Executive Summary: Branding Research Trends in the Construction Industry

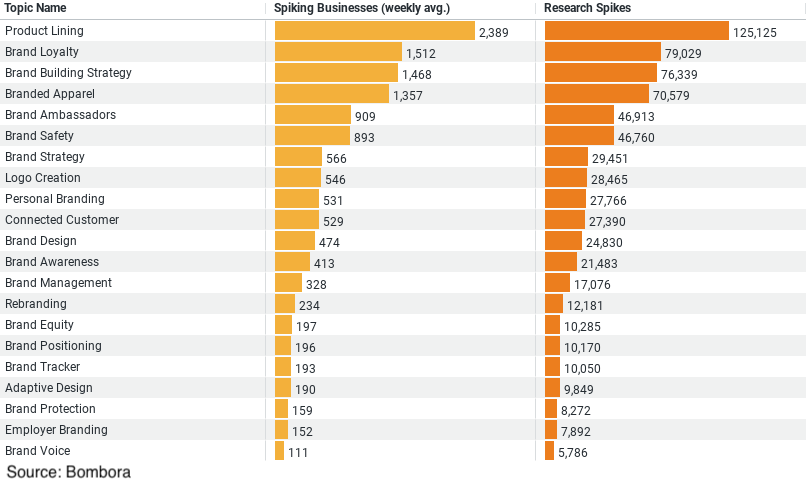

– Interest Distribution: The data reveals a descending interest in topics related to branding in the construction industry, starting from “Product Lining” as the most researched topic to “Brand Ambassadors” as the least, based on weekly averages of spiking businesses.

– Top Interest (Product Lining): With the highest weekly average (2389.25 businesses) and total research spikes (125,125), “Product Lining” emerges as the paramount focus area. This indicates a significant industry trend towards product strategy and portfolio management.

– Customer Engagement: “Brand Loyalty” and “Brand Ambassadors” topics highlight the construction industry’s effort in customer engagement and advocacy strategies, with respective total research spikes of 79,029 and 46,913.

– Branding Strategies: Both “Brand Building Strategy” and “Branded Apparel” show substantial interest with 76,339 and 70,579 total research spikes, respectively. This underscores the multifaceted approach to branding, from foundational strategies to tangible brand expressions like apparel.

– Research Intensity: The overall research intensity, evidenced by the total research spikes across the top topics, suggests a strong and widespread focus on branding within the construction industry, emphasizing its strategic importance.

This summary encapsulates the key data points and trends, providing a clear picture of the current branding research dynamics in the construction sector.

The Paramount Importance of Product Lining

At the forefront of branding research within the construction sector is the concept of Product Lining. With an astonishing weekly average of 2389.25 businesses delving into this area, accumulating a total of 125,125 research spikes, it’s clear that product strategy holds the throne. This intense focus underscores the industry’s push towards not just diversifying offerings but also strategically organizing them to meet diverse market needs and preferences. Product lining isn’t just about adding variety; it’s about creating a cohesive, comprehensive portfolio that resonates with the target audience, ensuring that each product not only meets a specific need but also strengthens the overall brand perception.

Fostering Brand Loyalty: A Close Second

Brand loyalty trails closely, with an average of 1511.98 businesses per week exploring this theme, culminating in 79,029 research spikes. This shows a keen interest in understanding and implementing strategies that go beyond the initial sale, aiming to build enduring relationships with customers. In an industry where projects can span months to years, and repeat business is invaluable, fostering loyalty is not just beneficial; it’s essential. Strategies may include superior customer service, consistent quality delivery, and engagement that extends beyond the construction site, weaving the brand into the fabric of the customer’s daily lives.

Strategizing Brand Building: More Than Just Visibility

The research on Brand Building Strategy, attracting around 1468.37 businesses weekly with a total of 76,339 spikes, highlights an analytical approach to brand development. It’s evident that construction companies are keen on laying a solid foundation for their brand, crafting strategies that encompass identity, values, and communication. This area’s popularity signifies a shift from seeing branding as a surface-level exercise to recognizing its role in driving business strategy, differentiating from competitors, and articulating a unique value proposition.

The Tangible Touch of Branded Apparel

Interestingly, the construction industry also shows a significant penchant for Branded Apparel, with about 1356.65 businesses per week researching this topic, leading to 70,579 total spikes. This interest points towards an appreciation for the tangible aspects of branding. Branded apparel serves not just as a walking advertisement but as a symbol of team unity and pride. It’s a visual endorsement of the brand, enhancing visibility while fostering a sense of belonging and community among employees and customers alike.

Leveraging Brand Ambassadors

Lastly, the role of Brand Ambassadors, though less researched compared to other topics with 908.81 businesses weekly and 46,913 total spikes, indicates a strategic exploration of influencer marketing within the construction industry. Utilizing influential figures, whether they’re industry experts, satisfied clients, or even celebrities, can help amplify a brand’s message, extend its reach, and build trust among potential customers.

The Strategic Weave of Branding in Construction

The data paints a vivid picture of the construction industry’s multi-faceted approach to branding. It’s not just about making a name; it’s about building a reputation, ensuring quality, fostering loyalty, and creating a community. As businesses delve deeper into these topics, the insights gained can pave the way for more sophisticated, strategic branding efforts that resonate deeply with their audience, distinguishing them in a crowded market.

In conclusion, the construction industry’s research interests in branding showcase a strategic and comprehensive approach to building strong, enduring brands. Through focusing on product lining, brand loyalty, strategic development, tangible branding elements, and influencer marketing, businesses are not just constructing buildings; they’re constructing powerful brands that stand the test of time.

Company Sample Data

The dataset categorizes companies into five distinct size brackets based on the number of employees: Micro (1 – 9 Employees), Small (10 – 49 Employees), Medium-Small (50 – 199 Employees), Medium (200 – 499 Employees), and Medium-Large (500 – 999 Employees).

For each category, it provides two key metrics:

– Spiking Businesses (weekly avg.): The average number of businesses showing a significant increase in researching specific topics weekly.

– Percent of Total: The proportion of total businesses that each category represents in the dataset.

Analysis and Trends

1. Micro (1 – 9 Employees): Representing the smallest company size, Micro businesses show a considerable level of activity with an average of 804.75 businesses spiking weekly, accounting for about 9.98% of the total. This suggests a high level of initiative from the smallest market players, possibly indicating their need to be agile and responsive to market changes or their pursuit of growth opportunities.

2. Small (10 – 49 Employees): Small businesses demonstrate a significant jump in research activity, with 2290 businesses on average spiking weekly, comprising 28.41% of the total. This increase reflects the growing complexities and challenges faced by businesses as they exit the micro segment, emphasizing the importance of strategic planning and market research in sustaining growth.

3. Medium-Small (50 – 199 Employees): This category leads in research activity, with an average of 2476.08 spiking businesses weekly, making up 30.72% of the total. This peak indicates that medium-small businesses, possibly at a crucial stage of scaling operations, are most actively seeking insights and strategies to navigate the competitive landscape effectively.

4. Medium (200 – 499 Employees): With 1108.65 average weekly spikes and 13.75% of the total, medium-sized businesses show a reduced but still substantial level of research interest. This could imply a transition phase where businesses consolidate their growth and focus on optimizing existing strategies over exploring new territories.

5. Medium-Large (500 – 999 Employees): The activity tapers further in this segment, with 533.52 businesses spiking weekly, accounting for 6.62% of the total. The decline in research intensity could suggest that businesses of this size have established more stable growth patterns and may rely more on in-house expertise or have specific, targeted research needs rather than broad explorations.

Implications and Conclusion

The trend across different company sizes indicates a bell curve of research intensity, peaking with medium-small businesses. This pattern likely reflects the evolving needs and strategic focuses of companies as they grow. Smaller companies demonstrate agility and a hunger for growth, leading to high research activity. As companies scale, their research intensity peaks, possibly in search of strategies to navigate the complexities of growth and competition. Beyond a certain size, the urgency for broad research diminishes, possibly due to established strategies, market presence, and the development of specialized, internal research capabilities.

This trend underscores the importance of tailored strategic planning and market research at different stages of a company’s growth, highlighting the dynamic nature of business strategies in response to organizational scale and market position.