Executive Summary: Corporate Finance Research trends in the Construction Industry

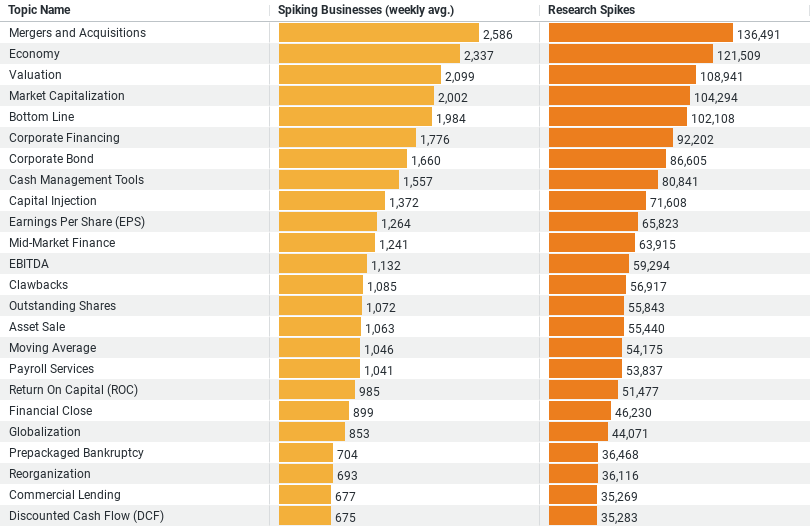

– Mergers and Acquisitions top the chart, indicating a strategic priority for growth and consolidation, with over 2,585 weekly researching businesses and 136,491 research spikes.

– Economy and Valuation follow closely, emphasizing the industry’s vigilance towards economic conditions and the intrinsic value of businesses, attracting 2,336 and 2,098 weekly researching businesses, respectively.

– Interest in Market Capitalization and Bottom Line reflects a keen focus on company size, market position, and profitability, with each topic drawing nearly 2,000 weekly researching businesses.

This data suggests a strategic approach within the construction industry to corporate finance, prioritizing growth, economic awareness, and financial health. With high levels of research activity across these topics, it’s clear the industry is actively seeking to enhance decision-making and operational strategies through informed financial analysis.

A Strategic Emphasis on Mergers and Acquisitions

At the forefront of the industry’s research activities is the topic of Mergers and Acquisitions (M&A). With an impressive weekly average of 2,585 businesses delving into this area and a total of 136,491 research spikes, it’s evident that M&A is a key strategic priority. This interest likely stems from the desire to expand market reach, diversify service offerings, and achieve economies of scale. By focusing on M&A, construction companies are not only seeking to bolster their competitive edge but also to secure a more significant market share in an increasingly globalized economy.

Economic Insights Drive Strategic Decisions

Following closely behind M&A, the Economy emerges as the second most researched topic, attracting the attention of 2,336 businesses on a weekly basis and accounting for 121,509 research spikes. This indicates a pronounced industry focus on understanding macroeconomic trends, financial markets, and economic indicators that can influence strategic decision-making. In a sector as closely tied to economic cycles as construction, staying informed on these matters is crucial for navigating uncertainties, timing investments, and planning for future growth.

Valuing Valuation: A Critical Component of Financial Analysis

Valuation is another key area of interest, with 2,098 businesses researching this topic weekly, leading to 108,941 research spikes. The importance placed on valuation reflects the construction industry’s need to accurately assess the financial worth of companies, projects, and assets. This insight is indispensable for making informed investment decisions, evaluating potential M&A opportunities, and guiding financial planning processes. A robust understanding of valuation principles enables construction firms to allocate resources efficiently, pursue strategic initiatives confidently, and maximize shareholder value.

Market Capitalization and Bottom Line: Indicators of Financial Health

Market Capitalization and Bottom Line are also among the top researched topics, highlighting the industry’s emphasis on understanding company size, market position, and profitability. With nearly 2,000 businesses investigating each topic weekly, these areas are critical for assessing competitive dynamics, financial stability, and operational efficiency. Interest in market capitalization underscores the importance of gauging a company’s size and influence within the market, while a focus on the bottom line reflects an overarching concern for profitability and financial success.

Insights and Implications

The trends observed in the construction industry’s research interests reveal a comprehensive approach to corporate finance, characterized by a strategic focus on growth, an acute awareness of economic conditions, and a commitment to financial health. The prioritization of topics like M&A, economy, valuation, market capitalization, and bottom line indicates an industry poised to leverage financial insights for strategic advantage.

This proactive stance towards corporate finance research underscores the construction industry’s recognition of its role in not just responding to market changes but anticipating and strategically navigating them. By investing in understanding the intricacies of corporate finance, construction companies are better equipped to make data-driven decisions, capitalize on opportunities, and mitigate risks.

Conclusion

the construction industry’s focused research on corporate finance topics signifies a forward-thinking approach to business strategy. As companies continue to navigate the complexities of global markets and economic cycles, their investment in financial knowledge and analysis will undoubtedly play a pivotal role in shaping the industry’s future trajectory.

Company Sample Data on Corporate Finance Research in the Construction Industry

Company Sample Data typically encompasses various metrics that can include company size (often measured by employee count or revenue), industry sector, geographical location, and specific intentions or focus areas of the companies listed. When the data also tracks “intent,” it may refer to companies’ investment directions, technology adoption plans, areas of research and development focus, or other strategic priorities.

Trends by Company Size

1. Small vs. Large Companies: Smaller companies might show a higher propensity for certain types of innovation or niche markets due to their agility and flexibility, whereas larger companies might focus on scaling existing solutions or investing in technologies that promise to streamline operations and cut costs across a wider scale.

2. Adoption of New Technologies: Emerging technologies might be more quickly adopted by medium-sized companies that possess both the agility of smaller firms and the resources of larger ones, making them trendsetters in certain sectors.

3. Strategic Investments: Larger companies may trend towards investing in established, less risky ventures due to the need to protect shareholder value, while smaller companies might take bigger risks on groundbreaking or disruptive technologies, seeking a competitive edge.

4. Focus Areas: The intent or focus areas might vary significantly with company size; for example, larger companies might prioritize global expansion and market dominance, while smaller companies focus on community engagement, customer loyalty, and building a strong brand identity.

Why This Is a Trend

The variation in strategic priorities and focus areas by company size is a reflection of the different challenges and opportunities businesses face at various stages of their growth. Small companies often need to be more innovative and take greater risks to capture market share, while large companies might focus on efficiency, process improvement, and consolidation to maintain or grow their market position.

Understanding these trends is crucial for businesses, investors, and policymakers alike, as it helps in tailoring strategies, products, and services to the specific needs and behaviors of companies of different sizes. It also sheds light on the overall health and direction of various sectors within the economy, indicating areas of growth, stagnation, or decline.