Executive Summary: Personal Protective Equipment (PPE) Research Trends in the Construction Industry

– Dataset Overview: The dataset comprises data points from the construction industry related to the research of various PPE topics.

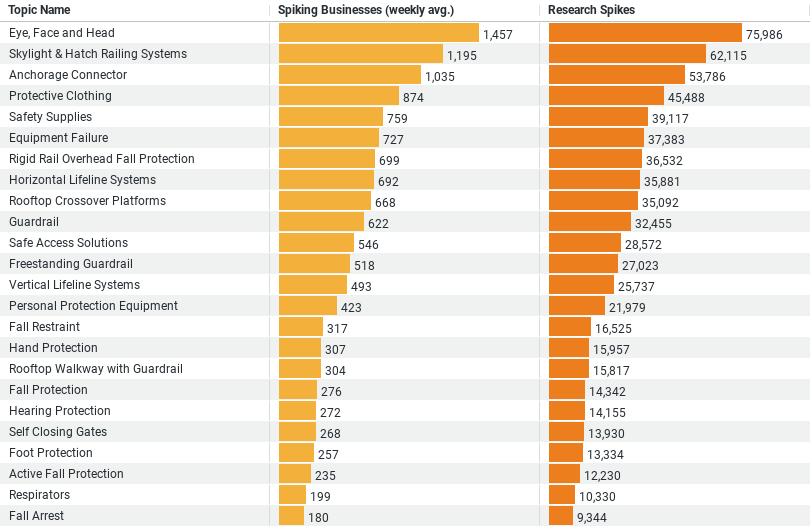

Primary Columns Analyzed:

– Topic Name: Specific safety topics being researched.

– Spiking Businesses (weekly avg.): Indicates the average number of businesses researching each topic per week.

– Research Spikes: Total number of times research activity spiked for each topic.

Key Statistics

– Most Researched Topic: ‘Eye, Face and Head Protection’ with the highest weekly business engagement (approx. 1457 businesses) and the most research spikes (75986).

– Second Most Focused Area: ‘Skylight & Hatch Railing Systems’ with significant interest (1195 businesses weekly) and research spikes (62115).

– ‘Anchorage Connector’: Averages 1035 businesses weekly, with 53786 research spikes.

– ‘Protective Clothing’: Averages 874 businesses weekly, with 45488 research spikes.

– ‘Safety Supplies’: Averages 759 businesses weekly, with 39117 research spikes.

Observations

– High Engagement: Demonstrates a strong proactive stance in safety research, especially in areas directly impacting worker safety such as head and fall protection.

– Industry Priorities: Prioritization of topics suggests an alignment with safety standards and possibly emerging trends or recent incidents sparking increased research activities.

Exploring PPE Research Trends in the Construction Industry

The construction industry, known for its high-risk environments, consistently emphasizes worker safety and compliance with safety regulations. A recent analysis of data related to Personal Protective Equipment (PPE) research within the industry reveals fascinating trends about where businesses are focusing their safety efforts. This blog post delves into these insights, providing a clear picture of the current priorities and interests in PPE research among construction companies.

Prioritizing Eye, Face, and Head Protection

One standout trend from the data is the significant emphasis on eye, face, and head protection. This area tops the list with the highest weekly average of businesses (approximately 1,457) engaging in research, and an impressive total of 75,986 research spikes. The construction industry’s focus here is likely driven by the direct risks that workers face daily from airborne debris, falls, or other hazards. Protecting these vital areas is not only crucial for maintaining workers’ health but also for preventing any possible injuries and long-term disabilities.

Enhancing Safety with Skylight and Hatch Railing Systems

The second most researched topic is skylight and hatch railing systems, with around 1,195 businesses exploring this area weekly, culminating in 62,115 research spikes. Skylights and hatch openings on construction sites pose significant fall risks, making effective railing systems a critical safety feature. The high volume of research reflects ongoing efforts to improve fall prevention solutions, ensuring that these installations provide robust protection against accidents.

Anchorage Connectors: Essential for Fall Protection

Research into anchorage connectors, which play a pivotal role in fall arrest systems, also shows considerable activity, with an average of 1,035 businesses per week and 53,786 spikes in research. The focus on anchorage connectors underscores the industry’s proactive approach to enhancing fall protection measures. Reliable anchorage is fundamental to the effectiveness of fall arrest systems, which are designed to save lives in the event of a fall by distributing the impact forces throughout the body.

The Role of Protective Clothing

Another significant area of interest is protective clothing, with approximately 874 businesses engaging in research weekly and 45,488 research spikes observed. In the construction industry, protective clothing includes garments designed to protect against severe weather, chemical exposures, electrical hazards, and more. This sustained interest indicates a comprehensive approach to protective gear, ensuring workers are equipped to handle a variety of onsite risks.

Demand for General Safety Supplies

Finally, safety supplies encompass a broad category that includes various types of equipment, such as gloves, boots, and hearing protection. This category sees a steady demand, with around 759 businesses researching it weekly and 39,117 research spikes. The consistent interest in general safety supplies highlights the industry’s ongoing commitment to maintaining a high standard of safety across all areas of operation.

Industry Insights and Future Directions

The data provides clear evidence of where the construction industry is channeling its research efforts regarding PPE. The focus on specific types of PPE like eye and head protection aligns with the direct hazards present in daily construction activities. Similarly, the interest in more specialized equipment like skylight and hatch railing systems reflects a nuanced understanding of the various risks workers face.

These trends not only highlight current priorities but also suggest areas for future development. For PPE manufacturers, these insights can guide product innovation and marketing strategies, aligning offerings with the most pressing needs of the industry. For construction companies, the data underscores the importance of continuous investment in research and training to enhance safety measures.

As the industry continues to evolve, staying ahead of safety trends through proactive research and adopting new technologies will be crucial. The construction sector’s focused research on PPE demonstrates a commendable commitment to not just compliance, but to exceeding safety standards, ultimately aiming to reduce workplace injuries and fatalities significantly.

Company Sample Data

1. Company Size: Categorizes businesses based on the number of employees. The categories include Micro (1-9 Employees), Small (10-49 Employees), Medium-Small (50-199 Employees), Medium (200-499 Employees), and Medium-Large (500-999 Employees).

2. Spiking Businesses (weekly avg.): Shows the average number of businesses per week within each size category that have spiked in their research activity.

3. Percent of Total: Indicates the proportion of the total research activity that each company size category represents.

Data Insights

– Micro Companies (1 – 9 Employees): Average of 587 businesses spiking weekly, constituting about 8.7% of the total research. This suggests that while micro companies are active, their overall impact on research volume is relatively smaller.

– Small Companies (10 – 49 Employees): Average of 1,785 businesses spiking weekly, representing about 26.5% of the total research. This higher activity level indicates that small businesses are significantly engaged in research, likely due to their agility and need to stay competitive.

– Medium-Small Companies (50 – 199 Employees): Lead in research activity with an average of 2,023 businesses spiking weekly, making up 30% of the total. This size bracket seems to be the most active, possibly reflecting a stage where businesses have sufficient resources to invest heavily in research while still being agile enough to respond quickly to industry changes.

– Medium Companies (200 – 499 Employees): These companies show a substantial drop in activity compared to medium-small companies, with 1,003 businesses spiking weekly, about 14.9% of the total. This might indicate that as companies grow, their research activities become more focused and possibly slower due to larger organizational structures.

– Medium-Large Companies (500 – 999 Employees): With 508 businesses spiking weekly and accounting for 7.5% of the total, medium-large companies demonstrate the least relative activity among the categories. This could reflect a maturity in operations where less exploratory research is needed, or it could indicate a shift towards internal R&D efforts not captured in this dataset.

Trend Analysis

The data suggests a trend where medium-small companies are the most active in research, possibly due to their optimal balance of resources, flexibility, and innovation pressure. Smaller companies, although active, contribute less to total research volume, potentially due to limited resources. As companies grow, there is a noticeable shift in how research intensity is sustained, likely influenced by increased bureaucratic processes and established practices that might slow down the rate of new research initiatives.

This trend underscores the different strategic priorities in research and development across various company sizes, reflecting their unique operational, competitive, and developmental stages. These insights can help businesses, policymakers, and analysts understand where targeted interventions or support mechanisms are most needed to boost innovation and competitiveness in specific segments of the market.