Manual entry. Lost invoices. Payments slipping through the cracks. If your crew’s juggling paperwork and QuickBooks at the same time, something’s bound to fall. That’s where field service management (FSM) software makes a real difference—especially when it integrates directly with QuickBooks. To learn more about the ins and outs of managing your service business, check out this comprehensive guide to field service management.

QuickBooks handles the numbers. FSM software handles the work. Put them together, and your team spends less time behind a desk and more time on the job site. But not every tool plays nice with QuickBooks—and choosing the wrong one means more double entry and disconnected data.

This guide breaks down everything you need to know about FSM software that works hand-in-hand with QuickBooks. We’ll walk through why compatibility matters, the real-world benefits, which software to check out, and how to choose the right one for your team.

Here’s what we’ll cover:

- The importance of QuickBooks compatibility in field service management

- 7 benefits of integrating FSM software with QuickBooks

- Top 8 field service management software compatible with QuickBooks

- How to choose the right field service management software that integrates with QuickBooks

Next up—we’ll start with why QuickBooks compatibility is non-negotiable if you're serious about cutting admin time and keeping your books clean.

The importance of QuickBooks compatibility in field service management

You already rely on QuickBooks to keep your books in order. But if your field team’s working in a separate system, there’s a disconnect—and that gap costs you time and money.

When your field service management software connects directly with QuickBooks, your team isn’t stuck doing double entry. Invoices sync automatically. Payments hit the books without someone having to chase them. Job costs flow into your accounting system in real time. That’s more than convenience—it’s control.

QuickBooks compatibility also means your technicians can focus on service while the office stays on top of the numbers. No toggling between systems. No waiting days to see if a customer paid. Everything is tracked, logged, and linked back to the right job, customer, and technician—right from the field.

If your FSM tool doesn’t talk to QuickBooks, you’re flying blind. And in this business, that’s a recipe for billing delays, accounting mistakes, and missed revenue.

Invoicing Toolkit for Commercial Contractors

Learn how to sync your field service payments cycle from end-to-end.

7 benefits of integrating FSM software with QuickBooks

When your field service management software links up with QuickBooks, it’s not just about syncing data—it’s about syncing your entire workflow. Here’s how that connection pays off in real-world results:

1. Invoices go out faster

No more waiting on handwritten notes or job folders to land back in the office. Techs can trigger an invoice the moment the job’s done. That invoice hits QuickBooks automatically—no copy-pasting, no delays. If speed and accuracy in billing are critical, check out 8 of the best field service management solutions to take that off your team’s plate.

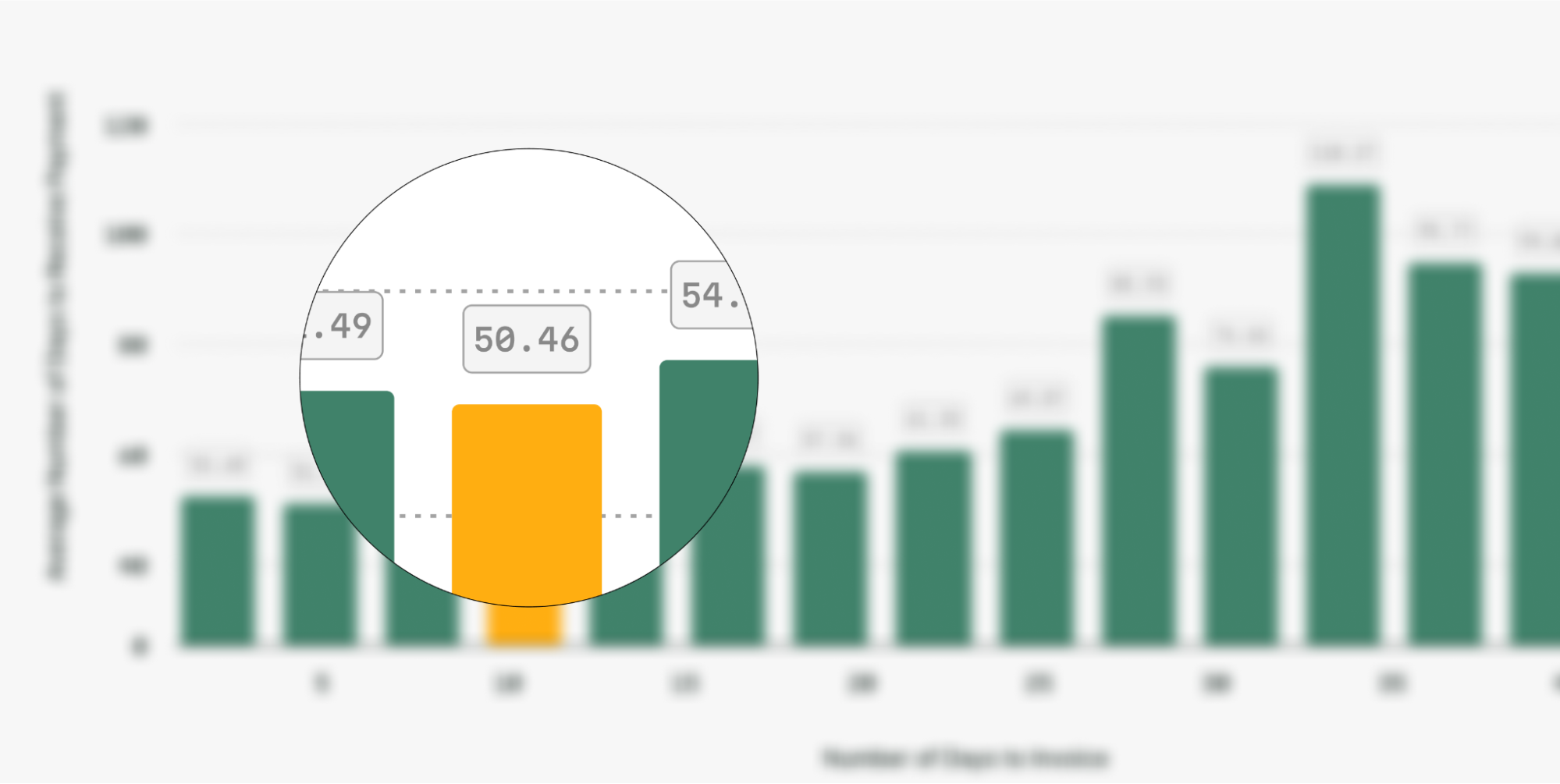

Data shows that companies who send invoices within 24 to 48 hours of completing a job are 5X more likely to get paid on time. But the longer you wait, the harder it is to collect—delays beyond one week can nearly double your chances of late payment.

2. Payments get tracked in real time

Payments collected in the field get logged directly into QuickBooks. Whether it’s a check, card, or mobile payment, your books update right away. No more wondering what’s been paid or chasing down your office for updates.

3. Job costs sync without guesswork

Every labor hour, part, and travel charge gets pushed into QuickBooks from the job record. That means cleaner profit tracking, easier audits, and less back-and-forth between accounting and ops. If your goal is tighter cost control, QuickBooks integration locks it in.

4. Time tracking flows into payroll

Instead of juggling timesheets, hours worked in the field move directly into payroll through QuickBooks. That means fewer payroll errors and less time spent manually reconciling hours.

5. Reporting is based on real numbers

With synced data between your FSM software and QuickBooks, you’re not guessing. Revenue, expenses, and profit margins update in real-time. That level of visibility is a major reason why field service management software market trends continue to favor platforms with deep accounting integrations.

6. Fewer errors from manual entry

Any time a human is retyping job data into QuickBooks, there’s risk—missing digits, wrong pricing, duplicate records. Automation eliminates that risk and keeps your books clean.

7. A tighter back office

Teams aren’t stuck chasing paperwork or reconciling mismatched records. With QuickBooks-compatible FSM tools, your back office runs smoother—and that means your techs can stay focused on jobs, not admin. Many of the benefits of field service management—like faster billing, streamlined operations, and improved communication—are only fully realized when your software works directly with your accounting system.

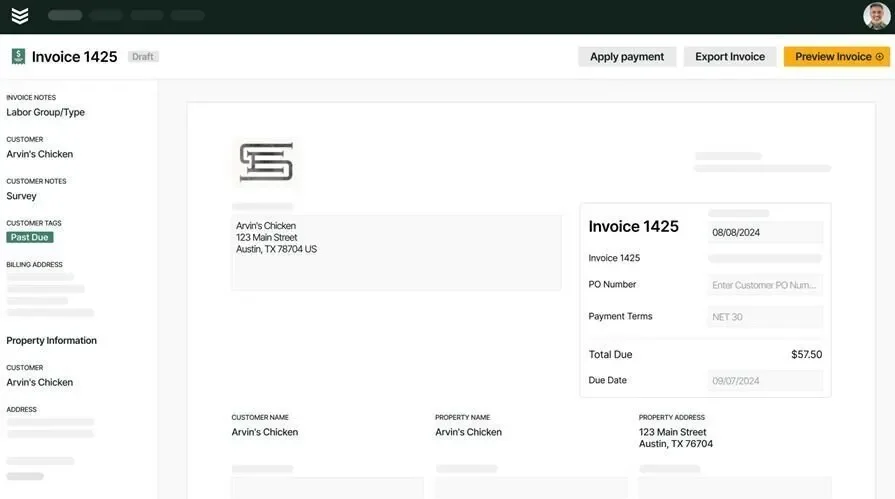

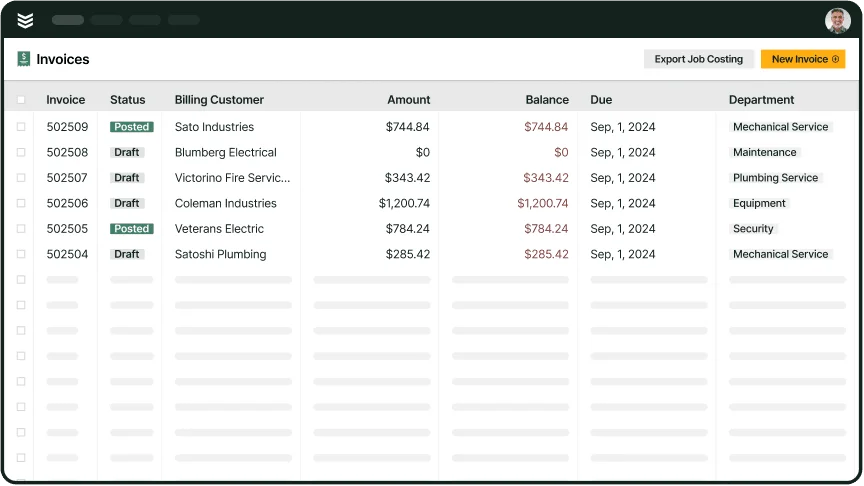

BuildOps Invoicing for field service

Track payments, and ensure accurate job costing—all synced with Quickbooks.

Top 8 field service management software compatible with QuickBooks

Not every field service management tool works well with QuickBooks. Some require clunky workarounds, while others don’t sync crucial job data properly. Below are eight FSM solutions designed to integrate seamlessly, ensuring your books stay accurate and your operations stay efficient.

1. Best for commercial: BuildOps

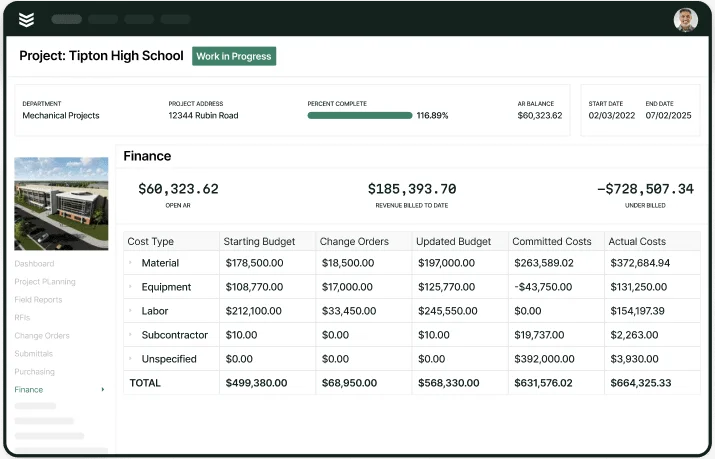

BuildOps is a full-scale field service management platform tailored for commercial contractors, particularly in industries like HVAC, plumbing, and electrical. Unlike residential-focused FSM tools, BuildOps streamlines complex job management with real-time scheduling, dispatching, and financial tracking—all while integrating directly with QuickBooks. This ensures that job costs, invoices, and payments are automatically recorded without manual entry, reducing administrative workload and improving financial accuracy.

How pricing works: BuildOps operates on a custom pricing model based on company size, required features, and the number of users. Pricing is structured as a per-user, per-month fee with enterprise-level options available.

Features beyond invoicing:

- Advanced job costing and profitability tracking synced with QuickBooks

- Smart scheduling and dispatching to optimize technician efficiency

- Custom workflows designed for large-scale commercial service businesses

- Asset and equipment tracking for preventive maintenance contracts

What sets it apart for commercial: BuildOps is built specifically for commercial contractors who need more than just basic invoicing and scheduling. It offers deep QuickBooks integration to keep accounting in sync with field operations, while also handling complex commercial workflows like service contracts, large-scale job tracking, and multi-location management.

Quickbooks + BuildOps

Stop chasing paperwork and see how we keep field service invoicing on track.

2. Best for residential: Housecall Pro

Image Source: Housecall Pro

Housecall Pro is an FSM solution designed for home service businesses, including HVAC, plumbing, electrical, and cleaning companies. It helps small to mid-sized contractors automate their operations, offering scheduling, invoicing, and payment processing—all with seamless QuickBooks integration. This ensures that residential service businesses can track expenses, generate invoices, and manage customer payments without extra steps. However, Housecall Pro is heavily geared toward residential service businesses and may not provide the advanced job costing or contract management features that commercial contractors need for deeper QuickBooks integration.

How pricing works: Housecall Pro follows a tiered pricing model, starting at a monthly subscription fee. Higher-tier plans include additional features like automated marketing, job proposals, and premium support.

Features beyond invoicing:

- Automated appointment scheduling and customer notifications

- Online booking with payment processing linked to QuickBooks

- GPS tracking to monitor technician locations and optimize routes

- Paperless invoicing and recurring service reminders

What sets it apart for residential: Housecall Pro is designed to simplify operations for home service professionals who need a lightweight but powerful FSM tool. Its easy-to-use interface and direct QuickBooks integration make bookkeeping hassle-free, while automated scheduling and payment features help keep residential service businesses running smoothly.

3. Best for general contractors: Jobber

Image Source: Jobber

Jobber is a versatile FSM platform built for general contractors managing multiple service types, from landscaping and property maintenance to remodeling and specialty trades. It helps streamline scheduling, client communication, and job tracking, making it easier to keep field teams organized. With QuickBooks integration, contractors can automatically sync invoices, expenses, and payments—eliminating the need for manual bookkeeping. That said, Jobber is best suited for small to mid-sized operations. Larger contractors handling complex job costing and project-based financial tracking may find its QuickBooks integration somewhat limited.

How pricing works: Jobber’s pricing is based on a monthly subscription, with different tiers depending on the number of users and required features. The platform scales easily, making it a great fit for both solo contractors and larger teams.

Features beyond invoicing:

- Real-time job tracking with automated customer updates

- Online quoting and proposal management with QuickBooks sync

- Custom job workflows for different types of projects

- Technician time tracking with payroll integration

What sets it apart for general contractors: Jobber is ideal for businesses that juggle different job types and client needs. Its intuitive scheduling tools keep field teams organized, while QuickBooks integration ensures seamless expense tracking, invoicing, and payment management.

4. Best for small to mid-sized field service businesses: FieldEdge

Image Source: FieldEdge

FieldEdge is designed for small to mid-sized service businesses that need to automate operations while keeping their financials in check. It integrates seamlessly with QuickBooks, allowing businesses to track job costs, process invoices, and monitor technician performance all in one place. FieldEdge also offers recurring service agreements, time tracking, and customer history logs, making it a strong choice for businesses focused on growth. However, FieldEdge is better suited for smaller teams looking to scale gradually. Companies with more complex multi-location operations may find their QuickBooks integration lacking in enterprise-level customization and reporting.

How pricing works: FieldEdge follows a subscription-based pricing model, tailored to business size and the number of users. The platform is designed to be cost-effective for small service teams while offering features that support growth.

Features beyond invoicing:

- Live customer history tracking for repeat business

- Business performance dashboards with profitability insights

- Automated recurring service agreements and customer reminders

- Technician time tracking integrated with payroll processing

What sets it apart for small to mid-sized field service businesses: FieldEdge is a great choice for service businesses that want to grow without the complexity of an enterprise FSM tool. Its automation capabilities, paired with QuickBooks integration, make it easy to manage cash flow, reduce manual accounting work, and scale operations efficiently.

5. Best for scaling businesses: Zoho

Image Source: Zoho

Zoho is a cloud-based FSM and business management platform that helps growing service businesses streamline their workflows. It provides a suite of tools for scheduling, invoicing, and customer management, all while integrating with QuickBooks for seamless financial tracking. With automation features designed to handle increasing workloads, Zoho is a strong choice for businesses looking to scale efficiently. However, its QuickBooks integration may not be as deep as other FSM tools, requiring additional customization for complex job costing and financial reporting.

How pricing works: Zoho offers multiple pricing tiers, with costs depending on the number of users and selected features. It follows a subscription-based model with monthly and annual billing options.

Features beyond invoicing:

- AI-powered automation to reduce administrative workload

- Built-in CRM and sales tracking tools

- Custom reporting dashboards for performance monitoring

- Mobile app access for field technicians and managers

What sets it apart for scaling businesses: Zoho’s flexibility and automation capabilities allow businesses to grow without being bogged down by manual processes.

6. Best for finance monitoring: Field Promax

Image Source: Field Promax

Field Promax is a field service software designed to help businesses manage work orders, scheduling, and financial transactions with a strong focus on financial tracking. Its integration with QuickBooks ensures that job expenses, invoices, and payments are accurately recorded, making it ideal for businesses that need precise financial oversight. Despite that, it may lack some of the advanced job dispatching and workflow customization options found in other FSM platforms.

How pricing works: Field Promax follows a per-user subscription model, with different pricing plans based on team size and feature requirements.

Features beyond invoicing:

- Advanced financial reporting tools

- Work order tracking with QuickBooks sync

- Automated scheduling and job assignment

- Recurring service contract management

What sets it apart for finance monitoring: Field Promax is a great choice for businesses that need detailed financial tracking alongside FSM capabilities.

7. Best for template integration: Service Fusion

Image Source: Service Fusion

Service Fusion is a versatile FSM platform known for its extensive third-party integrations, including QuickBooks. It’s a strong fit for businesses that rely on multiple software tools and need a centralized system to manage scheduling, invoicing, and customer data. With its focus on automation and connectivity, Service Fusion makes it easier to sync operations with accounting processes. However, businesses looking for deep, built-in QuickBooks features without relying on third-party integrations may find other FSM solutions more suitable.

How pricing works: Service Fusion offers subscription-based pricing with different plans based on the number of users and available features.

Features beyond invoicing:

- Customizable job templates for faster work order creation

- GPS tracking and fleet management tools

- Mobile invoicing with QuickBooks sync

- Multi-platform integration through Zapier and other APIs

What sets it apart for template integration: Service Fusion is ideal for companies that use multiple digital tools and need seamless connectivity.

8. Best for independent contractors: Kickserv

Image Source: Kickserv

Kickserv is a user-friendly FSM software designed specifically for small businesses and independent contractors. It simplifies scheduling, invoicing, and customer management while integrating with QuickBooks for streamlined financial tracking. For solo operators or small teams, Kickserv provides an affordable way to manage daily operations without a complex setup. Although its QuickBooks integration is more basic than enterprise-level FSM tools, it potentially limits advanced financial reporting and job costing needs.

How pricing works: Kickserv offers a free plan for single users, with paid plans available for larger teams and additional features. Pricing follows a per-user, per-month model.

Features beyond invoicing:

- Customer self-service portal for online booking

- Automated reminders and follow-ups for clients

- Lead and estimate tracking for sales management

- Mobile app for on-the-go job updates

What sets it apart for independent contractors: Kickserv is a great option for independent contractors who need an all-in-one solution without a steep learning curve.

How to choose the right field service management software that integrates with QuickBooks

Not all field service management software works the same way with QuickBooks. Some offer full automation, while others require manual workarounds. To make the best choice, consider these key factors:

- Integration depth – Does the software fully sync invoices, job costs, and payments with QuickBooks, or does it only handle basic invoicing?

- Industry fit – Is it designed for your business type (residential, commercial, or both)?

- Ease of use – Will your team need extensive training to navigate the integration?

- Automation capabilities – Does it reduce double data entry, or will you still need manual adjustments?

- Scalability – Can the software handle your company’s growth and increasing financial complexity?

Picking FSM software that integrates well with QuickBooks is about more than just compatibility—it’s about efficiency. Up next, we’ll cover how BuildOps brings all these elements together for commercial contractors.

Deep Dive

If you want to learn more actionable best practices you can start with today to improve your end-to-end payments process—from quoting to field notes to invoicing to payments—check out our in-depth guide to field service invoicing.

Finding the best field service management software that integrates with QuickBooks can transform business operations. A seamless connection eliminates manual data entry, keeps financial records accurate, and ensures that all teams stay in sync. However, not all FSM software delivers the same level of integration. Some tools only sync invoices, while others provide full financial visibility including job costing, payroll tracking, and automated expense management. Choosing a platform that meets your business's specific needs is key to maximizing efficiency.

For commercial contractors, the demands of large-scale projects, service contracts, and multi-location management require a comprehensive solution. Many FSM tools focus on basic scheduling and invoicing, but few offer a true all-in-one platform that ties field operations directly to financials. That’s where BuildOps stands out—delivering a complete FSM system designed specifically for commercial service businesses.

Demo our QuickBooks integration

See how the platform connects field service and accounting, end-to-end.