Executive Summary: Agency/Dept Research Trends in the Construction Industry

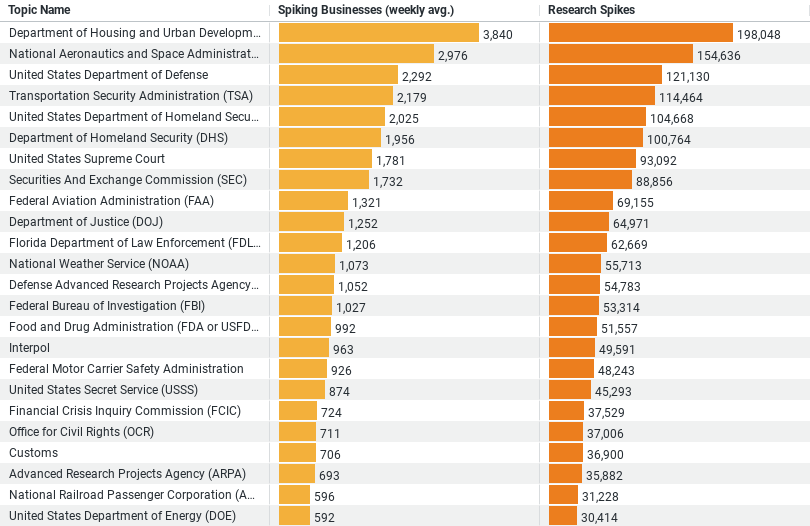

– Top Researched Agencies/Departments: The data highlights the Department of Housing and Urban Development (HUD) as the most researched agency, with significant spikes in business interest. This is followed by NASA, the Department of Defense, TSA, and the Department of Homeland Security.

– Weekly Business Spikes: HUD leads with an average of approximately 3,840 businesses per week showing increased activity. NASA and the Department of Defense have weekly averages of about 2,976 and 2,292 businesses respectively, indicating robust industry interest.

– Research Activity: In terms of research spikes, HUD shows the highest activity with nearly 198,048 spikes, reflecting intense scrutiny and involvement by construction businesses. NASA and the Department of Defense follow with 154,636 and 121,130 spikes respectively, underscoring significant interest in projects potentially related to these agencies.

Construction Industry Focus: Agency/Dept Research Trends

The construction sector, with its myriad facets and evolving landscape, often turns its gaze towards governmental agencies and departments. This focus isn’t arbitrary but a strategic alignment with where significant projects, funding, and regulations emanate from. Recent data sheds light on how the construction industry prioritizes its research efforts, highlighting which agencies catch its interest the most and why this matters.

The data reveals that the Department of Housing and Urban Development (HUD) tops the list of most-researched agencies. This isn’t surprising given HUD’s central role in urban planning and development, areas that directly impact large segments of the construction industry. On average, about 3,840 businesses per week show increased activity in researching HUD-related topics. The implications here are profound, with businesses likely exploring new opportunities in affordable housing projects or staying abreast of changes in regulations that could affect future construction practices and standards.

Following HUD, the National Aeronautics and Space Administration (NASA) commands attention, drawing an average weekly interest from approximately 2,976 businesses. The connection between NASA and the construction industry might not seem intuitive at first, but it becomes clearer when considering the burgeoning interest in aerospace facilities and associated infrastructure. As the space sector grows, construction firms are positioning themselves to capitalize on building complex structures that meet the unique demands of aerospace applications.

The United States Department of Defense (DoD) and the Department of Homeland Security (DHS) are also focal points for the construction industry’s research efforts. These departments oversee a wide range of infrastructure needs from national security facilities to emergency response systems, making them critical for construction businesses that specialize in secure, resilient building projects. With 2,292 and 2,025 businesses per week delving into DoD and DHS topics respectively, the construction industry shows a strong predilection for projects that involve national security and safety measures.

Transportation Security Administration (TSA) is another significant area of interest, particularly relevant for those involved in constructing transportation infrastructure such as airports and checkpoints. The weekly average of about 2,179 businesses researching TSA-related topics underscores the strategic importance of transportation projects, which often require sophisticated construction solutions to meet stringent security standards.

These research spikes are not mere numbers but indicate where the construction industry expects growth and where it anticipates governmental policy shifts. For example, the high volume of research spikes in HUD topics, which reach nearly 198,048 instances, suggests a keen interest in how urban development policies will evolve. Similarly, the 154,636 and 121,130 research spikes for NASA and the DoD, respectively, reflect an industry preparing for future demands in aerospace and defense infrastructure.

Why do these insights matter?

They reveal the strategic thinking behind the construction industry’s pursuits. By understanding which agencies attract the most research, stakeholders can better predict where the industry will allocate resources, what kinds of projects will likely emerge, and how regulatory frameworks could shift. This foresight is crucial for making informed decisions whether you’re a contractor, an investor, or a policymaker in the construction realm.

Moreover, this focused research activity speaks to the adaptive nature of the construction industry. As government priorities shift and new funding opportunities arise, construction firms must stay informed and agile, ready to pivot their strategies to align with the current and future landscapes. This agility is particularly vital in a post-pandemic world where the dynamics of urban development, transportation, and national security are all in flux.

Conclusion

The construction industry’s intensive research into specific governmental agencies and departments is a clear indicator of where it sees potential for growth and revenue. For industry watchers and participants alike, keeping an eye on these trends is not just useful but essential for navigating the complex interplay between government actions and construction opportunities.

Company Sample Data

Data Overview

– Company Size: Categorization of companies based on the number of employees (e.g., Micro, Small, Medium-Small, Medium, Medium-Large).

– Spiking Businesses (weekly avg.): Average weekly count of businesses in each size category showing increased activity or interest.

– Percent of Total: Proportion of each company size category contributing to the total spikes observed.

Trends and Insights

– Micro (1 – 9 Employees): Despite their small size, micro-businesses show a considerable average weekly spike of approximately 2,349 businesses. They contribute about 12.6% of the total spikes, highlighting significant activity at the grassroots level.

– Small (10 – 49 Employees): Small businesses are the most active, with a weekly average of about 6,174 businesses spiking, accounting for approximately 33.2% of total activity. This indicates a strong engagement from small businesses, possibly due to their agility and ability to quickly adapt to market changes.

– Medium-Small (50 – 199 Employees): These businesses also show robust activity, with a weekly average of 5,716 spiking businesses and making up about 30.7% of the total. Their slightly larger structure allows for more strategic and resource-intensive pursuits.

– Medium (200 – 499 Employees): The activity drops notably in this category, with an average of 2,131 businesses showing spikes weekly, contributing about 11.5% of the total. This suggests a different strategic focus or perhaps a challenge in mobilizing larger resources quickly.

– Medium-Large (500 – 999 Employees): The activity further drops to 884 businesses on average per week, with these companies making up about 4.8% of the total spikes. Larger companies might be involved in fewer but more substantial projects, thus showing less frequent but potentially more impactful activity spikes.

Why This Is a Trend

The trend in spiking businesses across various company sizes may indicate several underlying dynamics:

– Responsiveness to Market Opportunities: Smaller companies, particularly those in the micro to small range, seem to be more responsive to immediate market opportunities or changes, likely due to less bureaucratic inertia and greater flexibility.

– Strategic Depth: As companies grow, their strategic interests may become more profound and less volatile, leading to fewer spikes but perhaps more significant individual investments or project initiations.

– Resource Allocation: Larger organizations may also have longer planning horizons and more complex decision-making processes, which can affect the frequency of their market activity spikes.

This data is crucial for understanding how different segments of the market react to opportunities and challenges, allowing stakeholders to tailor strategies that cater to or leverage the strengths of various company sizes.