Executive Summary: Supply Chain Trends in the Construction Industry

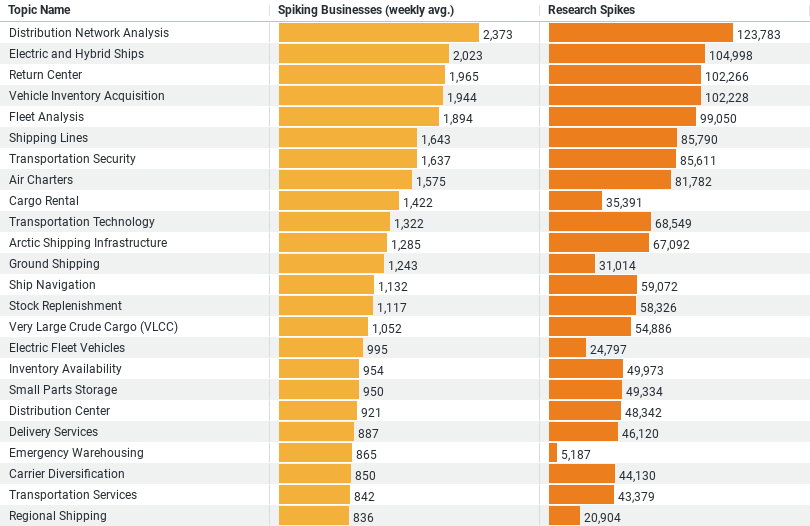

– Topics Covered: It lists different subjects within the supply chain domain, such as Distribution Network Analysis, Electric and Hybrid Ships, Return Center, Vehicle Inventory Acquisition, and Fleet Analysis.

– Spiking Businesses (weekly avg.): This column shows the average weekly count of businesses where interest or activity related to the corresponding topic has spiked. For instance, Distribution Network Analysis has a weekly average spike in 2373.46 businesses.

– Research Spikes: Indicates the number of times research or inquiries into the topic have surged. Distribution Network Analysis leads with 123,783 spikes.

This data suggests a focused interest in areas that are crucial for optimizing supply chain operations, highlighting the industry’s move towards more sustainable practices (like electric and hybrid ships) and efficient inventory and fleet management.

In today’s fast-evolving economic landscape, the construction industry stands at the cusp of a transformative shift, particularly in how it navigates the complexities of the supply chain. A recent analysis of trending topics within the supply chain domain sheds light on this industry’s proactive approach towards adopting innovative practices and technologies. This blog post delves into the insights derived from the data, revealing the construction sector’s keen interest in areas such as Distribution Network Analysis, Electric and Hybrid Ships, Return Centers, Vehicle Inventory Acquisition, and Fleet Analysis.

The data unveils that ‘Distribution Network Analysis’ tops the list with an average weekly spike of 2373.46 businesses showing increased activity or interest. This statistic is a testament to the construction industry’s push towards optimizing logistical operations. By analyzing their distribution networks, companies aim to streamline processes, reduce costs, and enhance delivery times, ensuring materials and equipment are available when and where needed, thus minimizing project delays.

Following closely is the burgeoning interest in ‘Electric and Hybrid Ships,’ with a weekly average spike of 2023.19 businesses. This pivot towards sustainable transportation solutions reflects the sector’s commitment to reducing its carbon footprint. Electric and hybrid ships offer a greener alternative for transporting bulky materials and machinery across vast distances, aligning with global sustainability goals and regulations. This shift not only underscores the industry’s environmental responsibility but also highlights its adaptation to changing regulations and public expectations concerning sustainability.

‘Return Centers’ emerge as another focal point, with 1964.96 businesses weekly showing heightened interest. The construction industry, known for its significant material usage and waste, is increasingly prioritizing circular economy principles. By investing in return centers, companies are facilitating the reuse and recycling of materials, reducing waste, and promoting sustainability. This approach not only minimizes environmental impact but also offers cost benefits by reclaiming valuable resources.

‘Vehicle Inventory Acquisition’ and ‘Fleet Analysis’ also feature prominently, with weekly spikes of 1943.54 and 1893.60 businesses, respectively. These insights highlight the industry’s focus on optimizing its vehicle and equipment fleet, crucial for transporting materials and personnel. Through sophisticated inventory management and fleet analysis, construction companies are ensuring operational efficiency, reducing downtime, and cutting unnecessary expenditures. This meticulous management of assets is critical in a sector where delays can lead to significant financial losses.

The data, with ‘Research Spikes’ ranging from 99050 to 123783, indicates a robust and growing interest in these topics. This intense research activity underscores the construction industry’s proactive stance in exploring and implementing cutting-edge supply chain solutions. By doing so, the industry is not only enhancing its operational efficiency but also addressing broader challenges such as sustainability, cost management, and technological adoption.

This shift towards advanced supply chain practices in the construction industry is driven by several factors. The global push for sustainability, heightened by climate change concerns, mandates a reevaluation of traditional practices. Meanwhile, technological advancements offer unprecedented opportunities for efficiency gains, from AI and IoT in fleet management to blockchain in securing transparent and efficient supply chains. Additionally, the COVID-19 pandemic has highlighted the vulnerabilities in global supply chains, prompting industries, including construction, to seek more resilient and adaptable strategies.

Conclusion

The construction industry’s focused research and interest in innovative supply chain solutions signal a significant transformation. By embracing advanced technologies and sustainable practices, the sector is not only enhancing its operational efficiency but also contributing to a more sustainable and resilient future. As this industry continues to evolve, its proactive approach to supply chain management will undoubtedly serve as a blueprint for others, showcasing the immense potential of innovation in driving economic, environmental, and societal progress.

Company Sample Data

This data is pivotal for understanding how different segments of the business world are engaging with supply chain innovations and strategies. Here’s a breakdown of the key components found within this dataset:

– Company Size: The dataset categorizes companies into five distinct groups based on the number of employees. These categories are Micro (1 – 9 Employees), Small (10 – 49 Employees), Medium-Small (50 – 199 Employees), Medium (200 – 499 Employees), and Medium-Large (500 – 999 Employees). This classification helps in analyzing the data according to the scale of operations and potential impact on the supply chain domain.

– Spiking Businesses (weekly avg.): This column shows the average weekly count of businesses within each size category that have demonstrated a spike in interest or activity related to supply chain topics. For example, the data indicates that small companies (10 – 49 Employees) have the highest average weekly spike, with 6957.21 businesses showing increased activity, highlighting the keen interest of smaller enterprises in optimizing their supply chain operations.

– Percent of Total: This metric represents the proportion of total businesses in each size category that are engaging with supply chain-related topics. The small businesses category, with 33.3105% of the total, shows a significant engagement level, suggesting that supply chain optimization is a critical area of focus for this segment.

The dataset provides a fascinating glimpse into how businesses of different sizes prioritize and engage with supply chain innovations. Smaller companies, in particular, appear to be actively exploring supply chain improvements, potentially seeking agility and competitive advantages in a complex business landscape.

This data is invaluable for stakeholders within the supply chain ecosystem, offering insights into where attention and resources might be most effectively directed to foster collaboration, innovation, and efficiency across the board.