Executive Summary: Finance IT Research Trends in the Construction Industry

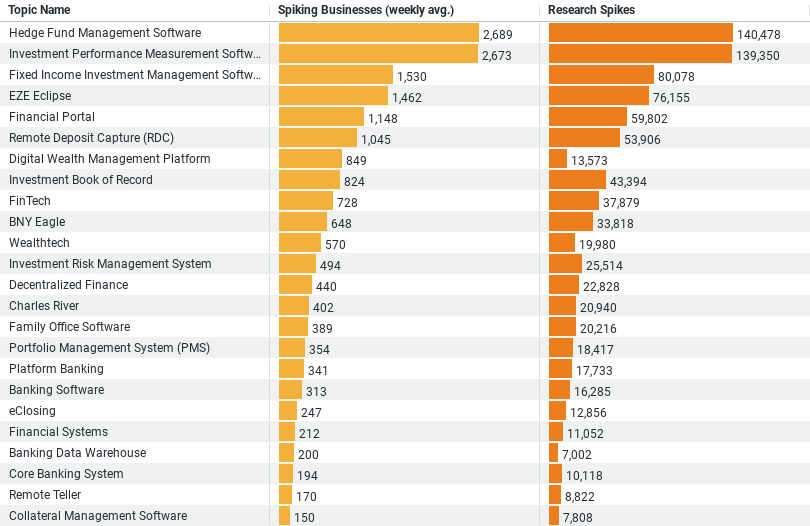

– Average Trends: There’s a significant interest in finance IT topics among businesses, with an average of 417 businesses per week showing a spike in engagement, and an average of 20,719 research spikes across all topics.

– Most Researched Topics: The top topics generating the most research interest are “Hedge Fund Management Software,” “Investment Performance Measurement Software,” and “Fixed Income Investment Management Software.” These topics stand out for both their high research activity and their ability to attract weekly spikes from thousands of businesses, suggesting they are critical to financial strategies in the construction sector.

– Business Engagement: The leading topics also see the highest weekly average of business engagement, with “Hedge Fund Management Software” and “Investment Performance Measurement Software” attracting over 2,600 businesses each week. This level of engagement indicates a robust interest in advanced financial tools and solutions that can provide competitive advantages.

Harnessing Finance IT: Trends and Insights in the Construction Industry

The intersection of finance and technology has revolutionized many industries by streamlining operations, enhancing efficiency, and offering deeper insights into financial management. The construction sector is no exception, with its increasing adoption of Finance IT to tackle unique financial challenges from project cost overruns to financial risk management. Recent data sheds light on how businesses within this sector are leveraging finance IT tools, indicating a surge in both interest and application.

Emerging Trends in Finance IT Adoption

The data reveals an intriguing pattern of research and engagement across various finance IT topics by construction businesses. On average, about 417 construction-related businesses per week exhibit a marked increase in interest towards specific finance IT topics. This spike in interest underscores the growing relevance of financial technology in an industry traditionally seen for its brick-and-mortar characteristics.

Among the most researched finance IT topics are Hedge Fund Management Software, Investment Performance Measurement Software, and Fixed Income Investment Management Software. These topics alone have sparked significant research activity, with Hedge Fund Management Software leading the pack at an astounding 140,478 research spikes. This high level of interest suggests that construction firms are looking to hedge funds as a viable investment avenue for surplus funds or as a financial strategy to maximize returns on investment.

High Business Engagement

The analysis also highlights which topics are capturing the most weekly business engagement. Hedge Fund Management Software and Investment Performance Measurement Software each attract over 2,600 businesses weekly. This indicates that not only are these topics of high interest in terms of research, but they are also being actively integrated into business processes within the industry. It suggests a shift towards more sophisticated investment strategies and performance measurement techniques, likely driven by the need to improve financial outcomes and project profitability.

Strategic Implications for the Construction Sector

The strategic implications of these trends are significant. By integrating advanced Finance IT solutions, construction companies can gain a competitive edge through optimized financial management and enhanced decision-making capabilities. For instance, using advanced analytics from Investment Performance Measurement Software can help firms assess the performance of their investments in real-time, allowing for timely adjustments in strategy.

Furthermore, the focus on Fixed Income Investment Management Software indicates a cautious approach towards maintaining steady returns and managing financial risks, crucial in an industry known for its cyclical nature and vulnerability to market fluctuations.

Looking Forward

As construction firms continue to embrace digital transformation, the role of finance IT becomes increasingly central. The insights gained from current research trends suggest several forward-looking strategies for stakeholders in the construction industry:

1. Invest in Training and Development: Ensuring that staff are well-versed in the latest financial technologies is crucial. Investing in ongoing training will help firms maximize the benefits of these tools.

2. Adopt a Data-Driven Approach: Leveraging data for financial decision-making can significantly enhance accuracy and efficiency. Construction firms should continue to integrate data analytics into their financial strategies.

3. Enhance Risk Management: With tools like Hedge Fund Management Software, firms can better navigate financial risks, ensuring more stable returns and financial health.

Conclusion

The data-driven insights into how the construction industry researches and engages with finance IT not only highlight the critical areas of interest but also map out a pathway for integrating these technologies into core financial operations. As the industry continues to evolve, staying ahead in finance IT adoption will undoubtedly play a pivotal role in shaping its future, driving profitability, and enhancing overall business resilience.

Company Sample Data Analysis

Company Size Categories:

1. Micro (1 – 9 Employees)

2. Small (10 – 49 Employees)

3. Medium-Small (50 – 199 Employees)

4. Medium (200 – 499 Employees)

5. Medium-Large (500 – 999 Employees)

6. Large (1000+ Employees)

Insights and Trends

The data indicates that businesses of different sizes show varying degrees of engagement and interest in finance IT or similar topics. Here’s a breakdown based on the provided data:

– Smaller Companies (Micro and Small): These companies, particularly those with 10 to 49 employees, show substantial activity, accounting for nearly 29.2% of the total research spikes. This suggests that smaller businesses are keenly interested in leveraging technology to enhance their competitive edge, likely due to the need for efficiency and cost-effective solutions in their operations.

– Medium-Sized Companies: The medium-small category (50 – 199 employees) is the most active, with the highest average of spiking businesses and representing about 29.9% of the total activity. This segment likely has the resources and the imperative to invest in technology that supports scalability and operational efficiency.

– Larger Companies (Medium to Medium-Large): As companies grow larger, there appears to be a relative decrease in the percentage of total spikes, with medium companies (200 – 499 employees) and medium-large companies (500 – 999 employees) showing lower engagement percentages. This could be attributed to established processes and slower adoption of new technologies compared to their smaller counterparts. However, these businesses still engage significantly, indicating ongoing interest in optimizing current systems and exploring new tech opportunities.

Why This Is a Trend

The trend of varying engagement levels across different company sizes can be attributed to several factors:

– Resource Allocation: Smaller companies may have fewer resources, leading them to seek out technology solutions that offer significant ROI and operational improvements.

– Agility and Flexibility: Smaller to medium-sized businesses are often more agile, making it easier for them to adopt and implement new technologies compared to larger organizations that might face bureaucratic hurdles.

– Strategic Imperatives: Medium-sized companies are at a critical growth phase where the right technology can facilitate scaling and expansion, hence their higher engagement levels.

Conclusion

The interest and investment in technology across different company sizes highlight the diverse strategies and priorities within the construction industry. Smaller companies focus on technology to level the playing field, while medium-sized enterprises use it as a lever for growth. Larger companies, while somewhat less engaged proportionally, continue to invest in technology to enhance efficiencies and maintain competitiveness. This segmentation of technology adoption is reflective of the broader industry trends toward digital transformation.