reports to track invoice performance, disputes, and late payments

In the trades, speed matters—but only when accuracy keeps up. For subcontractors balancing job schedules, approvals, and billing, payment isn’t just about dollars—it’s about momentum. Every delay slows your crew. Every misstep sets the job back. That’s why choosing subcontractor payment software that actually matches how your team works in the field is a move worth making.

The tools we covered above each bring something different to the table. But if you're managing large-scale commercial field service projects, payments can’t be an isolated workflow. They need to plug into scheduling, dispatch, reporting, and technician updates without creating friction. That’s where an all-in-one platform like BuildOps fits in—giving subcontractors one system that keeps every jobsite, invoice, and crew connected.

Curious to see BuildOps at work?

We handle payments, field updates, and job coordination—all from one place.