Executive Summary: Logistics Research Trends in the Construction Industry

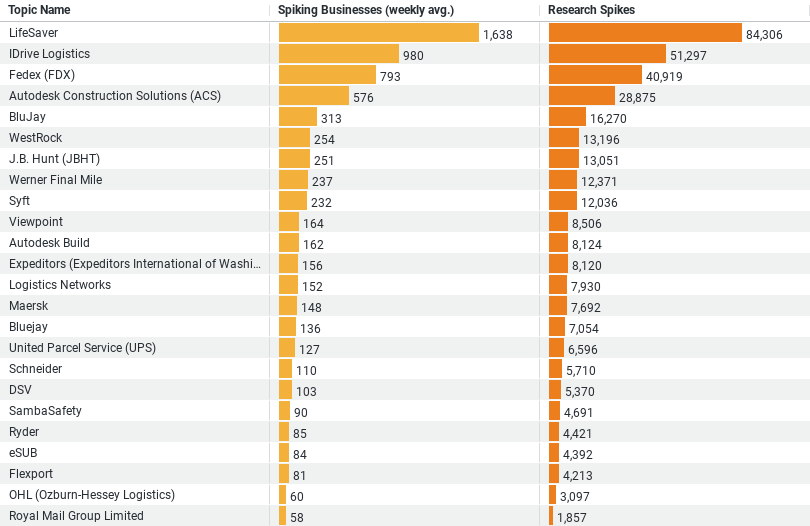

1. Dominant Topic: ‘LifeSaver’ dominates the research interest in construction logistics, with the highest weekly average of spiking businesses at approximately 1,638 and the most research spikes amounting to 84,306.

2. Significant Service Providers: Logistics service providers like ‘IDrive Logistics’ and ‘Fedex’ show substantial engagement, with weekly averages of around 980 and 793 spiking businesses respectively, indicating the construction industry’s heavy reliance on efficient logistics services.

3. Software Integration: The prominence of ‘Autodesk Construction Solutions (ACS)’ with an average of 576 spiking businesses weekly underlines the critical role of software solutions in managing and optimizing logistics within the construction sector.

4. Overall Engagement: The dataset reveals a robust interest across a variety of topics within logistics, suggesting a broad approach to enhancing logistical operations in construction through both technological and service-oriented solutions.

Harnessing Logistics: Insights into the Construction Industry’s Research Focus

The construction industry, a cornerstone of the global economy, is continually evolving, driven by the need to adapt to new technologies, methodologies, and operational frameworks. One of the critical areas under constant development within this sector is logistics. Efficient logistics management can significantly reduce costs, enhance efficiency, and streamline operations in construction projects. In this blog post, we explore recent data that reveals how the construction industry researches and prioritizes different aspects of logistics, shedding light on the sector’s current interests and potential future directions.

Diverse Interests in Logistics Solutions

The construction industry’s interest in logistics is broad, encompassing a range of solutions from sophisticated software tools to essential delivery services. A recent analysis of industry data points to a variety of topics that have captured the attention of businesses, indicating a multifaceted approach to tackling logistical challenges. For instance, companies are not only looking into traditional logistics services like FedEx but are also keen on integrating advanced software solutions such as Autodesk Construction Solutions (ACS). This blend of technological and service-based solutions highlights the industry’s commitment to adopting comprehensive strategies that address various logistical hurdles.

Leading the Pack: LifeSaver

One of the standout topics from the recent data is ‘LifeSaver’, a term that perhaps metaphorically represents a crucial service or tool in the logistics landscape of construction. It dominates the research interest, with the highest weekly average of engaged businesses and a significant number of research spikes. This suggests that LifeSaver could be a pivotal innovation or methodology that is considered a ‘game-changer’ in the way construction projects manage logistics. The specifics of LifeSaver are not detailed in the data, but its prominence indicates a major trend or tool that could be revolutionizing the industry.

Key Players: IDrive Logistics and FedEx

Other significant findings from the data include the strong focus on established logistics service providers such as IDrive Logistics and FedEx. These companies play essential roles in the construction logistics chain, offering reliable delivery services that ensure materials and equipment are where they need to be, when they need to be there. The high level of engagement with these services underscores the construction industry’s reliance on timely and efficient material and equipment delivery, which is crucial to maintaining project timelines and budgets.

The Role of Software in Construction Logistics

The inclusion of Autodesk Construction Solutions (ACS) in the research topics reflects the industry’s increasing reliance on digital tools to manage complex logistics. ACS and similar software platforms offer robust solutions that help project managers track resources, manage supply chains, and optimize schedules. The high engagement with such software solutions is a clear indicator of the construction industry’s move towards digital transformation, aiming to leverage technology to enhance operational efficiency and reduce risks associated with logistical management.

Implications and Future Trends

The insights gleaned from this data not only highlight the current research interests within the construction industry regarding logistics but also suggest several implications for future trends. As businesses continue to explore and integrate both traditional and innovative logistics solutions, we can expect a more streamlined, efficient, and cost-effective approach to managing construction projects. Moreover, the focus on both service providers and software solutions indicates a balanced approach, where technology complements traditional methods, leading to more holistic and integrated logistics strategies.

In conclusion, the construction industry’s research into logistics illustrates a dynamic and adaptive approach to overcoming traditional challenges in the sector. By focusing on a mix of reliable service providers and cutting-edge software, the industry is setting the stage for significant advancements in project management and execution. As these trends continue to evolve, they will undoubtedly shape the future of construction logistics, leading to more refined and sophisticated management practices that could set new standards across the industry.

Company Sample Data: Trends Based on Company Size

– Company Size Categories: Companies are categorized by size ranging from micro (1 – 9 employees) to medium-large (500 – 999 employees). This categorization likely reflects different operational scales and corresponding logistical needs or interests.

– Spiking Businesses (Weekly Avg.): This column shows the average number of businesses in each size category that show heightened activity or interest in a particular topic or service weekly. This metric can be interpreted as a gauge of engagement or relevance of the topic to businesses of different sizes.

– Percent of Total: This indicates the percentage each company size category contributes to the total number of spiking businesses. This provides a sense of how much each size tier is engaged relative to others.

Trends and Implications Based on Company Size

1. Medium-Small Businesses Lead in Engagement: The medium-small category (50 – 199 employees) shows the highest average weekly spiking businesses at about 1,410, constituting roughly 29.2% of the total. This suggests that businesses within this size range are possibly the most dynamic or affected by logistics issues, perhaps due to their scale which necessitates more complex logistics solutions but without the vast resources of larger companies.

2. Small Businesses Also Highly Active: Following closely are small businesses (10 – 49 employees) with an average of approximately 1,189 spiking businesses weekly, accounting for 24.6% of the total. This high engagement might reflect the growth phase of these businesses where logistics can play a critical role in scaling operations effectively.

3. Micro and Medium-Large Companies: Both the smallest and the upper medium-tier companies show lower engagement, with micro-sized companies contributing only about 8.5% and medium-large about 8.1% to the total. This could indicate that very small businesses might not have as complex logistical needs or resources to invest heavily in logistics, whereas medium-large companies might start to have in-house solutions or partnerships that minimize their need for external logistics insights or services.

4. Significance of Company Size to Logistics Focus: The trend that emerges is that company size significantly influences how businesses engage with logistics. Smaller to medium-sized companies, particularly those on the cusp of major growth phases, tend to show heightened interest and activity in logistics-related research and services. This likely reflects their need to optimize operations to compete effectively and manage growth sustainably.

This data-driven insight provides valuable information for service providers and companies in the logistics sector, indicating potential markets and needs based on company size. It also helps in understanding how different sized companies prioritize and engage with logistical challenges, which can be crucial for tailored marketing strategies or service offerings.