Executive Summary: Document Management Research Trends in the Construction Industry

1. High Interest in Multimedia Document Management:

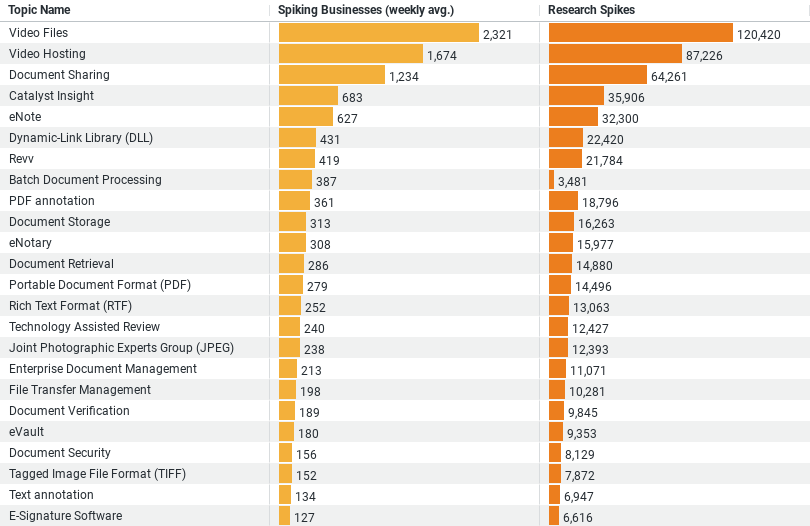

– Video Files: This topic leads with the highest weekly average of spiking businesses at 2,320.52, indicating a significant research interest, and a total of 120,420 research spikes. This suggests that construction companies are heavily invested in understanding and improving their management of video files.

– Video Hosting: Following closely, this topic has a weekly average of 1,673.69 spiking businesses with 87,226 research spikes. It highlights a strong interest in solutions for hosting video content, possibly for training, project documentation, or marketing purposes.

2. Document Sharing:

– With a weekly average of 1,234.13 spiking businesses and 64,261 research spikes, document sharing is a key concern. This indicates a focus on collaboration and efficient distribution of documents among stakeholders in construction projects.

3. Catalyst Insight and eNote:

– Catalyst Insight: Shows a moderate level of interest with a weekly average of 683.13 spiking businesses and 35,906 research spikes. This could point towards a need for insights or analytics derived from documents to inform decision-making.

– eNote: With 626.98 weekly spiking businesses and 32,300 research spikes, there’s an indication that digital note-taking or annotation tools are sought after for their convenience in managing project details and communications.

Overall Insights:

– The construction industry shows a strong inclination towards digital solutions for managing video content and facilitating document sharing, pointing towards trends in digital transformation.

– There’s also considerable interest in tools that provide insights from documents and digital note-taking, indicating a need for solutions that enhance productivity and decision-making through better document management practices.

– These trends suggest an overarching theme of seeking efficiency, collaboration, and accessibility in document management within the construction sector.

The Drive Towards Multimedia Document Management

At the forefront of this digital shift is a significant emphasis on multimedia document management, particularly video files and hosting. Data indicates that “Video Files” is the top-researched topic, with an average of 2,320.52 businesses per week looking into it, culminating in 120,420 research spikes. This interest likely stems from the growing recognition of video as a crucial medium for documentation, training, and promotional purposes in construction projects. It underscores a need for solutions that can efficiently manage, store, and distribute video content, ensuring that vital information is accessible and usable.

Following closely is “Video Hosting,” with 1,673.69 businesses per week exploring it, resulting in 87,226 research spikes. This trend highlights the industry’s move towards cloud-based platforms that offer secure, scalable, and accessible video hosting services. Such platforms are invaluable in facilitating project updates, team training, and stakeholder engagement, proving that video content is an indispensable asset in the construction industry’s communication toolkit.

The Importance of Document Sharing

Another critical area of interest is “Document Sharing,” with 1,234.13 spiking businesses weekly and a total of 64,261 research spikes. In the construction sector, where projects often involve numerous stakeholders, including architects, engineers, contractors, and clients, the ability to share documents swiftly and securely is paramount. This focus on document sharing reflects an ongoing effort to improve collaboration and streamline workflows, ensuring that everyone involved in a project has timely access to the necessary information.

Innovative Tools for Insight and Note-Taking

The data also sheds light on the industry’s interest in innovative document management tools like “Catalyst Insight” and “eNote.” With 683.13 and 626.98 weekly spiking businesses respectively, these topics illustrate the construction sector’s pursuit of tools that offer more than just storage and sharing capabilities. “Catalyst Insight” suggests a demand for analytics and insights derived from documents, which can inform better decision-making and strategic planning. Meanwhile, the interest in “eNote” indicates a move towards digital note-taking and annotation tools, which can enhance project documentation, communication, and overall management efficiency.

Conclusion

The construction industry’s research trends in document management reveal a sector that is keenly aware of the potential of digital tools to transform traditional practices. The emphasis on video management, document sharing, and innovative analytical tools indicates a comprehensive approach to digitalization, aiming to tackle various aspects of project management from communication to collaboration and insight generation.

As the industry continues to evolve, construction firms that embrace these digital solutions will not only streamline their operations but also enhance their project outcomes. By leveraging the right document management technologies, the construction sector can build a more connected, efficient, and resilient future. This digital evolution is not merely a response to technological advancements but a strategic move toward redefining what’s possible in construction project management.

Company Sample Data

– Micro (1 – 9 Employees): With an average of 644.31 spiking businesses weekly, micro-enterprises account for approximately 9.16% of the total. This suggests that even the smallest companies are actively exploring digital solutions, underscoring the essential role of technology in starting and scaling businesses in today’s economy.

– Small (10 – 49 Employees): Small businesses show a significantly higher level of digital intent, with 1,821.60 spiking businesses weekly, representing 25.89% of the total. This jump indicates that as companies grow, their need for digital tools and solutions becomes more pronounced, likely driven by increased operational complexities and the need for efficiency.

– Medium-Small (50 – 199 Employees): This category leads in digital intent, with 2,069.58 weekly spiking businesses, accounting for 29.42% of the total. The data highlights that medium-small companies, possibly at a stage of rapid growth or expansion, are the most active in seeking digital enhancements. This could be attributed to their need to optimize processes, improve communication, and maintain competitiveness.

– Medium (200 – 499 Employees): Medium-sized companies, with 1,024.65 weekly spiking businesses, make up 14.57% of the total. The relative decrease in proportion, compared to medium-small companies, might reflect a transition phase where companies are implementing digital strategies at scale, thus potentially showing a momentarily reduced rate of researching new solutions.

– Medium-Large (500 – 999 Employees): With 536.44 weekly spiking businesses, medium-large companies represent 7.63% of the total. This indicates a lower level of digital intent research relative to company size. It may suggest that at this scale, businesses have established digital infrastructures and may focus more on leveraging existing technologies rather than actively seeking new solutions.

Trend Analysis and Implications

The data reveals a clear trend: as companies grow from micro to medium-small, their research into digital solutions intensifies, peaking with medium-small businesses. This peak suggests a critical point where businesses are keenly aware of the advantages that digital transformation can offer in terms of scalability, efficiency, and competitive edge. However, beyond this point, as businesses grow into medium and medium-large sizes, the proportion of businesses researching digital solutions decreases.

This trend may imply several things:

– Digital Maturity: Larger companies may have already undergone significant digital transformation efforts and are now focusing on optimization rather than exploration.

– Resource Allocation: Bigger companies might allocate resources towards integrating and maximizing the value of their existing digital tools rather than continuously seeking new technologies.

– Strategic Focus Shift: As companies grow, their strategic focus might shift towards consolidation, global expansion, or deepening market penetration, which might not necessarily be reflected as digital intent in the form of researching new solutions.

Conclusion

The updated 2023 – 2024 data illustrates a journey of increasing digital intent that peaks at a certain growth stage before stabilizing as companies mature and solidify their digital infrastructure. Understanding these trends is crucial for service providers and technology developers aiming to tailor their offerings to meet the nuanced needs of businesses at various growth stages.