Executive Summary: HR Research Trends in the Construction Industry

– Total HR Topics Analyzed: The dataset includes a variety of HR topics, each showing different levels of research interest from businesses in the construction industry.

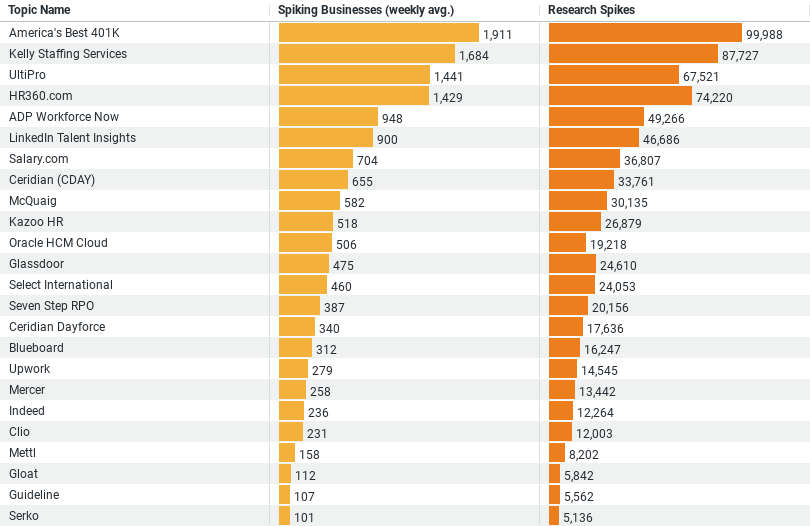

– Top Researched Topic: “America’s Best 401K” leads with 99,988 research spikes, indicating a significant focus on retirement and financial planning services among construction businesses.

– Staffing and Resource Management: “Kelly Staffing Services” and “HR360.com” follow closely with 87,727 and 74,220 research spikes respectively, highlighting the importance of staffing services and comprehensive HR resources.

– Adoption of HR Technologies: Technologies like “UltiPro,” “ADP Workforce Now,” and “Ceridian (CDAY)” are highly researched, with spikes ranging from 33,761 to 67,521. This suggests a trend towards the integration of digital solutions in HR management.

– Insights on Talent and Compensation: “LinkedIn Talent Insights” and “Salary.com” also feature prominently with 46,686 and 36,807 research spikes, underscoring the ongoing need for competitive talent acquisition and compensation strategies.

Exploring HR Trends in the Construction Industry

The construction industry is a dynamic field where managing human resources effectively can significantly influence success. Recent data sheds light on the prevailing HR topics that construction companies are keenly researching. This insight not only reflects the sector’s current needs and challenges but also highlights the strategic priorities that are shaping the industry’s approach to workforce management.

Deep Dive into Popular HR Topics

The most researched HR topic by construction businesses is “America’s Best 401K,” with an impressive 99,988 research spikes. This strong interest underscores the industry’s focus on providing robust retirement benefits, a key factor in attracting and retaining skilled labor in a competitive market. As construction projects often demand a high level of commitment and long-term investment from employees, ensuring financial security through comprehensive retirement plans is paramount.

Following closely are “Kelly Staffing Services” and “HR360.com,” with 87,727 and 74,220 research spikes, respectively. These figures indicate a significant emphasis on staffing solutions and accessible HR resources. Kelly Staffing Services, known for its recruitment and staffing capabilities, aligns well with the construction industry’s frequent need for specialized talent to address project-specific demands. Meanwhile, HR360.com offers a plethora of HR tools and resources that help companies stay compliant with labor laws and regulations, which are particularly complex in the construction sector due to its diverse and often transient workforce.

Technological Integration in HR Functions

The data also highlights the construction industry’s shift towards integrating technology into HR functions. Solutions like “UltiPro,” “ADP Workforce Now,” and “Ceridian (CDAY)” are prominently researched, with interest levels ranging from 33,761 to 67,521 spikes. These platforms offer cloud-based HR services that streamline various processes such as payroll, benefits administration, and compliance management. By adopting these technologies, construction companies can enhance efficiency and accuracy in their HR operations, freeing up resources to focus more on core business activities such as project management and client relations.

Focus on Talent Management and Compensation

“Talent Insights” by LinkedIn and “Salary.com” are also among the top topics, with 46,686 and 36,807 research spikes, respectively. This interest is indicative of the industry’s proactive stance on talent acquisition and compensation strategies. With construction projects often subject to tight schedules and budgets, attracting the right talent at the right time is crucial. Additionally, LinkedIn Talent Insights provides valuable data that helps companies understand labor market trends and identify potential candidates more effectively. Similarly, Salary.com offers tools for benchmarking compensation, ensuring that wages are competitive and equitable, which is vital for maintaining employee satisfaction and loyalty.

Strategic Implications for the Construction Industry

The insights from this data are not just numbers; they represent a broader narrative about how the construction industry is evolving its approach to HR management. By prioritizing financial security, efficient resource management, technological integration, and strategic talent acquisition, companies are not only addressing their immediate operational needs but are also building a resilient workforce capable of driving future growth.

In conclusion, the construction sector’s focused research on diverse HR topics reveals a sophisticated understanding of the challenges and opportunities that human capital presents. As companies continue to navigate a complex and ever-changing business environment, these insights can guide strategic decisions, enhance competitive advantages, and ultimately contribute to the sustained success of the industry. This blend of traditional values and modern solutions is what will define the future of HR in construction, making it an exciting time for professionals within this field.

Company Sample Data

– Company Size: Categorizes companies based on the number of employees. The categories range from micro (1 – 9 employees) to medium-large (500 – 999 employees).

– Spiking Businesses (weekly avg.): Represents the average weekly count of businesses within each size category showing increased research or activity in a given topic.

– Percent of Total: Indicates the percentage of the total activity attributed to each company size category.

Key Observations:

1. Company Size Variation:

– The dataset captures a broad spectrum of company sizes, allowing for a nuanced analysis of how different business scales engage with specific topics or activities.

2. Activity Distribution:

– Medium-Small companies (50 – 199 employees) have the highest average weekly spike in business activity, suggesting that this segment is particularly active in researching or engaging with the topic at hand.

– Small companies (10 – 49 employees) follow closely, making up a significant portion of the activity, evidenced by both the high number of spiking businesses and their substantial percentage of the total activity.

– Conversely, micro and medium-large companies show less activity both in terms of spiking businesses and their overall contribution to the total percentages.

Trend Analysis

The data suggests a notable trend where companies in the “Medium-Small” and “Small” categories are the most active. This could be attributed to several factors:

– Resource Allocation: Medium-small companies often have more resources than micro businesses but still maintain the agility to adapt and innovate, driving them to research new opportunities or solutions vigorously.

– Growth Phase: Companies in this size range may be in a critical growth phase, requiring frequent updates to their operations and strategy, which could explain the increased activity.

– Operational Needs: The operational complexities for small to medium-sized companies are often significant, requiring constant learning and adaptation, which could lead to increased research and engagement in specialized topics.

Overall, the trend indicates that while larger companies might have established protocols and resources, the medium-small to small companies exhibit a higher level of dynamism in exploring new ideas or business enhancements. This insight can help tailor strategies for businesses and service providers aiming to target these segments effectively based on their unique characteristics and needs.