Executive Summary: Air Quality Research Trends in the Construction Industry

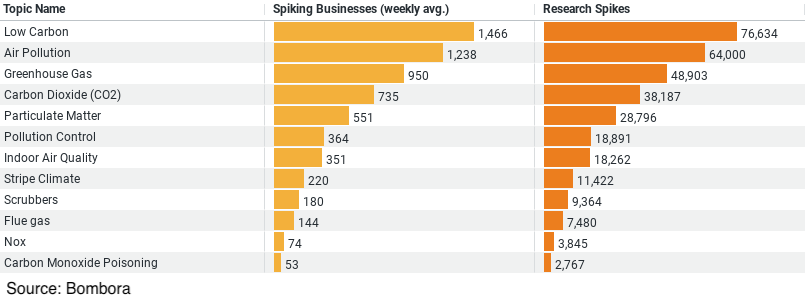

1. Low Carbon: This topic is the most researched, with a weekly average of 1,466 businesses focusing on it, and a total of 76,634 research spikes. This indicates a strong industry focus on reducing carbon emissions and implementing low-carbon solutions.

2. Air Pollution: The second most researched topic, with 1,237 businesses on average researching it weekly, and a total of 64,000 research spikes. This shows significant concern and interest in addressing air pollution within the construction sector.

3. Greenhouse Gas: Garnering interest from 950 businesses weekly on average, with 48,903 research spikes. This highlights the construction industry’s attention towards reducing greenhouse gas emissions.

4. Carbon Dioxide (CO2): With an average of 735 businesses researching this topic weekly and 38,187 research spikes, the focus here is on the primary greenhouse gas emitted through human activities, indicating efforts to mitigate CO2 emissions.

5. Particulate Matter: Attracting research from 551 businesses weekly on average, with 28,796 research spikes. This suggests a significant concern for the health impacts of particulate matter, which is a common air pollutant, especially in construction sites.

These trends suggest a strong emphasis within the construction industry on environmental sustainability, specifically in improving air quality, reducing carbon and greenhouse gas emissions, and mitigating the health impacts of air pollution.

The Forefront of Research: Low Carbon Initiatives

At the helm of research interests is the pursuit of low carbon solutions, with an average of 1,466 businesses weekly delving into this area. This not only represents a significant shift towards sustainable construction practices but also underscores the industry’s acknowledgment of its role in carbon emissions. With 76,634 research spikes, the intense focus on low carbon technologies and methods is a testament to the sector’s dedication to minimizing its carbon footprint. The move towards low carbon construction is not just about regulatory compliance; it’s a holistic approach that encompasses energy efficiency, use of sustainable materials, and innovative building techniques that collectively reduce emissions.

Addressing the Challenges of Air Pollution

Air pollution, a critical environmental and public health issue, ranks second in the industry’s research priorities. With 1,237 businesses engaging in this research weekly and a total of 64,000 research spikes, the construction industry is actively seeking ways to mitigate the impact of air pollutants. This involves adopting cleaner construction practices, reducing the use of polluting machinery, and implementing dust control measures. By tackling air pollution, the industry aims not only to protect the environment but also to safeguard the health of its workforce and the wider community.

The Greenhouse Gas Conundrum

Greenhouse gas (GHG) emissions are closely linked to climate change, and the construction industry is stepping up to address this challenge. Research into greenhouse gas emissions attracts 950 businesses weekly, with a total of 48,903 research spikes. This focus is crucial in developing strategies to reduce GHG emissions from construction activities. It includes exploring renewable energy sources, enhancing building insulation, and promoting the circular economy within construction materials.

Carbon Dioxide (CO2) Emissions in Focus

Carbon Dioxide, the primary greenhouse gas emitted through human activities, is another major area of research, with 735 businesses investigating it weekly. The industry’s interest in CO2 emissions, demonstrated by 38,187 research spikes, highlights the ongoing efforts to identify and implement CO2 reduction strategies. This could involve enhancing energy efficiency in buildings, exploring carbon capture technologies, and promoting the use of low-carbon construction materials.

Particulate Matter and Health Concerns

Particulate matter, a pervasive air pollutant, poses significant health risks, particularly in urban and industrial settings. With 551 businesses focusing on this topic weekly and 28,796 research spikes, the construction industry is actively researching methods to reduce particulate emissions. This involves dust suppression techniques, the use of non-toxic materials, and the implementation of green construction sites.

Conclusion

The data reveals a construction industry deeply engaged in research and innovation to improve air quality and reduce environmental impact. From low carbon solutions to the mitigation of air pollution and greenhouse gases, the sector is embracing its responsibility towards the planet and its inhabitants. The focus on CO2 and particulate matter further underscores the industry’s commitment to addressing specific pollutants that have profound implications for climate change and public health.

As the construction industry continues to evolve, its research into air quality and sustainable practices is more important than ever. By prioritizing environmental and health concerns, the sector is not only contributing to the global fight against climate change but also paving the way for a healthier, more sustainable future.

Company Sample Data

Micro (1 – 9 Employees)

– Weekly Average of Spiking Businesses: 400.19

– Percent of Total: 9.15%

Micro businesses show a significant level of activity considering their small size, suggesting agility and the ability to pivot or adopt new trends quickly. Their relatively high engagement could be due to the direct impact that industry trends have on their operations and survival.

Small (10 – 49 Employees)

– Weekly Average of Spiking Businesses: 1,068.54

– Percent of Total: 24.43%

Small businesses, with a higher resource pool compared to micro enterprises, show even greater engagement. This size category likely represents businesses at a growth stage, actively seeking new opportunities or technologies to scale up their operations.

Medium-Small (50 – 199 Employees)

– Weekly Average of Spiking Businesses: 1,261.42

– Percent of Total: 28.84%

The medium-small companies appear to be the most engaged in researching industry trends, which could be attributed to their sufficient resources and the necessity to innovate to compete with larger companies. This size bracket may be at a critical point where they are looking to solidify their market presence and potentially disrupt traditional markets or defend against larger competitors.

Medium (200 – 499 Employees)

– Weekly Average of Spiking Businesses: 665.31

– Percent of Total: 15.21%

Medium-sized companies show a decrease in weekly spiking businesses compared to medium-small companies, which might be due to the challenges of steering a larger organization towards new trends quickly. This size indicates a more established business possibly with more bureaucracy, making rapid changes or adoption of trends slightly more cumbersome.

Medium-Large (500 – 999 Employees)

– Weekly Average of Spiking Businesses: 358.92

– Percent of Total: 8.21%

Interestingly, medium-large companies have fewer businesses spiking in interest weekly than medium companies. This reduction could be due to these companies already having established their market presence and being more selective or slower in adopting new trends, given the scale at which changes would need to be implemented.

Trend Analysis and Implications

The data suggests a bell curve in the engagement with industry trends, peaking with medium-small companies and tapering off as companies grow larger. The peak at medium-small companies could indicate a sweet spot where companies have enough resources to actively pursue new trends and innovations but have not yet reached a size that makes rapid changes difficult.

This pattern underscores the dynamic nature of business agility and innovation across different company sizes. Smaller companies may be quicker to explore and adopt new trends due to their nimbleness and the imperative to grow. In contrast, larger companies might engage with trends more strategically, given the complexity and potential risk of implementing changes at scale.

The varying levels of engagement across company sizes also highlight the importance of tailor-made strategies for businesses looking to stay ahead of industry trends. It suggests that the capacity to innovate and adapt is not just a function of size but also of the organizational structure, culture, and strategic vision.

In conclusion, the data from the “Intent by Company Size” file reveals fascinating insights into how businesses of different sizes interact with industry trends. This underscores the nuanced relationship between company size, agility, and innovation, offering valuable lessons for businesses aiming to navigate the complexities of growth and market dynamics.