Executive Summary: Insights into the Construction Industry’s Sales Research Trends

The construction industry is experiencing a significant transformation, driven by dynamic market demands and the constant evolution of sales strategies. An in-depth analysis of recent market research trends within the industry reveals key areas of focus that are shaping the way construction companies approach sales and business growth. This summary encapsulates the critical insights derived from the data, highlighting the strategic priorities of businesses as they navigate the complex landscape of sales in the construction sector.

Key Research Topics and Trends

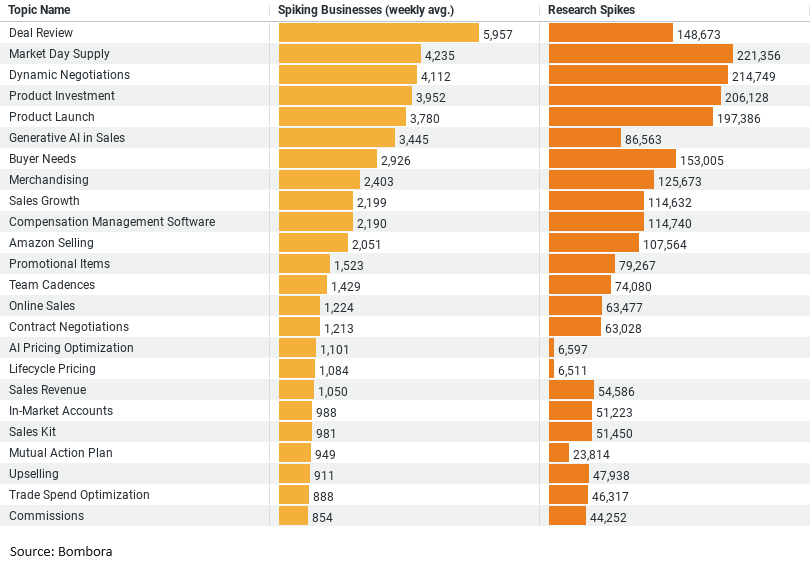

Deal Review: With an average weekly spike of 5,957.04 businesses researching this topic and a total of 148,673 research spikes over the past 12 months, Deal Review emerges as the leading area of interest. This trend underscores the industry’s emphasis on optimizing sales strategies and negotiations to ensure profitability and competitive advantage in every transaction.

Market Day Supply: Garnering an average weekly interest of 4,234.69 businesses and a total of 221,356 research spikes over the year, Market Day Supply highlights the critical importance of supply chain dynamics. This focus reflects the industry’s proactive efforts to align supply with market demand, ensuring efficient stock management and sales forecasting.

Dynamic Negotiations: Attracting an average weekly research interest of 4,111.73 businesses, with a yearly total of 214,749 spikes, Dynamic Negotiations point to the industry’s strategic approach to securing favorable deals. This indicates a broader trend towards enhancing negotiation capabilities to adapt swiftly to market changes and secure advantageous contract terms.

Product Investment: With 3,952 businesses researching this topic weekly on average and a total of 206,128 spikes over the year, Product Investment demonstrates the industry’s commitment to innovation and growth. Companies are increasingly focusing on exploring new product opportunities and enhancing existing offerings to strengthen market presence and drive sales.

Product Launch: Averaging 3,779.85 businesses researching weekly and totaling 197,386 research spikes over the past 12 months, Product Launch signifies the strategic importance of introducing new products. This trend reflects the industry’s effort to capture market share, address emerging customer needs, and differentiate from competitors through new offerings.

Strategic Implications and Outlook

The construction industry’s focused research on sales-related topics reveals a strategic orientation towards maximizing sales outcomes, enhancing market positioning, and fostering growth. The emphasis on deal review, supply chain management, dynamic negotiations, product investment, and product launches indicates a comprehensive approach to navigating sales challenges. These insights suggest that construction companies are keenly aware of the need to adapt to market dynamics, innovate, and strategically plan their sales efforts to achieve sustained success.

As the industry continues to evolve, leveraging these insights will be crucial for companies aiming to enhance their sales strategies, capitalize on new opportunities, and maintain a competitive edge in the market. The data-driven understanding of market research trends offers a roadmap for navigating the complexities of sales in the construction industry, emphasizing the importance of strategic planning, innovation, and adaptability in achieving business objectives.

Company Data Sample

The newly analyzed dataset, provides a detailed view of market research trends across different company sizes in the construction industry. This summary delves into the key insights derived from the sample data, focusing on how companies of various sizes are showing interest in sales-related topics.

Dataset Overview

The dataset categorizes companies into five size-based segments:

Micro (1 – 9 Employees)

Small (10 – 49 Employees)

Medium-Small (50 – 199 Employees)

Medium (200 – 499 Employees)

Medium-Large (500 – 999 Employees)

It measures the average weekly spikes in businesses researching sales-related topics and calculates each segment’s percentage of the total research activity.

Key Trends and Insights

Dominant Interest from Small and Medium-Small Companies: Small (10 – 49 Employees) and Medium-Small (50 – 199 Employees) companies are the most active in researching sales-related topics, with weekly averages of 9,772.85 and 8,168.65 businesses, respectively. This activity accounts for approximately 36.55% and 30.55% of total research, highlighting the significant interest in sales strategies within these segments.

Micro Companies Show Considerable Interest: Despite their size, Micro (1 – 9 Employees) companies also show notable research activity, with a weekly average of 3,463.19 businesses engaging in sales-related topics. This represents about 12.95% of the total, indicating a strong interest in sales strategies among the smallest of enterprises.

Decreased Activity in Larger Companies: Interestingly, as company size increases, the volume of research into sales topics decreases. Medium (200 – 499 Employees) and Medium-Large (500 – 999 Employees) companies show lower levels of research activity, with weekly averages of 2,713.98 and 1,088.54 businesses, respectively. This suggests that larger organizations may rely more on established sales strategies or have different priorities in their market research activities.

Market Engagement Across the Spectrum: The data indicates a broad engagement with sales-related research across different company sizes, suggesting that regardless of size, companies are keenly interested in enhancing their sales approaches. This points to a competitive landscape where businesses are continuously seeking to refine their sales tactics to gain an edge.