Executive Summary: Research Trends for Monitoring in the Construction Industry

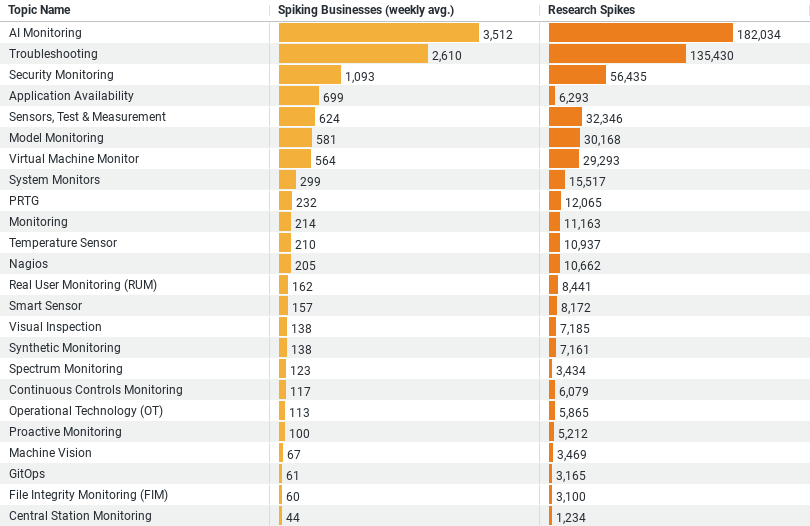

1. AI Monitoring is the most researched topic, with an average of 3,512 businesses spiking in interest weekly. This suggests a significant interest in leveraging artificial intelligence for monitoring purposes within the industry, reflecting a trend towards automation and intelligent systems. The research spikes have reached 182,034, indicating a substantial volume of research activity.

2. Troubleshooting ranks second, with 2,609 businesses on average researching this topic weekly. With 135,430 research spikes, it highlights the importance of solving issues and maintaining operational efficiency in the construction sector, suggesting a focus on enhancing problem-solving capabilities.

3. Security Monitoring is the third most popular area of research, with an average of 1,093 businesses engaging weekly. This topic’s 56,435 research spikes indicate a strong emphasis on safety and security within the industry, reflecting concerns over protecting assets and sites.

4. Application Availability is researched by an average of 699 businesses weekly, with 6,293 research spikes. This suggests a growing interest in ensuring that software applications, likely used for project management, design, or monitoring, are reliable and consistently available.

5. Sensors, Test & Measurement is another key area, with 624 businesses researching it weekly and 32,346 research spikes. This trend underscores the importance of accurate data collection and analysis in the construction industry, highlighting a demand for technology that can measure and monitor various parameters accurately.

These trends indicate a significant interest in monitoring technologies within the construction industry, with a particular emphasis on AI, troubleshooting, security, application reliability, and the use of sensors for precise measurements. This reflects an industry moving towards more technologically advanced and efficient practices.

AI Monitoring Leads the Charge

At the forefront of this technological embrace is AI Monitoring, a topic that has captivated an average of 3,512 businesses weekly. The substantial research spikes reaching up to 182,034 illustrate the construction industry’s keen interest in leveraging artificial intelligence for monitoring purposes. AI’s capability to predict potential issues, automate tasks, and provide real-time analytics is transforming how projects are managed and executed. This surge in interest suggests a shift towards more intelligent, automated systems that can enhance efficiency, reduce costs, and improve safety on construction sites.

The Crucial Role of Troubleshooting

Troubleshooting follows closely, with 2,609 businesses exploring this area weekly, culminating in 135,430 research spikes. This trend underscores the industry’s focus on maintaining operational efficiency and solving issues promptly. In a field where time is money, and delays can lead to significant financial losses, the emphasis on troubleshooting reflects a proactive approach to problem-solving. By adopting advanced monitoring tools, construction professionals can detect and address issues before they escalate, ensuring projects stay on track.

Security Monitoring: A Priority in Today’s World

With 1,093 businesses delving into Security Monitoring weekly and a total of 56,435 research spikes, the data signals a strong emphasis on safety and security within the construction sector. The importance of monitoring for security purposes cannot be overstated, as construction sites are often vulnerable to theft, vandalism, and safety hazards. Through advanced surveillance technologies and monitoring systems, businesses are looking to safeguard their assets, personnel, and project integrity. This trend indicates a holistic approach to construction monitoring, where security is integral to operational success.

Ensuring Application Availability in 2024

The research interest in Application Availability, with 699 businesses engaging weekly and 6,293 research spikes, highlights the construction industry’s reliance on software applications. These tools, crucial for project management, design, and monitoring, must be reliable and available. Downtime can halt progress and lead to delays, making the availability of these applications a key concern. The industry’s focus on this area suggests a push towards more robust IT infrastructures and cloud solutions that can ensure uninterrupted access to essential software.

The Importance of Sensors, Test & Measurement

Lastly, the focus on Sensors, Test & Measurement, as evidenced by 624 businesses researching it weekly and 32,346 research spikes, points to the industry’s demand for precision. Accurate data collection and analysis are vital in construction, where measurements dictate structural integrity and safety. The interest in this area reveals an industry eager to adopt technologies that offer real-time, accurate monitoring of various parameters, from environmental conditions to material strength.

Conclusion

The construction industry’s research trends in monitoring technologies paint a picture of a sector keen on innovation and efficiency. From AI Monitoring to the emphasis on security and precision measurement, these insights reveal an industry in transition. As construction professionals continue to explore and integrate these technologies, we can expect a future where construction sites are not only safer and more secure but also managed with an unprecedented level of efficiency and precision. The path forward is clear: embracing technological advancements in monitoring is not just a trend but a necessity for the modern construction industry.

Company Sample Data

Micro (1 – 9 Employees)

Micro-sized businesses, the smallest category, show a notable level of activity with an average of 861.94 spiking businesses weekly, representing 10.68% of the total. This level of engagement suggests that even the smallest companies are actively researching or showing interest in the analyzed topic or technology. The relatively high activity level, despite the small size, underscores the agility and nimbleness of micro businesses in exploring new trends or tools that could give them a competitive edge.

Small (10 – 49 Employees)

Small businesses demonstrate significantly more activity, with 2,328.29 spiking businesses on average each week, accounting for 28.84% of the total. This group’s increased activity could reflect the additional resources and capacity to invest in research and development or new technologies compared to micro-sized companies. The higher percentage indicates a strong engagement with current trends, possibly driven by the need to scale operations or enhance competitiveness.

Medium-Small (50 – 199 Employees)

The medium-small category shows the highest level of activity among the groups, with an average of 2,436.38 spiking businesses weekly, which is 30.18% of the total. This peak suggests that companies of this size have enough resources and a strategic interest in staying at the forefront of industry trends. Their engagement level could be attributed to the necessity to innovate and adopt new technologies to maintain growth and compete effectively with larger players.

Medium (200 – 499 Employees)

Companies in the medium category have an average of 1,057.94 spiking businesses weekly, representing 13.10% of the total. Although there is a decrease in activity compared to medium-small companies, the engagement level remains significant. This could reflect a more deliberate and strategic approach to research and adoption of new trends, as businesses of this size likely have established processes and resources dedicated to innovation and market analysis.

Medium-Large (500 – 999 Employees)

The medium-large category, representing the largest companies in this dataset, shows 529.85 spiking businesses on average each week, making up 6.56% of the total. The lower activity level, relative to the other categories, might suggest that larger organizations move more cautiously when exploring new trends or technologies, due to the complexities of implementing change at scale. However, their engagement indicates a sustained interest in innovation, likely driven by the need to stay competitive and responsive to market demands.

Conclusion

The data highlights a clear trend: as company size increases, the percentage of total activity generally decreases, with a peak in activity among medium-small businesses. This pattern suggests that while smaller companies may be more agile and quick to explore new trends, medium-sized businesses are the most engaged in researching and potentially adopting new technologies or practices. This trend might depend on the balance between available resources, the agility to adopt new trends, and the strategic necessity to innovate for growth and competitiveness. As companies grow larger, the complexity of implementing change may temper the speed and scale of their engagement with new trends, although the interest remains significant across all sizes.