Executive Summary: Finance Research Trends in the Construction Industry

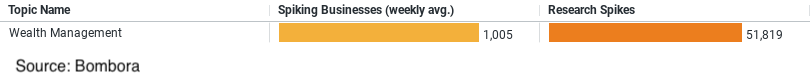

– Spiking Businesses (Weekly Average): Approximately 1005 construction businesses increase their research activities weekly on wealth management.

– Total Research Spikes: The topic has experienced a total of 51,819 research spikes, indicating substantial and recurrent interest.

– Insights: The construction industry exhibits a profound and targeted interest in wealth management, likely driven by the necessity to manage financial resources efficiently, explore investment avenues, and ensure long-term financial sustainability in a sector known for its high capital requirements.

The Construction Industry’s Focus on Wealth Management: A Financial Perspective

The construction industry is a powerhouse of economic activity, heavily influencing job creation, infrastructure development, and investment opportunities. However, like any other sector with high stakes, the construction industry faces unique challenges, particularly in managing financial health and assets. Recent data sheds light on how companies within this sector are intensively focusing their research efforts on a crucial financial topic: wealth management.

Understanding the Financial Landscape

Wealth management, as a financial practice, involves comprehensive handling of financial affairs and investment planning, which is crucial for construction businesses that deal with large-scale projects and capital-intensive investments. A recent study has revealed that approximately 1005 construction businesses are actively increasing their research activities in wealth management on a weekly basis. This statistic not only highlights the sector’s keen interest in financial optimization but also points to a systematic approach to managing assets, liabilities, and potential revenue streams efficiently.

Research Trends and Business Implications

The number of research spikes in wealth management, totaling 51,819, indicates a robust and growing interest in this area. These spikes can be interpreted as moments when businesses either seek new information on wealth management strategies or intensify their existing efforts to understand better and implement sophisticated financial management techniques. This trend is indicative of the dynamic nature of the construction industry’s financial landscape, where companies continuously adapt to market changes, regulatory requirements, and economic fluctuations.

This focused research into wealth management suggests that construction companies are not merely reacting to financial trends but are proactively seeking to equip themselves with the knowledge to make strategic decisions. It could involve exploring new investment opportunities, understanding financial risks, or optimizing asset allocation tailored to long-term business sustainability.

Strategic Importance of Wealth Management in Construction

The strategic importance of wealth management in the construction industry cannot be overstated. Given the high financial stakes involved in construction projects, managing wealth efficiently ensures that businesses can sustain operations, fund new projects, and mitigate financial risks associated with market volatility and economic downturns. Effective wealth management helps construction firms maximize their financial resources, improve their investment returns, and ensure liquidity to handle operational needs.

Moreover, with the rise of digital technologies and financial tools, construction companies have unprecedented access to sophisticated wealth management solutions. These tools can provide detailed analytics on investment performance, risk assessment models, and forecasts that aid in making informed financial decisions. The adoption of such technologies in their financial strategies can significantly enhance a company’s ability to manage its finances in a more informed and proactive manner.

The Role of Continuous Learning and Adaptation

The continuous spikes in research indicate an ongoing need for education and adaptation among construction companies. This continuous learning curve is crucial for staying ahead in a competitive market. By staying updated with the latest financial management strategies and economic trends, construction companies not only protect their assets but also position themselves for growth and expansion.

Conclusion

The focus on wealth management within the construction industry highlights a broader trend towards strategic financial planning and risk management. As construction companies continue to navigate a complex and often unpredictable market, their intensified research into wealth management reflects a clear commitment to securing financial stability and fostering long-term growth.

This data-driven perspective into the construction industry’s financial research endeavors not only provides insights into current trends but also serves as a beacon for other sectors to follow suit. In doing so, it underscores the critical role of strategic financial management in sustaining business operations and driving economic growth in high-stakes industries like construction.

Company Sample Data Analysis

– Company Size: This column categorizes companies based on the number of employees. The categories range from “Micro (1 – 9 Employees)” to larger scales.

– Spiking Businesses (weekly avg.): Indicates the average number of businesses per week in each size category that have shown a spike in research activity.

– Percent of Total: Represents the proportion of total research activity attributed to each company size category.

Insights from the Data

1. Micro (1 – 9 Employees): Despite being the smallest size category, these companies show a notable average of 81 businesses spiking in research weekly, which makes up approximately 8.48% of the total research activity. This suggests that even the smallest enterprises are keen on staying informed, possibly to remain competitive or innovate within their niches.

2. Small (10 – 49 Employees): This category shows a significant increase in research activity with an average of 222 companies showing spikes weekly, constituting about 23.25% of total research. Small businesses likely research to expand their operations or improve their market strategies.

3. Medium-Small (50 – 199 Employees): Representing the highest percentage of research spikes at approximately 27.80%, these businesses are possibly at a stage where they need to make strategic decisions to scale up or optimize their operations, reflecting the highest engagement in research.

4. Medium (200 – 499 Employees) and Medium-Large (500 – 999 Employees): These groups show a lesser but still significant interest in research compared to smaller businesses. They account for 15.55% and 8.81% of the total activity, respectively. Larger companies might have established systems and resources to conduct sustained research, or they might rely more on internal data and analytics teams.

Trend Analysis

This trend indicates that company size does impact research behavior, with medium-small businesses showing the most activity. The reason could be that companies in this size range are at a critical growth phase, requiring more strategic planning and market understanding to transition to larger operations. Smaller companies may be leveraging research as a tool for innovation and niche positioning, while larger companies might be focusing on optimizing existing processes and expanding into new markets.

Overall, the data underscores the importance of research across all business sizes, reflecting a strategic emphasis on staying informed and competitive in the market. Each company size appears to engage in research with different intents and needs, which is crucial for their development and adaptation in a dynamic business environment.