Executive Summary: Research Trends on Construction Instruments

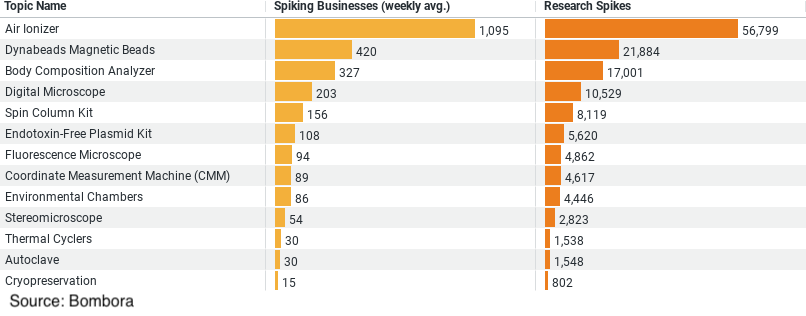

– Air Ionizer: Leads with the highest engagement, suggesting air quality is a paramount concern.

– Dynabeads Magnetic Beads: Indicates an interest in innovative construction materials or technologies.

– Body Composition Analyzer: Reflects a focus on workforce health and safety.

– Digital Microscope: Points towards an emphasis on material quality and precision.

– Spin Column Kit: Suggests environmental considerations and material testing are key areas of interest.

The data underscores the industry’s move towards embracing technology, prioritizing quality, safety, and sustainability.

Company Sample Data

1. Micro (1 – 9 Employees): This segment shows an average weekly interest from approximately 179 businesses, accounting for 8.31% of the total. This level of engagement suggests that even the smallest companies are keen on exploring and potentially adopting new technologies, possibly to enhance operational efficiency or competitive edge.

2. Small (10 – 49 Employees): Small companies demonstrate a higher level of research activity, with about 484 businesses showing weekly interest, making up 22.52% of the total. This indicates a significant interest in technological advancements and innovations, likely driven by the need to scale operations and improve project outcomes.

3. Medium-Small (50 – 199 Employees): This category exhibits the highest engagement, with approximately 565 businesses researching weekly, constituting 26.26% of the overall activity. This suggests that medium-small companies are actively seeking to integrate advanced instruments and technologies, potentially to optimize efficiency and enhance their capabilities in competitive markets.

4. Medium (200 – 499 Employees): Medium-sized companies show substantial interest, with an average of 315 businesses engaging in research weekly, accounting for 14.65% of the total. This level of engagement implies a strategic approach to technological adoption, focusing on innovations that offer significant value to their operations and project execution.

5. Medium-Large (500 – 999 Employees): This segment, while smaller in numbers, still shows considerable activity with about 189 businesses researching weekly, representing 8.80% of the total. This indicates that medium-large companies are also invested in exploring new instruments and technologies, potentially to maintain their competitive advantage and operational excellence.

Trend Analysis

The data indicates a clear trend across company sizes, where businesses of all scales show interest in researching and potentially adopting new instruments and technologies. This trend reflects a broader industry movement toward innovation, efficiency, and sustainability. The varied levels of engagement can be attributed to different capacities for investment, the impact of technological integration on operations, and strategic priorities based on company size.

– Micro to Small Companies: The engagement from micro to small companies suggests a growing interest in leveraging technology to level the playing field, allowing these smaller entities to compete more effectively with larger firms by enhancing their efficiency and project delivery capabilities.

– Medium-Small to Medium-Large Companies: Companies in this range show the highest levels of research activity, likely due to their greater resources and a strategic imperative to invest in technologies that can significantly impact their operational efficiency, project management, and sustainability practices.

The trend across various company sizes underscores the construction industry’s shift towards digital transformation and technological adoption, recognizing the potential of innovative instruments to revolutionize project delivery, enhance safety, and minimize environmental impact.