Executive Summary: Email Research Trends in the Construction Industry

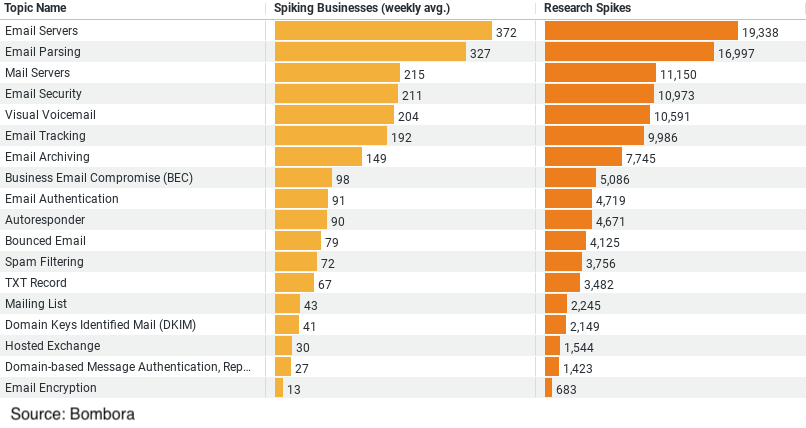

1. Email Servers Lead Research Interest: The data indicates that “Email Servers” is the most researched topic, with an average of approximately 372 businesses per week showing spiked interest and a total of 19,338 research spikes. This suggests a robust interest in enhancing email infrastructure.

2. Importance of Email Parsing: “Email Parsing” ranks second, with around 327 businesses on average per week and a total of 16,997 spikes in research activity. The focus here likely revolves around improving the efficiency of handling and automating email content.

3. Mail Servers and Security: “Mail Servers” and “Email Security” also feature prominently, indicating significant concerns about maintaining robust and secure email communication channels.

4. Technological Integration: “Visual Voicemail” shows a notable presence, indicating an inclination towards integrating traditional email systems with newer technologies to streamline communications.

Exploring Email Innovations: How the Construction Industry Stays Connected

In today’s fast-paced construction industry, staying connected and managing communications efficiently is more crucial than ever. As businesses within this sector continue to evolve, their reliance on technology, particularly email, has grown significantly. A recent analysis of how the construction industry researches and engages with email-related topics provides valuable insights into their priorities and technological interests.

Email Servers: The Backbone of Communication

At the forefront of the construction industry’s research interests are Email Servers, with data showing an impressive weekly average of 372 businesses exploring this topic, cumulating in 19,338 research spikes. This overwhelming interest underlines the critical role that robust email servers play in supporting day-to-day operations. Email servers not only facilitate the basic exchange of communications but also ensure that large files, often essential in construction projects, are shared swiftly and securely. The high volume of research indicates an industry-wide push towards optimizing these systems, likely driven by a need for greater reliability and capacity in communications infrastructure.

Email Parsing: Streamlining Efficiency

Close behind, with 327 businesses investigating weekly and a total of 16,997 research spikes, is Email Parsing. This topic’s popularity underscores a growing need to streamline communication and automate the handling of incoming emails. In the construction sector, where time-sensitive decisions and updates are routine, the ability to automatically sort, tag, and respond to emails can significantly enhance operational efficiency. Email parsing technology allows businesses to extract valuable data from emails automatically, reducing manual entry errors and ensuring that critical information is quickly accessible and actionable.

Security and Mail Servers: Ensuring Safe Communications

With 214 and 211 businesses per week exploring Mail Servers and Email Security respectively, the industry’s focus clearly extends beyond functionality to the security of these communication systems. The construction industry, involving numerous stakeholders including suppliers, contractors, and government agencies, requires a secure method of communication to protect sensitive information. The high level of interest in Email Security, with 10,973 research spikes, illustrates a proactive approach towards safeguarding data against cyber threats, highlighting the importance of robust security measures in today’s digital landscape.

Visual Voicemail: A Glimpse into Future Integrations

An interesting insight from the data is the emerging interest in technologies like Visual Voicemail, which saw around 204 businesses per week engaged in research, totaling 10,591 spikes. This technology represents a blend of traditional and new media, where voicemails are converted into a visual format and can be managed directly from an email inbox. For the construction industry, where communication often happens on the go, such integrations can provide a seamless way to manage messages without the need to switch between multiple platforms.

Implications and Future Directions

The concentrated research into these areas reveals a broader narrative about the construction industry’s adaptation to digital transformations. As companies continue to seek enhanced efficiency, security, and integration in their communication systems, the role of advanced email technologies becomes increasingly central. This not only improves day-to-day operations but also supports scalability and growth.

Furthermore, the integration of new technologies such as Visual Voicemail points towards a future where the convergence of different communication forms could streamline workflows even further. As the industry evolves, staying abreast of these technological advancements will be key to maintaining competitive edges and optimizing operational processes.

In conclusion, the construction industry’s deep dive into the various aspects of email technologies highlights its commitment to leveraging digital tools for better communication. As this sector continues to grow and face new challenges, its focus on enhancing and securing email infrastructure is likely to drive significant innovations, shaping the future of construction communications.

Company Sample Data

1. Company Size: Categorizes companies based on the number of employees, ranging from micro to large enterprises.

2. Spiking Businesses (weekly avg.): Indicates the average number of businesses per week within each size category that have shown increased research activity or interest.

3. Percent of Total: Represents the percentage share of each company size category in the total research spikes observed.

Overview of Data

– Micro (1 – 9 Employees): Shows the smallest average weekly spike in research, but still significant considering the size, at about 117 businesses, accounting for 8.4% of the total.

– Small (10 – 49 Employees): Significantly higher activity with around 284 businesses spiking weekly, representing 20.4% of the total.

– Medium-Small (50 – 199 Employees): Similar to small companies in activity with approximately 288 businesses, accounting for 20.7% of total spikes.

– Medium (200 – 499 Employees): A decrease in activity compared to smaller sizes, with about 188 businesses, and 13.5% of the total.

– Medium-Large (500 – 999 Employees): Fewer spikes than medium-sized but still substantial at about 141 businesses weekly, making up 10% of the total.

Analysis and Trends

The data suggests a trend where the intensity of research interest correlates closely with company size, up to a point. Small to medium-small companies show the highest levels of spiking businesses, likely due to their nimble nature and possibly greater need to leverage strategic information for competitive advantage. Larger companies, while still active, show a relative decrease in the proportion of spiking businesses. This could be due to having more established procedures and resources, which might reduce the necessity for frequent exploratory research compared to smaller companies that need to adapt more aggressively to stay competitive.

This pattern highlights how business size influences the approach to market research and information gathering. Smaller and medium-sized companies might be more responsive to industry changes and more aggressive in pursuing new opportunities or technologies. In contrast, larger companies might rely more on established strategies and internal research resources.

This data provides valuable insights for marketers, business developers, and industry analysts who aim to understand how different sized companies engage with market trends and information. It can guide tailored marketing strategies, product development, and customer engagement approaches based on company size.