Executive Summary: Labor Research Trends in the Construction Industry

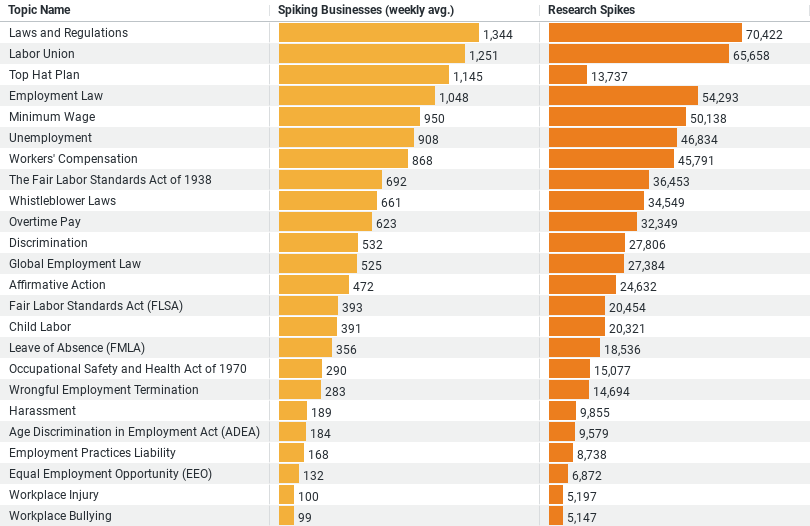

– Data Overview: The dataset consists of 33 entries across three key metrics: Topic Name, Spiking Businesses (weekly average), and Research Spikes.

– Regulatory and Labor Concerns Dominate: The topics “Laws and Regulations” and “Labor Union” are the most actively researched areas, suggesting a strong focus on compliance and labor relations within the construction industry.

– High Business Engagement: These topics also see the highest average weekly business engagement, indicating widespread relevance and urgency among companies.

– Emerging Interests: Although “Top Hat Plan” has fewer research spikes, it remains significantly relevant to businesses, potentially due to its implications for senior management and strategic planning.

– Regulatory Changes: High activity in research related to laws and labor suggests ongoing or anticipated changes in regulations affecting the industry.

– Business Preparedness: The consistent engagement from businesses across the top topics points to a proactive approach in adapting to these changes.

Construction Industry Focus: Key Insights on Labor Research

The construction industry stands as a cornerstone of economic development, constantly adapting to changes in regulations, market dynamics, and workforce management. A recent analysis of data concerning the industry’s research into labor-related topics has shed light on the prevailing concerns and interests among construction businesses. Here’s a deep dive into what’s capturing the industry’s attention and how these interests are shaping their strategies.

Regulatory Compliance and Labor Relations Take Center Stage

The data reveals that “Laws and Regulations” and “Labor Union” topics dominate the research landscape, highlighting the industry’s focus on compliance and labor relations. These topics not only garnered the most research spikes but also saw the highest weekly engagement from businesses. This trend underscores the construction sector’s urgency to navigate the complex web of legal frameworks that dictate operational practices and labor relations.

The high volume of research in these areas can be attributed to several factors. For one, the ever-evolving nature of legal requirements in various jurisdictions compels businesses to stay abreast of changes to remain compliant. Additionally, the labor-intensive nature of the construction industry makes labor relations especially critical. Union engagements, negotiations, and labor laws directly impact how projects are staffed and managed, influencing everything from project timelines to profitability.

Emerging Topics: Compensation and Employment Law

While regulatory compliance and labor relations form the crux of research, topics like “Employment Law” and “Minimum Wage” also feature prominently. The significant interest in these areas suggests an industry grappling with the dual challenges of attracting skilled labor and managing costs. Employment law, with its implications for worker rights, contracts, and workplace safety, is particularly pertinent in an industry prone to high physical risk.

Minimum wage discussions reflect broader economic conditions and the industry’s response to them. As wage standards are debated nationally and locally, construction firms must adjust their compensation strategies to attract and retain talent, especially in a competitive labor market. This not only affects bottom-line costs but also plays a crucial role in the industry’s capacity to scale operations and meet project demands.

Special Focus: Top Hat Plans

A notable emerging topic from the data is the “Top Hat Plan,” which, despite fewer overall research spikes, indicates significant business interest. This topic, related to deferred compensation plans for executives, highlights the strategic planning businesses are engaging in at higher management levels. Such plans are critical for attracting top-tier talent to lead complex construction projects and guide firms through periods of growth or uncertainty.

Visualizing Trends and Business Engagement

Through visual analysis, the top researched topics were mapped against two key indicators: the number of research spikes and the average weekly business engagement. This approach not only identified the most pressing topics but also illuminated the depth of interest across the sector. The alignment between high research activity and business engagement in areas like labor laws and union activities further confirms their critical impact on business operations.

Adapting to Change: A Proactive Industry

The consistent engagement from businesses across these topics reveals a sector that is not just reactive but highly proactive. By keeping their finger on the pulse of labor-related changes, construction companies are better positioned to make informed decisions, from strategic planning to daily operations.

Conclusion

As the construction industry continues to evolve, its focus on labor-related research highlights a commitment to resilience and adaptability. Understanding and anticipating changes in labor laws, compensation, and workforce dynamics enables construction leaders to steer their projects and companies successfully through the complexities of modern economic landscapes. This proactive approach in research and adaptation is a testament to the industry’s dedication to growth and stability, ensuring that it remains robust and responsive to the changing tides of labor dynamics.

Company Sample Data: Intent by Company Size

1. Company Size: Categorizes companies based on the number of employees, ranging from micro businesses (1-9 employees) to medium-large businesses (500-999 employees).

2. Spiking Businesses (weekly avg.): Shows the average weekly number of businesses in each size category that demonstrated a spike in specific business activities or interests.

3. Percent of Total: Represents the percentage that each company size category contributes to the total spikes observed.

Key Observations

– Higher Activity in Smaller Companies: The data shows a notable spike in businesses with 50 to 199 employees (classified as Medium-Small), suggesting a higher level of activity or interest in the specified intent among these businesses. They contribute the highest percentage (about 30.73%) of total activity spikes.

– Small Companies Show Significant Engagement: Following closely are Small companies (10-49 employees) which also show significant engagement, accounting for 25.51% of the total spikes.

– Decrease in Larger Companies: There is a noticeable decrease in activity as company size increases, with Medium-Large companies (500-999 employees) contributing only 7.69% to the total spikes.

Analysis of Trends Based on Company Sizes

The trend of higher activity among smaller to medium-sized companies could be indicative of several factors:

– Agility and Responsiveness: Smaller companies are often more agile and can quickly adapt to new opportunities, technologies, or market changes, leading them to engage more actively in certain business intents.

– Resource Allocation: Smaller to medium-sized companies might be more focused on growth and expansion, which could explain their higher activity levels as they seek out new opportunities or solutions.

– Impact of Scale: Larger companies may have established routines and systems that slow down rapid shifts in interest or activity compared to their smaller counterparts.

This trend highlights how company size can influence business behavior and responsiveness to market or operational opportunities. It suggests that smaller companies, being less bureaucratic and more flexible, are quicker to react to new trends or business imperatives, which could be a strategic advantage in rapidly changing environments.