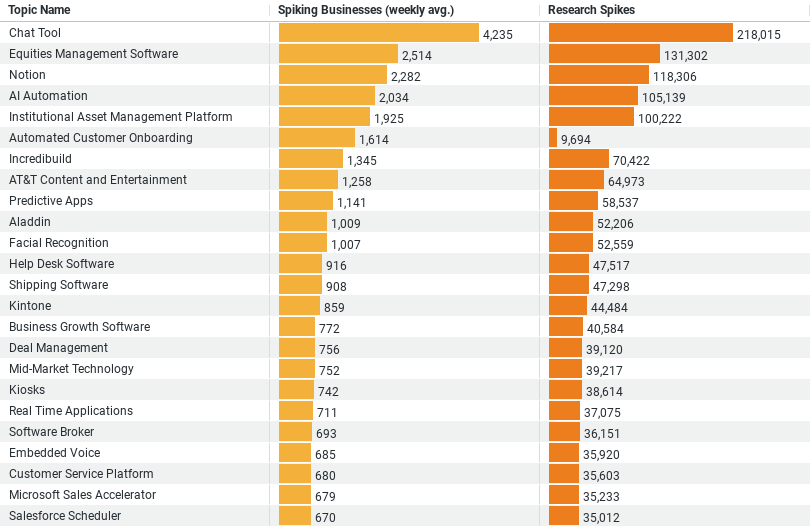

(Data visualized in the chart captures buying and research signals for the past 365 days)

The dataset provides a focused look at the construction industry’s research interests in Business Solutions:

– The dataset covers 5 topics with significant interest from the construction industry, ranging from communication tools to financial and asset management software, as well as organizational and automation technologies.

– Chat Tool emerges as the most popular topic, commanding the highest average weekly interest (4,235 businesses) and the largest research spike (218,015 instances).

– Equities Management Software and Notion follow, with weekly interests of 2,514 and 2,282 businesses, respectively, highlighting the industry’s focus on financial management and organizational tools.

– AI Automation and Institutional Asset Management Platform show robust interest, with over 2,034 and 1,925 average weekly business interests, indicating a keen investment in technology to streamline operations.

– The research spikes provide an additional layer of insight, showing significant peaks in activity across all topics, with numbers ranging from 100,222 to 218,015, suggesting periods of heightened interest or industry events driving research.

The Rise of Chat Tools

At the forefront of this digital revolution is the adoption of Chat Tools, which has seen the highest average weekly interest from businesses, with approximately 4,235 businesses exploring its potential. The research spike of 218,015 instances illustrates not just a fleeting curiosity but a deep-seated intent to integrate communication technologies that can streamline operations, enhance team collaboration, and improve stakeholder engagement. This move towards Chat Tools signifies a shift in the industry’s approach to communication, prioritizing efficiency and real-time connectivity over traditional, slower methods.

Financial Management Software: A Key Focus

The construction industry’s focus on Equities Management Software, with an average weekly interest of around 2,514 businesses and a significant research spike of 131,302, underscores the critical role of financial management in the sector. As projects become more complex and budgets tighter, the ability to manage equities efficiently can be the difference between profit and loss. Similarly, the interest in Institutional Asset Management Platforms, attracting an average weekly interest from 1,925 businesses, highlights the industry’s need for robust solutions to navigate the financial intricacies of large-scale construction projects.

Organizational Efficiency with Notion

The emphasis on Notion, attracting an average weekly interest from 2,282 businesses, reflects the industry’s dedication to organizational efficiency. In the fast-paced construction environment, managing tasks, schedules, and documentation efficiently is paramount. Tools like Notion offer a centralized platform for project management, enabling teams to stay organized, aligned, and focused on delivering projects on time and within budget.

AI Automation: The Future is Now

The construction industry’s interest in AI Automation, with 2,034 businesses on average researching this topic weekly, signals a transformative shift towards embracing artificial intelligence. With a research spike of 105,139, it’s clear that AI and automation technologies are seen as key drivers for innovation, offering solutions for automating repetitive tasks, enhancing precision, and improving safety on construction sites. The move towards AI Automation is a testament to the industry’s forward-thinking approach, aiming to leverage technology to address traditional challenges and improve overall productivity.

Implications for the Future

The data reveals a construction industry at the cusp of a technological renaissance, keenly focused on harnessing the power of “Business Solutions” to tackle contemporary challenges. The insights underscore a collective move towards digitalization, with an emphasis on enhancing communication, financial management, organizational efficiency, and operational workflows through technology.

This trend towards digital adoption is not just about staying competitive; it’s about redefining what’s possible in construction. By embracing innovative solutions, the industry is setting new standards for efficiency, safety, and sustainability. The integration of these technologies is facilitating smoother project executions, enabling better decision-making, and fostering a culture of continuous improvement.

Conclusion

As the construction industry continues to research and integrate “Business Solutions,” the implications for the future are profound. This shift towards digital tools and technologies is paving the way for a more efficient, safer, and more sustainable construction sector. The data highlights not only the areas of keen interest but also the industry’s commitment to embracing innovation at every turn. As we look ahead, it’s clear that the construction industry’s journey towards digital transformation is just beginning, promising a future where technology and construction go hand in hand to build a better world.

Population Sample For The Above Article

The dataset categorizes companies into five sizes and details the average weekly interest (spiking businesses) in specific topics or technologies, along with their respective percentage of the total interest observed. Here’s a breakdown of the company sizes and their corresponding data:

1. Micro (1 – 9 Employees): This category has an average of approximately 2,299 spiking businesses weekly, making up about 11.57% of the total interest observed.

2. Small (10 – 49 Employees): Small companies show a significantly higher average of spiking businesses, with around 6,609 weekly. This size category contributes to 33.27% of the total interest, the largest share among all groups.

3. Medium-Small (50 – 199 Employees): These companies have a similar level of interest to small companies, with an average of 6,173 spiking businesses weekly, accounting for 31.07% of the total.

4. Medium (200 – 499 Employees): Medium-sized companies have an average of 2,323 spiking businesses weekly, representing about 11.69% of the total interest.

5. Medium-Large (500 – 999 Employees): The medium-large category shows the least weekly average of spiking businesses, with around 1,006, which constitutes 5.06% of the total interest observed.

This data suggests a strong interest in specific topics or technologies across various company sizes, with small and medium-small businesses showing the most significant engagement. The distribution indicates that businesses of all sizes are exploring new opportunities or solutions, but the level of interest and engagement varies significantly depending on the company size.