By most estimates, field service management is an industry that’s already worth billions of US dollars and is only going to get bigger in the coming years. The industry’s average estimated market value within the past few years has been about $4.5 billion USD, with an average forecasted value of $14.94 billion USD by 2033.

For field service companies looking for a management software solution, it can be useful to know where the industry currently stands, where it’s going, and what’s helping or hindering it in getting there. This lets field service companies make informed decisions on who to buy from, what features & technologies to prioritize, and what challenges they need to be aware of. This article will serve as a guide to the field service management market that covers the following topics:

- Field service management market share

- The field service market by region

- Predicted future and growth of the field service management market

- What are the main challenges in the field service management software market?

- Emerging tech affecting the future of field service management companies

- Top 8 field service software market reports and industry reviews

First, we’ll have a look at how the field service management (FSM) market is currently divided up among various major companies, functions, platform deployments, company sizes, and industries.

By market leading companies

Image Source: Markets and Markets

Oracle, Microsoft, Comarch, Infor, Salesforce, Trimble, IFS, FieldAware, and ServiceMax are companies often mentioned as major players in the global field service management software industry. However, according to a report by Mordor Intelligence, none of these companies have been able to establish dominance in the market as of 2024. So the market remains relatively fragmented and open to heavy competition.

One other notable trend is that several companies in the market are exploring mergers and acquisitions as ways of artificially growing their market share.

By application

Image Source: Fortune Business Insights

FSM software is used for many distinct functions, including managing work orders, scheduling & dispatching, customer relationship management (CRM), inventory management, service contract management, and reporting & analytics.

As of 2023, CRM-oriented field service software held the largest market share by application, at 23.6%. This market share is expected to continue growing through 2028 as part of a larger global trend of companies adopting customer-centric business strategies. Companies are increasingly focusing on providing optimized customer experiences to drive loyalty, retention, sales, and revenue.

Other applications expected to grow are work order management (for prioritizing jobs and organizing them by urgency), service contract management (due to automation making creating and renewing service contracts easier), and scheduling & dispatch (to improve customer satisfaction by offering more timely service).

By platform deployment

Image Source: S & S Insider

FSM software is typically deployed either in-house or as a cloud-based solution. In 2022 and 2023, cloud-based FSM software deployments accounted for about 2/3 of the market revenue share (67.7% and 66.3% respectively). However, there is disagreement on whether the use of cloud-based FSM platforms will continue to grow in the coming years.

Some reports predict that it will, with a report from Grandview Research estimating a compound annual growth rate (CAGR) of 14.9% between 2023 and 2030. Arguments in favor of increased cloud-based FSM software adoption include that it offers greater data storage space, allows data to be accessed from virtually anywhere, and doesn’t cost businesses as much upfront in hardware & software. This makes cloud solutions easier and more cost-efficient to deploy and scale.

Other points indicating that cloud-based FSM software use is on the rise include how remote work has become the norm following the COVID-19 pandemic, as well as increasing government investment in cloud computing (a 15.2% increase in the US between 2022 and 2023, according to S & S Insider).

However, other reports forecast that in-house FSM software will see a greater increase in market share over the coming years. For instance, a report from Future Market Insights predicts a CAGR of 10.8% between 2023 and 2033. A major argument in favor of increased in-house FSM software is data security. The fact that cloud platforms are run by third parties and allow access to data from almost anywhere makes them more vulnerable to hackers. Having an in-house FSM solution means companies have greater control over their own data, as well as how the software interacts with their existing technology infrastructure.

As we’ll discuss in greater detail in the next section, another factor that may point to higher use of in-house FSM software is that most companies currently using FSM solutions tend to be larger companies. This means they’re better able to deal with the heavy initial hardware and software investments required for in-house systems. In fact, they may prefer these costs to paying for a cloud-based field service management software over time.

By company size

Image Source: Grandview Research

Larger companies currently tend to be the most frequent users of FSM software. Reports peg their market share at about 2/3 across 2022 and 2023 (66.1% and 65.3% respectively). Like with platform deployment, though, forecasters disagree about whether FSM software use will grow faster among large companies or small-to-medium companies over the coming years.

For example, a report by Future Market Insights predicts FSM platform use will grow faster among larger companies – at a CAGR of 11.1% – from 2023 to 2033. There are several reasons for this estimated growth, as well as why larger companies currently hold the bulk of field service management market share. One is that they have more resources to invest in FSM solutions than small and medium-sized companies do, and another is that larger companies have a greater need for FSM software than smaller companies. Because of their size, they need more help with managing larger workforces and a wider range of complicated, detail-oriented, and large-scale tasks.

However, a report by Grandview Research estimates that small and medium-sized companies are poised to grow their FSM software market share faster – at a CAGR of 16.4% – between 2023 and 2030. It argues that smaller companies are recognizing FSM software’s value after seeing larger companies succeed with adopting it. The report also predicts that FSM solutions will likely not only come down in cost, but also become more cost-effective as they adopt improvements in technologies such as cloud computing, mobile apps, and AI.

By niche industry

Many different industries – including telecom, utilities, energy, and manufacturing – use FSM software. Of all of these, telecom currently dominates the FSM market at about 1/3 of the industry share (30.8% in 2022 and 31.1% in 2023). Again, though, market experts disagree on how fast FSM software use will continue to grow in the telecom industry over the next several years.

For instance, a report by Grandview Research predicts telecom will continue to have one of the highest rates of FSM software adoption among industries between 2023 and 2030, at a CAGR of 15.4%. This forecast – and telecom’s current market share – is based on the telecom industry’s critical need to manage widespread field operations for installing networks, maintaining equipment, and helping customers.

It’s thought these needs will only increase in the coming years as telecom networks become more complicated, with heightened demand for new technologies such as fiber optic cables and 5G wireless capabilities. In addition, customers will expect better service, which will require telecom companies to more efficiently manage their field operations.

However, a report by Verdantix forecasts that it will actually be the manufacturing sector that sees the biggest jump in FSM platform adoption between 2022 and 2028, with a CAGR of 15.5%. The reasoning behind this is that the design of FSM software is improving to allow for asset-centric project management, which is particularly useful in manufacturing.

Meanwhile, the report predicts that telecom’s FSM platform adoption rate will grow by a more modest 9% during the same time period. This is because the industry’s already-high market share may mean many telecom companies are already using FSM solutions. So it makes sense that the adoption rate would slow a bit.

Explore our service management suite

Equip your crew with the tools they need to get jobs done in the field.

The field service market by region

These are stats about how the use of field service management software is expected to change in specific countries and geographical areas over the next several years.

Predicted growth in the industry’s leading countries

Image Source: BuildOps

A Future Market Insights report includes the following national field service management market size growth forecasts between 2023 and 2033:

- United States – 11.1% CAGR to a value of $4.3 billion USD. This is based on the expected expansion of the US oil & gas industry (predicted to grow by 7% during the same time period), as oil becomes more expensive while field equipment drops in price. FSM software is projected to play a key role in inspections, surveys, and maintenance to maximize efficiency and profits.

- United Kingdom – 10.7% CAGR to a value of $959.2 million USD. This is based on the expected expansion of the UK’s fire and life safety industry, which was already worth $1.5 billion USD in 2021 and is forecasted to grow by 6% until 2033. FSM software is projected to play roles in monitoring fire detection and other security devices, as well as responding promptly to customer communications. It can also help with upholding compliance standards.

- China – 10.4% CAGR to a value of $468.6 million USD. This is based on China’s increasing investment in healthcare to support its aging population. FSM software is expected to help contractors with installing, repairing, and maintaining medical equipment. Particularly, it could be useful in streamlining record-keeping (for compliance) and invoicing (by integrating it into accounting).

- Japan – 9.8% CAGR to a value of $715.5 million USD. This is based on FSM software’s potential applications in Japan’s information technology industry, valued at $450 billion USD in 2021. Particularly with Internet and telecom, FSM software can help install, maintain, and manage complicated network and data infrastructures.

- South Korea – 9.4% CAGR to a value of $434.9 million USD. This is based on the forecasted growth of South Korea’s construction industry (particularly shipbuilding), which was worth $240 billion USD in 2021. FSM software is ideal in this industry for supporting communication between field techs and back office staff. It can also be helpful for documenting and retrieving information.

North America’s current FSM market dominance

North America currently has the highest FSM market share by region, estimated at 26.5% in 2022 and increasing to almost 1/3 in 2023. This is attributed to an increasing demand for utility and transportation infrastructure upgrades in the region.

Both the public and private sectors are investing in “smart city” projects to enhance urban living through digital technologies. To install and maintain these new infrastructures, field service companies need mobile-friendly, cost-effective management solutions to streamline processes such as scheduling & dispatching techs.

Asia-Pacific’s predicted FSM market emergence

A report by Grandview Research predicts that the Asia-Pacific region will experience the highest growth rate in FSM software adoption between 2023 and 2030, at an estimated CAGR of 19.4%. This is based on the growth of industries in the region that can benefit from FSM software, notably healthcare and oil & gas. As these industries play bigger roles in the region’s economy, they will need FSM solutions that are able to increase productivity through optimizing workflows.

Predicted future and growth of the field service management market

Here, we cover general estimates of how much the global field service management software market size is expected to grow over the coming years. Forecasts vary because different reports use different timeframes for backing data & measurement, and have different reasons for their conclusions.

The CAGR across all reports covered here averages about 12.33% over their respective measured time periods, with a low of 11% and a high of 13.7%. Each report starts in 2022 or 2023 (with one starting in 2021 and one in 2025), and the average estimated starting valuation of the global FSM market is $4.5 billion USD. Based on each report’s starting year, valuation, and CAGR, the average market value estimate by the latest year covered (2033) is about $14.94 billion USD.

Image Source: BuildOps

The general predictions on FSM market size from each individual report – including starting year, starting valuation, CAGR, ending year, and ending valuation – are as follows:

Markets and Markets

Image Source: Markets and Markets

Starting year: 2023

Starting year FSM market valuation: $4 billion USD

CAGR: 12.8%

Ending year: 2028

Ending year FSM market valuation: $7.3 billion USD

Markets and Markets sees growth of the global FSM market driven primarily by technological advancements such as artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), cloud computing, and mobile devices. Another key catalyst is that field service companies are facing higher customer expectations, and so need help doing their work more efficiently and effectively.

However, potential limiting factors are shortages of skilled labor, difficulty integrating FSM systems with existing technology stacks, and high competition within the FSM markets.

Mordor Intelligence

Image Source: Mordor Intelligence

Starting year: 2025

Starting year FSM market valuation: $5.52 billion USD

CAGR: 11.7%

Ending year: 2030

Ending year FSM market valuation: $9.6 billion USD

Mordor Intelligence observes that FSM companies are under increasing pressure to provide effective and safe services in the wake of the COVID-19 pandemic. This will likely lead to greater adoption of technologies such as cloud computing, ML, and IoT. The goals are to provide more time-efficient and cost-efficient FSM services while making things easier for field service company IT departments.

Particularly, there is a growing drive to automate back-end processes, such as through remotely monitoring job sites, to compensate for a projected lack of skilled field service workers.

Grandview Research

Starting year: 2022

Starting year FSM market valuation: $4 billion USD

CAGR: 13.3%

Ending year: 2030

Ending year FSM market valuation: $10.62 billion USD (projected)

Grandview Research forecasts that expanding applications in industries such as telecom, oil & gas, construction, energy, and utilities will drive the growth of the field service software market over the next several years. It also predicts that more small-to-medium-sized companies will adopt FSM platforms in the near future, further growing the industry.

Future Market Insights

Starting year: 2023

Starting year FSM market valuation: $4.2 billion USD

CAGR: 11.4%

Ending year: 2033

Ending year FSM market valuation: $12.2 billion USD

Future Market Insights predicts the FSM software market will grow due to the need for field service companies to digitize and automate their operations. This includes real-time remote field monitoring and cloud-based FSM solutions that allow data access from anywhere. The goals are to achieve higher productivity, pay lower labor costs, and provide better customer service.

Verdantix

Image Source: Verdantix

Starting year: 2022

Starting year FSM market valuation: $3.83 billion USD

CAGR: 11%

Ending year: 2028

Ending year FSM market valuation: $7.16 billion USD

Verdantix forecasts the growth of the FSM market will be spurred by the increasing productivity benefits it gives field service companies (especially in maintenance tasks), particularly as it incorporates new technologies such as AI. This will help field service companies combat labor shortages. However, Verdantix also predicts some dips in FSM market growth rate due to decreasing investment in the software industry as a whole. Global economic instability – particularly inflation in the US and Europe – is also causing customers to spend more cautiously, meaning FSM software vendors have to adjust their pricing strategies.

S & S Insider

Image Source: S & S Insider

Starting year: 2023

Starting year FSM market valuation: $4.31 billion USD

CAGR: 13.7%

Ending year: 2028

Ending year FSM market valuation: $13.68 billion USD

S & S Insider attributes the potential growth of the FSM software market to increasing government investment in digital “smart city” infrastructure. Therefore, there’s an increasing need for field service companies to install, repair, and maintain the relevant equipment. In doing so, field service companies are turning to FSM software to monitor and manage techs in real time. The goal is to increase customer satisfaction by providing timely service that solves issues with just one job site visit.

Allied Market Research

Image Source: Allied Market Research

Starting year: 2023

Starting year FSM market valuation: $5.2 billion USD

CAGR: 19.2%

Ending year: 2031

Ending year FSM market valuation: $29.9 billion USD

Allied Market Research predicts that the FSM market’s growth will be driven by a need for mobile real-time tech monitoring, the benefits of digitizing and automating field service processes, and improvements in FSM software through technological advancements – cloud computing, IoT, AI, virtual reality (VR), and augmented reality (AR). However, this growth will likely be restrained by a lack of skilled workers who can operate FSM systems. There is also the chance that field service companies will opt for manual management methods in the face of data security concerns.

Zion Market Research

Image Source: Zion Market Research

Starting year: 2023

Starting year FSM market valuation: $4.31 billion USD

CAGR: 11.8%

Ending year: 2032

Ending year FSM market valuation: $7.3 billion USD

Zion Market Research forecasts the FSM market will grow as its software is used in different industries – particularly manufacturing, construction, transportation, and oil & gas. FSM platforms will likely assist these industries with saving time and money on tasks such as sales, accounting, invoicing, customer service, scheduling/dispatching, and fleet management. However, the high cost of FSM software may slow its adoption.

What are the main challenges in the field service management software market?

Though there are many opportunities for the field service management industry to grow in the years ahead, experts identify a number of obstacles that may impede the industry’s growth. Here are three major ones mentioned frequently in field service industry reports.

Data security

FSM software collects and manages sensitive data like from customer financial details, service records, and even intellectual property, so companies that offer or use FSM platforms have to protect that data. This is especially challenging given the high use of cloud-based FSM solutions, which are managed by third parties and allow data access from virtually anywhere.

Failing to protect this data can cause FSM software users and providers to sustain financial damage and lose customer trust. It even opens them up to fines and other legal penalties.

Skilled labor shortage

FSM software is expected to help solve general labor shortages as it’s able to automate certain tasks that would otherwise need to be done manually. However, field service companies still need workers who know how to use FSM platforms efficiently. Some companies may be reluctant to adopt FSM systems due to the increased onboarding costs of training underskilled workers on those systems.

General economic conditions

The FSM market’s growth may be hampered by a slowdown in investment in the software industry as a whole. In addition, economic instability (especially in major markets like the US and Europe) will likely make companies looking for FSM software very cautious about how much they spend on it. So FSM platform providers will have to adjust their pricing strategies accordingly, especially because the market is still very wide open and competitive.

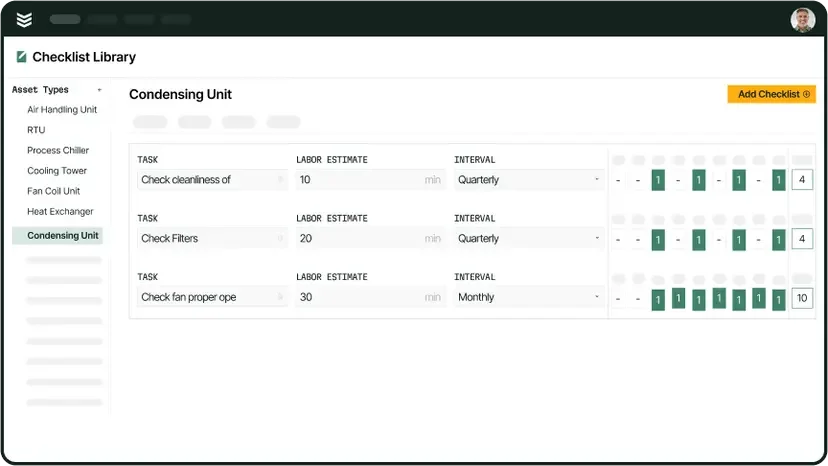

Easily compare software tools

Determine the right fit for your team with this easy-to-use scoresheet.

Emerging tech affecting the future of field service management companies

Experts often mention new and evolving technologies as key drivers in the growth of the global field service management market. Here are five that are expected to play major roles in the near future, and how you as a business owner can build a competitive edge by investing in FSM software that uses them.

AI (Artificial Intelligence)

Artificial intelligence and machine learning (ML) are poised to let FSM software detect patterns in data through repeated use. This analysis can allow FSM systems to do things like predict when equipment will fail, calculate the most efficient routes for techs to visit job sites, and optimize scheduling & dispatching (based on how long certain types of jobs take and techs’ current locations).

AI can also be used to provide automated support for customers and in-field assistance for techs. For example, chatbots and other virtual assistants are increasingly common, letting customers get self-serve help or information in real time. On the field tech side of things, AI can help with tasks including checking spelling and grammar, translating text into different languages, and even structuring field notes into a report or invoice.

AR (Augmented Reality)

Augmented reality is a technology that overlays computer-generated content on parts of the physical world. This can help provide field service techs with visual cues, step-by-step instructions, and expert advice that directly relate to the equipment they’re working on, which reduces the need for inefficient manual problem-solving methods like phone calls or consulting service manuals. It also makes it easier for techs to solve difficult problems faster and without needing to redo the work.

Mobile devices

Approximately 99% of field techs use a mobile device to help with their work, according to Service Council’s 2021 Voice of the Field Service Engineer survey. So it shouldn’t be surprising that FSM solutions including mobile apps are in high demand among field service companies. A field service mobile app allows for more direct communication and information-sharing between techs in the field and dispatchers and back office staff at headquarters. This makes it easier to get jobs done right, faster, and with less administrative back-and-forth. And that makes for happier customers!

Cloud technologies

Cloud technology refers to hosting computer functions on remote servers and then delivering them over the Internet. This allows end users to access these functions from virtually anywhere without bearing the associated hardware and software costs. This makes cloud-based FSM solutions cost-effective, flexible, scalable, and easy to deploy for field service companies.

Many experts expect adoption of cloud-based software-as-a-service (SaaS) FSM platforms to accelerate over the coming years due to two key trends. One is that national governments are increasing investment in cloud technology – for example, US investment in cloud computing systems jumped by 15.2% between 2022 and 2023. The other is that remote work has become much more common following the COVID-19 pandemic, so field service workers need the ability to access data and functions without physically being at the office.

IoT (Internet of Things)

Internet of Things refers to embedding Internet connectivity into objects that traditionally didn’t have it. Sensors and software in objects like tools, clothing, safety equipment, vehicles, etc. allow FSM systems to collect additional data on techs’ in-field performance. This enables analysis – perhaps through AI – on how efficiently techs are using resources and how to improve processes to increase productivity.

Top 8 field service software market reports and industry reviews

We drew on a number of recent reports about the FSM software market to provide as complete a snapshot as we could, both of assessments on where the market currently is and predictions on where it’s going. This article summarizes their findings and perspectives.

If you’d like a deeper dive into any one report, we’ve listed links to them all here:

- Field Service Management (FSM) Market Size, Share & Segmentation By Component, By Deployment, By Enterprise, By End-use, By Region, and Global Forecast 2024-2032 | S & S Insider | December 2024

- Field Service Management Market Size - Industry Report on Share, Growth Trends & Forecasts Analysis (2025 - 2030) | Mordor Intelligence | August 2024

- Field Service Management Market By Solution, By Deployment Mode, By Verticals, And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032 | Zion Market Research | May 2024

- Field Service Management Market by Solutions - Global Forecast to 2028 | Markets and Markets | March 2024

- Market Size And Forecast: Field Service Management Software 2022-2028 (Global) | Verdantix | January 2024

- Field Service Management Market Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise, By End-use, By Region And Segment Forecasts, 2023 - 2030 | Grandview Research | October 2023

- Field Service Management Market Report – Trends & Forecast 2023-2033 | Future Market Insights | February 2023

- Field Service Management Market Size, Share, Competitive Landscape and Trend Analysis Report, by Component, by Deployment Model, by Enterprise Size, by Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2031 | Allied Market Research | October 2022

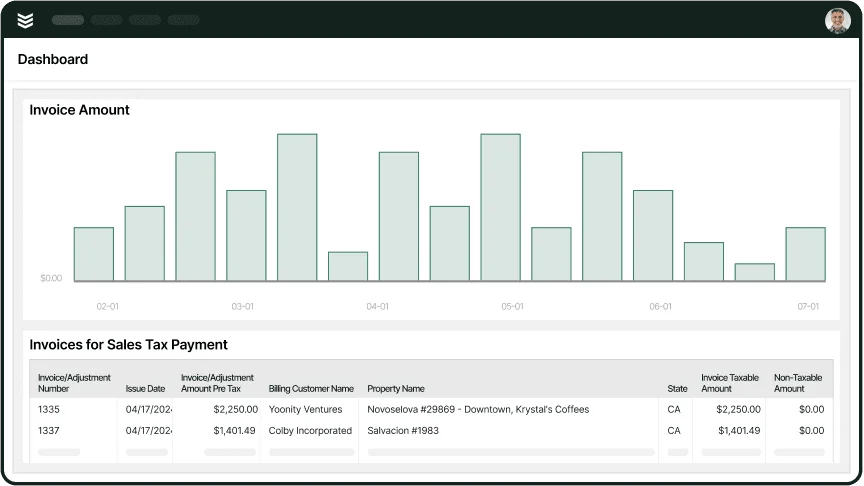

BuildOps is on the cutting edge of commercial field service management software, offering asset-centric management for small jobs and bigger projects alike, and if your goal is to grow your business within the field service market, BuildOps could be an essential component of boosting that growth.

It features a mobile app enhanced with AI and loaded with features to help you get jobs done right and on time.

Curious how BuildOps works?

Find out how we keep commercial field teams ahead of the curve.