Executive Summary: Enterprise Research Trends in the Construction Industry

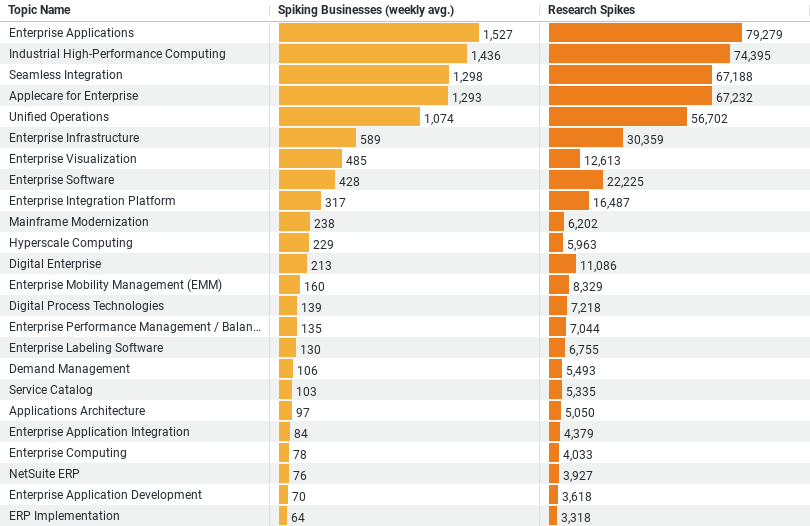

– The dataset reveals a keen interest in technology-driven solutions within the construction industry, highlighting the top five research topics.

– Enterprise Applications lead the interest with the highest weekly average of spiking businesses (1,527.25) and the most research spikes (79,279), indicating a strong focus on leveraging software to streamline business processes.

– Industrial High-Performance Computing shows significant interest as well (1,435.73 weekly spiking businesses, 74,395 research spikes), reflecting the industry’s need for complex computational capabilities.

– Seamless Integration and Applecare for Enterprise are closely matched in interest (1,297.54 and 1,293.37 weekly spiking businesses, respectively), suggesting a priority for system interoperability and reliable support for Apple products in business operations.

– Unified Operations also stands out (1,073.81 weekly spiking businesses, 56,702 research spikes), indicating a move towards centralizing operations for better management and efficiency.

This summary underscores the construction industry’s strategic focus on enhancing operational efficiency, computational power, and system integration through the adoption of advanced technology solutions.

Embracing Enterprise Applications

At the forefront of this digital shift is a strong interest in Enterprise Applications. Data shows an average of 1,527.25 businesses spiking in research weekly, with a total of 79,279 research spikes, indicating a robust demand for software solutions designed to streamline business processes. This trend suggests that construction companies are increasingly seeking out applications that can manage various aspects of their operations, from project management and accounting to customer relations and human resources. By leveraging these tools, businesses aim to enhance efficiency, improve decision-making, and drive growth.

Leveraging Industrial High-Performance Computing

Not far behind is the industry’s focus on Industrial High-Performance Computing (HPC), with 1,435.73 spiking businesses on average per week and 74,395 research spikes. This interest points towards the construction industry’s need for powerful computational resources. High-performance computing can support complex tasks such as simulations, data analysis, and modeling, critical for project planning, design optimization, and risk management. By investing in HPC, construction firms can unlock new possibilities in project accuracy, sustainability, and innovation.

Prioritizing Seamless Integration

The construction industry’s research also underscores a significant emphasis on Seamless Integration, with 1,297.54 spiking businesses weekly and 67,188 research spikes. In today’s fragmented digital landscape, the ability to integrate various systems and technologies smoothly is paramount. Construction companies are seeking solutions that can connect disparate software and hardware, enabling data to flow freely across platforms. This focus on integration is driven by the desire to enhance operational efficiency, reduce data silos, and foster better collaboration across project teams.

Investing in Applecare for Enterprise

Interestingly, Applecare for Enterprise has emerged as a key area of interest, with an average of 1,293.37 spiking businesses weekly and 67,232 research spikes. This trend indicates that construction businesses are not only investing in Apple’s hardware and software solutions but also seeking dedicated support services to ensure reliability and uptime. Applecare for Enterprise represents a commitment to leveraging high-quality, user-friendly technology solutions backed by comprehensive support, reflecting the industry’s dedication to maintaining seamless operations.

Centralizing with Unified Operations

Finally, the data reveals a strong trend toward Unified Operations, with 1,073.81 spiking businesses weekly and 56,702 research spikes. This shift towards centralizing operations under a unified framework aims to enhance visibility, control, and coordination across various functions. By adopting unified operations management solutions, construction companies can streamline workflows, improve resource allocation, and achieve greater project oversight, all of which are crucial for delivering projects on time and within budget.

Conclusion

The construction industry’s pivot towards enterprise solutions is a clear indicator of its readiness to embrace the future. By focusing on enterprise applications, high-performance computing, seamless integration, Applecare support, and unified operations, construction companies are laying the groundwork for a more efficient, innovative, and resilient sector. As technology continues to advance, the construction industry’s ability to adapt and integrate these solutions will undoubtedly play a pivotal role in shaping its future success. This strategic embrace of enterprise technology not only highlights the sector’s forward-thinking approach but also sets the stage for transformative changes in how construction projects are planned, executed, and managed.

Company Sample Data

Company Size Categories:

1. **Micro (1 – 9 Employees)**

2. **Small (10 – 49 Employees)**

3. **Medium-Small (50 – 199 Employees)**

4. **Medium (200 – 499 Employees)**

5. **Medium-Large (500 – 999 Employees)**

Key Metrics:

– Spiking Businesses (weekly avg.): This metric measures the average number of businesses within each size category that show a significant increase in research activity on a weekly basis.

– Percent of Total: This percentage represents each company size category’s share of the total research activity.

Insights and Trends:

1. Medium-Small companies (50 – 199 Employees) lead in research activity, with the highest average number of spiking businesses (1,943.90) and constituting 29.33% of the total research activity. This suggests a robust engagement in seeking out new solutions or technologies, likely driven by a desire to scale operations or improve efficiencies as they transition from small to medium-sized entities.

2. Small companies (10 – 49 Employees) follow closely, with an average of 1,783.31 spiking businesses and making up 26.91% of the total. These companies might be in a phase of rapid growth and evolution, seeking solutions that can support this expansion and streamline processes.

3. Interestingly, Micro companies (1 – 9 Employees), despite being the smallest, are not the least active. They have an average of 645.23 spiking businesses weekly, accounting for 9.74% of total research activity. This indicates a significant level of engagement among the smallest businesses, possibly looking for ways to gain a competitive edge or efficiencies with limited resources.

4. Medium (200 – 499 Employees) and Medium-Large (500 – 999 Employees) companies show lower levels of spiking activity (949.44 and 499.21, respectively) but still contribute significantly to the overall research landscape (14.33% and 7.53%, respectively). This could reflect a more established operational framework within these companies, resulting in a more focused and perhaps less frequent need for researching new enterprise solutions.

Why This Is a Trend

The distribution of research activity across different company sizes indicates a trend where companies in the growth phase (especially those transitioning from small to medium-sized) are the most active in researching new solutions. This heightened activity likely stems from the need to find scalable, efficient solutions that support growth, improve productivity, and enhance competitiveness. As companies grow, their operational complexities increase, necessitating a more proactive approach to adopting new technologies and solutions.

This trend highlights the dynamic nature of the construction industry’s engagement with enterprise solutions, with smaller and medium-sized businesses showing the most significant interest. It underscores the importance of technology and innovation in supporting business growth and adaptation in an increasingly digital marketplace.