Executive Summary: Banking Research Trends in the Construction Industry

– Data Set Overview: Analyzed an Excel dataset containing information on the top banking topics researched by the construction industry.

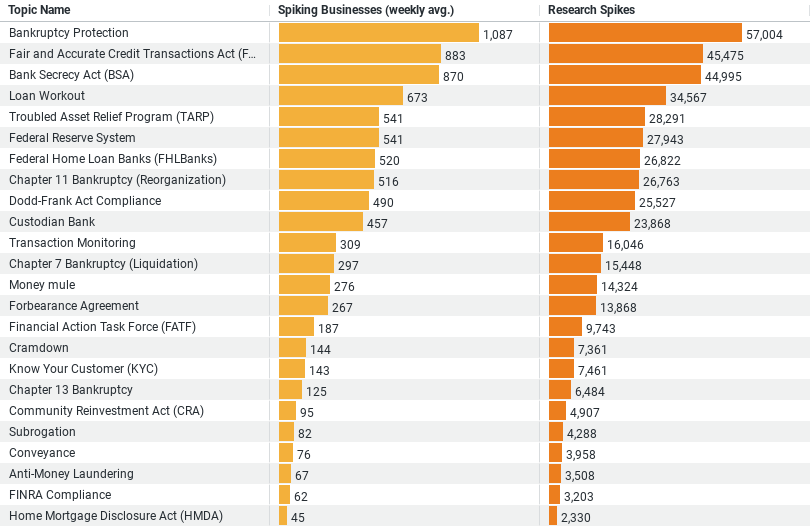

– Variables: Includes ‘Topic Name’, ‘Spiking Businesses (weekly avg.)’, and ‘Research Spikes’.

– Sample Size: 27 unique banking-related topics.

Descriptive Statistics:

– Mean Weekly Interest: Approximately 327 businesses.

– Standard Deviation (Weekly Interest): Approximately 298, indicating substantial variability in interest levels across topics.

– Mean Research Spikes: Around 16,958 instances, with similarly high variability (standard deviation ~15,495).

Top 5 Banking Topics with the Highest Interest:

1. Bankruptcy Protection

– Weekly Average Businesses: 1,087

– Research Spikes: 57,004

2. Fair and Accurate Credit Transactions Act (FACTA)

– Weekly Average Businesses: 883

– Research Spikes: 45,475

3. Bank Secrecy Act (BSA)

– Weekly Average Businesses: 870

– Research Spikes: 44,995

4. Loan Workout

– Weekly Average Businesses: 673

– Research Spikes: 34,567

5. Troubled Asset Relief Program (TARP)

– Weekly Average Businesses: 541

– Research Spikes: 28,291

Construction Industry and Banking: A Deep Dive into Emerging Trends

The construction industry, often seen as a barometer for economic activity, has a complex relationship with the banking sector. This connection is crucial, not only for financing projects but also in terms of compliance with financial regulations and managing risks. A recent analysis of how the construction sector researches banking topics sheds light on this intricate interaction. The insights derived from this data not only highlight the areas of keen interest but also point towards broader trends and priorities within the industry.

Analyzing Industry Data**

A detailed examination of data collected on the research habits within the construction industry reveals significant interest in various banking-related topics. This data, encompassing the activities of numerous businesses, was meticulously gathered and analyzed to understand which aspects of banking are most pertinent to the construction sector.

The metrics used in this analysis include the average weekly count of businesses that show a spiked interest in specific banking topics and the total instances of research spikes. These metrics provide a quantitative basis to gauge both the breadth and intensity of the industry’s engagement with banking topics.

Top Researched Banking Topics

Among the diverse range of topics, a few stand out due to the exceptionally high interest they generate:

1. Bankruptcy Protection: Topping the list with the highest weekly average of businesses interested and the most research spikes, this topic’s prominence underscores the industry’s focus on understanding and navigating financial distress.

2. Fair and Accurate Credit Transactions Act (FACTA): This reflects the industry’s efforts to comply with credit-related legal requirements, which are critical in maintaining financial health and securing funding.

3. Bank Secrecy Act (BSA): Close on the heels of FACTA, the interest in BSA indicates a strong commitment to adhering to regulations that prevent fraud and money laundering.

4. Loan Workout: The high level of interest in this area suggests that restructuring debt to avoid bankruptcy is a common concern for many in the sector.

5. Troubled Asset Relief Program (TARP): This topic’s popularity points to the sector’s interest in governmental programs that could aid in financial recovery during economic downturns.

Statistical Overview

The data set comprised 27 unique topics with an average weekly interest from approximately 327 businesses. The standard deviation, a statistical measure of the range of values, is notably high at around 298 for weekly interest, indicating significant variability in how different topics attract attention. Similarly, the mean number of research spikes stands at about 16,958, with a standard deviation of approximately 15,495, further highlighting the diverse focus areas within the industry.

Implications of Data-Driven Insights

The insights gleaned from this data are multifaceted. Firstly, they reveal the construction industry’s proactive approach in equipping itself to better manage financial challenges. Topics like bankruptcy protection and loan workouts are not just about survival but strategic planning and risk management.

Secondly, the focus on compliance-related topics such as FACTA and BSA suggests that the industry is keenly aware of the regulatory landscape and its implications on operations. This is crucial in a sector where financial transactions are large, frequent, and scrutinized.

Lastly, the interest in programs like TARP highlights a recognition of the role that governmental support can play in stabilizing the industry during tumultuous periods. This points to a broader understanding within the industry of leveraging external aids for internal stability.

Conclusion

The construction industry’s research into banking topics is both a mirror and a map. It mirrors current concerns and maps out the areas where the industry is seeking knowledge and solutions. This data-driven insight into the construction industry’s banking-related interests provides not only a snapshot of current priorities but also a lens through which future trends and shifts might be anticipated. As the industry continues to evolve in an ever-changing economic landscape, understanding these dynamics will be key to navigating the challenges and opportunities that lie ahead.

Company Sample Data

Analyzing Industry Data

A detailed examination of data collected on the research habits within the construction industry reveals significant interest in various banking-related topics. This data, encompassing the activities of numerous businesses, was meticulously gathered and analyzed to understand which aspects of banking are most pertinent to the construction sector.

The metrics used in this analysis include the average weekly count of businesses that show a spiked interest in specific banking topics and the total instances of research spikes. These metrics provide a quantitative basis to gauge both the breadth and intensity of the industry’s engagement with banking topics.

Top Researched Banking Topics

Among the diverse range of topics, a few stand out due to the exceptionally high interest they generate:

1. Bankruptcy Protection: Topping the list with the highest weekly average of businesses interested and the most research spikes, this topic’s prominence underscores the industry’s focus on understanding and navigating financial distress.

2. Fair and Accurate Credit Transactions Act (FACTA): This reflects the industry’s efforts to comply with credit-related legal requirements, which are critical in maintaining financial health and securing funding.

3. Bank Secrecy Act (BSA): Close on the heels of FACTA, the interest in BSA indicates a strong commitment to adhering to regulations that prevent fraud and money laundering.

4. Loan Workout: The high level of interest in this area suggests that restructuring debt to avoid bankruptcy is a common concern for many in the sector.

5. Troubled Asset Relief Program (TARP): This topic’s popularity points to the sector’s interest in governmental programs that could aid in financial recovery during economic downturns.

Statistical Overview

The data set comprised 27 unique topics with an average weekly interest from approximately 327 businesses. The standard deviation, a statistical measure of the range of values, is notably high at around 298 for weekly interest, indicating significant variability in how different topics attract attention. Similarly, the mean number of research spikes stands at about 16,958, with a standard deviation of approximately 15,495, further highlighting the diverse focus areas within the industry.

Implications of Data-Driven Insights

The insights gleaned from this data are multifaceted. Firstly, they reveal the construction industry’s proactive approach in equipping itself to better manage financial challenges. Topics like bankruptcy protection and loan workouts are not just about survival but strategic planning and risk management.

Secondly, the focus on compliance-related topics such as FACTA and BSA suggests that the industry is keenly aware of the regulatory landscape and its implications on operations. This is crucial in a sector where financial transactions are large, frequent, and scrutinized.

Lastly, the interest in programs like TARP highlights a recognition of the role that governmental support can play in stabilizing the industry during tumultuous periods. This points to a broader understanding within the industry of leveraging external aids for internal stability.

Conclusion

The construction industry’s research into banking topics is both a mirror and a map. It mirrors current concerns and maps out the areas where the industry is seeking knowledge and solutions. This data-driven insight into the construction industry’s banking-related interests provides not only a snapshot of current priorities but also a lens through which future trends and shifts might be anticipated. As the industry continues to evolve in an ever-changing economic landscape, understanding these dynamics will be key to navigating the challenges and opportunities that lie ahead.