Executive Summary: Virtualization Research Trends in the Construction Industry

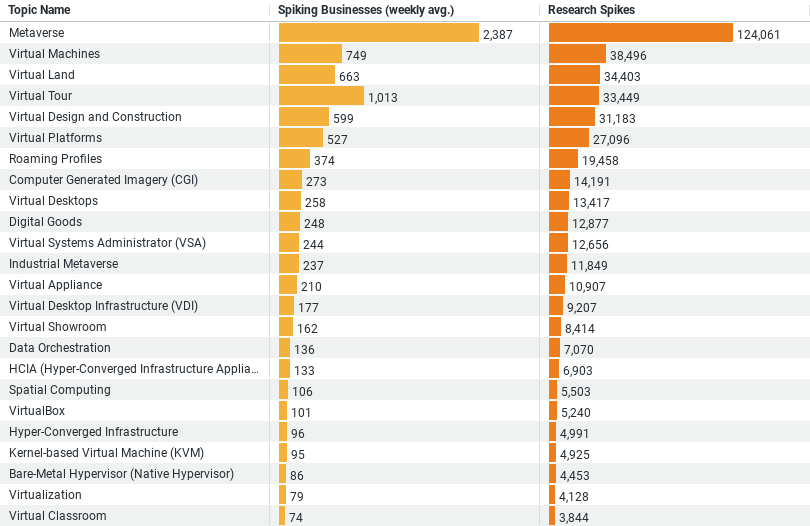

– Dominant Research Topic: The ‘Metaverse’ is the leading topic of interest, with approximately 2,387 businesses per week showing a spike in research, amounting to a total of 124,061 research spikes, indicating a strong industry focus on immersive virtual environments.

Other Key Topics

– Virtual Machines: Average of 749 spiking businesses weekly with a total of 38,496 research spikes.

– Virtual Land: Average of 663 spiking businesses weekly with a total of 34,403 research spikes.

– Virtual Tour: Average of 1,013 spiking businesses weekly with a total of 33,449 research spikes.

– Virtual Design and Construction: Average of 599 spiking businesses weekly with a total of 31,183 research spikes.

Trend Analysis

– The data suggests a robust interest across several facets of virtualization, notably in areas that enhance interactive experiences and operational efficiencies.

– There’s a balanced spread of interest in both conceptual (Metaverse, Virtual Land) and practical applications (Virtual Machines, Virtual Design) of virtual technologies.

Virtualization Trends in Construction: A Data-Driven Insight

The construction industry is currently experiencing a significant transformation, driven by advances in virtualization technology. This shift is not just about adopting new tools, but a fundamental change in how projects are conceptualized, planned, and executed. As we delve into the data, it’s evident that businesses within the industry are increasingly researching topics related to virtualization, with a keen focus on several key areas.

Metaverse: Leading the Charge

The standout topic in construction-related virtualization research is the Metaverse. Data shows an impressive average of 2,387 businesses per week experiencing spikes in Metaverse research, culminating in a staggering total of 124,061 research spikes. This massive interest suggests that the construction industry sees the Metaverse as more than just a digital space for interaction. It’s viewed as a potential game-changer for project visualization, stakeholder engagement, and even real-time collaboration across geographical boundaries.

Virtual Machines and Practical Applications

Following the Metaverse, Virtual Machines are the second most researched topic, with about 749 businesses per week showing increased interest. This indicates a total of 38,496 research spikes, underscoring the critical role of virtual machines in the construction sector. Virtual machines allow companies to run multiple operating systems and applications, facilitating simulations and testing environments that are crucial for the planning and execution of complex projects. This technology supports risk mitigation and ensures that various project phases can be tested virtually before actual construction begins.

Exploring Virtual Land and Tours

The interest in Virtual Land and Virtual Tours also highlights a significant trend. With 662 and 1,013 weekly spiking businesses, respectively, these areas are gaining traction. Virtual Land research, which includes studying digital representations of physical land, plays a vital role in project planning and design. Virtual Tours, on the other hand, are becoming essential for marketing and client engagement, providing immersive previews of proposed projects and ongoing constructions.

Virtual Design and Construction

Lastly, the topic of Virtual Design and Construction is also prominent, with around 599 businesses per week delving into this area. This segment of virtualization speaks to the integration of digital tools in the design and construction phases, enhancing accuracy and efficiency. With a total of 31,183 research spikes, it’s clear that there is a substantial push towards adopting technologies that streamline design processes and facilitate a more integrated approach to construction management.

Implications and Future Prospects

What does all this data suggest about the future of construction? For one, the shift towards virtualization is likely to accelerate further. As these technologies evolve, their integration into everyday construction practices will become more streamlined, leading to greater efficiencies and opening up new possibilities for remote and hybrid construction processes.

Moreover, the focus on the Metaverse and other virtualization topics indicates a shift towards more interactive and user-friendly models of construction. This could redefine client interactions, making them more engaging and informative, with the use of virtual reality and augmented reality becoming standard practice for project presentations and approvals.

In conclusion, the construction industry’s exploration into virtualization is a clear indicator of its readiness to embrace the future. By investing in these technologies, construction firms are not only enhancing their operational capabilities but are also setting the stage for a more dynamic, efficient, and innovative industry. As data continues to illuminate the path forward, one thing is certain: virtualization will play a pivotal role in shaping the future of construction.

Company Sample Data: Intent by Company Size

– Company Size: Categorizes companies based on the number of employees, ranging from micro to large enterprises.

– Spiking Businesses (weekly avg.): Represents the average weekly count of businesses within each size category that have shown a spike in interest in virtualization technologies.

– Percent of Total: The percentage representation of each company size category in relation to total businesses showing interest.

Breakdown of the Data

– Micro (1 – 9 Employees): On average, 551 businesses show spiking interest weekly, constituting about 9.6% of the total.

– Small (10 – 49 Employees): About 1501 businesses per week show interest, representing 26.1% of the total.

– Medium-Small (50 – 199 Employees: Leads with approximately 1676 businesses weekly, accounting for 29.2% of the total.

– Medium (200 – 499 Employees: Has an average of 840 businesses per week, making up 14.6% of the total.

– Medium-Large (500 – 999 Employees): An average of 454 businesses show interest weekly, about 7.9% of the total.

Analysis of Trends Depending on Company Sizes

– Smaller Companies (Micro and Small): These companies show significant engagement with virtualization technologies. Smaller firms may be more agile and able to adopt new technologies quicker than larger counterparts, allowing them to leverage virtual tools to compete more effectively in the market.

– Medium-Small Companies: This category shows the highest weekly spiking interest, likely due to having enough resources to invest in new technologies and the need to innovate to sustain growth and competitiveness.

– Larger Companies (Medium to Medium-Large): Although these companies have the resources, the proportion of businesses showing spiking interest is relatively lower compared to smaller companies. This could be due to longer decision-making processes and the complexity of integrating new technologies into established systems.

The trend suggests a robust interest in virtualization technologies across the board, with medium-sized businesses showing the highest engagement, likely driven by their balance of agility and resources. This pattern reflects the growing importance of virtualization in improving efficiency, reducing costs, and enhancing competitive advantage in various scales of the construction industry.