Executive Summary: Immigration Research Trends in the Construction Industry

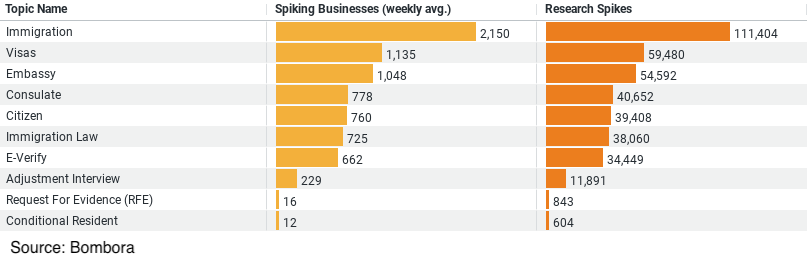

– Immigration stands out as the most researched topic, with a weekly average of approximately 2,150 businesses showing a spike in interest and a total of 111,404 research spikes.

– Visas follow as the second most researched topic, with an average of 1,134 businesses per week and 59,480 total research spikes, indicating significant concern with the legal aspects of employing foreign labor.

– Embassy-related research is conducted by an average of 1,048 businesses weekly, accumulating 54,592 research spikes, which may relate to obtaining necessary documentation and legal support for foreign workers.

– Consulate sees an average weekly interest from 778 businesses and totals 40,652 research spikes, reflecting efforts to navigate international employment laws.

– Research on Citizen issues involves 760 businesses weekly on average, with 39,408 total spikes, likely focused on citizenship status impacts on employment eligibility.

Exploring Immigration: Trends in Construction Industry Research

The construction industry, known for its dynamic workforce and global ties, has shown a marked interest in the complex and ever-relevant topic of immigration. As businesses within this sector strive to navigate regulatory landscapes and optimize their labor forces, immigration emerges not just as a matter of compliance, but as a strategic focal point. The recent data extracted from industry research provides a detailed look into how construction companies are prioritizing their inquiries and concerns regarding immigration, visas, and related issues. This blog post delves into these trends, offering insights into what drives the industry’s research efforts and how it could shape future practices.

Immigration at the Forefront

The topic of immigration itself tops the chart as the most researched subject, with an impressive weekly average of 2,150 businesses actively seeking information. This high level of interest results in over 111,404 recorded research spikes, illustrating the critical role immigration plays in the sector. The primary interest likely stems from the need to understand the changing regulations that impact the ability to hire and retain foreign labor—a crucial component in an industry often experiencing labor shortages and relying heavily on a diverse workforce.

Visas: A Key Concern

Following closely, the subject of visas garners significant attention, with an average of 1,134 businesses per week exploring this area. The total of 59,480 research spikes reflects the industry’s focus on the legal processes necessary for employing international workers. Whether it’s dealing with visa applications, renewals, or compliance with employment laws, the construction sector shows a proactive approach in ensuring that its operations remain uninterrupted and legally sound. This emphasis on visas highlights the practical aspects of workforce management in construction, where the ability to quickly adapt to visa regulations can be a competitive advantage.

Diplomatic Channels in Focus

Research into matters related to embassies and consulates also shows considerable engagement, with topics like “Embassy” and “Consulate” attracting research spikes of 54,592 and 40,652, respectively. This indicates that construction businesses are not only dealing with workforce issues domestically but are also engaging in international negotiations and procedures. The involvement with embassies and consulates typically relates to obtaining necessary work permits, handling immigration documentation, and solving issues that may arise with the status of their international employees.

Citizenship Issues

The interest in citizenship status, as indicated by the research into the topic “Citizen,” which sees about 760 businesses engaged weekly (totaling 39,408 spikes), underscores the importance of understanding how citizenship can affect employment eligibility and rights. In construction, where projects are often spread across various regions, the legal status of workers can influence hiring decisions, project allocations, and compliance with local labor laws.

Implications and Future Directions

The construction industry’s focused research on immigration and related topics reflects its reliance on an international workforce and its vulnerability to changes in immigration laws. These insights not only highlight the areas of highest concern and activity but also point to potential strategies that businesses might adopt. For example, an increased understanding of visa processes can lead to better workforce planning and risk management. Similarly, engagement with diplomatic channels can help companies expedite the resolution of documentation issues, ensuring that projects are not delayed by workforce shortages or legal hurdles.

Moreover, the data suggests that construction companies might benefit from partnerships with legal experts and immigration consultants to navigate this complex field more effectively. By investing in knowledge and resources related to immigration, companies can better anticipate changes in the law, adapt their practices accordingly, and maintain a stable, compliant, and efficient workforce.

In conclusion, the construction industry’s in-depth research into immigration-related topics is a testament to the sector’s strategic approach to workforce management. By staying informed and proactive, companies in this industry can not only comply with the law but also harness the full potential of a diverse and skilled international workforce, ensuring sustained growth and competitiveness in a global market.

Company Sample Data

1. Company Size: Categorizes companies into groups based on the number of employees. This classification includes Micro (1 – 9 Employees), Small (10 – 49 Employees), Medium-Small (50 – 199 Employees), Medium (200 – 499 Employees), and Medium-Large (500 – 999 Employees).

2. Spiking Businesses (weekly avg.): Represents the average weekly number of businesses in each size category that have shown a spike in research activity.

3. Percent of Total: Indicates the percentage of total research activity accounted for by each company size category.

From the data, here’s a breakdown of the research activity by company size:

– Micro companies show a notable level of activity, considering their small size, with over 526 businesses spiking weekly, making up about 10.37% of the total.

– Small companies are significantly more active, with approximately 1,358 businesses showing research spikes, representing 26.76% of the total.

– Medium-Small companies exhibit the highest level of research activity, with around 1,492 businesses engaged weekly, contributing to 29.40% of the total.

– Medium companies show a substantial decrease in research intensity compared to smaller businesses, with 733 businesses and 14.44% of the total.

– Medium-Large companies, despite potentially having more resources, have fewer businesses showing research spikes (375 businesses), accounting for only 7.39% of the total.

Trend Analysis

The data highlights an interesting trend where medium-small companies (50 – 199 employees) are the most active in research activities, potentially indicating a greater need to innovate or adapt due to competitive pressures. As companies grow larger, there appears to be a decline in the proportion of businesses actively spiking in research, which might suggest that larger companies could be relying more on established practices or have less proportionate need to seek out new information regularly.

The higher activity in smaller companies (especially micro to medium-small) might be driven by the necessity to stay competitive and agile in a changing market. These companies often need to be more responsive to industry changes to survive and grow, hence the greater focus on research.

Conversely, the reduced activity in larger companies could be attributed to having established channels and resources for obtaining necessary information, or possibly having in-house expertise which reduces the need for external research.

This dataset underscores the dynamic nature of business activities across different company sizes and offers insights into how businesses prioritize and handle research based on their scale and operational needs.