Keeping a construction business profitable means staying on top of your cash flow. But when paperwork piles up, jobs get delayed, or invoices fall through the cracks, that’s when the real chaos kicks in. That’s why more contractors are switching to construction invoice software to stay on schedule, keep money moving, and reduce time wasted chasing payments. Ideally, your invoicing tool should be part of a full field service management system—so everything from job tracking to billing flows through one connected platform. With the right setup, your crew can send bills straight from the field, cut down on admin work, and get paid quicker—without sacrificing accuracy or professionalism.

In this guide, we’ll break down everything you need to know about choosing the best construction invoice software for your team, including:

- Choosing the right construction invoice software for your team

- 7 key features to look for in invoicing software for construction

- 7 best construction invoice software for all contractor types

- 7 benefits of using construction invoice software

- 4 important construction invoice software FAQs answered

Choosing the best construction invoicing software is about finding a system that fits the way your crew works. Whether you're running multiple job sites or managing service calls from the office, the right software helps you cut delays, reduce errors, and keep cash flowing. Before you pick a platform, it’s worth asking a few key questions to make sure it actually solves your invoicing headaches—not adds to them.

Choosing the right construction invoice software for your team

Construction businesses have different invoicing needs—what works for a small contractor may not cut it for a large firm handling complex billing. The right software should fit your workflow, automate key tasks, and eliminate bottlenecks. Before making a decision, ask yourself these key questions:

- Scalability – Will this software grow with your business? Can it handle an increasing number of invoices, clients, and payment methods without slowing you down?

- Integration with existing systems – Does it sync with your accounting software, job costing tools, and other platforms to keep everything connected?

- Ease of use – Can your team quickly learn and adopt it, or will it slow down your operations with a steep learning curve?

- Automation capabilities – How much of the invoicing process can be automated? Does it handle recurring billing, late payment reminders, and tax calculations?

- Payment processing options – Does the software support multiple payment methods, including credit cards, ACH transfers, and digital wallets?

- Features – Does it offer mobile invoicing, custom branding, and payment tracking? Are there built-in reporting tools to monitor cash flow?

The right software should make invoicing a seamless part of your workflow—not another headache to deal with.

6 key features to look for in invoicing software for construction

Managing invoices in construction means keeping cash flow steady and ensuring projects stay on schedule. Job costs, material purchases, and subcontractor payments need to be tracked accurately, or the entire operation risks delays. Construction invoice management software simplifies this by providing tools that generate estimates, track payments, and send invoices directly from the job site. Now, let’s go over six essential features that make construction invoicing management software a must-have for contractors.

1. Payment processing system

Handling payments manually slows down cash flow and increases the risk of delays. A built-in payment processing system ensures invoices are paid faster by allowing clients to use credit cards, ACH transfers, or digital wallets.

Think about a general contractor wrapping up a commercial project. The invoice is ready, but waiting weeks for a check to clear could stall the next job. Instead of dealing with unnecessary delays, they use payment processing software for construction invoicing to send a digital invoice that the client can pay instantly—keeping operations moving without financial bottlenecks.

2. Job cost tracking

Every construction project involves fluctuating labor, material, and equipment costs. A system that tracks these costs in real time ensures that invoices reflect actual project expenses, preventing lost revenue.

Consider this: A roofing contractor finishes a job only to realize that additional labor hours and materials weren’t included in the final bill. Instead of manually cross-referencing receipts, they rely on reporting software to automatically sync job costs with invoices—ensuring accurate billing and no missed charges.

3. Mobile invoicing capability

Manually processing invoices at the end of the day leads to delays, errors, and missed payments. Mobile invoicing allows contractors to generate, edit, and send invoices immediately after completing a job—no office visit required.

Let’s say a concrete subcontractor is wrapping up a foundation pour. Instead of leaving invoicing for later and risking delays, they pull out their phone, open technician mobile app for construction, and send an invoice on the spot. The client receives it instantly, approves it, and the payment process is already underway before the subcontractor even leaves the site.

4. Automated service agreements

For contractors handling recurring maintenance and service contracts, manually creating invoices for each visit is inefficient. Automated service agreements ensure invoices are sent on time without extra admin work.

Here’s a common scenario: An HVAC contractor maintains heating and cooling systems across multiple commercial properties. Without automation, keeping track of recurring billing would be a nightmare. Instead, they use service agreement software for construction invoicing to auto-generate invoices after every service visit—keeping cash flow consistent and eliminating the risk of missed billings.

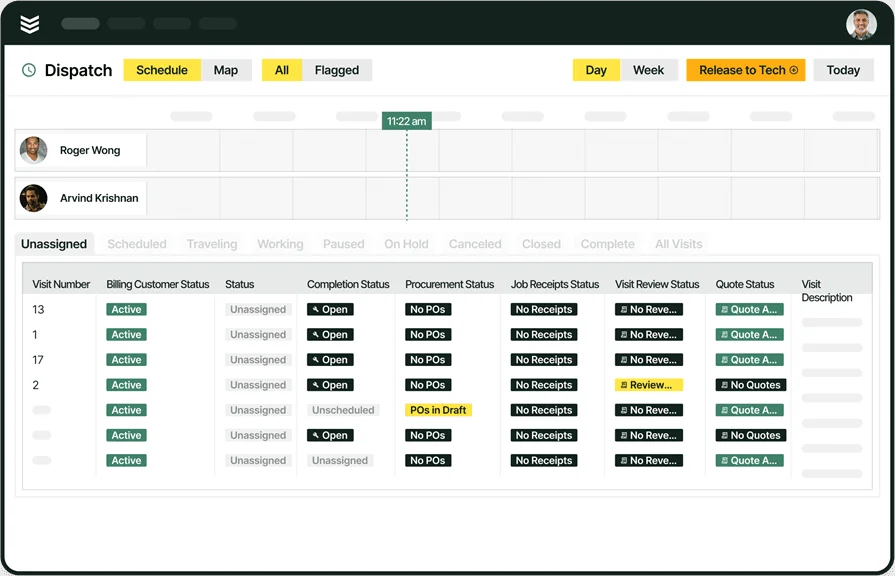

5. Scheduling and dispatch integration

Disconnected scheduling and invoicing systems create gaps in billing, leading to unaccounted labor and material costs. When these systems work together, every completed job is accurately reflected in the final invoice.

Imagine a mechanical contractor managing multiple service calls daily. If job details aren’t properly recorded, they risk underbilling or forgetting to invoice at all. By using scheduling software for construction invoicing, every completed job automatically triggers an invoice, ensuring that nothing falls through the cracks.

6. Customer and project history tracking

Having a detailed record of past invoices, payments, and project costs helps contractors maintain financial accuracy and avoid disputes. A CRM feature within invoicing software centralizes all past transactions for quick access.

Think back to a commercial electrician working with a long-term client. The client requests a breakdown of past invoices, but instead of digging through old records, the contractor uses CRM software to instantly pull up past billing details. Everything is organized in one place, making it easy to track payments and maintain strong client relationships.

Other critical features to look for in a construction invoicing software

Beyond core invoicing functions, a well-rounded construction invoicing software should include additional tools that enhance efficiency and accuracy. These features help contractors streamline operations and maintain better control over financial workflows.

- Time tracking integration – Ensuring accurate labor costs is essential for precise invoicing. A system that integrates time tracking allows contractors to automatically log billable hours and sync them with invoices. Time tracking software helps eliminate manual entry errors and ensures fair compensation for every hour worked.

- Fleet management connectivity – For contractors managing multiple job sites, tracking vehicle usage and fuel costs plays a direct role in invoicing accuracy. Fleet management software helps construction teams allocate transportation expenses correctly, ensuring clients are billed for travel-related costs when necessary.

- Pipeline and forecasting tools – Having visibility into upcoming projects and financial forecasts helps contractors plan for future invoicing needs. Pipeline management for construction businesses provides insights into expected revenue, pending invoices, and overall cash flow projections.

Choosing the right construction invoicing software means looking beyond just sending bills. The features above add another layer of efficiency, helping contractors manage time, resources, and financial forecasting in one seamless system.

Speed up payment times

Get tips, templates, and advice on how to take control of payments.

7 best construction invoice software for all contractor types

Not all contractors have the same invoicing needs—what works for a small residential crew might not be enough for a large commercial operation. The right construction invoice software helps contractors streamline billing, track payments, and ensure every job is accounted for, no matter the business size. Here are seven top invoicing solutions, breaking down their features, pricing, and best use cases for different types of construction contractors.

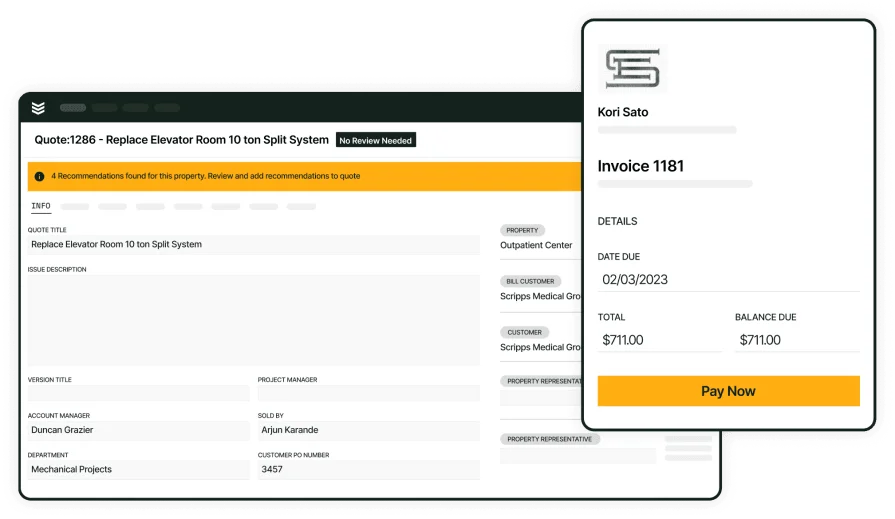

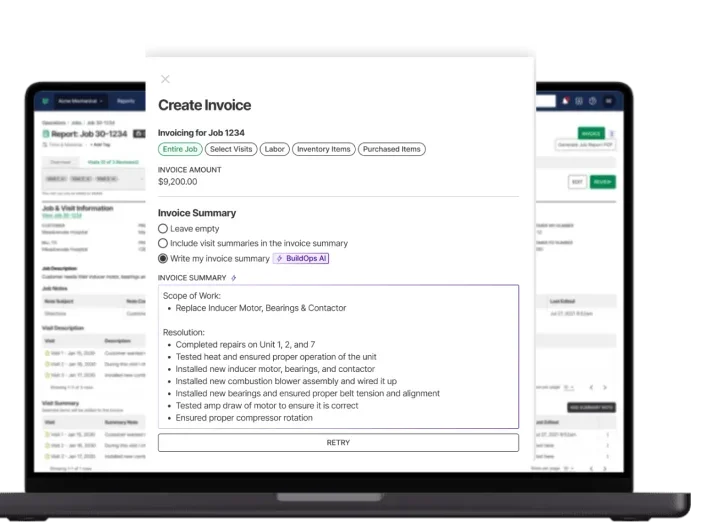

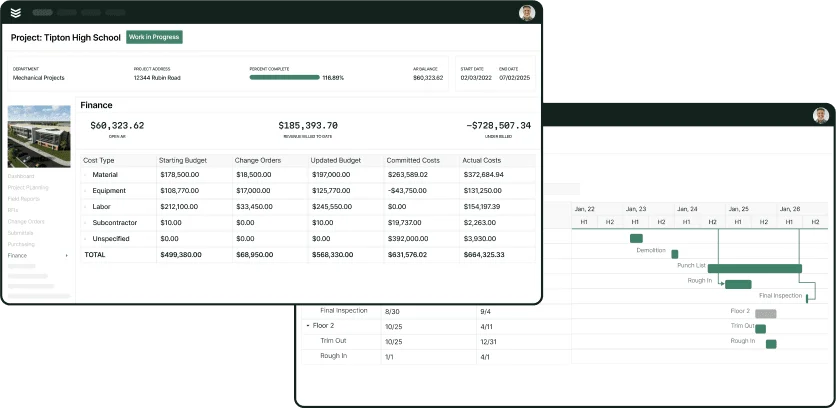

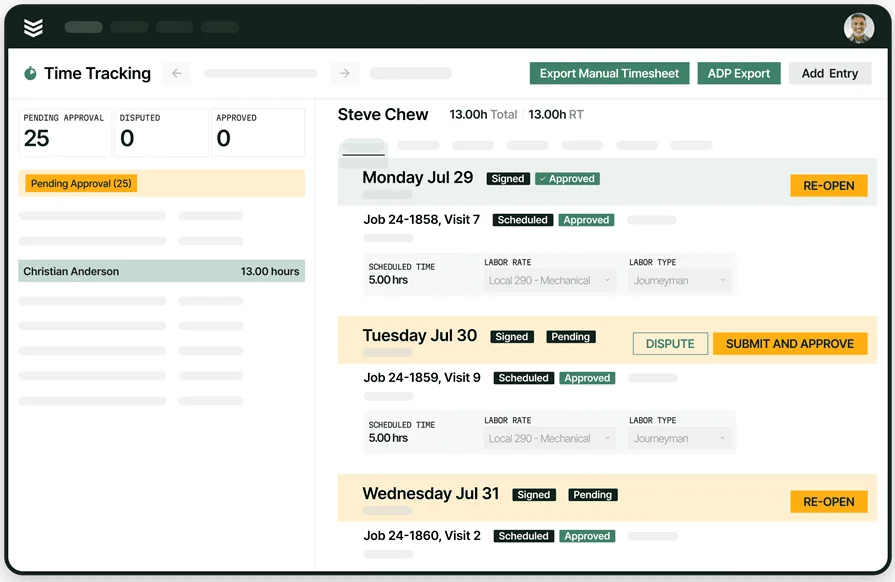

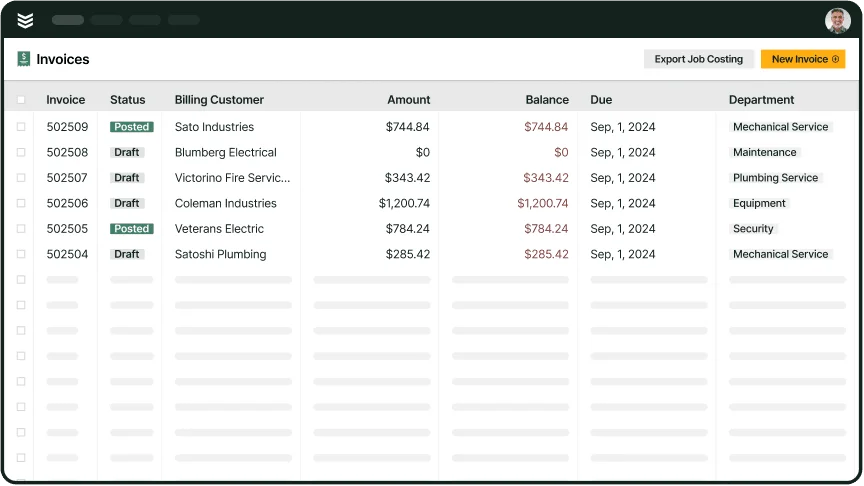

1. Best for commercial: BuildOps

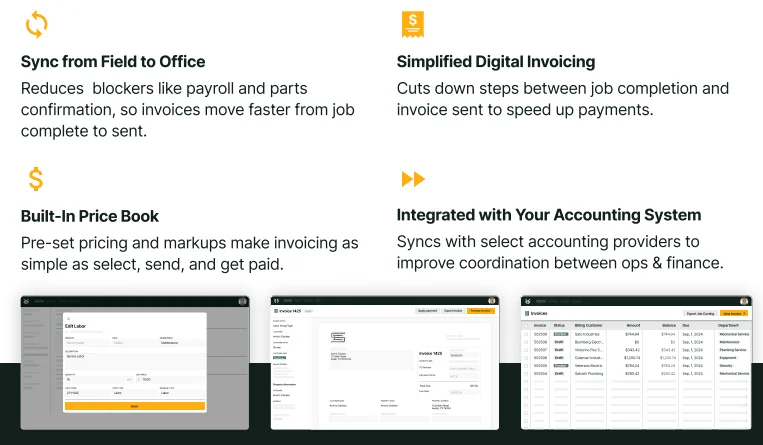

BuildOps was designed for commercial contractors who need powerful automation tools for invoicing, scheduling, and job management. Unlike platforms focused on residential services, BuildOps seamlessly integrates job costing, dispatching, and real-time tracking into its invoicing system. This ensures accurate billing, reduces admin work, and helps large-scale contractors manage complex financial workflows with ease.

How Pricing Works: BuildOps offers live demos every week. You can also book a one-on-one session to explore features and see if it’s the right fit for your business.

Features Beyond Invoicing: Integrated job scheduling, dispatch management, and automated service agreements.

What Sets It Apart for Commercial: Built for high-volume construction businesses that require enterprise-level automation to keep invoices accurate and payments flowing.

See BuildOps in action

Explore how automated billing, scheduling, and job tracking improves efficiency.

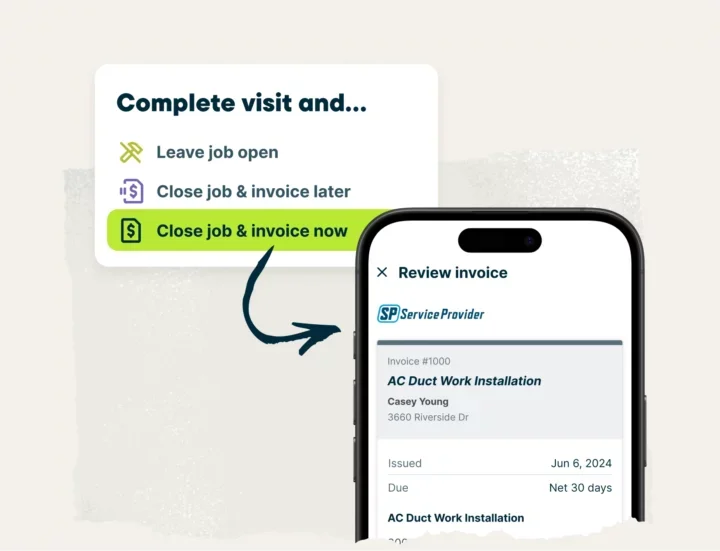

2. Best for residential: Housecall Pro

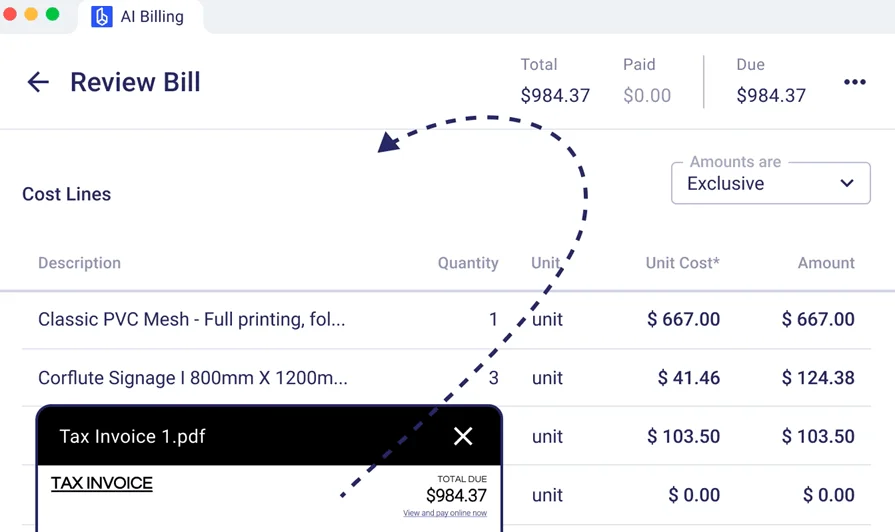

Image Source: Housecall Pro

Housecall Pro is a solid option for residential contractors who need an all-in-one invoicing and scheduling solution. The platform makes it easy to generate and send invoices directly from a mobile device, ensuring technicians get paid quickly after completing a job. It also includes automated follow-ups and online payment processing, reducing the risk of late payments. However, companies handling larger commercial projects may find its features limited in terms of advanced job costing and financial tracking.

How Pricing Works: Starts at $59/month, with higher-tier plans offering advanced automation and integrations.

Features Beyond Invoicing: Online booking, customer reminders, and marketing automation.

What Sets It Apart for Residential: Simple, user-friendly interface designed for small service businesses and independent contractors.

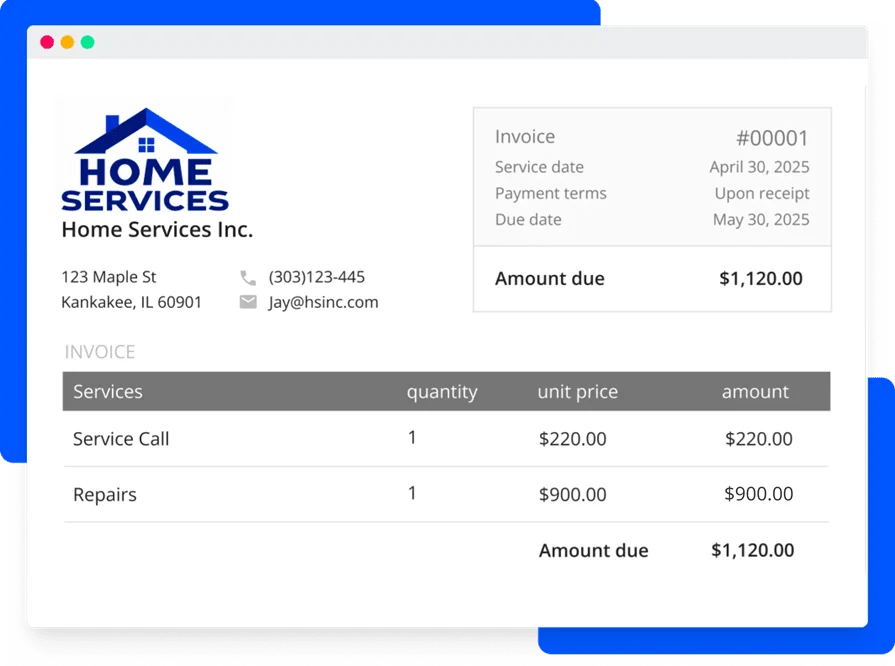

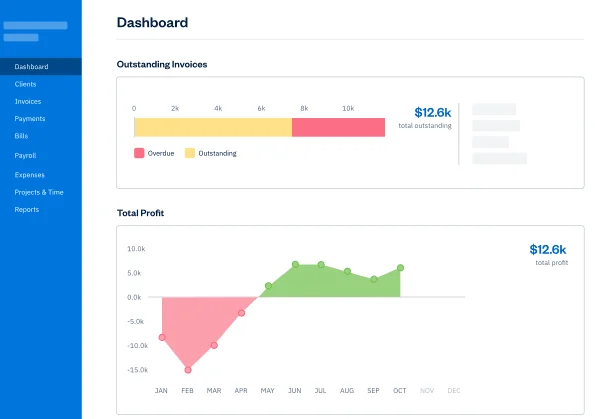

3. Best for general contractors: Jobber

Image Source: Jobber

Jobber is designed for general contractors who need a balance between scheduling, invoicing, and client management. The platform streamlines job tracking and invoicing by allowing contractors to convert work orders into invoices automatically. While Jobber is great for small to mid-sized contracting businesses, those handling large-scale projects may require a more robust system with deeper financial reporting.

How Pricing Works: Offers tiered pricing, with plans starting at $69/month and additional automation features at higher levels.

Features Beyond Invoicing: CRM tools, team management, and automated client communication.

What Sets It Apart for General Contractors: Strong scheduling and job-tracking features combined with a simple invoicing system for contractors handling a mix of residential and light commercial projects.

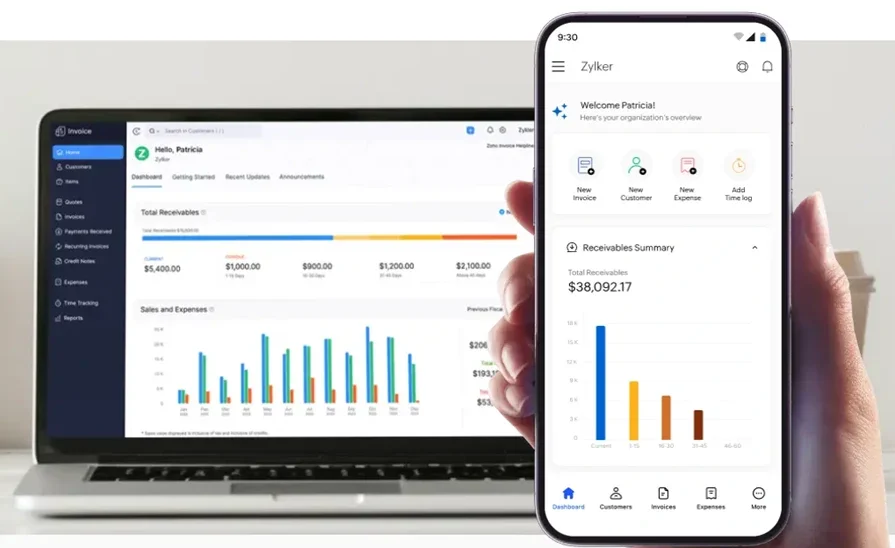

4. Best for construction firms: Zoho

Image Source: Zoho

Zoho offers a cloud-based invoicing solution that works well for contractors looking for a customizable platform with strong financial management tools. It includes invoice automation, expense tracking, and client portals for easy payment collection. However, it lacks the deep integrations with construction-specific workflows like job costing and dispatch management.

How Pricing Works: Offers a free plan with limited features, with paid plans starting at $15/month.

Features Beyond Invoicing: Expense tracking, multi-currency invoicing, and client self-service portals.

What Sets It Apart for Construction Firms: A flexible invoicing system with extensive customization options, ideal for small to mid-sized firms managing multiple clients.

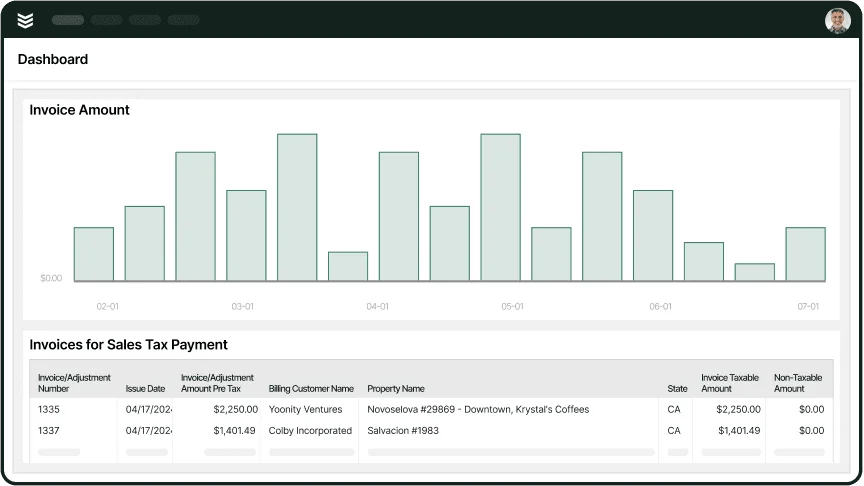

5. Best for construction purchase orders: Buildern

Image Source: Buildern

Buildern is an invoicing and project management tool built specifically for construction businesses. It includes purchase order tracking, budgeting, and financial reporting, making it a strong option for firms that need greater control over job expenses. However, it may not be the best choice for contractors looking for an all-in-one dispatch and invoicing solution.

How Pricing Works: Pricing is customized based on company size and usage, with details available upon request.

Features Beyond Invoicing: Purchase order management, project budgeting, and job cost tracking.

What Sets It Apart for Construction Purchase Orders: A strong financial workflow system that helps contractors streamline purchasing and vendor payments.

6. Best for small construction firms: FreshBooks

Image Source: FreshBooks

FreshBooks is a popular invoicing and accounting platform for small businesses, including construction firms. It offers automated invoices, expense tracking, and time tracking, making it a useful tool for independent contractors and small crews. However, it lacks specialized construction features like job costing and service agreements.

How Pricing Works: Starts at $19/month, with additional features available in higher-tier plans.

Features Beyond Invoicing: Time tracking, accounting tools, and automated payment reminders.

What Sets It Apart for Small Construction Firms: A simple and affordable invoicing solution for contractors who need built-in accounting tools.

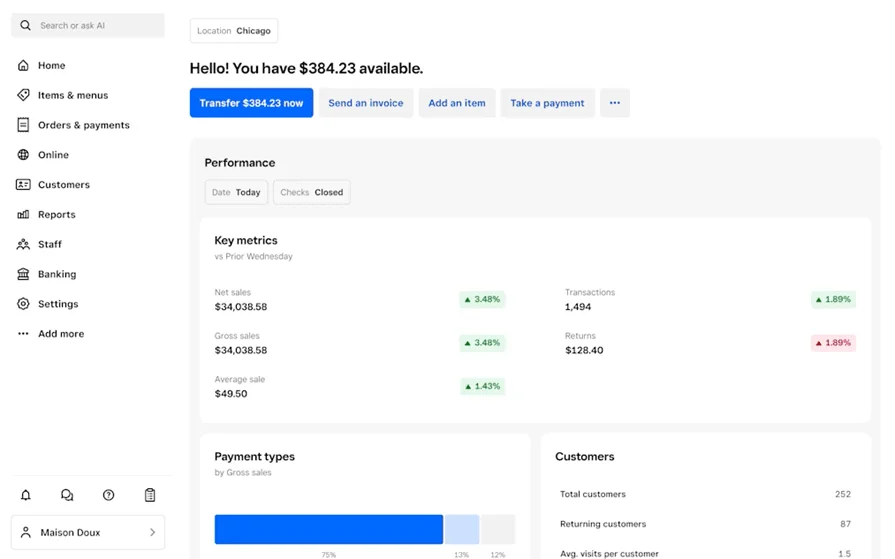

7. Best for construction workflow: Square

Image Source: Square

Square provides an easy-to-use invoicing and payment processing system, making it ideal for contractors who need a straightforward way to collect payments. It includes mobile invoicing, digital payment options, and contract management. However, it’s not designed for complex construction workflows like job costing and project tracking.

How Pricing Works: No monthly fee for basic invoicing, with transaction fees starting at 2.9% + 30¢ per payment.

Features Beyond Invoicing: Mobile payment processing, contract management, and customer directories.

What Sets It Apart for Construction Workflow: A simple invoicing and payment solution that works well for small contractors and subcontractors handling quick jobs.

Streamline construction invoicing

BuildOps helps construction contractors get paid faster—without delays.

7 benefits of using construction invoice software

Managing invoices manually in construction leads to payment delays, errors, and wasted time on admin work. A construction invoice software helps contractors keep cash flow steady, reduce billing disputes, and simplify the entire payment process. Here’s how it makes a difference.

1. Faster payments and improved cash flow

Waiting on paper checks or manually processing payments can slow down revenue cycles. With digital invoicing, contractors can send invoices instantly and accept online payments, reducing the time it takes to get paid. For example, a subcontractor finishing a framing job doesn’t have to wait days to generate and send an invoice. Instead, they issue one on the spot using invoicing software, allowing the general contractor to approve and pay within minutes.

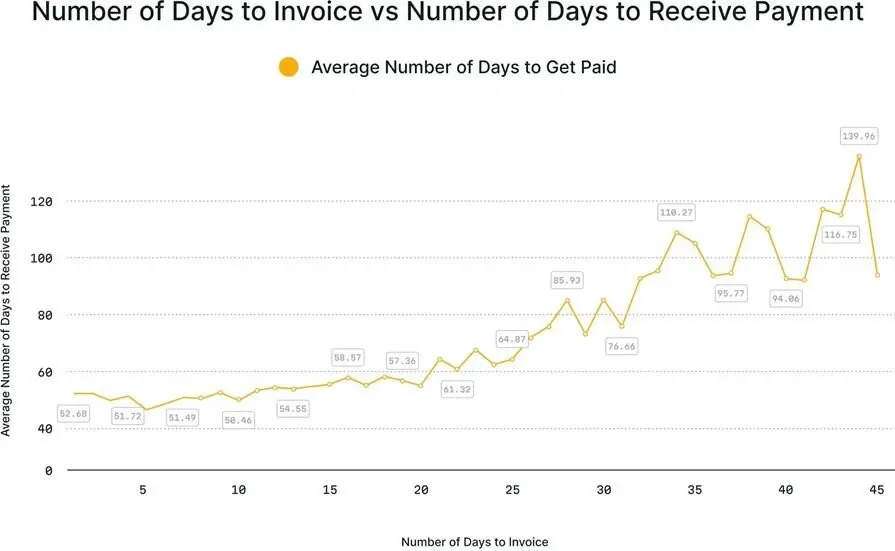

Deep Dive

Getting paid faster is all about promptly billing customers. In the Invoicing Sweet Spot, we explore how timing impacts payment times so you can eliminate late payments and keep cash flow steady.

2. Reduced administrative workload

Manually creating and tracking invoices eats up valuable hours that could be spent on active job sites. Automating invoicing cuts down paperwork, reduces errors, and allows contractors to focus on running their business. Think about a project manager juggling multiple job sites. Instead of spending hours reviewing invoices, they use construction field service management software to automate invoicing alongside scheduling and job tracking—keeping operations efficient.

3. Fewer payment disputes

Inaccurate or missing job details on an invoice can lead to delayed payments or outright disputes. Construction invoice software ensures all billable hours, materials, and change orders are properly documented, making it easy to verify charges. For example, a concrete contractor completing a foundation pour can pull up a detailed breakdown of labor and materials directly from their invoicing system. If a client questions the cost, everything is already recorded—eliminating back-and-forth arguments over pricing.

4. Better financial forecasting and job costing

Knowing when payments are coming in and tracking outstanding invoices helps contractors plan ahead. A system that tracks job costs alongside invoicing ensures projects stay profitable. Imagine how a general contractor managing multiple projects can use construction industry trends insights alongside invoicing data to identify cash flow patterns and adjust pricing strategies accordingly.

5. Seamless client communication and professionalism

Sending clear, well-structured invoices builds trust with clients. Automated reminders ensure payments aren’t forgotten, and digital invoices with branding create a professional image. Consider a roofing company that relies on manual invoicing. Their invoices are often delayed, and clients frequently request clarifications. By switching to automated invoicing, they send branded invoices with clear payment terms, improving client relationships and reducing unpaid balances.

6. Integration with scheduling and job management

When invoicing is tied to job scheduling, contractors can track completed work and ensure every billable task is accounted for. This prevents underbilling and improves financial accuracy. A plumbing contractor using an integrated system can immediately generate an invoice as soon as a job is marked complete. This eliminates gaps in billing and ensures technicians get paid for every service call.

7. Stronger client relationships and repeat business

Clear invoicing, easy payment processing, and transparent records make it easier to maintain long-term client relationships. Contractors who provide a seamless billing experience are more likely to secure repeat business. A remodeling contractor working with repeat clients relies on construction contractor CRM to track past invoices, payment histories, and job details—ensuring they always provide accurate estimates and maintain positive client relationships.

4 important construction invoice software FAQs answered

Contractors often ask: What exactly does it do? How does it work? Is it worth the investment? And most importantly, how can you implement it effectively? – To help you make an informed decision, we’ve answered these key questions to show how invoicing software can streamline your billing process and improve cash flow.

1. What is construction invoice software?

Construction invoice software is a digital tool designed to help contractors create, send, and manage invoices efficiently. It automates billing, tracks payments, and integrates with job costing, scheduling, and dispatching, to ensure accurate financial management for construction projects.

In the construction industry, invoicing involves tracking labor, materials, and contract terms to ensure every cost is accounted for. With construction-specific invoicing software, contractors can streamline cash flow, reduce admin work, and prevent payment disputes.

2. How does construction invoicing software work?

Construction invoicing software simplifies the billing process by:

- Generating invoices automatically based on completed work and tracked labor/material costs

- Allowing digital payment collection via credit card, ACH, or online portals

- Syncing with job scheduling and project management tools for real-time billing accuracy

- Sending automated reminders to reduce late payments

By integrating invoicing with other construction operations, the software ensures every job is billed correctly and payments are received faster.

3. Is invoicing software worth the cost for construction professionals?

Yes, investing in invoicing software saves contractors time, reduces errors, and accelerates payments—ultimately improving profitability. Manual invoicing leads to delays, missed charges, and unnecessary admin work. Automated systems eliminate these inefficiencies, ensuring accurate and timely billing.

For construction professionals managing multiple projects, the return on investment comes from improved cash flow, reduced disputes, and fewer administrative burdens. The right invoicing tool can help contractors stay organized while scaling their business effectively.

4. What are some best practices to follow when implementing construction invoice software?

To maximize the benefits of construction invoice software, contractors should follow these best practices:

- Set up integrations – Connect the software with accounting, scheduling, and job costing tools to ensure seamless data flow.

- Customize invoices – Add branding, clear payment terms, and itemized job details to improve professionalism and transparency.

- Automate follow-ups – Set up automatic reminders for overdue payments to reduce collection delays.

- Train your team – Ensure both field crews and office staff know how to create, send, and track invoices efficiently.

- Regularly review reports – Use built-in reporting features to monitor outstanding balances, cash flow, and job profitability.

- Utilize mobile invoicing – Enable technicians to generate and send invoices directly from the job site, speeding up approvals.

- Sync with scheduling and dispatch – Ensure completed jobs are automatically linked to invoices to avoid missed billings.

- Standardize payment terms – Clearly define due dates, late fees, and accepted payment methods to prevent disputes.

- Secure digital records – Store invoices and payment history in a centralized system for easy access and audits.

A well-implemented invoicing system helps construction businesses reduce admin work, improve cash flow, and eliminate billing errors.

Choosing the right construction invoice software can make a huge difference in keeping projects profitable, cash flow steady, and admin work minimal. From automating invoices and tracking payments to integrating job costing and scheduling, the right system helps contractors stay organized while reducing financial headaches. While many invoicing tools offer basic billing functions, not all include the advanced features construction businesses need—like service agreements, dispatch integration, and job cost tracking.

For commercial field service businesses that need an all-in-one platform, BuildOps provides a fully integrated solution designed to streamline invoicing alongside scheduling, job tracking, and payments. Unlike generic invoicing tools, BuildOps ensures that every billable detail is accounted for, reducing revenue loss and improving financial accuracy.

Schedule a no-commitment demo

See how BuildOps helps construction businesses take control of cash flow.