Executive Summary: Demand Generation Research Trends in the Construction Industry

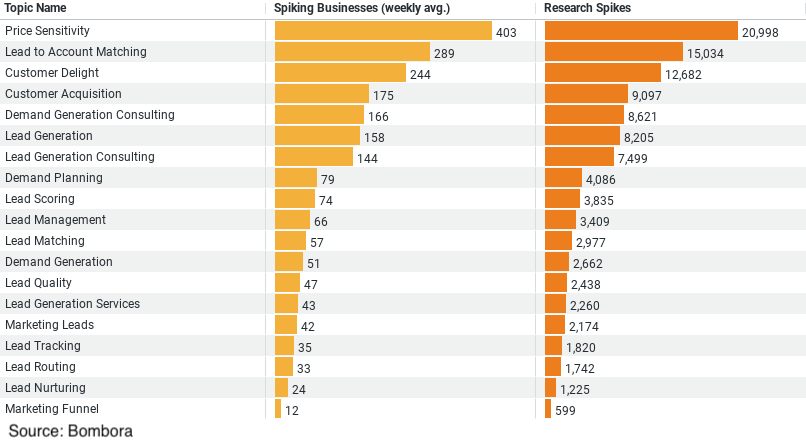

1. Price Sensitivity is the most researched topic, with an average of 403 businesses researching it weekly. This topic also has the highest research intensity, with 20,998 spikes in research activity. It suggests a strong focus within the construction industry on understanding how price affects demand and customer decisions.

2. Lead to Account Matching is the second most popular topic, with an average of 289 businesses researching it weekly, and 15,034 research spikes. This indicates a significant interest in optimizing sales processes and improving the efficiency of converting leads into accounts.

3. Customer Delight ranks third, with 244 businesses researching it on average each week, and 12,682 research spikes. This shows a growing trend towards enhancing customer satisfaction and loyalty as a strategy for demand generation.

4. Customer Acquisition is the fourth most researched topic, with an average of 175 businesses per week and 9,097 research spikes. This reflects the industry’s ongoing efforts to attract new customers and grow their market share.

5. Demand Generation Consulting is the fifth topic, with an average of 166 businesses researching it weekly and 8,621 research spikes. This suggests that there is a considerable interest in seeking external expertise to improve demand generation strategies.

Understanding the Trends

The bell-curve pattern observed in the research intensity across company sizes offers profound insights. For smaller companies, the vigorous pursuit of Demand Generation strategies is a testament to their entrepreneurial spirit and the necessity of innovative marketing to secure a market position. As companies grow, the focus gradually shifts towards refining and optimizing these strategies, indicating a strategic realignment with the company’s evolving market status and resources.

Strategic Implications

For marketers and strategists within the construction industry, these trends underscore the importance of tailoring Demand Generation strategies to the company’s size and stage of growth. Micro and small businesses must focus on aggressive and innovative tactics to break through the market noise, while larger entities should aim to optimize and deepen their market engagements.

This nuanced approach to Demand Generation not only ensures the efficient allocation of resources but also maximizes the impact of marketing efforts across different stages of corporate growth. By understanding and leveraging these insights, companies in the construction industry can more effectively navigate their path to market leadership and sustainability.

In conclusion, the data paints a compelling picture of how Demand Generation research and strategies evolve across the spectrum of company sizes in the construction industry. It’s a strategic mosaic where size does indeed matter, influencing not just the volume of research but also the nature and focus of Demand Generation efforts.

Company Sample Data

1. Micro (1 – 9 Employees): These are the smallest businesses, showing a weekly average of approximately 113 spiking businesses in their research activity. They constitute about 8% of the total activity observed. This indicates a significant interest in Demand Generation, which is notable given the limited resources typically available to businesses of this size.

2. Small (10 – 49 Employees): Small businesses demonstrate a more substantial engagement, with around 289 weekly spikes on average. They represent over 20% of the total research activity, suggesting that Demand Generation is a critical area of focus as these companies seek to expand their market presence.

3. Medium-Small (50 – 199 Employees): This category shows the highest average weekly research activity with approximately 305 spiking businesses. Accounting for nearly 22% of the total, this group’s interest in Demand Generation likely reflects strategic efforts to leverage their slightly larger resources and capabilities for market growth and customer acquisition.

4. Medium (200 – 499 Employees): Medium-sized companies have a lower average of about 196 weekly spikes but still make up around 14% of the total activity. This reduction might indicate a transition point where businesses have established more stable demand generation channels, focusing more on optimization than exploration.

5. Medium-Large (500 – 999 Employees): With roughly 137 weekly spikes on average and contributing to about 9.7% of the total, medium-large companies show a lower level of research activity in Demand Generation. This could be due to these organizations having more established processes and market positions, potentially reducing the necessity for intensive research in this area.

Analysis of the Trend

The trend highlighted in this data suggests a bell-curve-like pattern in the intensity of Demand Generation research relative to company size. Smaller companies, particularly in the micro to medium-small range, show a higher level of engagement with Demand Generation topics, likely driven by the need to carve out a market niche and expand their customer base. In addition, this activity peaks with medium-small businesses, which may be at a critical growth stage where effective Demand Generation strategies are crucial for scaling operations and reaching sustainability.

As companies grow larger, into the medium and medium-large categories, the intensity of research into Demand Generation decreases. This reduction may reflect a shift in focus towards optimizing existing channels, deeper investment in established strategies, or a broader spread of strategic priorities now that a certain level of market penetration has been achieved. Larger organizations might also have more resources to invest in direct marketing efforts or partnerships, reducing the reliance on broad research for Demand Generation.

Conclusion

The “Company Sample Data” underscores the varying priorities and strategies across different company sizes in the construction industry, especially concerning Demand Generation. It highlights a nuanced landscape where business size influences not just the capacity for research and development but also dictates the strategic focus areas. This trend provides valuable insights for marketers, strategists, and industry analysts looking to understand or engage with the construction industry across its diverse segments.