Executive Summary: Labor Relations Research Trends in the Construction Industry

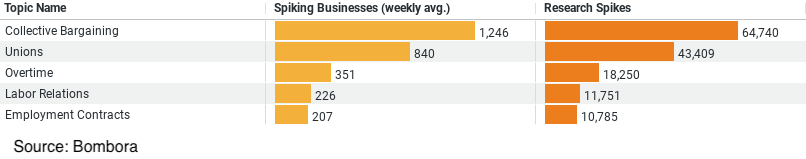

– The dataset comprises 5 main topics related to labor relations in the construction industry.

– Collective Bargaining emerges as the most critical topic, averaging 1,246 business interest spikes weekly and accumulating the highest number of research spikes at 64,740.

– Unions also show strong interest with 840 businesses focusing on this topic weekly, resulting in 43,409 research spikes.

– Overtime, Labor Relations, and Employment Contracts are also significant but with lower metrics compared to the top two topics.

– The mean weekly interest across all topics is 574 businesses, with a high variability (standard deviation of 455), indicating significant differences in the level of interest across topics.

– Research spikes also vary widely, with a mean of 29,787 and a standard deviation of 23,594, reflecting diverse engagement levels among the businesses in the industry.

Insights on Labor Relations Research in the Construction Industry

In today’s ever-evolving business landscape, the construction industry remains at the forefront of complex labor dynamics. Recent data provides compelling insights into the topics that are currently driving research and business interest within the sector. As companies strive to navigate the intricacies of labor relations, understanding these trends is crucial for anyone involved in this industry.

Key Focus Areas in Labor Relations

The data reveals that “Collective Bargaining” is the most researched topic within the industry, with an impressive average of 1,246 businesses per week spiking their interest in this area. This topic alone has generated 64,740 research spikes, indicating a robust engagement and the critical nature of negotiating labor agreements in construction. Collective bargaining serves as a cornerstone for defining wages, working conditions, and other employment terms, which are pivotal in an industry known for its labor-intensive nature.

Following closely is the topic of “Unions,” which sees around 840 businesses weekly delving into the subject, culminating in 43,409 research spikes. The unionization in construction is a vital element, often influencing project outcomes and worker satisfaction. Unions play a significant role in advocating for worker rights and can be a powerful partner in achieving stable labor relations.

“Overtime” is another significant area of focus, with 350 businesses weekly exploring this issue, resulting in 18,250 research spikes. In construction, where project timelines and labor demands can be unpredictable, understanding and managing overtime is crucial for maintaining worker morale and operational efficiency.

The broader topic of “Labor Relations” garners interest from 226 businesses each week, with a total of 11,751 research spikes. This category likely covers a wide range of issues from dispute resolution methods to labor law compliance, reflecting the comprehensive challenges that construction firms face in managing workforce relations.

Lastly, “Employment Contracts” are also a critical area, attracting the focus of approximately 207 businesses weekly, with a total of 10,785 research spikes. These contracts are fundamental in clarifying the expectations and responsibilities of both the employer and the employees, providing a legal framework that can help prevent conflicts and misunderstandings.

Analyzing the Interest and Impact

The variation in weekly business interest and research spikes across these topics highlights the diverse challenges within labor relations that construction companies must address. The high standard deviation observed in the data suggests that while some topics like collective bargaining and unions dominate the discourse, other areas also require attention due to their impact on operational and project success.

This focused interest also underlines the strategic importance of these topics as companies seek to enhance their labor relations strategies. By understanding the dynamics of collective bargaining and union engagements, firms can better negotiate terms that benefit both workers and the company’s bottom line. Similarly, managing overtime and structuring effective employment contracts can lead to more efficient project management and improved worker satisfaction.

Strategic Implications for Industry Stakeholders

For stakeholders in the construction industry, these insights are not just numbers but are indicative of where resources and strategic efforts need to be channeled. Enhancing knowledge and practices around these key topics can lead to more robust labor relations strategies, which are essential for maintaining a competitive edge in this labor-intensive industry.

Furthermore, the focus on these topics can guide training programs, policy development, and even influence legislative advocacy. By aligning business practices with the most pressing issues reflected in the data, construction companies can not only improve internal operations but also contribute to broader industry standards that support fair and efficient labor relations.

Conclusion

As the construction industry continues to grow and evolve, the significance of labor relations remains paramount. The data-driven insights into what topics garner the most research and interest provide a valuable roadmap for companies looking to navigate the complexities of labor dynamics effectively. By focusing on these key areas, industry leaders can ensure that their labor relations strategies are not only compliant but also conducive to fostering a productive and harmonious working environment.

Company Sample Data

– Company Size: Categorizes companies into different size brackets based on the number of employees. The categories provided are:

– Micro (1 – 9 Employees)

– Small (10 – 49 Employees)

– Medium-Small (50 – 199 Employees)

– Medium (200 – 499 Employees)

– Medium-Large (500 – 999 Employees)

– Large (1000+ Employees)

– Spiking Businesses (weekly avg.): Represents the average weekly number of businesses in each category that show a spike in interest for a certain topic.

– Percent of Total: Indicates the percentage each company size category contributes to the total number of spiking businesses.

Analysis of Trends by Company Size

The data reveals varying levels of interest across different company sizes, which can reflect trends in resource allocation, strategic priorities, and market responsiveness.

1. Micro to Medium-Small Companies: There appears to be a peak in activity among medium-small sized companies (50 – 199 Employees) with the highest average weekly spiking businesses. This could indicate that companies of this size are at a developmental stage where they are particularly receptive to new trends and business strategies.

2. Decrease in Larger Companies: The data shows that as companies grow larger (200 employees and up), the average weekly spiking businesses tend to decrease. This could be due to more established processes and slower adaptability to new market trends in larger organizations compared to smaller, more agile ones.

3. Percent of Total: The percent contribution to total spikes also mirrors this trend where medium-small companies have the highest impact. This suggests that despite smaller absolute sizes, the collective impact of smaller companies on market trends can be significant.

The trend indicated by the data could be attributed to several factors. Smaller companies might be more agile and quicker to respond to market changes or adopt new technologies and practices. Conversely, larger companies might engage in more thorough evaluations before adopting new strategies, leading to fewer spikes in activity but potentially more significant shifts when they occur.