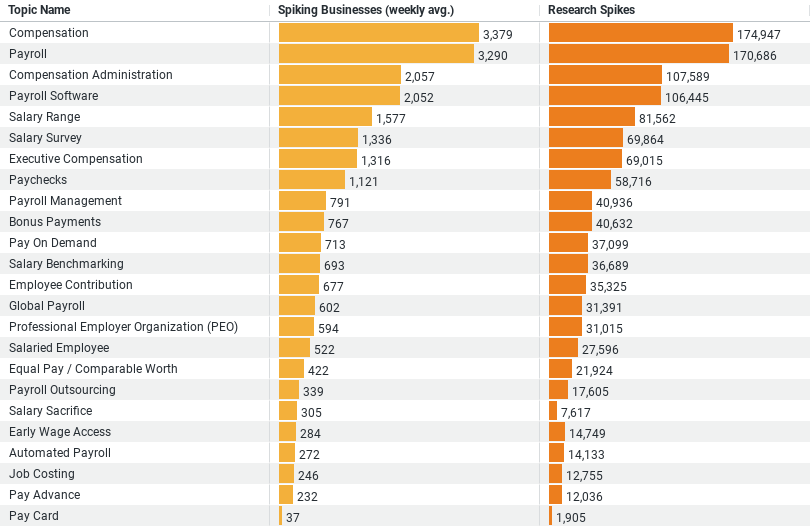

Executive Summary: Payroll & Compensation Research Trends in the Construction Industry

1. Compensation:

– Weekly Average of Spiking Businesses: 3,379.06

– Research Spikes: 174,947

2. Payroll:

– Weekly Average of Spiking Businesses: 3,290.13

– Research Spikes: 170,686

3. Compensation Administration:

– Weekly Average of Spiking Businesses: 2,057.46

– Research Spikes: 107,589

4. Payroll Software:

– Weekly Average of Spiking Businesses: 2,051.77

– Research Spikes: 106,445

5. Salary Range:

– Weekly Average of Spiking Businesses: 1,577.08

– Research Spikes: 81,562

These metrics provide insights into the interest and activity levels across different areas related to payroll and compensation, highlighting the topics that are currently most engaging for businesses and researchers.

In the dynamic world of the construction industry, managing payroll and compensation effectively is crucial. This sector, known for its rigorous demands, fluctuating project timelines, and diverse workforce, places a unique emphasis on the administrative aspects of payroll and compensation. A recent analysis of data highlights the significant areas of interest and research within the construction industry, providing valuable insights into how businesses navigate these critical topics.

This reveals the key areas of focus for businesses in the construction sector. With a detailed examination of weekly averages of spiking businesses and research spikes, we can discern the priorities and challenges that these companies face in managing their workforce.

Compensation

This emerges as the top area of interest, with a weekly average of 3,379.06 spiking businesses and an impressive 174,947 research spikes. This indicates a strong emphasis on understanding and implementing effective compensation strategies. In the construction industry, where the competition for skilled labor is fierce, establishing competitive compensation packages is vital. Businesses are keen on exploring strategies that not only attract but also retain talent, ensuring project continuity and success.

Payroll

Closely following compensation, records a weekly average of 3,290.13 spiking businesses and 170,686 research spikes. The construction industry, characterized by its project-based work, seasonal fluctuations, and reliance on subcontractors, faces unique payroll challenges. Companies are actively seeking innovative solutions to streamline payroll processes, ensuring accuracy, compliance, and timeliness. The high level of interest reflects the need for systems that can adapt to the complex and variable nature of construction work.

Compensation Administration

This is another critical area, with 2,057.46 spiking businesses weekly and 107,589 research spikes. Effective administration is the backbone of a successful compensation strategy. Construction companies are looking into advanced administrative practices that can handle the intricacies of their operations, from managing diverse job roles to adhering to various regulatory requirements. This interest underscores the necessity for robust administrative systems that support strategic compensation decisions.

Payroll Software

This topic stands out as a significant area of focus, with 2,051.77 spiking businesses weekly and 106,445 research spikes. The adoption of specialized payroll software is on the rise, as construction companies recognize the benefits of leveraging technology to enhance payroll management. These tools offer solutions tailored to the industry’s unique needs, such as handling multiple job sites, varying pay rates, and compliance with labor laws. The high level of interest in payroll software indicates a shift towards digital transformation in managing payroll and compensation.

Salary Range

With 1,577.08 spiking businesses weekly and 81,562 research spikes, it highlights the importance of transparency and competitiveness in salary offerings. Understanding the market salary range is crucial for construction companies to remain competitive employers. It enables them to set compensation levels that attract skilled professionals while maintaining financial sustainability. This interest reflects the ongoing efforts to balance competitiveness with cost management in a labor-intensive industry.

Conclusion

The insights from this graph shed light on the critical areas of research and interest within the construction industry related to payroll and compensation. It’s evident that companies are actively seeking knowledge and solutions to address the complexities of managing a diverse and dynamic workforce. The focus on compensation, payroll, administrative practices, software solutions, and understanding salary ranges underscores the strategic importance of these areas in achieving business success.

As the construction industry continues to evolve, the emphasis on effective payroll and compensation management will undoubtedly remain a priority. By leveraging the insights from this data, businesses can navigate the challenges of workforce management, ensuring operational efficiency and competitiveness in the market.

Company Sample Data

This data offers insights into how businesses of various sizes prioritize and research payroll and compensation-related issues. Here’s a summary of the key insights from the first few rows:

1. Micro (1 – 9 Employees):

– Weekly Average of Spiking Businesses: 1,020.5

– Percent of Total: 9.12%

2. Small (10 – 49 Employees):

– Weekly Average of Spiking Businesses: 3,395.08

– Percent of Total: 30.34%

3. Medium-Small (50 – 199 Employees):

– Weekly Average of Spiking Businesses: 3,632.65

– Percent of Total: 32.47%

4. Medium (200 – 499 Employees):

– Weekly Average of Spiking Businesses: 1,489.58

– Percent of Total: 13.31%

5. Medium-Large (500 – 999 Employees):

– Weekly Average of Spiking Businesses: 651.62

– Percent of Total: 5.82%

The data illustrates a clear trend: interest in payroll and compensation issues is significantly concentrated in the small to medium-small company segments. These segments represent the highest weekly averages of spiking businesses, indicating a strong focus on managing payroll and compensation effectively within these company sizes. This could reflect the growing complexities and regulatory requirements faced by growing businesses in managing their workforce compensation and payroll systems.