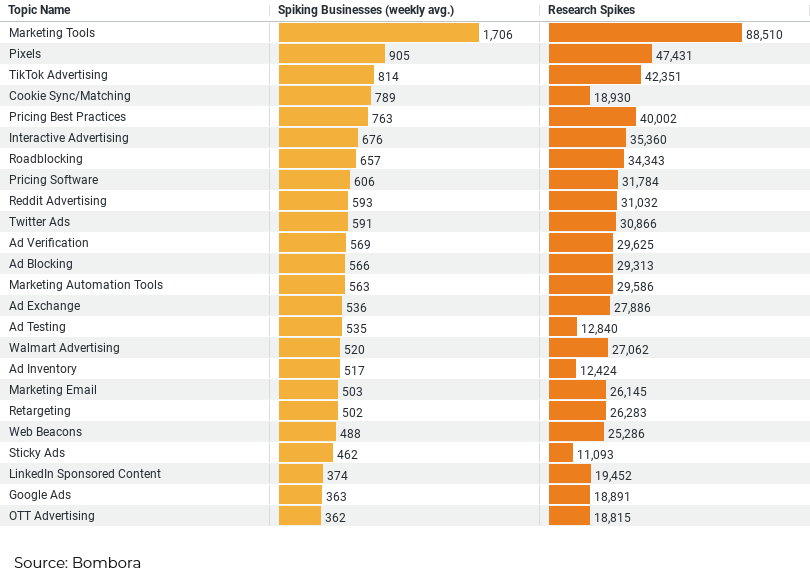

(Data visualized in the chart captures buying and research signals for the past 365 days)

The data from the construction industry’s research on AdTech technologies showcases several key trends and insights:

- High Interest in Marketing Tools: The construction industry is heavily investing in researching marketing tools, suggesting a focus on leveraging AdTech to enhance marketing strategies and execution.

- Growing Interest in Social Media Advertising: With “TikTok Advertising” being a significant area of research, there’s a clear trend towards exploring social media platforms for advertising. This reflects an interest in tapping into newer, dynamic advertising channels that can reach a broader and potentially younger demographic.

- Attention to Data and Privacy: The interest in “Pixels” and “Cookie Sync/Matching” indicates a focus on tracking technologies and data synchronization practices, highlighting concerns around data privacy and the need to effectively target and retarget audiences.

- Investment in Pricing Strategies: The research into “Pricing Best Practices” suggests an effort to optimize AdTech investments and ensure cost-effective advertising strategies.

- This data reveals a multifaceted approach within the construction industry towards researching AdTech technologies, focusing not just on expanding their marketing reach but also on ensuring data privacy, audience targeting efficiency, and cost-effectiveness.

How the Construction Industry’s Research and Interest in AdTech is Paving the Way Forward

The construction industry, traditionally viewed as a sector slow to adopt digital innovations, is now at the forefront of exploring advanced advertising technologies (AdTech). This shift towards AdTech signifies a transformative phase within the industry, aiming to leverage digital tools to enhance visibility, efficiency, and engagement. A recent analysis of industry trends provides compelling insights into how construction businesses are navigating the AdTech landscape. Here, we delve into these trends, revealing the strategic focus areas and the potential impacts on the industry’s future marketing practices.

A Surge in Marketing Tools Adoption

Data reveals an overwhelming interest in marketing tools, with an average of 1,706 businesses per week demonstrating a spike in research activities. This trend underscores the industry’s urgency to adopt digital marketing solutions that can streamline campaigns, automate processes, and personalize customer interactions. The substantial number of research spikes, totaling 88,510, further emphasizes the growing reliance on these tools to stay competitive and responsive in a rapidly evolving market.

Embracing Social Media for Advertising

Another notable trend is the construction industry’s foray into social media advertising, with TikTok advertising emerging as a significant area of interest. On average, 813 businesses are exploring this platform weekly, drawn by its vast, engaged user base and innovative ad formats. This pivot towards social media platforms like TikTok reflects a strategic move to tap into younger demographics, leveraging creative content to build brand awareness and foster community engagement.

Focused on Data and Privacy

The research data also highlights a keen focus on pixels and cookie sync/matching, with 905 and 789 businesses per week, respectively, delving into these areas. This interest points to the industry’s awareness of the importance of data tracking and synchronization technologies in understanding customer behaviors, optimizing ad targeting, and ensuring compliance with privacy regulations. With 47,431 and 18,930 research spikes for pixels and cookie sync/matching, respectively, the construction sector is evidently prioritizing the need to navigate the complex landscape of digital privacy and audience targeting with precision and responsibility.

Optimizing Pricing Strategies

Investigations into pricing best practices reveal an industry-wide effort to refine AdTech investment strategies. With 763 businesses per week examining this area and 40,002 total research spikes, there’s a clear emphasis on understanding how to maximize return on investment. This focus indicates a strategic approach to AdTech, where cost-effectiveness and value generation are paramount, guiding businesses toward sustainable growth and profitability.

Implications for the Construction Industry

The construction industry’s intensified interest in AdTech is a testament to its commitment to innovation and adaptation. This pivot is not merely about adopting new technologies but reflects a deeper understanding of the changing consumer landscape and the need for more engaging, efficient, and data-driven marketing strategies.

Enhanced Customer Engagement: By leveraging marketing tools and social media platforms, construction businesses can create more personalized and engaging experiences for their customers. This engagement is crucial in building brand loyalty and differentiating in a competitive market.

Data-Driven Decision Making: The focus on data and privacy technologies underscores a shift towards more informed decision-making. By harnessing data analytics and tracking technologies, businesses can gain deeper insights into customer behaviors and preferences, enabling more targeted and effective marketing campaigns.

Cost-Effective Marketing: The research into pricing best practices reflects an industry-wide quest for efficiency. In a sector where margins can be tight, optimizing AdTech investments to ensure maximum impact at minimal cost is essential for sustaining growth and competitiveness.

Conclusion

The construction industry’s exploration of AdTech technologies marks a significant milestone in its digital transformation journey. By embracing marketing tools, social media advertising, data privacy technologies, and pricing strategies, the industry is positioning itself for a future where digital marketing is not just an option but a necessity. As these trends continue to evolve, the construction sector’s approach to AdTech will undoubtedly serve as a blueprint for innovation, efficiency, and engagement in the digital age.

Population Sample For The Above Article

- The data indicates that small-sized businesses (10 – 49 Employees) are the most active in researching or showing interest in market insights, with over 2651 businesses on average weekly, making up nearly 29.36% of the total activity.

- Micro-sized businesses are also notably active, with over 933 businesses showing interest weekly, although they make up a smaller portion of the total activity (10.34%).

- The trend continues with medium-small (50 – 199 Employees) and medium-sized (200 – 499 Employees) companies showing significant interest, suggesting a high level of engagement across a spectrum of company sizes.

- The distribution of interest across different company sizes might indicate varied strategic priorities and resource allocations towards market research and insights, with smaller companies possibly leveraging such insights to compete more effectively in their markets.