Executive Summary: AI Research Trends in the Construction Industry

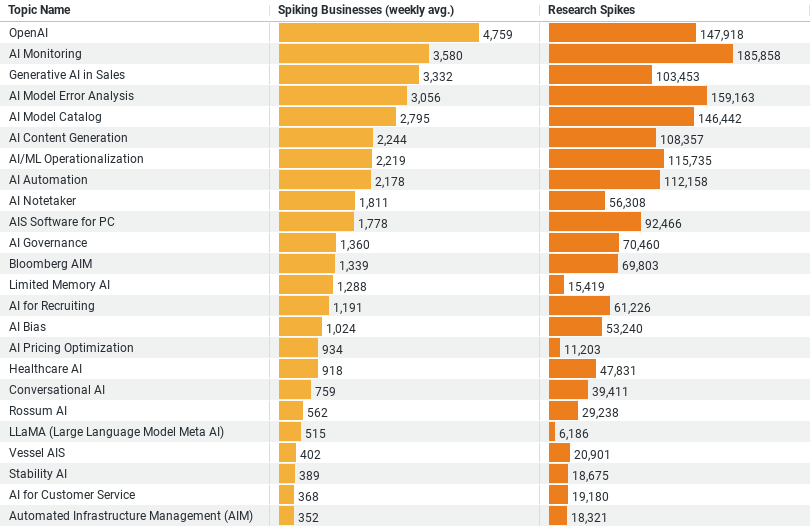

– Topic Popularity: The data highlights “OpenAI” as the most engaging topic, with an average of 4,759 businesses showing interest weekly, accompanied by 147,918 research spikes. This suggests a strong and widespread interest in OpenAI technologies within the industry.

– Research Depth: “AI Monitoring” leads in research intensity with 185,858 spikes, despite a lower business engagement rate of 3,580 weekly on average. This indicates a deep, possibly investigative interest in how AI systems are monitored in construction settings.

– Specialized Interest: Topics like “Generative AI in Sales” and “AI Model Error Analysis” are also significant, showing both high business engagement and research activity. This reflects a focus on applying AI to enhance sales processes and on understanding as well as mitigating AI model errors.

– Engagement Trends: Across the board, the data shows that emerging AI technologies are drawing considerable attention from businesses, with focused spikes in research likely aimed at integration and optimization in construction practices.

Exploring AI: Trends in Construction Industry Research

The construction industry, traditionally seen as slow to adopt new technologies, is rapidly changing its course with the integration of Artificial Intelligence (AI). An analysis of recent data on how construction-related businesses are engaging with AI reveals fascinating trends and a growing focus on specific AI technologies. This blog post delves into these insights, highlighting the key areas of interest and research within the construction sector.

Dominant Interest in OpenAI

OpenAI emerges as the leading topic of interest, with an average of 4,759 businesses actively engaging with it weekly. This statistic is not just a number; it reflects the construction industry’s keen interest in exploring how OpenAI’s cutting-edge technologies can be applied to enhance operational efficiencies and solve complex engineering challenges. The high number of research spikes, totaling 147,918, suggests a vigorous, ongoing exploration into the capabilities of OpenAI technologies, potentially ranging from automated design processes to predictive analytics for project management.

Focused Research on AI Monitoring

AI monitoring stands out with the highest research intensity, evidenced by 185,858 spikes. This indicates a significant concern within the industry regarding the oversight and reliability of AI systems. Construction projects involve substantial investments and bear high risks; therefore, ensuring that AI systems operate correctly and predictably is crucial. The focus on AI monitoring likely encompasses research into performance benchmarks, safety protocols, and compliance with industry standards, all of which are essential for gaining trust and scaling AI solutions in construction settings.

Generative AI in Sales and AI Model Error Analysis

Generative AI in sales and AI model error analysis are also prominent areas of research, with 103,453 and 159,163 spikes, respectively. These topics reflect a nuanced approach to AI adoption, where the construction industry not only looks at AI as a tool for operational tasks but also explores its potential in sales enhancement and risk management. Generative AI applications in sales might include personalized customer interactions and automated generation of sales materials, while AI model error analysis could focus on identifying and mitigating faults in AI-driven systems, which is vital for critical applications such as structural assessments and materials testing.

Implications and Future Directions

The engagement and research trends suggest that the construction industry is not only adopting AI but is also shaping its evolution according to specific needs and challenges. This targeted approach helps in tackling the unique complexities of construction projects, such as varying site conditions, safety requirements, and project scales. Moreover, the focus on research-intensive topics like AI monitoring and error analysis underscores a move towards responsible and reliable AI use, which is fundamental in a risk-averse industry like construction.

Strategic Investment and Collaboration Opportunities

For technology developers and AI researchers, these insights open up avenues for strategic collaborations and product developments that align with the industry’s needs. Understanding where the construction industry’s interests lie enables the creation of tailored AI solutions that can effectively address the specific challenges faced by construction professionals. Moreover, these collaborations can drive innovation not just in the application of AI, but also in the development of regulatory frameworks and ethical guidelines, ensuring that AI integration is both beneficial and sustainable.

Conclusion

As the construction industry continues to research and integrate AI into its operations, the focus on specific technologies like OpenAI, AI monitoring, and generative AI highlights a broader trend of technological transformation. This shift is not just about adoption but is about adapting AI to meet the high stakes and complex demands of construction projects. The data-driven insights from the current research trends serve as a bellwether for the future of construction, indicating areas of growth, potential challenges, and the evolving landscape of industry standards driven by AI adoption. By embracing these technologies, the construction industry is setting itself on a path of innovative development, aiming for higher efficiency, enhanced safety, and ultimately, smarter construction practices.

Company Sample Data

Data Overview

– Company Size Categories: The dataset categorizes companies based on the number of employees, ranging from micro businesses (1-9 employees) to medium-large businesses (500-999 employees).

– Spiking Businesses (weekly avg.): This column shows the average number of businesses in each size category that have shown a spike in a certain activity or interest each week.

– Percent of Total: This indicates the percentage each company size category contributes to the total activity or engagement recorded.

Analysis of Trends by Company Size

1. Micro (1 – 9 Employees): With an average of 1870.44 spiking businesses weekly and accounting for about 12.19% of the total, micro companies show a decent level of activity. This could be due to the agility and flexibility of smaller teams, allowing them to quickly adapt and respond to new opportunities or market changes.

2. Small (10 – 49 Employees): These businesses show the highest weekly average spikes at 4896.12, making up about 31.92% of the total. Small businesses are often at a stage of growth where they are expanding their market reach and operational capacities, leading to increased activity and engagement.

3. Medium-Small (50 – 199 Employees): This category is slightly less active than small companies, with an average of 4692.37 weekly spikes, yet still contributes a substantial 30.59% to the total. Companies in this bracket may be experiencing stabilization in their operations and could be focusing on streamlining and optimizing rather than expanding.

4. Medium (200 – 499 Employees): These companies have fewer weekly spikes, averaging 1828.65, and make up about 11.92% of the total. This decrease in relative activity might reflect the challenges of scaling operations and the increased complexity of management as businesses grow.

5. Medium-Large (500 – 999 Employees): With the smallest activity, averaging 828.73 spikes weekly and contributing 5.40% to the total, medium-large companies are likely to have more established processes and markets, which may result in fewer spikes in new or expanded activity.

Why This Is a Trend

– The trend observed in the data, where smaller companies tend to have higher relative spikes in activity compared to larger ones, could be attributed to the nature of growth stages. Smaller companies often seek opportunities more aggressively and are more responsive to new market demands as they try to establish a foothold. In contrast, larger companies might focus more on improving efficiency and productivity within their already established markets and processes.

– Additionally, smaller companies might engage more in certain activities due to their need to differentiate themselves in the market, whereas larger companies might not need to spike in these areas due to their already strong market presence.

This analysis provides a clear picture of how company size influences business activities and engagement, showcasing the dynamic nature of business operations across different stages of growth.