Executive Summary: Marketing Strategy & Analysis Research Trends in the Construction Industry

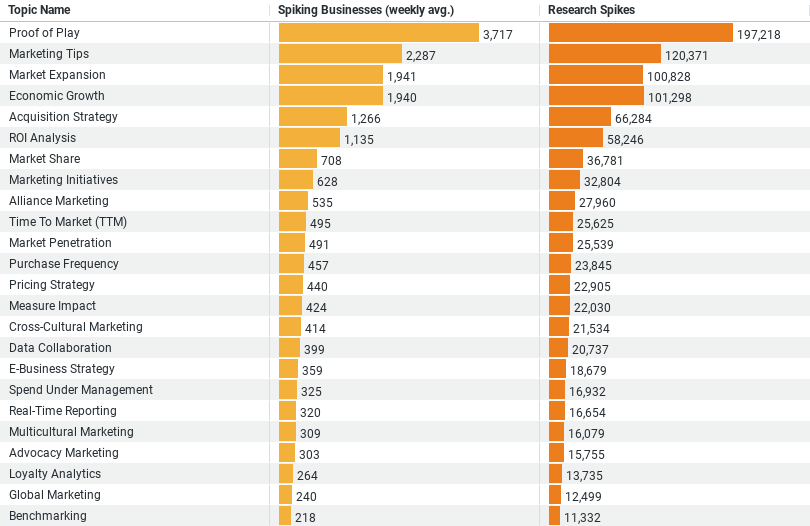

1. Highest Engagement: The topic “Proof of Play” records the highest industry engagement, evidenced by the largest weekly average of spiking businesses (approximately 3717) and the highest number of research spikes (197,218). This indicates a predominant interest in advertising effectiveness and verification.

2. Significant Interest in Marketing Strategies: “Marketing Tips” follows closely, with a notable weekly average of spiking businesses (around 2287) and a significant count of research spikes (120,371), highlighting the industry’s strong inclination towards actionable marketing strategies.

3. Focus on Growth: The topics “Market Expansion” and “Economic Growth” showcase similar levels of interest, with weekly averages of spiking businesses near 1941 and 1939, and research spikes of 100,828 and 101,298, respectively. These figures reflect the industry’s concerted focus on exploring avenues for expansion and understanding economic trends impacting growth.

4. Strategic Acquisitions: “Acquisition Strategy” also stands out as a key area of interest, with a weekly average of spiking businesses at 1266 and a total of 66,284 research spikes, pointing to a strategic approach towards consolidating market presence through acquisitions.

The data emphasizes a balanced focus on operational efficiency, market expansion, and strategic acquisition within the construction industry, underpinned by a robust engagement with marketing strategies and economic growth trends.

Leading the Charge: Proof of Play

Topping the chart with an astounding weekly average of 3,717 spiking businesses and a colossal research spike of 197,218, “Proof of Play” emerges as the crown jewel of the construction industry’s marketing interests. This term, traditionally associated with advertising’s digital footprint—validating that an ad was indeed displayed or played as intended—signals a significant shift towards digital marketing’s accountability and effectiveness. Construction businesses are increasingly investing resources in ensuring their marketing efforts are not just seen but are also impactful, driving the industry’s marketing strategies towards a data-verified future.

The Strategic Playbook: Marketing Tips and Market Expansion

Closely following are “Marketing Tips” and “Market Expansion,” with weekly averages of 2,287 and 1,941 spiking businesses, respectively. These topics underline a voracious appetite for actionable insights and strategies that can propel businesses forward in a competitive landscape. The research spike figures—120,371 for marketing tips and 100,828 for market expansion—illustrate an industry keen on harnessing practical advice and exploring new territories for growth. It’s evident that construction businesses are not just building structures; they’re also building robust marketing strategies designed to navigate the complexities of market dynamics and economic fluctuations.

Economic Growth: A Foundation of Strategy

Nearly neck and neck with market expansion, “Economic Growth” captures the industry’s attention with a weekly average of 1,939 spiking businesses and a research spike of 101,298. This interest is a testament to the industry’s acute awareness of the broader economic landscape and its implications for future projects and investments. By closely monitoring economic trends, construction companies are positioning themselves to capitalize on growth opportunities, ensuring their marketing strategies are not only reactive but also proactive, aligning with long-term economic forecasts.

Acquisition Strategy: Building Market Presence

Not to be overlooked, the “Acquisition Strategy” topic, with a weekly average of 1,266 spiking businesses and a research spike of 66,284, reflects a tactical approach towards consolidating market position. In an industry where scale can often equate to competitive advantage, strategic acquisitions are a crucial component of the marketing playbook, enabling businesses to rapidly expand their capabilities, reach, and market share. This trend underscores the industry’s inclination towards growth not just organically but also through strategic partnerships and acquisitions.

Conclusion: A Blueprint for the Future

The construction industry’s focused research on marketing strategy and analysis topics reveals a multi-dimensional approach to growth and competitiveness. From ensuring the accountability of digital marketing efforts with “Proof of Play” to leveraging strategic insights for expansion and keeping a pulse on economic trends, the industry is building a comprehensive marketing strategy that mirrors its operational excellence.

This data-driven exploration into the construction industry’s marketing strategies provides valuable lessons for businesses across all sectors. It underscores the importance of a data-informed approach to marketing, the potential of strategic acquisitions, and the need to stay abreast of economic and market trends. As the construction industry continues to lay the foundation for its marketing efforts with the same precision it applies to its projects, it sets a benchmark for strategic planning and execution that is both robust and resilient.

In essence, the industry trends on marketing strategy and analysis are a testament to its commitment to not just build structures that stand the test of time but also forge business strategies that pave the way for sustainable growth and success.

Company Sample Data

1. Company Size: This column categorizes companies into different size brackets based on the number of employees. The categories include:

– Micro (1 – 9 Employees)

– Small (10 – 49 Employees)

– Medium-Small (50 – 199 Employees)

– Medium (200 – 499 Employees)

– Medium-Large (500 – 999 Employees)

2. Spiking Businesses (weekly avg.): This metric provides the weekly average of businesses within each company size category that have shown a significant increase in activity or interest in the context being analyzed. The figures suggest varying levels of engagement or intent, presumably in exploring or implementing marketing strategies, across the different sizes of companies.

3. Percent of Total: Reflects the proportional representation of each company size category in terms of the observed spikes or increased activity. This percentage gives insight into how each company size segment contributes to the overall pattern of engagement or research intensity within the dataset’s context.

Insights from the Data:

– Medium-Small (50 – 199 Employees) companies lead in terms of engagement, with the highest weekly average of spiking businesses (around 3918), closely followed by **Small (10 – 49 Employees)** companies (approximately 3892). This indicates a strong, active interest in the subject matter among businesses of these sizes.

– The Micro (1 – 9 Employees) and Medium-Large (500 – 999 Employees) categories show lower levels of activity compared to other segments, with Micro companies representing a smaller portion of the total activity (11.4%) and Medium-Large companies even less (5.79%).

– Despite having a smaller volume of spiking businesses, Medium (200 – 499 Employees) companies still represent a meaningful portion of the total activity (12.56%), indicating a significant, albeit less frequent, level of interest or engagement in the analyzed context.

This dataset is crucial for understanding how companies of various sizes engage with specific topics or strategies, revealing patterns that can inform tailored marketing approaches, resource allocation, or strategy development for targeting businesses across different segments.