Executive Summary: Product Development & QA Research Trends in the Construction Industry

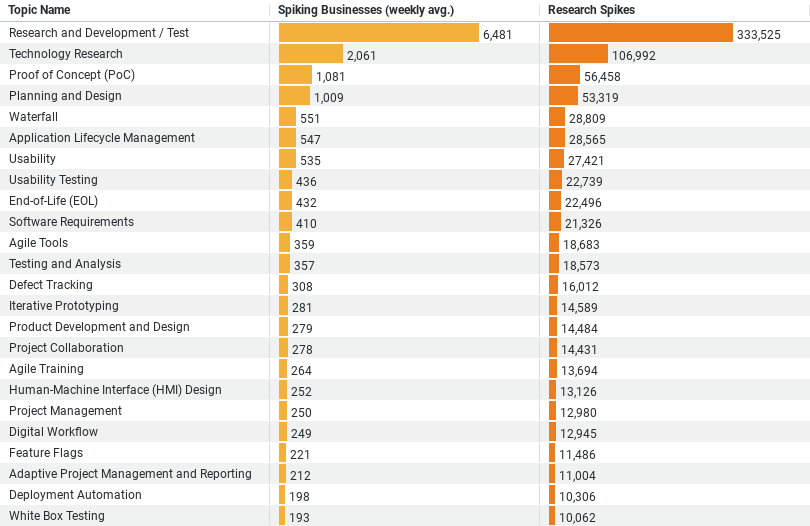

– High Engagement: The topic “Research and Development / Test” is the most actively engaged, with an average of 6480.98 businesses per week showing interest, indicating a strong industry focus on innovation and testing.

– Technology Emphasis: “Technology Research” attracts significant attention with 2061.35 businesses weekly, underscoring the importance placed on incorporating advanced technologies.

– Development Processes: Topics like “Proof of Concept (PoC)” and “Planning and Design” also show high engagement levels, highlighting the industry’s prioritization of validating concepts and detailed planning in project executions.

– Varied Interest Levels: There’s a broad range of interest across topics, from very high (thousands of businesses) to very low (fewer than 10 businesses for topics like “Stage Gate Process”).

– Research Activity: The topic with the highest number of research spikes is “Research and Development / Test” with 333,525 instances, which further supports its top positioning in terms of industry focus.

– Low Engagement Areas: Topics such as “Stage Gate Process”, “Rational Unified Process (RUP)”, and “Microsoft Most Valuable Professional (MVP)” exhibit minimal engagement, suggesting they are less critical or less relevant to the current industry focus.

The Leading Edge: Research and Development

The data indicates a robust engagement in “Research and Development / Test,” with an average of 6,480.98 businesses focusing on this area weekly. This is a clear indicator that the construction sector is heavily invested in innovating and testing new technologies. Companies are not just following trends; they’re actively participating in creating solutions that address unique challenges faced during construction projects. This trend underscores a shift towards a more proactive approach to overcoming industry hurdles and enhancing the overall quality and sustainability of construction projects.

Technology at the Forefront

Following closely is “Technology Research,” with 2,061.35 businesses engaged weekly. This significant interest highlights the industry’s commitment to integrating cutting-edge technologies into their operations. From the adoption of Building Information Modelling (BIM) systems to the use of advanced material sciences and IoT applications, technology is being leveraged to improve precision, efficiency, and safety on construction sites.

Validating Concepts and Detailed Planning

The “Proof of Concept (PoC)” and “Planning and Design” topics also feature prominently, with 1,080.73 and 1,009 businesses respectively, engaged on a weekly basis. These areas are crucial for the pre-construction phase, where businesses assess the viability of projects and lay out detailed plans to ensure successful execution. This focus is indicative of a growing awareness that thorough planning and proof of concept are essential to mitigate risks and ensure project success.

Areas of Lesser Focus

Interestingly, not all areas receive the same level of attention. Topics like “Stage Gate Process,” “Rational Unified Process (RUP),” and “Microsoft Most Valuable Professional (MVP)” show minimal engagement. This suggests that certain traditional or highly specific methodologies may not align as well with the current needs or the dynamic nature of today’s construction projects.

Industry Priorities Reflected in Research Spikes

The number of research spikes, particularly in “Research and Development / Test” (333,525 instances), further validates the industry’s emphasis on this area. These spikes reflect periods of intense research activity, likely coinciding with the development phases of major projects or the introduction of new regulations or technologies that necessitate a deeper understanding and adaptation.

Conclusion

The data paints a clear picture of a dynamic industry that is keenly focused on leveraging research and development to tackle both present and future challenges. By investing heavily in areas like research and testing, technology integration, and the validation of concepts through rigorous planning, the construction industry is not just responding to changes but is also shaping the future of construction methodologies and practices.

As the industry continues to evolve, staying abreast of these trends will be crucial for businesses aiming to remain competitive and innovative. For stakeholders in the construction sector, understanding these trends offers a roadmap for strategic investment in research and development efforts that will drive their growth and adaptability in a rapidly changing market environment.

Company Sample Data

– Company Size: Categorization of companies based on the number of employees. The categories range from “Micro (1 – 9 Employees)” to “Large (1000+ Employees)”.

– Spiking Businesses (weekly avg.): The average number of businesses in each size category showing increased activity or interest in a specific area each week.

– Percent of Total: Represents the percentage of the total spiking businesses that each size category constitutes.

From this summary, we can identify some key insights and why certain patterns may be considered trends:

Analysis of Engagement by Company Size

– Small and Medium-Sized Enterprises (SMEs) Lead in Activity: The data shows that smaller to medium-sized companies (ranging from 10 to 199 employees) have higher weekly engagement averages. Specifically, the “Small (10 – 49 Employees)” category shows the highest engagement, followed closely by the “Medium-Small (50 – 199 Employees)” category. This indicates a trend where SMEs are perhaps more agile or more affected by specific business trends or market changes, leading to more noticeable spikes in activity.

– Larger Companies Show Less Volatility: Larger companies, categorized here as “Medium (200 – 499 Employees)” and beyond, show lower average weekly spikes. This could be attributed to the stability and established processes in larger organizations, which might buffer them against rapid shifts in activity that smaller companies experience.

Why These Trends Matter

– Agility and Market Sensitivity: Smaller companies often react more quickly to market changes or new opportunities, reflected in the higher weekly spikes. This can be seen as an indicator of the business landscape’s dynamism, where smaller entities might pivot or adapt their strategies more swiftly.

– Strategic Focus: The data could suggest that SMEs are possibly more engaged in specific strategic activities, potentially driven by a need to compete effectively with larger corporations or to carve out a niche market.

– Resource Allocation and Prioritization: Larger companies might be engaging in a broader range of activities, dispersing their focus, which could explain the lower percentage of total spikes compared to smaller companies concentrated on fewer, more impactful areas.

This analysis provides valuable insights into how different company sizes engage with market trends and opportunities, highlighting the dynamism of SMEs and the comparative stability of larger organizations. Understanding these patterns can help in tailoring business strategies, marketing, and support services to different company categories effectively.