Executive Summary: Dispute Resolution Research Trends in the Construction Industry

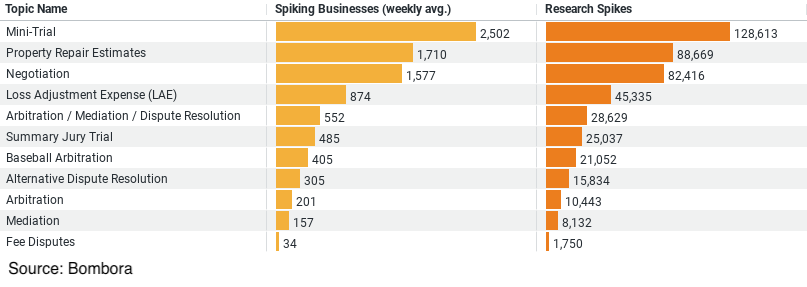

1. Mini-Trial emerges as the most prominent topic, with an overwhelming weekly average of 2,502 businesses showing interest and a high number of research spikes totaling 128,613. This indicates a strong industry focus on exploring mini-trials as an efficient dispute resolution method.

2. Property Repair Estimates follows, with 1,710 businesses per week and 88,669 research spikes, highlighting the industry’s concern with obtaining precise cost estimations to potentially mitigate disputes.

3. Negotiation maintains a solid presence, engaging 1,577 businesses weekly and accruing 82,416 research spikes, reflecting its fundamental role in dispute avoidance and resolution.

4. Loss Adjustment Expense (LAE) and Arbitration / Mediation / Dispute Resolution show fewer spikes and business interests compared to the top three topics but still represent significant areas of focus with 45,335 and 28,629 research spikes respectively. These figures underline ongoing efforts to manage dispute-related costs and explore structured resolution methods.

Trends in Dispute Resolution: Insights from the Construction Industry

The construction industry, with its complex projects and myriad stakeholders, often encounters disputes that can escalate into costly and time-consuming conflicts. Recognizing and understanding how the industry navigates these challenges through dispute resolution mechanisms is crucial. Recent data sheds light on the trending topics within dispute resolution that captivate the interest of construction businesses. Here, we explore the most researched topics and what they signify for the future of dispute management in construction.

Mini-Trial: A Preferred Mechanism

Topping the list of interests is the mini-trial, a less formal method of dispute resolution. The data reveals an average of 2,502 businesses per week showing a heightened interest in mini-trials, with a staggering 128,613 research spikes. This high level of engagement suggests that the construction industry sees the mini-trial as an effective tool to prevent lengthy legal proceedings. A mini-trial allows both parties to present their cases to a neutral advisor, who then offers an opinion on the likely outcome of a formal trial. This process encourages settlements and reduces the need for more costly dispute resolutions, reflecting a proactive approach to conflict management in construction projects.

Property Repair Estimates: A Critical Concern

Another significant area of focus is property repair estimates, which has attracted the attention of 1,710 businesses weekly, accompanied by 88,669 research spikes. Accurate repair estimates are crucial in construction to avoid disputes over costs and responsibilities. This interest indicates a push towards precision and transparency in project scopes and budgets. By emphasizing accurate estimations, construction firms aim to mitigate disputes before they arise, ensuring smoother project execution and fewer financial discrepancies.

Negotiation: The Art of Agreement

Negotiation skills remain a cornerstone of dispute resolution strategies, engaging 1,576 businesses weekly with 82,416 research spikes. It is essential in the construction industry, where agreements must be reached on everything from project timelines to resource allocations. The high number of research spikes reflects a continual need to enhance negotiation capabilities. Effective negotiation leads to better outcomes for all parties involved, reducing the likelihood of disputes escalating to formal resolutions.

Loss Adjustment Expense (LAE): Managing Costs

Loss Adjustment Expense (LAE) has also captured industry attention, with 873 businesses per week and 45,335 research spikes. LAE refers to the costs incurred during the process of determining the settlement of a claim, which can be a significant concern in construction disputes. The focus on LAE suggests that the industry is looking for strategies to manage these costs efficiently, possibly through quicker resolution techniques or better initial assessments.

Arbitration and Mediation: Formal Dispute Resolutions

Lastly, the combined interest in arbitration, mediation, and formal dispute resolution methods is reflected by the involvement of 551 businesses weekly and 28,629 research spikes. While these are more structured approaches compared to mini-trials and negotiations, their importance cannot be understated. Arbitration and mediation offer binding and non-binding resolutions, respectively, and are pivotal in resolving disputes without resorting to the judicial system. The construction industry values these mechanisms for their ability to provide conclusive outcomes while maintaining professional relationships.

Conclusion

The construction industry’s research and interest in various dispute resolution topics highlight a strategic approach to managing conflicts. From embracing less formal resolution methods like mini-trials and negotiations to relying on traditional mechanisms like arbitration and mediation, the industry is actively seeking ways to streamline dispute management. This proactive stance not only helps in reducing the duration and cost of disputes but also enhances overall project efficiency and stakeholder relationships. As the construction sector continues to evolve, these insights into dispute resolution trends will undoubtedly shape its future strategies, emphasizing the importance of knowledge and preparedness in tackling potential conflicts.

Company Sample Data

Data Overview:

– Company Size: This column categorizes companies into different size brackets, such as Micro, Small, Medium-Small, Medium, and Medium-Large.

– Spiking Businesses (weekly avg.): Indicates the average weekly number of businesses in each size category showing increased activity or interest in a certain area.

– Percent of Total: Represents the proportion of total spiking businesses that each company size category accounts for.

Observations by Company Size

1. Micro (1 – 9 Employees): Shows a moderate level of activity with an average of 681.25 spiking businesses weekly, accounting for about 10.69% of total spikes. This suggests that micro enterprises are actively engaging but their overall impact is smaller due to their size.

2. Small (10 – 49 Employees): This category is more active with 1,829.63 spiking businesses on average each week, making up 28.70% of the total. Small businesses appear to be significant players in pursuing new opportunities or interests.

3. Medium-Small (50 – 199 Employees): Exhibits the highest activity with 1,932.46 weekly spikes and the largest share of total activity at 30.31%. This indicates a robust engagement in strategic initiatives, possibly due to their sufficient resources and flexibility compared to larger organizations.

4. Medium (200 – 499 Employees): With 884.92 spiking businesses and 13.88% of the total, medium-sized companies show considerable engagement, though less than smaller firms, potentially due to more structured processes and less agility.

5. Medium-Large (500 – 999 Employees): Displays the least activity among the listed categories, with 428.27 spikes and 6.72% of total activity. This could reflect the challenges larger organizations face in rapidly changing or adopting new trends due to complex hierarchies or slower decision-making processes.

Trend Analysis

The data suggests a trend where smaller and medium-small companies are more agile and quicker to react to new opportunities or shifts in the market compared to their larger counterparts. This agility may be attributed to less bureaucratic inertia and greater flexibility in decision-making processes. Conversely, medium-large companies, while significant in size, show lesser engagement in spiking activities, potentially highlighting a strategic conservatism or slower response times to emerging trends.