Executive Summary: Insurance Research Trends in the Construction Industry

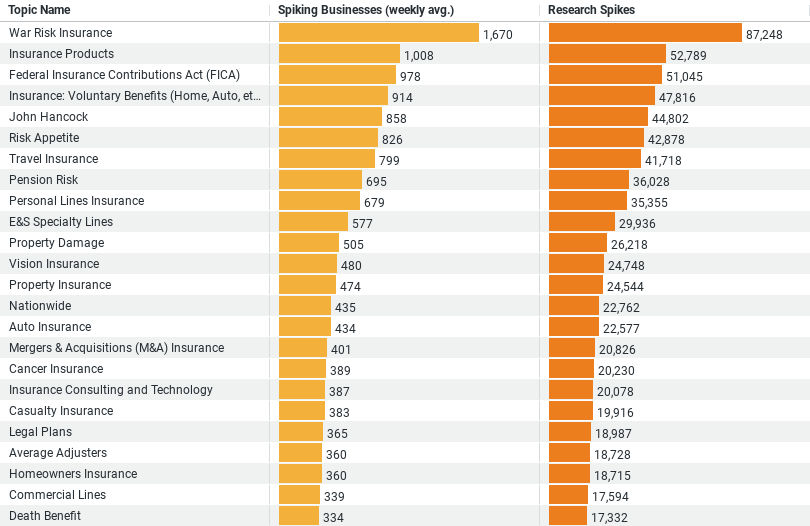

1. Dominant Interest in High-Risk Areas: The construction industry shows substantial interest in “War Risk Insurance,” highlighting a proactive approach to managing risks in potentially unstable regions.

2. Diverse Insurance Needs: The industry’s focus spans across general insurance products to specific legislations like FICA, reflecting a multifaceted insurance requirement landscape.

3. Employee-Centric Benefits: There is considerable attention towards voluntary benefits related to home and auto, suggesting an emphasis on enhancing employee welfare and company appeal.

Top Topics

– War Risk Insurance: Highest engagement with over 87,248 research spikes.

– Insurance Products: Second highest, indicating a broad interest in varied insurance solutions.

– Federal Insurance Contributions Act (FICA): High engagement, reflecting concern with compliance and employee-related insurance matters.

Construction Industry’s Focus on Insurance: A Data-Driven Analysis

In the ever-evolving construction sector, risk management and insurance are not just operational necessities but strategic imperatives. A recent analysis of data from industry research underscores a keen interest in a variety of insurance topics, reflecting the complexities and challenges faced by businesses today. This blog post delves into the data to uncover the key areas of focus and interest within the construction industry regarding insurance.

High-Risk Insurance in the Spotlight

One of the standout topics in the dataset is “War Risk Insurance,” which has recorded the highest level of engagement, with 87,248 research spikes. This indicates a significant concern among construction firms about managing risks in potentially volatile regions. The nature of construction work often requires firms to operate in or near conflict zones or regions with political instability. Therefore, war risk insurance becomes crucial as it provides coverage against losses due to acts of war, including terrorism and civil unrest. This heightened interest reflects a proactive approach by the industry to safeguard assets and human resources under risky operational conditions.

Diverse Insurance Needs

The data also highlights a broad interest in various insurance products, with “Insurance Products” itself being a major topic, drawing an average weekly spike from over 1,000 businesses. This suggests that construction firms are continually seeking to understand and adopt a wide range of insurance solutions to cover various aspects of their operations. From general liability insurance to more specific ones like professional liability and property insurance, the research indicates a dynamic market where firms are actively exploring their options to find the best fits for their unique needs.

Compliance and Legislation

Another significant area of interest is the “Federal Insurance Contributions Act (FICA),” which has seen considerable engagement from the industry. This federal law requires employers to contribute to Social Security and Medicare, an essential aspect of employee benefits in the U.S. The attention to FICA indicates that construction firms are not only committed to compliance with legal requirements but also keen on understanding how such legislations impact their financial and operational planning.

Employee-Centric Insurance Benefits

Moreover, the industry shows a strong focus on “Voluntary Benefits” such as home and auto insurance, which companies offer as part of their employment package. This type of benefit is becoming increasingly popular as firms look to attract and retain talent by enhancing the overall compensation package with options that add personal value to employees. The research into these benefits suggests that construction companies are looking to differentiate themselves in a competitive job market.

Prominent Names and Influencers

Lastly, the presence of topics such as “John Hancock” in the research data highlights the influence of major insurance providers and the interest construction firms have in their offerings. Companies like John Hancock are known for their comprehensive range of products and services, which likely appeal to large-scale construction businesses seeking robust and reliable insurance partnerships.

Implications and Strategic Outlook

This data-driven perspective into the construction industry’s research on insurance not only sheds light on the current priorities but also signals a forward-thinking approach to managing business risks. By understanding and addressing various insurance needs, construction companies are better positioned to navigate the complexities of modern business landscapes, ensuring stability and growth.

As the industry continues to evolve, staying informed and responsive to the changing insurance needs will be crucial. The insights from the data highlight the importance of a strategic approach to insurance—a key component in the risk management framework of any construction business aiming for longevity and success in today’s competitive environment.

This analysis is just the tip of the iceberg. As more data becomes available and trends continue to emerge, the construction industry’s engagement with insurance will undoubtedly adapt, offering new insights and strategies for risk management.

Company Sample Data Overview

– Company Size: Categorizes companies based on the number of employees. The sizes range from micro-sized companies with 1-9 employees to medium-large companies with 500-999 employees.

– Spiking Businesses (weekly avg.): The average number of businesses per week that show a significant increase in activity or interest in a given area.

– Percent of Total: Represents the percentage share of each company size category in the overall measurement.

Insights and Trend Analysis

Here are the insights from the data and the possible trends regarding company sizes:

1. Micro to Medium-Large Spectrum: The dataset spans various company sizes, providing a comprehensive view of market dynamics across different scales of business operations.

2. Dominant Engagement by Medium-Small Companies: Companies with 50-199 employees show the highest weekly spike average, suggesting that this segment might be the most active or responsive in the market. They account for approximately 30.39% of the total observed activity, indicating significant market influence or engagement relative to their size.

3. Significant Activity in Small Companies: Following closely are small companies (10-49 employees), with a substantial share of the weekly spikes and 27.60% of the total activity. This could suggest that smaller firms are more agile or possibly more affected by market changes than larger entities.

4. Decreasing Activity with Increasing Company Size: There’s a clear trend where the larger the company, the fewer the spikes in activity, as seen with medium and medium-large companies. This could be due to the slower reaction times to market changes in larger organizations, or perhaps a reflection of more stable business operations that don’t exhibit as much fluctuation.

Implications

The data reflects how different company sizes interact with the market, with smaller companies perhaps showing more volatility or responsiveness. This could be a critical insight for service providers, policymakers, or investors looking to understand which segments of the market are most dynamic or require tailored approaches due to their distinct behaviors.

Conclusion

The trends from this data suggest that while smaller companies are significantly reactive or involved in market activities, larger companies maintain a steadier presence. This varying degree of engagement across company sizes could be indicative of underlying factors like agility, risk tolerance, and operational dynamics that differ markedly between smaller and larger businesses. This understanding can help in designing targeted strategies for market engagement, policy formulation, or investment decisions.