Executive Summary: Business Structure Research Trends in the Construction Industry

The dataset from the construction industry research on the topic of Business Structure reveals several key trends and insights based on the average weekly spiking businesses and research spikes for the past year. Here’s a breakdown of the top trends and insights:

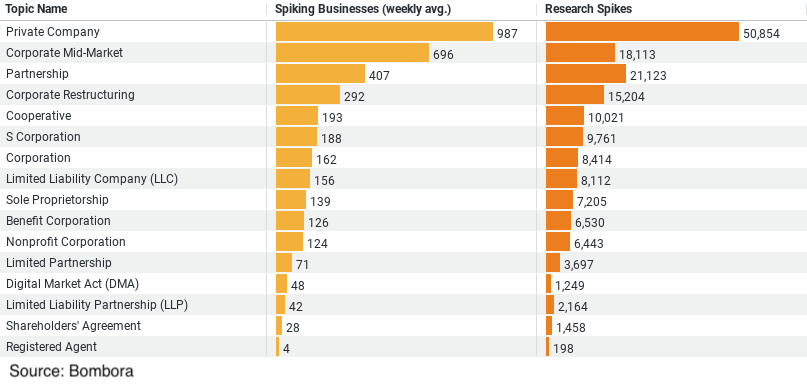

1. Private Company: This topic has the highest level of interest, with an average of 987 businesses per week spiking in research, leading to a total of 50,854 research spikes. This indicates a strong interest in private company structures within the construction industry.

2. Corporate Mid-Market: The interest in mid-market corporate structures is also significant, with an average of 696 businesses per week focusing their research here, totaling 18,113 research spikes. This reflects the importance of mid-market strategies in the industry.

3. Partnership: Partnerships are another popular business structure, with 406 weekly spiking businesses and a total of 21,123 research spikes. This suggests that collaborations and joint ventures are key areas of interest.

4. Corporate Restructuring: This topic sees an average of 292 businesses per week exploring it, resulting in 15,204 research spikes. The focus here indicates that restructuring for efficiency or growth is a common concern.

5. Cooperative: The least researched topic among the top five is the cooperative business structure, with 193 weekly spiking businesses and 10,021 research spikes. While it has the lowest numbers, it still represents a significant area of interest, possibly reflecting considerations for more collaborative or member-owned business models.

These insights suggest a diverse interest in business structures within the construction industry, with a strong emphasis on private companies and corporate strategies, alongside a notable interest in partnerships and restructuring efforts. This diversity may reflect the sector’s need to explore different models for growth, efficiency, and collaboration in a competitive and evolving market landscape.

The Pulse of the Construction Industry: Unveiling Research Trends in Business Structure

In an era where the construction industry faces ever-evolving challenges and opportunities, understanding how businesses within this sector approach the topic of business structure is pivotal. A recent analysis of industry data sheds light on these trends, revealing the strategic interests of companies of varying sizes. This blog post delves into these insights, exploring how construction businesses research and prioritize their organizational structures.

Micro to Medium-Large: A Spectrum of Inquiry

At the heart of our analysis is a dataset that categorizes companies based on their size—from micro enterprises with 1 to 9 employees to medium-large businesses housing 500 to 999 employees. The data points to a fascinating narrative: the intensity of research into business structures varies significantly across different company sizes, painting a complex picture of strategic priorities and challenges.

Micro Enterprises: The Foundation of Innovation

Micro-sized companies, while smaller in workforce, show a notable level of engagement in research, with an average of 183 weekly spiking businesses. This group’s activities account for approximately 7.93% of the total research interest. The data suggests that these firms, often characterized by their agility and innovative capabilities, are actively seeking ways to lay down robust business structures that could support sustainable growth and scalability.

Medium-Small Companies: At the Crossroads

The most noteworthy insight comes from medium-small companies (50 – 199 employees), which exhibit the highest level of research interest. With 586 weekly spiking businesses, they represent 25.35% of the total. This data point indicates a critical phase in the lifecycle of a construction business, where strategic decisions around business structure have far-reaching implications for future growth, market adaptation, and operational efficiency.

Medium Enterprises: Scaling Challenges

As companies grow into medium-sized enterprises (200 – 499 employees), the complexity of managing larger operations becomes evident. This segment shows a slightly reduced yet substantial engagement in research, with 356 weekly spiking businesses accounting for 15.41% of the total interest. The focus here shifts towards optimizing existing structures to support further scaling, diversification, and the introduction of more formalized management processes.

Medium-Large Businesses: Refinement and Optimization

Lastly, medium-large companies (500 – 999 employees) present a unique scenario. Despite their size, their research interest, representing 9.48% of the total, suggests a shift towards refining and optimizing their business structures rather than overhauling them. This trend underscores the need for continuous improvement and innovation, even as businesses establish themselves more firmly within the market.

Understanding the Trends: Strategic Implications for the Construction Industry

The insights gleaned from this analysis offer several key takeaways for stakeholders across the construction industry. For one, the intense focus on business structure among medium-small companies highlights a critical transition phase where strategic planning can make a significant difference in a company’s trajectory. This phase demands careful consideration of organizational design, leadership roles, and management practices to ensure scalability and responsiveness to market changes.

Moreover, the varying levels of research interest across company sizes reflect the diverse challenges and opportunities that businesses face as they grow. Service providers, consultants, and policymakers must recognize these differences, offering tailored support and guidance to help companies navigate their unique paths to success.

Conclusion

the construction industry’s exploration of business structures reveals a sector that is actively seeking ways to innovate, scale, and compete in a dynamic market landscape. By understanding these trends, companies can better position themselves for sustainable growth, leveraging strategic insights into organizational design to build a more resilient and prosperous future.

Company Sample Data on Business Structure Research in the Construction Industry

This analysis provides a quantitative breakdown of average weekly spiking businesses along with their percent share of the total. Here’s a detailed exploration of the dataset and the trends it unveils:

1. Micro (1 – 9 Employees): Micro-sized companies, with an average of 183 weekly spiking businesses, account for approximately 7.93% of the total. This shows a moderate level of research activity, which could indicate a strategic approach to growth and restructuring within very small enterprises.

2. Small (10 – 49 Employees): Small businesses demonstrate a more significant engagement in research, with an average of 490 weekly spiking businesses, making up 21.21% of the total. This higher level of interest might reflect the challenges and opportunities faced by small enterprises in scaling their operations or optimizing their organizational structure for improved efficiency and market competitiveness.

3. Medium-Small (50 – 199 Employees): Medium-small companies show the highest level of research activity among the groups, with 586 weekly spiking businesses, accounting for 25.35% of the total. This could suggest that businesses within this size range are at a critical juncture of growth, where strategic decisions regarding business structure could have profound impacts on their future development and sustainability.

4. Medium (200 – 499 Employees): Medium-sized companies, with 356 weekly spiking businesses, represent 15.41% of the total. The research interest from this group might be driven by the complexities that arise at this scale, including the need for more sophisticated management structures, diversification of business activities, or preparation for entering larger markets.

5. Medium-Large (500 – 999 Employees): Medium-large businesses have an average of 219 weekly spiking businesses, making up 9.48% of the total. This lower percentage, compared to medium-small companies, might indicate that once companies reach this size, their business structures are more established. However, they may still seek insights into optimizing or innovating within their existing frameworks to maintain competitiveness and adapt to market changes.

Trend Analysis and Implications

The data reveals a fascinating trend: the highest level of research interest comes from companies in the medium-small category, suggesting that businesses on the verge of transitioning to a medium scale are most actively seeking information on business structure. This peak of interest likely reflects the strategic inflection points these companies face, including challenges related to managing more significant operations, the need for more formalized structures, and the pursuit of efficiency and innovation to fuel further growth.

Conversely, micro-sized and medium-large companies exhibit less relative interest, possibly due to different stages of organizational development. For the former, the focus might be on survival and establishing a market presence, while the latter may be more about refinement and optimization of existing structures rather than foundational changes.

This trend underscores the dynamic nature of business growth and the varying needs and challenges businesses face as they expand. It highlights the importance of strategic planning, especially in terms of business structure, at different stages of a company’s lifecycle. Understanding these patterns can help service providers, consultants, and policymakers tailor their offerings and support to meet the distinct needs of businesses across the spectrum of size and maturity.