Executive Summary: Engineering Research Trends in the Construction Industry

Data-Focused Summary

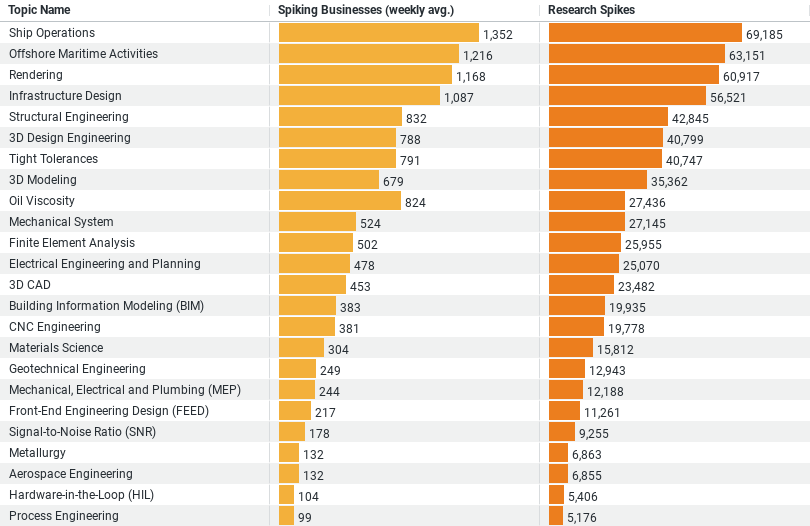

– Top Researched Topic: “Ship Operations” with 69,185 research spikes and the highest weekly average of business interest at 1,351.9.

– Top Five Topics by Research Activity: Ship Operations, Offshore Maritime Activities, Rendering, Infrastructure Design, and Structural Engineering. These topics collectively exhibit high levels of industry engagement, both in terms of research spikes and business interest.

– Emerging Trends: 3D technology applications (like 3D Design Engineering and 3D Modeling) and material science (e.g., Oil Viscosity) are emerging as significant areas of focus, indicating a shift toward innovation and advanced technologies in construction engineering.

– Business Engagement: The data shows consistent engagement across several topics with over 800 businesses on average showing weekly interest in at least five different areas, emphasizing a broad base of active research within the industry.

Top Engineering Topics in Construction

At the forefront of research is the topic of Ship Operations, which leads with an impressive 69,185 research spikes. This area not only attracts the highest number of research activities but also sees the most substantial business engagement, with an average of 1,351.9 businesses focusing on it weekly. The high level of interest likely stems from the increasing complexity and technological requirements of modern maritime projects, which require innovative engineering solutions to ensure efficiency and safety.

Following closely are Offshore Maritime Activities and Rendering, with 63,151 and 60,917 research spikes, respectively. These topics highlight the industry’s push towards exploring and harnessing marine environments, perhaps driven by the global demand for energy and the expansion of marine infrastructure. Rendering, on the other hand, points to a surge in utilizing digital technologies to visualize projects before physical construction begins, ensuring precision and reducing costly errors.

The Role of Advanced Technologies

Infrastructure Design and Structural Engineering also rank high on the list, attracting significant attention with 56,521 and 42,845 research spikes, respectively. These areas are critical as they directly relate to the core activities of the construction industry—designing and building structures that are safe, sustainable, and cost-effective. The data indicates a robust interest in developing advanced methods and materials to improve the longevity and functionality of infrastructure projects.

Emerging strongly from the data is the focus on 3D Design Engineering and 3D Modeling, which reflect the industry’s shift towards digitalization. These technologies allow for precise simulations and analyses, which are invaluable in making informed decisions during the construction process. They also facilitate greater collaboration among stakeholders, as models can be easily shared and modified.

Material Science and Mechanical Systems

Notably, Oil Viscosity and Mechanical Systems research are gaining traction. These topics might seem niche but are crucial for projects that demand high performance in challenging environments, such as high temperatures or corrosive conditions typically found in industrial and offshore constructions. Understanding the properties of materials and the mechanics of systems plays a vital role in ensuring that constructions are not only viable but also durable and efficient.

Business Engagement and Research Implications

The dataset reveals that over 800 businesses are actively engaged weekly in at least five different research areas. This broad base of interest underscores the construction industry’s commitment to staying at the forefront of technological and scientific advancements. Businesses are not just passively adopting new techniques; they are actively shaping the future of construction through targeted research and innovation.

Conclusion

The construction industry’s focus on advanced engineering topics highlights a clear trend towards incorporating more technology and scientific principles into everyday practices. As companies continue to explore these areas, they pave the way for more innovative, efficient, and sustainable construction methods. The insights from this data not only reflect the current state of the industry but also predict future directions. For industry professionals and stakeholders, understanding these trends is crucial for strategic planning and staying competitive in a rapidly evolving marketplace.

Company Sample Data Description

– Company Size: Categorizes companies into various groups based on the number of employees. The categories include Micro (1-9 employees), Small (10-49 employees), Medium-Small (50-199 employees), Medium (200-499 employees), and Medium-Large (500-999 employees).

– Spiking Businesses (weekly avg.): This column shows the average number of businesses in each size category that have shown a notable increase in specific activities or interest areas per week.

– Percent of Total: Represents the percentage that each company size category contributes to the total spikes observed across all categories.

Analysis of Trends Depending on Company Size

The data indicates significant variations in business activity across different company sizes, which likely reflect the distinct capabilities, resources, and strategic focuses of companies depending on their scale. Here’s an analysis of the potential reasons behind these trends:

1. Micro (1 – 9 Employees): These companies have the lowest weekly average of spiking businesses and a small percentage of total activity, which may be due to limited resources and less capacity to engage in diverse or large-scale research and development activities.

2. Small (10 – 49 Employees): Small businesses show a substantial increase in activity compared to micro businesses, possibly because they possess slightly more resources and might be more focused on expanding their market presence or exploring new opportunities.

3. Medium-Small (50 – 199 Employees): This group has the highest weekly average of spiking businesses and makes up the largest percent of the total. This could be attributed to these companies reaching a scale where they have sufficient resources to invest heavily in research and innovation, but are still agile enough to respond quickly to market changes.

4. Medium (200 – 499 Employees) and Medium-Large (500 – 999 Employees): These companies show a decline in activity compared to medium-small companies. This may be due to the increasing complexity of managing larger organizations, which can slow down decision-making processes and responsiveness to new trends. However, they still maintain a significant level of activity, likely due to their greater overall resources and established research departments.

These trends suggest that company size significantly influences business activities related to research and market engagement. Smaller companies might focus more on immediate survival and gradual growth, whereas medium-sized enterprises might have the optimal mix of agility and resources to heavily invest in new opportunities. Larger companies, while having more resources, might face challenges in maintaining the same level of responsiveness as smaller firms. This analysis helps to understand how different sizes of companies prioritize and manage their business activities in the context of market research and development.