Executive Summary: Employee Services Research Trends in the Construction Industry

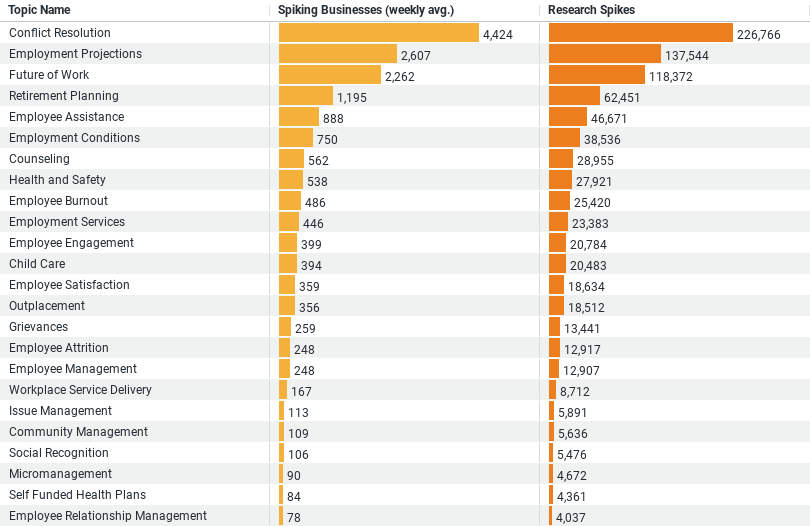

– High Interest in Conflict Management: The data reveals that “Conflict Resolution” is the most researched topic, with the highest number of research spikes (226,766) and the largest weekly average of spiking businesses (4,424). This suggests that conflict management is a top priority, likely due to its impact on workplace harmony and productivity.

– Future Planning and Projections: “Employment Projections” and “Future of Work” are the next most researched topics, highlighting the industry’s focus on understanding and preparing for future workforce dynamics and trends. These areas are essential for strategic planning and adaptation in a changing economic landscape.

– Engagement with Retirement and Assistance Programs: Topics like “Retirement Planning” and “Employee Assistance” also see significant engagement, indicating ongoing concerns with long-term employee welfare and immediate support mechanisms.

Employee Services Research Trends in the Construction Industry

In recent years, the construction industry has witnessed significant evolution, not just in technological advancements but also in how it manages and supports its workforce. As companies grapple with both internal challenges and external economic pressures, understanding the research trends within employee services can provide valuable insights into the industry’s priorities and concerns. Here, we explore the top topics that have captured the interest of the construction sector, particularly looking at conflict resolution, employment projections, and future work dynamics.

Conflict Resolution Takes the Lead

At the forefront of research is the topic of “Conflict Resolution.” The data shows an overwhelming number of research spikes, totaling 226,766 occurrences, with an average of 4,424 businesses per week showing a heightened interest in this area. This trend indicates that conflict management is a critical issue within the construction industry. Workplaces in this sector are often high-pressure environments with diverse teams working under tight deadlines, making effective conflict resolution strategies essential. Companies are likely investing in this area to enhance team cohesion, reduce workplace disruptions, and improve overall productivity.

Preparing for the Future: Employment Projections and Work Dynamics

Following closely are the topics of “Employment Projections” and “Future of Work,” which have also garnered substantial attention, with research spikes of 137,544 and 118,372, respectively. These topics reflect the industry’s proactive efforts to forecast and adapt to future labor market conditions. With the construction industry at a critical juncture, influenced by factors such as technological changes, aging workforce, and economic fluctuations, understanding future employment trends is crucial. This focus suggests that businesses are keen on developing strategies that align with anticipated industry growth and workforce needs, ensuring they remain competitive and resilient.

Interest in Long-term Employee Welfare

“Retirement Planning” and “Employee Assistance” are also among the highly researched topics, highlighting a growing concern for long-term employee welfare and immediate support mechanisms. Retirement planning research, with 62,451 spikes, points towards efforts to address the retirement readiness of the aging workforce, ensuring that employees can transition smoothly out of the workforce. Meanwhile, employee assistance programs, which focus on providing support through counseling and other services, show a research interest with 46,671 spikes. These programs are crucial in supporting employee mental health and well-being, factors that are increasingly recognized as critical to sustaining workforce productivity.

Analysis and Visual Trends

The analysis includes visual representations, which underline the distribution of research interest across these topics. Bar graphs comparing the “Research Spikes” and “Spiking Businesses (weekly avg.)” illustrate that while the interest levels in topics like conflict resolution are markedly high, there is a consistent pattern of concern across several areas of employee services. This pattern suggests a balanced approach to addressing immediate issues like conflict resolution while also preparing for future challenges through strategic planning.

Conclusion

The construction industry’s focused research on employee services highlights a comprehensive approach to workforce management. By addressing immediate issues such as conflict resolution and preparing for future changes with employment projections and retirement planning, the industry is taking significant steps to enhance its human resources practices. Such insights not only help individual companies to strategize and implement effective employee services but also paint a picture of an industry that is keen on nurturing a stable, productive, and forward-looking workforce.

As the construction sector continues to evolve, staying abreast of these trends will be vital for industry leaders. The insights gained from such research can guide strategic decisions that contribute to the industry’s sustainability and growth, ensuring that it remains robust in the face of changing market dynamics.

Company Sample Data Overview

1. Company Size: Categorizes companies into size brackets based on the number of employees. These categories include:

– Micro (1 – 9 Employees)

– Small (10 – 49 Employees)

– Medium-Small (50 – 199 Employees)

– Medium (200 – 499 Employees)

– Medium-Large (500 – 999 Employees)

2. Spiking Businesses (weekly avg.): Indicates the average weekly count of businesses in each size category that showed a significant spike in interest or activity related to the topic of study.

3. Percent of Total: Reflects the percentage that each company size category contributes to the total number of spiking businesses.

Analysis and Trends Based on Company Sizes

Analyzing the data, the trends in how different sized companies engage with particular topics can be indicative of various strategic priorities, resource allocations, and challenges unique to each size group:

– Small Companies (Micro and Small): These companies show substantial engagement, with the “Small (10 – 49 Employees)” category being particularly active. This high level of activity could be driven by the agility of smaller companies to adapt to new trends or challenges rapidly. Smaller firms may also be more reactive to industry changes due to their size, allowing them to pivot or adopt new practices quicker than their larger counterparts.

– Medium Companies: While medium-sized companies (especially those with 50 to 199 employees) also exhibit high levels of engagement, the interest appears to taper off as companies grow larger (200 to 999 employees). This might be due to the increasing complexity of operations and the layered decision-making processes that can slow down the adoption of new strategies or technologies.

– Larger Companies: The lowest engagement in terms of spiking businesses and percent of total comes from the medium-large category. Larger companies might have established procedures and systems that are less flexible to changing quickly, or they may be focusing their research and development efforts in areas not captured by this particular dataset.

Conclusion

The observed trend where smaller companies are more dynamically engaged in specific research activities suggests that size does impact how companies prioritize and react to industry developments. Smaller companies may find it easier to explore and implement new strategies due to their size and less bureaucratic structure, whereas larger organizations might focus on optimizing existing processes or invest in innovation at a more calculated and slower pace.