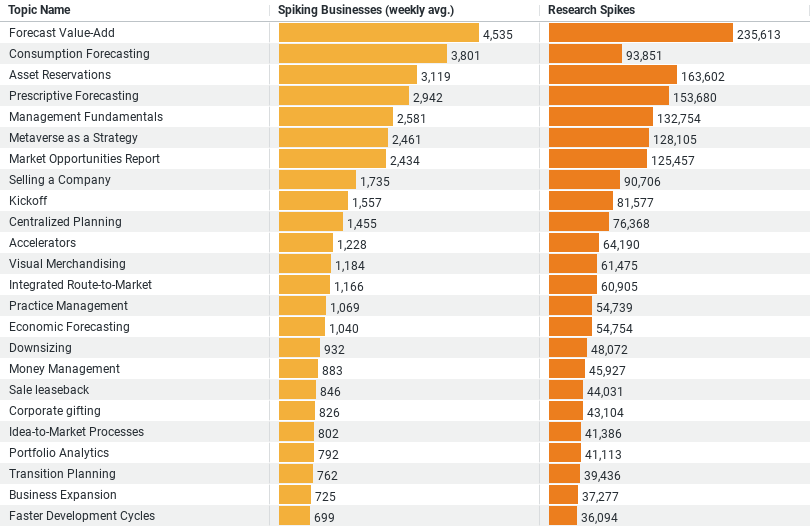

(Data visualized in the chart captures buying and research signals for the past 365 days)

The dataset provides a focused look at the construction industry’s research interests in Budgeting, Planning & Strategy:

Here’s a data-focused summary highlighting the key trends in the construction industry’s research into accounting topics:

- pronounced focus on value-adding forecasting techniques, evidenced by the highest engagement (4,535 businesses weekly) and research activity (235,613 spikes), indicating a strategic shift towards predictive analytics and proactive planning.

- Consumption Forecasting and Asset Reservations follow, with notable weekly business engagements (3,800 and 3,118, respectively) and research spikes (93,851 and 163,602), underscoring the emphasis on efficient resource management and planning.

- Prescriptive Forecasting and Management Fundamentals also attract significant attention, with over 2,500 businesses weekly delving into each topic, highlighting the industry’s drive towards actionable insights and solid management practices.

Forecasting: The Keystone of Construction Strategy

The paramount topic that has captivated the interest of the construction industry is Forecast Value-Add, with a whopping 4,535 businesses on average delving into it weekly. This trend underscores a collective endeavor to harness predictive analytics, transforming raw data into actionable insights. The construction industry, traditionally seen as slow to adopt new technologies, is now leading the charge in leveraging forecasting to add tangible value to projects. This approach not only enhances accuracy in budgeting and planning but also empowers companies to anticipate future challenges and opportunities, laying the groundwork for proactive strategy development.

The Rise of Consumption Forecasting

Close on the heels of Forecast Value-Add is Consumption Forecasting, with 3,800 businesses engaging with this topic weekly. The significance of this trend cannot be overstated, as it highlights an industry-wide shift towards sustainable practices. By accurately predicting the consumption of materials, construction companies can significantly reduce waste, optimize resource allocation, and achieve cost efficiencies. This meticulous approach to forecasting speaks volumes about the industry’s commitment to sustainability and economic prudence.

Strategic Asset Reservations: A Game-Changer

With 3,118 businesses exploring Asset Reservations weekly, the data reveals a keen interest in maximizing asset utilization. This trend points towards an industry that is becoming increasingly strategic in its resource management. By effectively reserving assets for upcoming projects, companies can ensure the right resources are available at the right time, thereby minimizing downtime and boosting productivity. This strategic layer of planning exemplifies the industry’s move towards more agile and efficient operational frameworks.

Prescriptive Forecasting: The Path to Actionable Insights

The interest in Prescriptive Forecasting, researched by 2,942 businesses weekly, signifies a notable evolution from merely predicting outcomes to actively shaping them. This forward-thinking approach enables construction companies to not only forecast future scenarios but also to receive tailored recommendations on the best courses of action. In an industry where the margin for error is slim, and the impact of decisions is monumental, prescriptive forecasting offers a beacon of guidance, empowering companies to make informed, strategic decisions.

Reinforcing Management Fundamentals

Lastly, the focus on Management Fundamentals, with 2,581 businesses engaging weekly, serves as a reminder of the enduring importance of solid management practices. In the complex, multifaceted world of construction, mastering the fundamentals of management is paramount. This includes effective leadership, strategic planning, and resource management – all crucial for navigating the intricacies of large-scale projects. By reinforcing these fundamentals, the construction industry is laying a strong foundation for future success.

Conclusion

The construction industry’s research interests in Budgeting, Planning, and Strategy paint a picture of a sector that is vigorously seeking to redefine its operational paradigms. Through a data-driven approach, construction professionals are not only aiming to enhance their forecasting capabilities but are also embracing sustainability, strategic asset management, and advanced decision-making methodologies. This proactive stance on research and development signals a transformative phase in the construction industry, one where strategic planning and technological adoption converge to pave the way for a more efficient, sustainable, and profitable future. In navigating these trends, the industry sets a benchmark for others to follow, demonstrating that with the right focus and investment in knowledge, the path to innovation and excellence is well within reach.

Population Sample For The Above Article

1. Company Size Categories: The data is organized into five distinct categories based on the number of employees, ranging from Micro (1 – 9 Employees) to Medium-Large (500 – 999 Employees). This categorization offers insights into how the scale of operations might influence strategic priorities and research behaviors.

2. Spiking Businesses (Weekly Avg.): For each company size category, the dataset reports the average weekly number of businesses that show a spiked interest in Budgeting, Planning, and Strategy topics. This metric highlights the level of active engagement and could indicate the urgency or relevance of these topics across different company sizes.

– Micro (1 – 9 Employees): Shows an average of 2,661.98 businesses engaging weekly, suggesting that even the smallest companies are keenly exploring these areas, possibly to optimize resources and strategize for growth.

– Small (10 – 49 Employees): With 7,697.33 businesses on average, small companies demonstrate a significant interest, likely driven by the need to establish more structured planning and budgeting processes as they scale.

– Medium-Small (50 – 199 Employees): This category, showing 7,014.21 businesses engaging weekly, indicates a robust interest that may reflect the complexities and challenges of managing larger projects and budgets.

– Medium (200 – 499 Employees) and Medium-Large (500 – 999 Employees): These groups, with 2,510.62 and 1,037.37 businesses engaging respectively, show a lesser but focused interest, possibly due to the presence of more established systems and a higher need for strategic overhauls.

3. Percent of Total: This column provides the percentage each category contributes to the total number of businesses engaged in researching Budgeting, Planning, and Strategy. This perspective allows us to understand the relative weight of each company size in the overall industry interest.

– The data ranges from 0.118122% for Micro companies to 0.341559% for Small companies, indicating a varied distribution of interest that leans towards smaller companies being more actively engaged in research. This might suggest that smaller companies are more agile in seeking out strategic insights to gain a competitive edge or address immediate operational challenges.

This dataset offers a comprehensive look into how the construction industry, across different scales of operation, is prioritizing research into Budgeting, Planning, and Strategy. The insights drawn from this data can help stakeholders understand the scope of interest across company sizes and tailor their strategies, solutions, or services to meet these varied needs effectively.