Running a commercial construction business takes a constant juggling act—coordinating crews, tracking equipment, hitting deadlines, and staying within budget. Software helps bring all those moving parts under control, but once you start looking into your options, one question always comes up: How much is this going to cost?

Construction management software pricing shifts depending on the tools you need, the size of your projects, and how your team is set up. You’re not just paying for a platform—you’re investing in how your business operates day to day. That’s why understanding how costs break down matters. Whether you're managing field crews or office workflows, software plays a central role.

If you're also managing dispatch-heavy operations, systems that cover construction field service management often overlap with broader construction platforms—another thing to consider when evaluating pricing. This guide walks you through the real numbers behind construction software price tags, the main factors that shape those costs, and how to evaluate whether what you’re getting lines up with what you actually need.

- What does construction management software typically cost?

- 8 key factors that influence construction software pricing

- Essential features to prioritize in a construction management tool

- 10 steps to choosing the right construction software platform

- 5 best construction management software options

- How to maximize value from the cost of construction management software

Let’s start with what you’re likely to pay. We'll break down typical pricing ranges first, then look at the key cost drivers and how to evaluate your options without getting buried in fine print or bloated features you won’t use.

What does construction management software typically cost?

Construction management software comes with a range of pricing models. What you pay depends on the size of your team, the complexity of your projects, and how the software is licensed or accessed. Here’s a clear look at the typical pricing structures used across the industry:

1. Per-user subscription (monthly or annual)

A per-user subscription is the most common model for cloud-based construction software, typically billed monthly or annually based on the number of active users. Costs usually range from $30 to $350+ per user per month. Pricing tiers often scale based on access to core features like project tracking, document control, scheduling, or integrations.

2. Flat-rate pricing

Flat-rate models charge a fixed monthly or annual fee regardless of the number of users. This is often used by companies with larger teams who benefit from unlimited access. Plans typically range from $500 to $2,500+ per month and may include a full suite of tools, though there can be limits on active projects, data storage, or support levels.

3. Perpetual license (one-time fee)

A perpetual license involves a one-time payment to own the software outright, usually for on-premise solutions. These licenses often start around $5,000 and can exceed $50,000, depending on the scope. Additional fees for updates, support, or system maintenance are often required.

4. Usage-based pricing

With this model, pricing is based on usage metrics like number of projects, data volume, or storage. It’s commonly used by firms with fluctuating workloads, and while the monthly cost may vary, it scales alongside business activity. It can be cost-effective for project-driven companies but harder to predict long-term.

5. Freemium or open-source options

These offer basic functionality at no cost, typically geared toward small teams or startups. Open-source platforms allow for more customization but usually require internal tech resources. Upgrades typically unlock more advanced features such as scheduling, reporting, or mobile app access.

Now that you’ve seen the typical pricing structures, it’s easier to understand the broad range of construction software costs. But the pricing model alone doesn’t explain everything. What really drives the total cost is how the software lines up with your team size, workflow, and the features your projects actually demand.

8 key factors that influence construction management software pricing

Sticker shock usually comes from not knowing what you’re really paying for. Behind every price tag is a mix of variables that depend on how your business is structured, what kind of jobs you run, and how much tech you actually use. Here's a look at the most common cost drivers, and how each one impacts the bottom line.

1. Team size

Construction software is often priced per user. The more people who need access—project managers, estimators, office staff, supers—the higher the monthly cost. Some platforms only charge for admin users, while others count everyone, including field crews. If your operation scales quickly, pricing can jump fast unless there’s a volume discount baked in.

2. Feature set

You’re not just paying for access—you’re paying for what the software actually helps you manage. Tools like scheduling, budget tracking, RFIs, submittals, and change orders are often bundled into pricing tiers. Companies that manage multiple trades under one roof often need a broader feature set than those focused on one type of work. Teams running complex builds typically layer in capabilities over time, similar to how most grow into full construction project management software for contractors as their needs expand.

3. Deployment method

Whether the software is cloud-based or hosted on your own servers changes how you’ll be billed. Cloud tools charge monthly or annually and usually include updates and support. On-premise setups come with a large upfront license cost, plus hardware, IT labor, and manual upgrades. If your business leans on internal tech teams, this model may fit—but most commercial contractors lean toward cloud platforms for flexibility.

4. Project volume

Some platforms calculate pricing based on how many active projects you're managing at a time. That might work well for companies handling a steady stream of similar jobs. But for firms with seasonal surges or highly varied project sizes, it can quickly become expensive. This structure works best when your workload is predictable—or when pricing is flexible enough to handle slow and busy periods without punishing you.

5. Integration needs

Software doesn’t operate in a vacuum. Most construction businesses already use tools for estimating, accounting, or lead tracking. The more systems you need to connect, the more likely you’ll face integration costs. That’s especially true if you’re already relying on a commercial construction CRM to manage client data, job history, and pipeline visibility. Seamless integration with your core software stack keeps information flowing without duplicating work.

6. Training and onboarding

Not every team is starting from scratch. Some are replacing outdated systems, while others are moving from spreadsheets or pen-and-paper. Either way, proper onboarding plays a big role in getting value from the software—and that often comes with a price tag. From data migration to hands-on training, those first few weeks can make or break adoption. The cost depends on how personalized the process needs to be.

7. Support and updates

Support isn’t always included. Some vendors package it with higher-tier subscriptions or offer basic coverage only during business hours. If your crews run nights or weekends—or you need guaranteed uptime—you might be looking at an additional monthly fee for premium support. Also factor in whether updates are automatic or require manual effort, especially for larger teams.

8. Industry trends

Pricing models shift with technology. As more platforms adopt automation, AI, and mobile-first interfaces, features that used to be add-ons are starting to become part of the base package. These shifts are often tied to bigger developments in the market, and understanding the direction the tech is moving can help you anticipate cost increases. Current construction industry trends show how these tools are evolving—and what that might mean for how software gets priced going forward.

Knowing what affects construction software pricing helps you avoid paying for tools that don’t fit how your business actually runs. But just as important as understanding cost drivers is knowing what features matter most. The next section breaks down the essentials—what your software should be able to handle out of the box to keep jobs moving and your team on track.

Essential features to prioritize in a construction management tool

Certain software features drive the cost of construction platforms because they directly affect how teams operate on the ground. Whether you're managing labor, scheduling, or tracking performance across sites, these tools aren't just useful—they're essential for keeping jobs on track and budgets under control.

Core features to prioritize

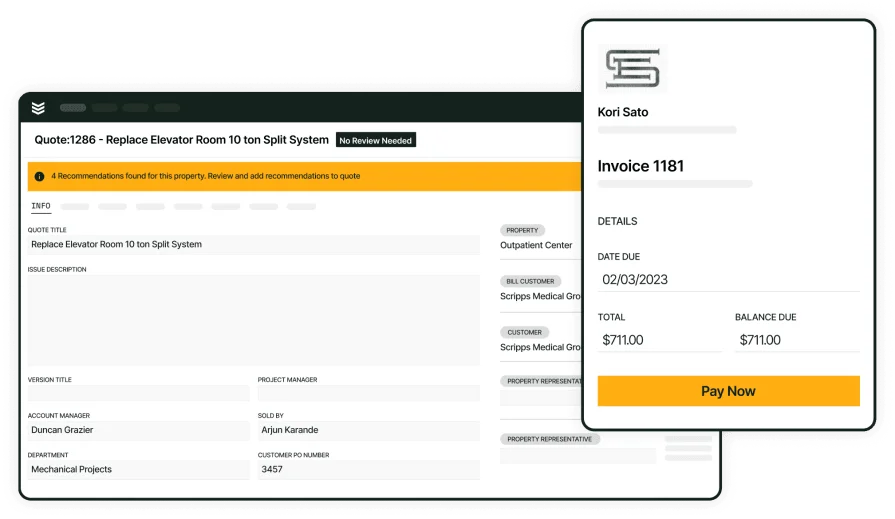

- Quoting tools that generate consistent, job-ready estimates - Quoting tools let you build estimates based on labor rates, material costs, and job history. Estimators can use templates, adjust numbers quickly, and generate quotes without relying on spreadsheets. This helps reduce underbidding and makes sure pricing reflects how the job will actually be done. Construction quoting software ties estimates directly to job execution so costs align from day one.

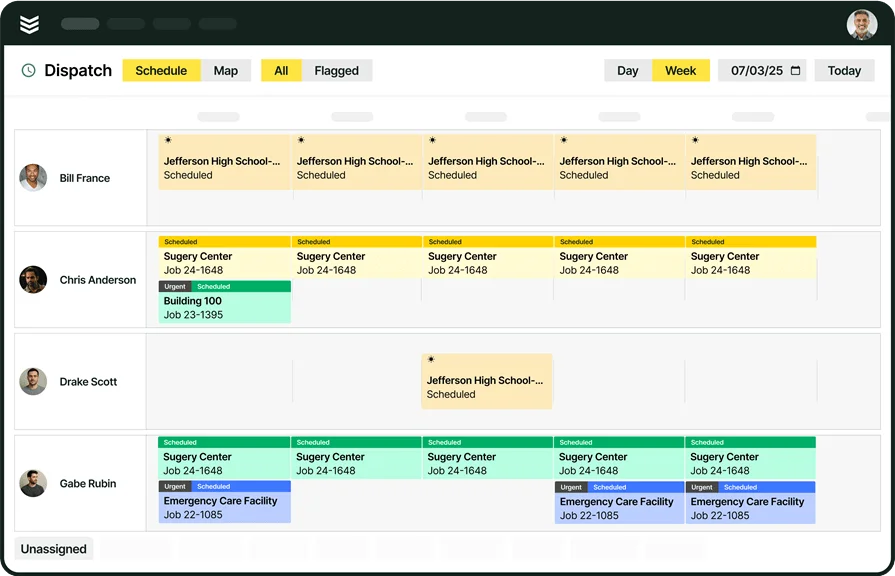

- Scheduling tools that match crews to job timelines - Scheduling features help assign the right crews to the right jobs at the right time. These tools let you view crew availability, shift assignments as delays happen, and reduce idle time. Field service scheduling tools keep projects on track by centralizing schedule visibility across teams and sites.

- Dispatching that coordinates field crews and equipment - Dispatch tools allow you to reroute crews, assign vehicles, and respond to field changes in real time. This keeps jobs moving and reduces miscommunication when site conditions shift or teams finish early. With field service dispatch software, the office can reassign teams on the fly without endless phone calls.

- CRM features that track project history and client communication - CRM systems organize customer data, job history, communication logs, and open proposals in one place. Instead of searching emails, the office can access everything tied to a client—including previous work orders and invoices. Construction CRM tools help keep client relationships smooth and eliminate guesswork on past projects.

- Mobile access that connects technicians with the office - Mobile features let field crews view job info, upload documentation, and complete tasks from anywhere. This ensures everyone is working with the same data in real time. Technician mobile app access enables accurate, fast updates directly from the jobsite.

- Time tracking that logs hours by job and employee - Accurate labor tracking is essential for billing, payroll, and performance reviews. With field service time tracking, crews log time directly from the field, tied to specific jobs. This cuts down on admin and ensures payroll reflects actual work done.

Explore our service management suite

We help teams manage construction projects from first quote to closeout.

Other notable construction management features to have

Beyond scheduling, quoting, and dispatching, there are additional tools that strengthen how construction teams manage day-to-day operations—especially when working across multiple sites with field crews. These features don’t always make the shortlist, but they can have a big impact on performance, accuracy, and long-term service delivery.

- Reporting and analytics to track job performance and cost trends - Reporting tools compile real-time job data—like labor hours, work completed, open tickets, and profit margins—into dashboards your team can act on. This helps project managers spot issues early and make better decisions across multiple jobs. With construction analytics & reporting tools, you can break down performance by crew, region, or job type to see what’s working and what needs to change.

- Fleet management for tracking vehicles and equipment in the field - Knowing where your trucks and equipment are at all times helps reduce delays, cut fuel costs, and prevent asset misuse. Fleet management software gives office staff visibility into vehicle locations, mileage, and maintenance schedules—all in one platform. It supports faster jobsite setup and keeps crews from waiting on missing tools or machines.

- Recurring service management for contract-based work - For teams that manage ongoing maintenance or service agreements, recurring job scheduling is a must. Service agreement tools automate future job generation, notify teams before the next visit, and ensure no contract falls through the cracks. It helps field service teams keep long-term clients happy without having to manually track repeat work.

Even if these features don’t drive the base construction software price, they can seriously affect long-term efficiency and client satisfaction. When combined with core tools like scheduling and quoting, they help teams stay organized, responsive, and ready to scale. Up next, we’ll walk through the steps to actually choose a platform—so you know what to look for and what questions to ask before you commit.

10 steps to choosing the right construction management software platform

Software decisions hit harder in construction because what’s on screen ends up affecting what happens on site. If the platform can’t keep up with how your team runs jobs, it slows everything down—scheduling gets messy, job details fall through the cracks, and costs start creeping up. Choosing a tool is about knowing whether it can keep projects moving when the pressure’s on.

1. Start by mapping your daily workflow

Before comparing platforms, write down how your jobs actually run—from estimating and scheduling to dispatch and closeout. List what’s currently done by hand, in spreadsheets, or across multiple systems. This will give you a clear view of what the software needs to solve.

For field-focused operations, that often includes managing mobile crews, tracking job progress, and capturing reports in real time. If those are part of your flow, you’ll want to consider tools built for construction field service management software that connect the office and field without delay.

2. Prioritize must-have features over nice-to-haves

Every platform will promise to “do it all.” But not every feature is equally valuable to your team. Go back to your workflow map and flag what’s critical. That usually includes quoting, scheduling, time tracking, and mobile access. Set a baseline of what your team can’t function without. This makes it easier to compare plans and avoid overspending on tools you won’t use—or missing tools you absolutely need.

3. Test usability with your actual field team

Demo environments are great, but real answers come from the people using the platform every day. That means involving project managers, techs, and back-office staff in the process. If they can’t use the system easily, you’ll either pay for retraining or deal with low adoption.

Make sure mobile features match how your field techs document work and capture site activity. If your team regularly logs jobsite updates, consider software that supports real-time data capture through a construction field report app—so you're not relying on paper or memory when the project closes.

4. Ask about long-term pricing and contract terms

Initial cost isn’t the full story. Ask how pricing scales with users, data, or project volume. Find out if integrations, support, or updates cost extra. Some platforms look affordable upfront but end up charging for everything beyond the basics. If you're planning to grow, pricing structure matters. Locking into the wrong contract can limit your flexibility and increase total cost of ownership.

5. Compare support, onboarding, and response times

The best tools fall flat without strong support. Ask how onboarding works—will they help migrate your data, train your team, and get your workflows set up? And if something breaks during a job, can you get a real human on the phone? Evaluate what support tiers cost, what’s included, and how responsive the vendor is. You’re not just buying features—you’re buying a partnership that should support your crew when things get tough.

6. Set up a personalized product demo

Most vendors offer live demos, but not all demos are created equal. A personalized walkthrough lets you focus on the workflows your team actually uses—not a generic feature tour. Make sure the demo reflects your day-to-day job flow, from scheduling and quoting to field reporting and payroll. If the software can't show how it handles your real job conditions, it's probably not the right fit. Look for demos that let you follow an actual job lifecycle so you can see how crews, managers, and office staff interact across roles.

7. Come to the demo with real questions and scenarios

Before the demo, gather input from your team—especially your project managers, supers, and back-office staff. What slows them down today? What gets missed between the office and field? Use those issues to build a list of questions and test cases. Ask how the software would handle a delayed inspection, a jobsite change order, or last-minute crew reassignment. The best platforms will walk you through those scenarios using their system live—not just promise it in theory.

8. Get live proof of your must-have features

Every platform claims to offer scheduling, dispatch, quoting, and tracking—but the way those features function can be wildly different. Ask to see your top priorities working in real time. For example, don’t just take their word that time tracking is built-in—ask to see how a technician logs time, how it routes to payroll, and what that looks like for admins. If job costing is critical, make sure the software can show a job budget that updates live as hours and materials are added. If they can’t show it clearly, it’s a red flag.

9. Involve your decision-makers and users early

The people who will use the platform should be part of the buying process—not just handed a login after the deal is done. Pull in your lead scheduler, your estimator, a foreman, and someone from accounting. Let them ask the hard questions, test the workflows, and point out gaps. Getting early buy-in helps avoid adoption issues and ensures you're not stuck training an unwilling team after implementation. Their feedback during demos can reveal issues leadership might overlook.

10. Compare post-sale support like it's part of the product

Once the sale is made, support becomes the product. Ask how issues are handled after onboarding: Can your team reach someone by phone? What’s the typical response time? Is there a dedicated point of contact? Good software with bad support becomes bad software fast—especially during peak project season. Choose a vendor who treats post-sale support like a core feature, not an afterthought.

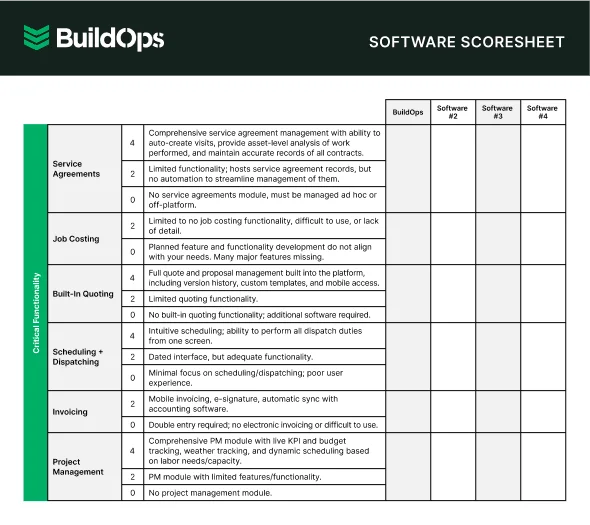

5 best construction management software options

Different contractors need different tools. A growing residential builder isn’t going to run jobs the same way a commercial firm managing multi-phase projects will. Whether you’re handling tenant improvement work, ground-up builds, or specialized service contracts, the right construction software depends on how you operate, not just what the marketing says. Here’s a breakdown of five leading options—what they’re good at, what to watch out for, and who they serve best.

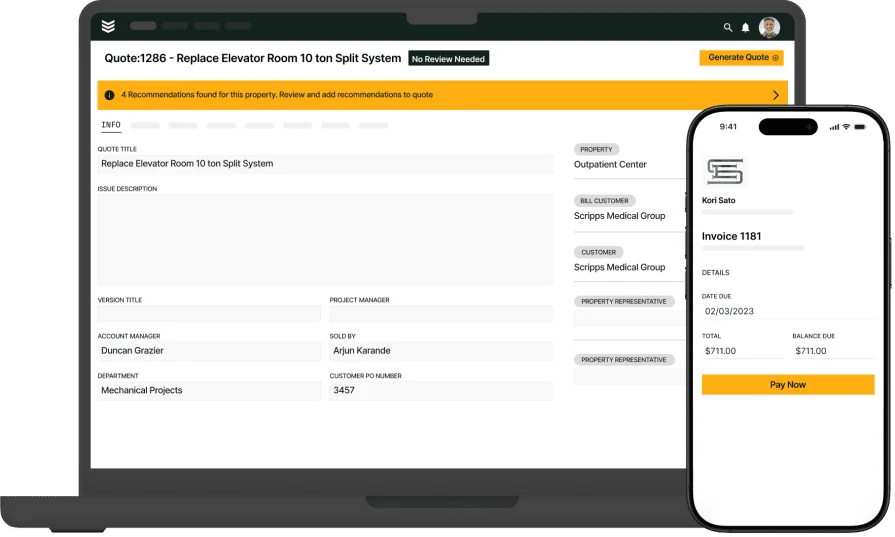

1. Best for commercial contractors: BuildOps

BuildOps is an all-in-one platform for commercial construction contractors managing multi-trade, multi-phase jobs. It centralizes project scheduling, dispatching, field reporting, quoting, time tracking, and asset management so project managers and field crews stay aligned in real time. It's designed for businesses that run fast-paced projects and need full visibility into job progress, labor, and materials from any location.

How Pricing Works: Pricing for BuildOps is customized based on company size, users, and needed features. You’ll need to connect with the team for a custom quote.

What Sets it Apart for Commercial Contractors: Built around the day-to-day needs of commercial field teams, BuildOps offers tight control over scheduling, job costing, mobile documentation, and communication. It replaces multiple disconnected systems with one cohesive platform built to scale with larger crews and higher project volumes.

Streamline your job operations

We help commercial contractors manage every job from pre-con to closeout.

2. Best for residential contractors: BuildBook

Image Source: BuildBook

BuildBook is a cloud-based platform geared toward home builders and remodelers. It offers client communication tools, budgeting, daily logs, and simple scheduling features. The interface is clean and approachable, making it easy for smaller teams and owner-operators to get up and running quickly. But it lacks the deeper operations and field coordination features needed by growing or multi-crew contractors.

How Pricing Works: Tier-based monthly or annual pricing depending on team size and number of active projects.

What Sets it Apart for Residential Contractors: BuildBook emphasizes the homeowner experience with tools that keep clients informed without flooding them with technical data. However, it can be overbuilt and costly for smaller teams or self-performing contractors.

3. Best for general contractors: Procore

Image Source: Procore

Procore is a broad, enterprise-level construction management solution aimed at general contractors managing a wide mix of job types. It offers robust tools for documentation, RFIs, drawing management, submittals, and team collaboration across stakeholders. However, it can be overbuilt and costly for smaller teams or self-performing contractors.

How Pricing Works: Custom pricing based on project volume, company size, and selected modules.

What Sets it Apart for General Contractors: Procore is strong on documentation, control, and compliance. It fits well for GCs managing subcontractors, multi-site projects, and complex approval chains.

4. Best for specialized contractors: Oracle Aconex

Image Source: Oracle

Oracle Aconex is built for highly regulated and technical construction environments. It offers detailed process control for documentation, workflows, and compliance, particularly in sectors like energy, infrastructure, and industrial construction. That said, it’s less flexible for field-driven work and can be too complex for teams that need agile job management tools.

How Pricing Works: Enterprise-level pricing based on contract terms, users, and scope of deployment.

What Sets it Apart for Specialized Contractors: It’s ideal for firms that must meet strict regulatory demands and audit-ready documentation.

5. Best for independent contractors: CoConstruct

Image Source: CoConstruct

CoConstruct serves custom builders and remodelers handling a few projects at a time. It includes budgeting, client selections, change orders, and messaging features. The platform is simple enough for owner-operators while still adding structure to growing firms. But its field tools and crew coordination capabilities are limited compared to platforms built for larger operational teams.

How Pricing Works: Tier-based monthly or annual plans with limits based on project volume and active users.

What Sets it Apart for Independent Contractors: CoConstruct shines for solo contractors or small firms focused on client-facing communication.

Find the ideal tool for your crew

Compare construction management tools with our easy-to-use scoresheet.

How to maximize value from the cost of construction management software

Paying for construction management software is one thing—getting real value out of it is another. Whether you’re coordinating schedules, tracking labor, or managing approvals, how your team uses the platform day to day will determine the return you see. Here’s how contractors can make that investment count.

- Think beyond today’s job list – Construction firms rarely stay the same size for long. Project volume grows, teams expand, and job types shift. That’s why your software needs room to scale. When comparing options, look at how pricing changes with added users or projects, and how features adapt to more complex workflows. This breakdown of field service software pricing over time gives a clear picture of what to expect as your needs evolve.

- Sync with your accounting tools – If you’re already using QuickBooks to manage job costs or invoices, your construction platform should connect to it cleanly. Avoiding double entry and mismatched records saves hours every month. That’s why platforms designed to integrate with QuickBooks are worth considering early on—especially if accounting is already dialed in and you don’t want to disrupt it.

- Get your teams trained up front – A system is only useful if people know how to use it. That includes project managers in the office and foremen in the field. Look for software that includes structured onboarding or quick-start guides tailored to construction workflows. When everyone understands how the tool supports their job, adoption goes faster and value shows up sooner.

- Automate the tasks that eat time – Construction management includes a ton of repeat admin—daily logs, labor hours, material updates. The right platform automates most of this so crews can focus on the work. If you’re not sure where those time sinks are, reviewing a standard field service workflow model can help you spot what’s worth automating.

- Keep updates flowing between the field and the office – When job changes, delays, or inspection notes sit in someone’s notebook, mistakes pile up. Software should connect field teams with the office in real time so dispatch, scheduling, and updates are visible to everyone. This matters most when you’re coordinating across multiple crews—something contractor dispatch management systems are purpose-built to handle.

- Make remote access a requirement, not a bonus – Field teams can’t afford to lose time driving back just to update a schedule or upload photos. Platforms that run in the cloud give techs access to everything they need from any connected device. This flexibility is a key part of keeping workflows moving—especially when your crews are spread across multiple job sites.

Construction management software pricing reflects how well a system supports the way your team operates. It's not only about features—it’s about whether the platform helps reduce delays, cut down on manual tasks, and keep field and office teams aligned. Every dollar spent should map directly to smoother workflows and fewer headaches on the job.

For commercial contractors with field crews, complex timelines, and shifting priorities, an all-in-one platform like BuildOps can bring everything—from quoting to reporting—into one connected system. But whatever tool you go with, the real value comes from finding software that works the way your jobs actually run, not how someone says they should.

Explore our FSM tool

We help teams streamline their operations, track jobs, and boost profits.