Executive Summary: Cloud Research Trends in the Construction Industry

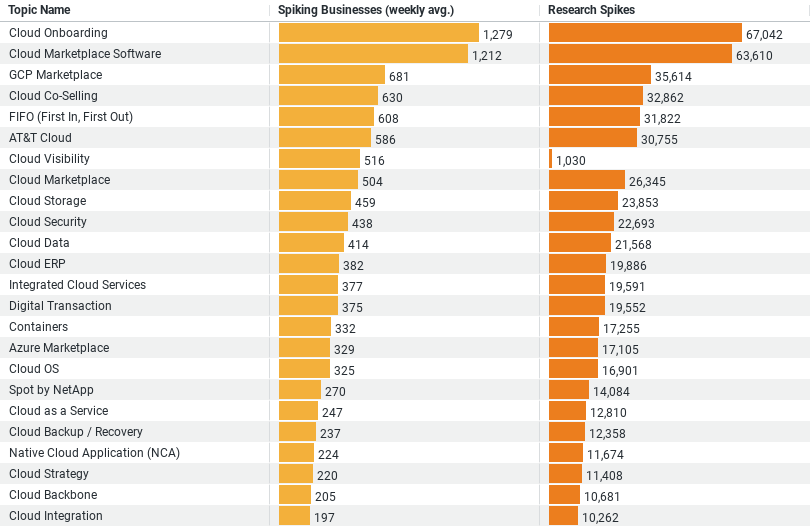

– Popular Topics: “Cloud Onboarding” and “Cloud Marketplace Software” are the most researched topics, showing strong interest in adopting and integrating cloud technologies.

– Average Weekly Research: The data reveals that, on average, around 1,279 businesses research “Cloud Onboarding” weekly, making it the most engaged topic. Other topics like “Cloud Marketplace Software” and “GCP Marketplace” also show significant weekly engagement with averages of 1,211 and 681 businesses respectively.

– Total Research Spikes: The total research spikes provide a measure of overall interest, with “Cloud Onboarding” leading at 67,042 spikes, followed by “Cloud Marketplace Software” with 63,610 spikes.

– Focus on Cloud Platforms: The specific mention of “GCP Marketplace” suggests a targeted interest in Google Cloud services, indicating that businesses are not only exploring cloud solutions but are also comparing specific cloud platforms.

– Operational Focus: The inclusion of operational management topics such as “FIFO (First In, First Out)” suggests an application of traditional operational principles to manage cloud resources or data.

Exploring the Cloud: Key Insights into the Construction Industry’s Research Interests

In recent years, the construction industry has increasingly turned its focus towards digital transformation, with cloud technology at the forefront of this shift. As construction firms seek to enhance their operational efficiencies and business processes, an analysis of industry research trends provides valuable insights into how companies are embracing cloud solutions. This blog post delves into the prevailing topics of interest within cloud technology for the construction industry, based on data from recent research metrics.

Top Research Topics in Cloud Technology

The leading topic among construction businesses is “Cloud Onboarding,” with an impressive weekly average of 1,279 businesses exploring this area. This statistic highlights the industry’s significant interest in understanding how to integrate cloud technology into their operations effectively. The process of onboarding indicates not just initial adoption but also the scaling and optimization of cloud solutions to fit various construction projects and business models.

Close behind in interest is “Cloud Marketplace Software,” with 1,211 businesses researching this weekly. The cloud marketplace serves as a digital storefront where businesses can discover, purchase, and manage cloud services and solutions. This strong focus suggests that construction companies are not only looking to adopt cloud solutions but are also keen on leveraging marketplaces to find the best tools and services that can be integrated seamlessly into their existing systems.

Specific Cloud Platforms: The Case of GCP Marketplace

Another specific area of interest is the “GCP Marketplace,” with around 681 businesses engaging weekly. This points to a targeted interest in the Google Cloud Platform (GCP), signaling that construction companies are comparing different cloud services to find the most suitable offerings that align with their unique needs. The preference for platforms like GCP could be attributed to their robust offerings in data analytics, machine learning, and infrastructure management—all crucial for the data-heavy, project-based nature of construction.

Emerging Trends: Cloud Co-Selling

With an average of 630 businesses per week researching “Cloud Co-Selling,” there’s growing curiosity about collaborative selling models in the cloud. This trend is indicative of construction companies looking to forge partnerships with cloud vendors to co-create and co-sell products. Such collaborations could enhance the reach of cloud solutions tailored to the construction industry, promoting innovations that address specific challenges such as project lifecycle management and real-time collaboration across sites.

Operational Efficiency with FIFO

Surprisingly, the topic of “FIFO (First In, First Out)” is also prevalent, with 607 businesses researching it weekly. While traditionally linked with inventory management, FIFO in the context of cloud research could imply a focus on optimizing data storage and management in cloud environments. Efficient data management is vital for construction projects, where vast amounts of data must be processed and accessed in an orderly manner to ensure project timelines and resource allocations are maintained.

Conclusion

The construction industry’s pivot towards cloud technology is driven by a desire to improve efficiency, scalability, and collaboration in an increasingly competitive and complex environment. The data reveals a broad and deep engagement with various aspects of cloud technology, from foundational onboarding processes to advanced marketplace solutions and strategic co-selling opportunities.

As the industry continues to evolve, the insights gleaned from such research not only reflect current interests but also predict future trends. Businesses within the construction sector that stay ahead of these trends, especially in adopting and optimizing cloud solutions, are likely to achieve significant gains in productivity and competitiveness. Embracing cloud technology is no longer just an option but a critical component of modern construction strategies.

Company Sample Data

Columns:

– Company Size: Categorizes companies based on the number of employees. The categories include Micro (1-9 employees), Small (10-49 employees), Medium-Small (50-199 employees), Medium (200-499 employees), and Medium-Large (500-999 employees).

– Spiking Businesses (weekly avg.): Shows the average number of businesses in each size category that are actively researching cloud-related topics each week.

– Percent of Total: Indicates the percentage that each company size category contributes to the total number of businesses researching cloud topics.

Data Overview:

– Micro (1 – 9 Employees): Weekly average of 625 businesses, contributing about 9.4% to the total.

– Small (10 – 49 Employees): Weekly average of 1,669 businesses, making up about 25.2% of the total.

– Medium-Small (50 – 199 Employees): Highest engagement with a weekly average of 1,814 businesses, accounting for about 27.4% of the total.

– Medium (200 – 499 Employees): Weekly average of 976 businesses, with a 14.8% share.

– Medium-Large (500 – 999 Employees): Weekly average of 551 businesses, contributing 8.3% to the total.

Trends and Implications:

The data shows a noticeable trend where businesses classified as Medium-Small (50-199 employees) exhibit the highest engagement in researching cloud technologies. This might indicate that companies of this size are at a critical growth stage where the scalability and flexibility offered by cloud solutions are crucial to their operational expansion and improvement. They likely have the resources to invest in technology and the need for the efficiency gains it can bring, more so than smaller companies but without the complexity and inertia that can characterize larger organizations.

The decreasing engagement among larger companies (Medium and Medium-Large) could be due to several factors:

1. Existing Infrastructure: Larger companies might already have significant investments in legacy systems and may be slower to transition to new technologies due to higher switching costs.

2. Custom Solutions: Bigger enterprises often require more customized solutions that might not be readily available in the market, leading to longer decision cycles.

Conversely, micro companies, despite their agility, might lack the financial resources or technical expertise to adopt cloud solutions at a larger scale, resulting in lower engagement levels compared to other categories.