Executive Summary: Channels & Types Research Trends in the Construction Industry

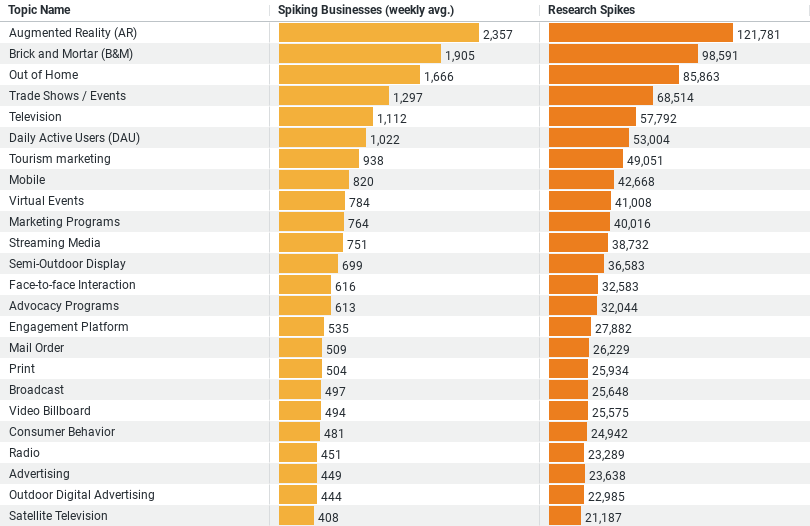

– Augmented Reality (AR) emerges as the most researched topic, with an overwhelming 121,781 research spikes, reflecting its potential to revolutionize the construction industry through immersive technologies.

– Brick and Mortar (B&M), representing traditional construction methods, also sees significant attention with 98,591 research spikes, indicating an interest in enhancing or innovating within conventional frameworks.

– The interest in Out of Home and Trade Shows / Events with 85,863 and 68,514 research spikes, respectively, highlights the construction industry’s focus on external advertising and professional community engagement as key strategies for growth and innovation.

– Television, although lower in the ranking with 57,792 research spikes, shows the ongoing relevance of traditional media in the industry’s research and marketing efforts.

The data reveals a balanced exploration within the construction industry, emphasizing both innovative technologies like AR and foundational practices and marketing strategies, underscoring a dynamic approach towards growth and adaptation.

Augmented Reality (AR): Leading the Technological Frontier

Topping the list of researched topics is Augmented Reality (AR), with an astounding 121,781 research spikes. This interest isn’t surprising given AR’s potential to drastically transform the construction landscape. From enhancing on-site workers’ ability to visualize projects in real-time to improving accuracy and efficiency in building designs, AR stands as a beacon of innovation. With an average of 2357 spiking businesses weekly delving into AR, it’s clear that the construction industry is eager to embrace this technology, recognizing its potential to streamline operations, reduce errors, and save costs.

Brick and Mortar (B&M): A Testament to Tradition

Following AR, Brick and Mortar (B&M) captures significant attention, with 98,591 research spikes. This interest underscores the industry’s commitment to understanding and improving traditional construction methods. Despite the allure of new technologies, the construction sector realizes the enduring value of brick and mortar. This method’s resilience, sustainability, and aesthetic appeal continue to make it a cornerstone of construction projects. The research reflects a desire to blend time-tested materials and techniques with modern innovations, ensuring the built environment remains both reliable and forward-thinking.

Out of Home: Expanding Industry Horizons

With 85,863 research spikes, Out of Home (OOH) ranks third in the industry’s research priorities. This category encompasses outdoor advertising and installations, highlighting the construction industry’s interest in projects that impact public spaces. The focus on OOH suggests a strategic move towards enhancing brand visibility and engaging the community through innovative constructions and advertisements. By researching OOH, construction businesses aim to leverage the public landscape as a canvas for creativity and communication, further broadening the industry’s scope.

Trade Shows / Events: The Power of Networking

Trade Shows and Events, attracting 68,514 research spikes, reveal the construction industry’s emphasis on community and professional development. These platforms offer invaluable opportunities for networking, learning, and showcasing the latest industry innovations. The keen interest in trade shows and events indicates the sector’s recognition of the importance of staying connected, sharing knowledge, and fostering partnerships. Such engagements are vital for driving progress, understanding emerging trends, and positioning businesses at the forefront of the construction revolution.

Television: The Role of Traditional Media

Even in an age dominated by digital media, Television remains a relevant research topic with 57,792 spikes. This enduring interest reflects the construction industry’s strategic use of traditional channels to reach broader audiences. Whether through advertising, educational content, or reality-based construction shows, television offers a platform to showcase projects, share insights, and inspire viewers. The continued research into television as a channel suggests a nuanced approach to marketing and communication, blending old and new media to maximize impact.

Conclusion

The construction industry’s research into Channels & Types paints a picture of a sector at a crossroads between innovation and tradition. By embracing cutting-edge technologies like AR, while also valuing foundational methods and community engagement, the industry is poised for a future that respects its roots while boldly stepping into new territories. This balanced approach ensures resilience, adaptability, and sustained growth, laying the groundwork for a construction landscape that is both innovative and enduring. As we look to the future, it’s clear that the construction industry’s research interests will continue to shape the built environment in profound and exciting ways.

Company Sample Data on Channels & Types Research in Construction

Why This Is a Trend Depending on Various Company Sizes

1. Resource Allocation: Larger companies often have more resources to invest in emerging technologies or market research, potentially leading to a greater diversity of interests or intents compared to smaller companies that might focus on core, proven strategies due to limited resources.

2. Risk Tolerance: Smaller companies might demonstrate higher agility in adopting new technologies or entering new markets as they seek competitive advantages, despite possibly having lower risk tolerance in terms of financial investment. Conversely, larger companies might be more cautious but can absorb the impact of new ventures not meeting expectations.

3. Market Influence: The intents of larger companies can set trends within industries due to their significant market influence. When a major player shows interest in a particular area, it often prompts others to follow suit, believing it to be a new industry direction.

4. Innovation and Niche Focus: Smaller companies might show trends towards more niche markets or innovative approaches as a way to differentiate themselves from larger competitors. This can reveal unique insights into how company size influences market strategies and areas of focus.

5. Adaptability and Change Management: The size of a company can also influence its adaptability to change. Smaller companies might pivot more quickly, showing trends towards emerging or rapidly evolving sectors. Larger companies, with more complex structures, might show a slower, more deliberate intent towards new areas, reflecting their need for more robust change management processes.

Understanding these dynamics can help stakeholders make informed decisions, tailor strategies to different market segments, and anticipate shifts in industry directions based on company size-related trends.