Executive Summary: APIs & Services Research Trends in the Construction Industry

The dataset provides insights into the top trends in the construction industry related to their research on APIs & Services. Here are the top trends and insights from the data:

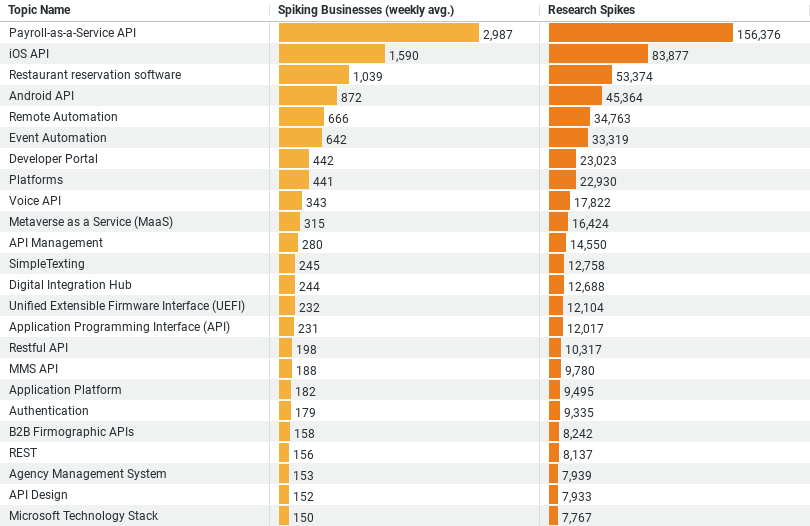

1. Payroll-as-a-Service API: This topic has the highest average weekly interest among spiking businesses, with an average of 2,987 businesses showing interest weekly. It also has the highest number of research spikes, amounting to 156,376. This indicates a significant interest in automating payroll through APIs, suggesting a focus on improving efficiency and accuracy in payroll processing within the construction industry.

2. iOS API: The second most researched topic is iOS API, with an average of 1,590 businesses researching it weekly and a total of 83,877 research spikes. This suggests a strong interest in developing iOS applications or integrating existing systems with iOS devices, possibly for fieldwork data collection, project management, or communication purposes.

3. Restaurant Reservation Software: Although not directly related to construction at first glance, the research into restaurant reservation software, with an average of 1,038 businesses looking into it weekly and 53,374 research spikes, could indicate interest in services that can be adapted for scheduling, booking, or managing spaces and resources in construction projects.

4. Android API: Similar to iOS API, Android API research is also high, with 871 businesses researching it weekly and a total of 45,364 research spikes. This indicates a balanced interest in developing or integrating systems for both major mobile operating systems, highlighting the importance of mobile solutions in the construction industry.

5. Remote Automation: With 666 businesses researching it weekly and 34,763 research spikes, remote automation stands out as a significant area of interest. This could involve the use of APIs to automate tasks that can be managed remotely, such as equipment monitoring, project tracking, and resource management, indicating a trend towards increasing operational efficiency and remote work capabilities.

These insights suggest a strong interest in the construction industry towards digital transformation, particularly in automating operations, enhancing mobile capabilities, and possibly leveraging technology for better resource and project management. The focus on both iOS and Android platforms implies a desire to cover a broad range of devices for operational flexibility, while the interest in payroll-as-a-service and remote automation highlights an emphasis on efficiency and modernization of traditional processes.

The Digital Transformation in Construction: A Deep Dive into APIs & Services Research

In recent years, the construction industry has seen a significant shift towards digitalization. The exploration of advanced technologies such as APIs (Application Programming Interfaces) and various services reveals a concerted effort to embrace efficiency, automation, and innovation. Analyzing recent data on how the construction sector is researching these topics provides valuable insights into its current priorities and future direction.

Embracing Payroll-as-a-Service for Efficiency

The data indicates that Payroll-as-a-Service API tops the list of interests among construction businesses, with a staggering weekly average of 2,987 companies delving into this topic and a total of 156,376 research spikes. This trend underscores the industry’s urgency in streamlining payroll operations. Given the complex nature of construction projects, which often involve numerous contractors and fluctuating workforces, the appeal of Payroll-as-a-Service is clear. It promises to simplify payroll management, ensuring accuracy and compliance while freeing up valuable resources to focus on core project activities.

The Rise of Mobile Integration: iOS and Android APIs

Mobile technology integration is another prominent area of focus, with significant interest in both iOS and Android APIs. The data shows that 1,590 businesses research iOS API weekly (83,877 spikes), while Android API interest isn’t far behind, with 871 weekly business researchers (45,364 spikes). This balanced attention to both platforms highlights a strategic push to enhance mobility in construction operations. By developing or integrating mobile applications, companies aim to improve on-site data collection, project management, and communication, ensuring that project stakeholders stay informed and connected, regardless of their location.

Unconventional Interest: Restaurant Reservation Software

Interestingly, the construction industry’s research into restaurant reservation software, with an average of 1,038 businesses exploring it weekly (53,374 spikes), may seem out of place at first glance. However, this interest could signify the sector’s innovative approach to adapting existing solutions to construction-specific needs. For instance, reservation systems could be repurposed for scheduling resources, managing space allocations on job sites, or even coordinating subcontractor work slots. This suggests an openness to cross-industry inspiration, seeking efficiency gains wherever possible.

The Drive for Remote Automation

Remote automation emerges as another significant theme, with 666 businesses researching it weekly (34,763 spikes). The construction industry appears keen on leveraging technology to automate remotely manageable tasks, such as equipment monitoring, project tracking, and resource management. This focus not only aims at enhancing operational efficiency but also at adapting to the growing trend of remote work. By automating routine tasks, companies can redirect their efforts toward more strategic, value-adding activities.

Implications and Future Directions

The construction industry’s research trends around APIs and services reveal a comprehensive digital transformation agenda. The focus on Payroll-as-a-Service API indicates a move towards operational efficiency and regulatory compliance. At the same time, the balanced interest in iOS and Android APIs reflects a commitment to leveraging mobile technology for better project management and stakeholder engagement.

The curiosity about adapting non-traditional software, like restaurant reservation systems, for construction purposes, showcases the industry’s innovative spirit. It demonstrates a willingness to explore unconventional solutions to enhance operational flexibility and efficiency. Lastly, the attention to remote automation aligns with the broader trend towards digitalization, emphasizing the need for technologies that support remote management and operational efficiency.

As the construction industry continues to navigate its digital transformation journey, these insights into its research priorities offer a glimpse into a future where technology drives efficiency, innovation, and competitive advantage. Companies within the sector should take note of these trends, considering how they can integrate such technologies and concepts into their operations. By doing so, they can not only improve their current processes but also position themselves as leaders in the digitally evolving construction landscape.

Company Sample Data on APIs & Services Research in the Construction Industry

This dataset records the average weekly number of spiking businesses (those showing increased activity or interest in a certain area) and their percentage of the total within each company size category. Here’s a breakdown of the findings and implications of these trends.

Micro (1 – 9 Employees)

Micro-sized companies, with 1 to 9 employees, show an average of 820.92 businesses spiking weekly, making up 10.32% of the total. This segment’s relatively high activity level suggests that despite their small size, micro enterprises are actively seeking new opportunities, technologies, or markets to leverage for growth. Their agility allows them to adapt quickly, making them an interesting group in terms of trends and intent.

Small (10 – 49 Employees)

Small companies, consisting of 10 to 49 employees, have a significantly higher weekly average of spiking businesses at 2,280.71, accounting for 28.66% of the total. This size category is crucial for understanding market trends, as businesses in this range often have enough resources to pursue strategic initiatives while still being nimble enough to innovate and adapt rapidly to new opportunities.

Medium-Small (50 – 199 Employees)

Medium-small businesses, with 50 to 199 employees, show the highest level of activity among the categories, with 2,343.25 spiking businesses weekly, representing 29.44% of the total. This indicates a strong engagement with market trends and a potential readiness to invest in growth areas. Companies in this category are likely at a stage where they have the operational capacity and resources to explore and integrate new technologies or methodologies extensively.

Medium (200 – 499 Employees)

Medium-sized businesses, housing 200 to 499 employees, present a weekly average of 1,093.58 spiking businesses, contributing to 13.74% of the total. Although there’s a decrease in activity compared to smaller sizes, this category remains significant. Businesses of this size may have more established processes and customer bases, potentially making them more selective in pursuing new opportunities or innovations.

Medium-Large (500 – 999 Employees)

Lastly, medium-large companies, with 500 to 999 employees, demonstrate the lowest activity level among the categories, with a weekly average of 562.46 spiking businesses, making up 7.07% of the total. This trend might reflect the challenges larger organizations face in swiftly adapting to market changes due to more complex structures and processes.

Trend Analysis and Implications

The data reveals a notable trend: as companies grow in size, there’s a peak in activity among medium-small businesses, followed by a gradual decrease in the percentage of spiking businesses as company size increases. This pattern suggests a sweet spot in the medium-small category, where businesses possess both the agility to react to market trends and the resources to act on them effectively. In contrast, larger organizations might struggle with agility, leading to fewer spikes in interest or activity on a weekly basis.

This trend underscores the importance of agility and the capacity to adapt to new trends, technologies, and market demands. It also highlights the potential advantages of medium-small businesses in the current economic and technological landscape, where flexibility and swift adaptation can be key drivers of success.

For stakeholders in the construction industry and beyond, understanding these dynamics can inform strategies for growth, investment, and innovation. Tailoring approaches to the unique characteristics and advantages of each company size could maximize opportunities and drive forward-looking decisions in a rapidly evolving market.