Executive Summary: Hardware Research Trends in the Construction Industry

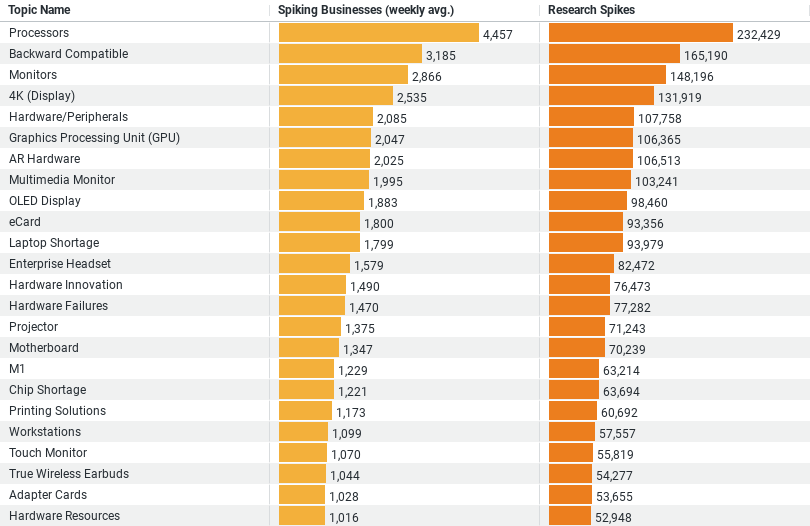

– Data Overview: The dataset includes information on the average weekly number of businesses showing interest in various hardware topics and the total number of research spikes for these topics.

– Key Findings:

1. Processors dominate the interest with the highest number of research spikes (232,429) and the largest average weekly spike in businesses researching this topic (4,457).

2. Backward Compatible and Monitors follow, with significant research spikes and business interest, highlighting a focus on compatibility and display technologies.

3. 4K (Display) and Hardware/Peripherals also show considerable research activity, underscoring an interest in high-definition display technologies and various hardware peripherals.

– Trend Analysis:

– There is a robust correlation between the number of businesses interested in a topic and the total research activity, suggesting widespread and deep interest in these areas within the industry.

– The data indicates a strong preference for upgrading to advanced processing technologies and ensuring backward compatibility with existing systems.

Construction Industry’s Keen Interest in Hardware Technologies: A Data-Driven Insight

The construction industry is often visualized with images of physical labor, heavy machinery, and towering structures. However, beneath this surface, there’s a vibrant undercurrent of technological engagement, particularly in the realm of hardware. Recent data reveals intriguing trends about how businesses within this sector are progressively leaning into various hardware technologies, from processors to peripherals. This blog post delves into these insights, offering a clearer picture of the technological priorities that are shaping the future of construction.

The Dominance of Processors

At the forefront of this technological pursuit is the significant interest in processors. Data indicates that processors lead with the highest number of research spikes (232,429) and an impressive average weekly spike in businesses researching this topic (4,457). This trend is not just a statistic but a testament to the growing complexity and computing needs of modern construction operations. Advanced processors are crucial for running sophisticated design and project management software, which are vital for enhancing efficiency and precision in construction projects.

Compatibility and Efficiency

Another notable trend is the industry’s focus on backward compatibility, with 3,185 businesses weekly delving into this area, accumulating a total of 165,190 research spikes. Backward compatibility is essential as it allows newer technology systems to work seamlessly with older construction equipment and software, ensuring a smooth transition and extended usability of existing resources. This not only optimizes costs but also eases the technology adoption curve for many construction firms.

Enhanced Display Technologies

The interest in monitors and 4K display technologies is also telling, with research spikes of 148,196 and 131,919, respectively. The drive towards better display technologies underscores the industry’s push towards more detailed and high-fidelity visualizations of construction projects. High-resolution displays are vital for architects and engineers who rely on precise visual details to plan and execute their projects effectively. Moreover, such technologies enhance collaborative efforts, allowing for more dynamic interactions and clearer communications among teams.

Peripheral Vision

Rounding out the top interests are hardware peripherals, which saw over 107,758 research spikes. This category includes a variety of devices that support construction activities, such as scanners, printers, and external storage devices. These tools are integral to the day-to-day operations, supporting everything from the on-site transfer of digital blueprints to the archiving of project documentation.

Interpreting the Data

What do these numbers really tell us about the construction industry? First and foremost, there is a clear indication that the sector is not shying away from embracing advanced technologies. The correlation between the number of businesses researching a topic and the total research activity suggests a widespread and profound interest in these areas. This trend is pivotal, considering the historically conservative approach to technology adoption in construction.

Moreover, the data highlights a strategic approach to technology investment. By focusing on processors and compatibility, the industry is setting a foundation for integrating more sophisticated technologies. This paves the way for the adoption of artificial intelligence and machine learning in the future, which could revolutionize everything from project planning to safety management.

Future Outlook

As the construction industry continues to evolve, its relationship with technology will undoubtedly deepen. The insights from current research trends not only reflect present priorities but also hint at the trajectory of future developments. Companies that continue to invest and innovate in their technological capabilities will likely find themselves at a competitive advantage, poised to deliver projects more efficiently, safely, and economically.

In conclusion, while the physical elements of construction will always be its backbone, the integration of advanced hardware technologies is rapidly becoming just as integral to the industry’s success. The ongoing research and interest in hardware signal a robust commitment to embracing the digital transformation, positioning the construction industry for a future where technology and tradition build in tandem.

Company Sample Data

1. Company Size: Categorizes companies into different groups based on the number of employees. The categories included are:

– Micro (1 – 9 Employees)

– Small (10 – 49 Employees)

– Medium-Small (50 – 199 Employees)

– Medium (200 – 499 Employees)

– Medium-Large (500 – 999 Employees)

– Large (1000+ Employees)

2. Spiking Businesses (weekly avg.): This column shows the average weekly number of businesses in each category that have shown a spike in research activity.

3. Percent of Total: This percentage represents each company size category’s share of the total spikes observed across all categories.

From this structure, we can glean several insights about how business size influences research interests and activity:

– Higher Activity in Small to Medium-Sized Businesses: The data shows that the majority of research spikes come from companies in the “Small (10 – 49 Employees)” and “Medium-Small (50 – 199 Employees)” categories. These companies are likely in a growth phase, requiring more research into new technologies, methods, and practices to enhance their operations and stay competitive.

– Micro and Small Businesses Show Significant Interest: Despite their size, micro and small businesses also show substantial activity, indicating a proactive approach to leveraging information and technology. This may be driven by the need to innovate faster and operate more efficiently to compete with larger entities.

– Diminishing Activity as Company Size Increases: Larger companies, such as those with 500 to 999 employees or more, show less research activity relative to their smaller counterparts. This might be due to established processes and slower adaptation to new technologies, or it could reflect a more focused research effort on specific areas rather than broad exploration.

Why This Is a Trend

The trend observed here is reflective of the agile and dynamic nature of smaller to medium-sized businesses in adapting to market changes and technological advancements. Smaller companies often have less bureaucracy, allowing them to pivot and adopt new technologies more quickly. Additionally, these businesses are continuously seeking ways to optimize and enhance their competitive edge, which often necessitates ongoing research and development.

Conversely, larger companies may have more resources but face challenges in shifting established systems and processes, which can slow down their research intensity. However, they might still be deeply engaged in research but in a more concentrated or specialized manner, which isn’t captured fully by spike counts alone.

This analysis of company sizes and their corresponding research activity provides valuable insights for service providers, technology developers, and policymakers aiming to support businesses across different stages of growth. By understanding where the most active research is happening, stakeholders can better target their offerings, support services, and innovation policies to meet the distinct needs of each business size category.