Executive Summary

Emphasis on Retirement Planning: The prominence of retirement-related topics such as “Retirement Trends,” “Retirement Savings / 401(k),” and “Pensions / Retirement Benefits” highlights a strong emphasis on retirement planning within the industry. This suggests that construction businesses are actively seeking insights and strategies to enhance their retirement benefits offerings, likely in an effort to better support their workforce’s financial security in retirement.

Pension Focus: The inclusion of “Pensions / Retirement Benefits” in the top researched topics indicates a specific interest in traditional pension schemes in addition to more modern retirement savings plans like 401(k)s. This dual focus suggests that businesses in the construction industry are exploring a range of options to cater to diverse employee preferences and needs regarding retirement savings.

Attracting and Retaining Talent: The focus on these retirement and pension-related topics likely reflects the industry’s recognition of the importance of competitive benefits packages in attracting and retaining talent. In a sector where skilled labor is in high demand, offering robust retirement benefits can be a key differentiator for employers.

Long-term Financial Security: This trend also points to a broader concern for long-term financial security, both for the businesses themselves and their employees. By researching and investing in comprehensive retirement and pension plans, construction companies are taking steps to ensure that their workforce is better prepared for the future, which can also contribute to employee satisfaction and loyalty.

The Construction Industry’s Deep Dive into HR and Benefits: A Look at Retirement and Pension Trends

In the rapidly evolving construction industry, where the battle for skilled labor intensifies, businesses are increasingly focusing on the holistic well-being of their workforce. A recent analysis of market insights reveals a significant trend: a deep and growing interest in “HR and Benefits,” particularly in retirement planning and pension schemes. This blog post delves into these findings, highlighting how construction industry employees are prioritizing research in these areas, and what it means for the sector at large.

A Focus on Retirement and Pensions

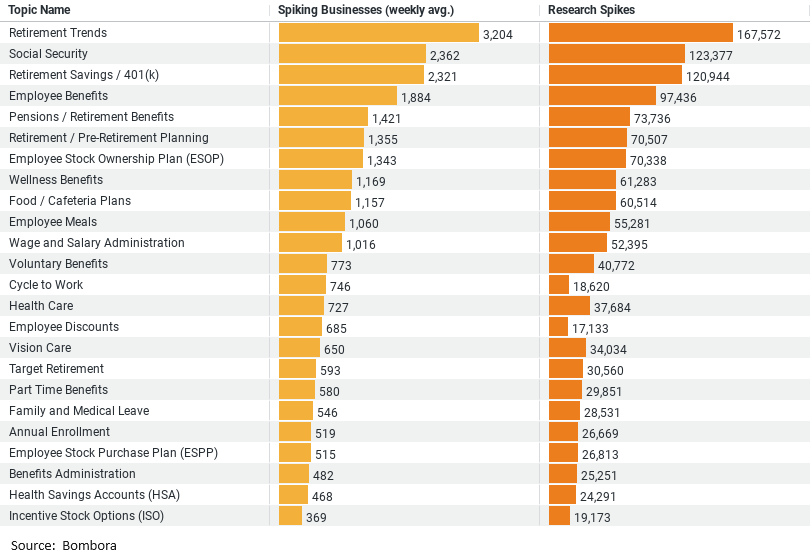

Among the myriad topics under the umbrella of HR and benefits, retirement-related issues stand out. Data indicates that four out of the top ten most researched topics in the past 12 months pertain to retirement planning and pensions. This not only underscores the importance of these benefits in the eyes of the construction workforce but also signals a shift in how the industry approaches long-term employee welfare.

1. Retirement Trends at the Forefront

Leading the charge in researched topics is “Retirement Trends,” with an astonishing 167,572 research spikes over the past year. This indicates a keen interest in understanding how retirement planning is evolving, likely driven by both demographic changes in the workforce and advancements in retirement planning tools and strategies.

2. Social Security and 401(k) Plans

Not far behind, topics like “Social Security” and “Retirement Savings / 401(k)” highlight a pragmatic approach to retirement savings. With over 120,000 research spikes combined, these topics reflect a dual focus: ensuring compliance and maximization of social security benefits, and leveraging 401(k) plans for employee retirement savings.

3. The Importance of Pensions

“Pensions / Retirement Benefits” also feature prominently in the industry’s research priorities, with 73,736 spikes. This suggests a revival of interest in traditional pension schemes, possibly as a complementary element to modern retirement savings plans. The construction industry appears to be exploring a range of options to cater to diverse employee needs and preferences.

Attracting and Retaining Talent

This marked interest in retirement planning and pensions is not just about financial security. It’s a strategic move by construction businesses to attract and retain talent in a competitive landscape. Offering robust retirement benefits is emerging as a key differentiator for employers. By providing comprehensive benefits packages, companies not only ensure their workforce’s financial well-being but also foster loyalty and satisfaction.

The Strategic Implications

The focus on HR and benefits, particularly retirement and pension plans, signifies a broader strategic shift in the construction industry. Companies are moving beyond traditional compensation models to embrace holistic employee welfare strategies. This is a reflection of a deeper understanding that the well-being of employees directly impacts productivity, job satisfaction, and ultimately, the bottom line.

1. Financial Security and Well-being

The construction industry’s emphasis on retirement planning underscores a commitment to the long-term financial security and well-being of its workforce. By actively researching and implementing comprehensive retirement plans, companies are taking a proactive approach to address one of the most critical aspects of employee welfare.

2. The Role of HR in Strategic Planning

The insights from this data highlight the increasingly strategic role that HR plays in the construction industry. HR and benefits are no longer just about compliance and administration; they are integral to strategic planning, directly contributing to the company’s competitive advantage.

3. Future Trends

As the construction industry continues to evolve, we can expect to see further innovations in HR and benefits. Companies may explore new retirement savings models, integrate technology to enhance benefits administration, and develop personalized benefits packages to meet the diverse needs of their workforce.

Conclusion

The construction industry’s focused research on HR and benefits, especially retirement planning and pensions, reflects a significant shift towards prioritizing employee welfare and financial security. This trend not only highlights the industry’s response to the changing needs of its workforce but also underscores the strategic importance of HR in building a sustainable and competitive business. As companies continue to navigate the challenges of talent management, those that invest in comprehensive and innovative HR and benefits strategies are likely to emerge as leaders in attracting and retaining the skilled labor force essential for their success.

Company Sample Used For This Article

This dataset encompasses market insights across a diverse sample of over 14,000 companies. This extensive compilation offers a panoramic view of how different company sizes are engaging with market trends, providing a rich foundation for understanding industry dynamics at various scales. From micro enterprises with fewer than 10 employees to medium-large companies boasting up to 999 employees, the data sheds light on the strategic priorities and market interests unique to each segment. This broad representation ensures a comprehensive analysis, enabling stakeholders to discern patterns, preferences, and priorities across the spectrum of company sizes.

Key Insights

The “Intent by Company Size (2).xlsx” file provides a detailed breakdown of market insights based on company size, reflecting the research interests and trends among businesses of varying scales. Here’s a snapshot of the findings:

Micro (1 – 9 Employees): Representing the smallest company segment, micro enterprises show a weekly average of 1,447.52 spiking businesses, accounting for approximately 10.37% of the total sample. This indicates a significant level of engagement from the smallest businesses in market research, highlighting their active pursuit of market insights despite their size.

Small (10 – 49 Employees): Small businesses exhibit a higher level of market research activity, with a weekly average of 4,378.44 spiking businesses, making up 31.35% of the total. This suggests that as companies grow, their capacity and need to engage with market insights increase correspondingly.

Medium-Small (50 – 199 Employees): This segment slightly edges out the small businesses in terms of market research activity, with a weekly average of 4,425.58 spiking businesses, contributing to 31.69% of the total. The close figures between small and medium-small businesses illustrate a steady interest in market insights as companies progress in size.

Medium (200 – 499 Employees): Medium-sized companies show a decrease in the weekly average of spiking businesses to 1,791.46, accounting for 12.83% of the total. This drop suggests a different strategic focus or perhaps a shift in the way market insights are utilized as companies enter the medium size category.

Medium-Large (500 – 999 Employees): The medium-large companies, despite their size, have a lower engagement in market research with a weekly average of 780 spiking businesses, representing 5.59% of the total. This may reflect a consolidation of market research efforts or a more directed approach in seeking market insights.