Executive Summary: Desktop Research Trends in the Construction Industry

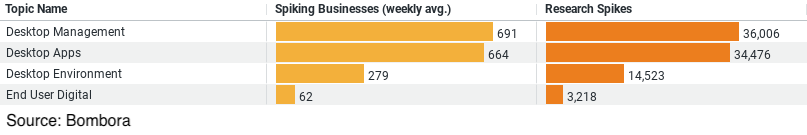

– Desktop Management

– 691.15 average businesses researching weekly.

– 36,006 total research spikes.

– Most researched topic, indicating high importance in managing desktop systems.

– Desktop Apps

– 663.83 average businesses researching weekly.

– 34,476 total research spikes.

– Significant focus on applications enhancing desktop productivity.

– Desktop Environment

– 279.37 average businesses researching weekly.

– 14,523 total research spikes.

– Moderate interest, reflecting attention to desktop configuration and optimization.

– End User Digital

– 61.85 average businesses researching weekly.

– 3,218 total research spikes.

– Least researched, but still a notable area regarding user interaction with digital tools.

Key Insights

– Highest interest in Desktop Management and Desktop Apps.

– Moderate focus on the Desktop Environment.

– Lesser emphasis on End User Digital interactions.

Exploring the Construction Industry’s Desktop Research Trends

In today’s digital age, the construction industry is increasingly reliant on technology to streamline operations and boost productivity. A fascinating area of focus has emerged around desktop-related topics, revealing insights into how the industry is researching and prioritizing various aspects of desktop management, applications, environments, and end-user interactions. Let’s delve into the data and explore what these trends mean for the construction sector.

The Dominance of Desktop Management

The most researched topic within the realm of desktop-related interests is Desktop Management. With an average of 691.15 businesses showing interest weekly and a staggering 36,006 research spikes, it’s clear that construction companies are keenly focused on managing their desktop environments effectively.

Desktop management encompasses a variety of tasks, including deploying, configuring, maintaining, and securing desktop systems. For construction companies, this focus likely stems from the need to ensure that project data, architectural designs, and other critical documents are securely managed and easily accessible. Efficient desktop management can lead to enhanced productivity, reduced downtime, and better overall project management.

A Close Look at Desktop Apps

Following closely behind Desktop Management is the interest in Desktop Apps. This category sees an average of 663.83 businesses researching weekly, with 34,476 research spikes. The high level of interest indicates that construction companies are actively seeking applications that can improve their workflows and operational efficiency.

Desktop applications in the construction industry can range from project management software and CAD tools to communication platforms and productivity suites. The search for effective desktop apps suggests a drive towards integrating technology that can support various stages of construction projects, from design and planning to execution and collaboration.

Understanding the Desktop Environment

The Desktop Environment topic garners moderate attention, with 279.37 businesses researching it weekly and 14,523 research spikes. This focus area involves the overall setup and optimization of desktop systems to ensure a seamless and efficient user experience.

In the construction industry, a well-configured desktop environment can significantly impact the ease of accessing project files, running demanding software applications, and maintaining smooth operations. This interest likely reflects a need to balance performance, usability, and security in the desktop setups used by construction professionals.

The Role of End User Digital

While it receives the least attention compared to other topics, End User Digital still holds importance, with 61.85 businesses researching it weekly and 3,218 research spikes. This area focuses on how end-users interact with digital tools and desktop systems.

For construction companies, end-user digital interactions are crucial as they directly affect productivity and user satisfaction. Ensuring that employees can efficiently use digital tools and desktops can lead to better project outcomes and a more streamlined workflow. Although it’s not the top priority, the construction industry recognizes the value of enhancing user experience with digital technologies.

Key Insights and Implications

The data reveals several key insights about the construction industry’s research trends in desktop-related topics:

1. High Priority on Management and Apps: The construction industry places the highest importance on Desktop Management and Desktop Apps. This reflects a strong focus on ensuring that desktop systems are effectively managed and equipped with the right tools to enhance productivity.

2. Moderate Focus on Environment: There is a moderate level of interest in optimizing the desktop environment, indicating a balanced approach to configuring desktops for performance and usability.

3. Lesser Emphasis on End User Digital: While still important, end-user digital interactions receive less attention. This suggests that while user experience is considered, it is secondary to the management and application aspects of desktops.

Conclusion

The construction industry’s research trends in desktop-related topics highlight a comprehensive approach to leveraging technology for improved operations. By focusing on Desktop Management and Apps, construction companies are prioritizing the efficiency and functionality of their desktop systems. The moderate interest in Desktop Environment further supports this, ensuring that systems are optimized for use. Even the lesser emphasis on End User Digital interactions underscores a holistic view of integrating technology in the construction sector.

As technology continues to evolve, staying abreast of these trends will be crucial for construction companies aiming to maintain a competitive edge and achieve project success through enhanced desktop management and application integration.

Company Sample Data

1. Micro (1 – 9 Employees)

– Spiking Businesses (weekly avg.): 109.31

– Percent of Total: 8.32%

– Micro companies show a modest level of interest, accounting for a smaller percentage of the total research activity. These small enterprises may have limited resources and specific, niche needs that drive their research.

2. Small (10 – 49 Employees)

– Spiking Businesses (weekly avg.): 282.40

– Percent of Total: 21.50%

– Small companies are more actively engaged in research, reflecting a substantial portion of the total interest. This size category likely seeks to optimize operations and adopt effective desktop solutions to support their growing teams.

3. Medium-Small (50 – 199 Employees)

– Spiking Businesses (weekly avg.): 307.79

– Percent of Total: 23.43%

– Medium-small companies represent the highest average of businesses researching desktop topics. These companies are at a growth stage where efficient desktop management and applications are critical for scaling operations and improving productivity.

4. Medium (200 – 499 Employees)

– Spiking Businesses (weekly avg.): 193.85

– Percent of Total:** 14.75%

– Medium-sized companies show a significant but relatively lower interest compared to medium-small and small companies. Their research activity suggests a focus on refining existing systems and integrating advanced desktop solutions to support a larger workforce.

5. Medium-Large (500 – 999 Employees)

– Spiking Businesses (weekly avg.): 122.96

– Percent of Total: 9.36%

– Medium-large companies have a lower average of businesses researching desktop topics. These firms likely have more established systems but still seek improvements and new technologies to maintain efficiency and competitiveness.

Analysis of Trends by Company Size:

Micro Companies

Micro companies show the least research activity in desktop-related topics. This is likely due to their smaller scale and limited resources, which may constrain their ability to invest heavily in new desktop technologies. These companies might focus on essential tools that directly impact their immediate operational needs.

Small Companies

Small companies have a higher research activity, reflecting their need to enhance productivity and manage growth. As these companies expand, they require better desktop management and applications to support increased workloads and more complex projects. Their interest is driven by the need to adopt scalable solutions that can keep up with their growth trajectory.

Medium-Small Companies

Medium-small companies exhibit the highest research activity. This size category is often in a critical growth phase where optimizing operations and ensuring efficient desktop management are paramount. These companies are likely looking for robust desktop solutions that can support their expanding teams and more sophisticated project requirements.

Medium-sized companies show significant but moderate research activity. These companies are typically more established and may already have effective systems in place. However, they continue to seek improvements and innovations to maintain and enhance their operational efficiency.

Medium-Large Companies

Medium-large companies have a lower average of businesses researching desktop topics compared to smaller counterparts. These firms are likely well-established with mature IT systems but still need to stay updated with the latest technologies to ensure they remain competitive and efficient.

Conclusion

The data highlights a clear trend: smaller and medium-sized companies in the construction industry are more actively researching desktop-related topics. This trend can be attributed to their need for scalable, efficient desktop solutions to support growth and enhance productivity. As companies grow larger, their focus shifts slightly towards refining and optimizing existing systems rather than extensive research into new technologies. Understanding these trends helps in tailoring desktop solutions that meet the specific needs of different company sizes within the construction industry.