Executive Summary: Benefits Research Trends in the Construction Industry

The dataset reveals the construction industry’s significant engagement in researching benefits, particularly around retirement-related topics. Here’s a quick data-focused summary:

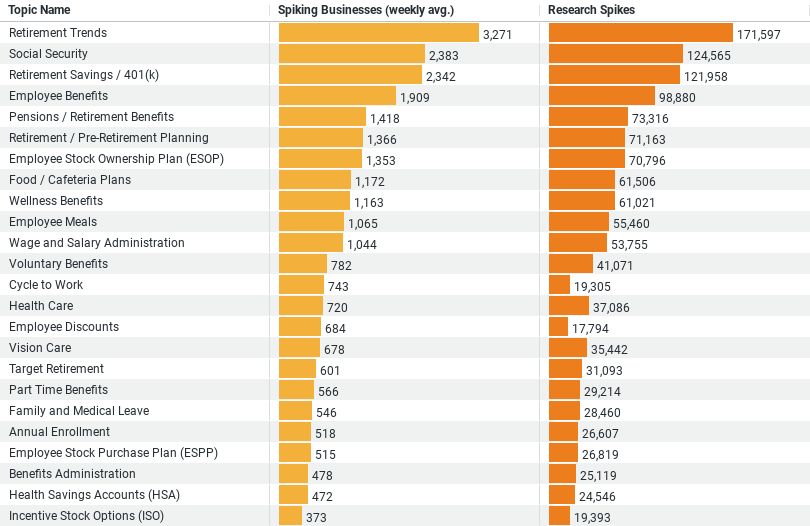

– Retirement Trends is the most researched topic, with a weekly average of 3,271 businesses showing interest and a total of 171,597 research spikes.

– Social Security and Retirement Savings / 401(k) also see substantial interest, with weekly averages of 2,383 and 2,341 spiking businesses respectively, and over 120,000 research spikes each, indicating a strong focus on securing financial stability for retirees.

– Employee Benefits, more broadly, are researched by 1,909 businesses weekly, with nearly 99,000 research spikes, highlighting a wider interest in employee welfare beyond retirement.

– Pensions / Retirement Benefits attract attention from 1,418 businesses weekly, with 73,316 research spikes, underscoring the ongoing relevance of traditional pension schemes.

This summary underscores a focused concern within the construction industry on enhancing retirement benefits and overall employee welfare, reflected in both the high levels of research activity and the diversity of topics being explored.

Unveiling the Construction Industry’s Focus on Benefits: A Deep Dive into Retirement and Employee Welfare

In the dynamic world of the construction industry, businesses are not just built on concrete and steel but are increasingly focusing on the foundation of their workforce’s future. A recent analysis of how the construction sector is researching benefits, especially around retirement and employee welfare, sheds light on the evolving priorities within the industry. Through an exploration of data, we uncover the depth of the industry’s commitment to ensuring the financial security and well-being of its employees.

The dataset reveals a strong inclination towards retirement-related research, with Retirement Trends leading the pack. An average of 3,271 businesses per week are spiking in their research efforts on this topic, cumulating to an astounding 171,597 research spikes. This data not only underscores the industry’s foresight in planning for the future but also reflects a comprehensive approach to understanding and implementing retirement benefits that cater to the evolving needs of the workforce.

Following closely are topics like Social Security and Retirement Savings / 401(k), with weekly averages of 2,383 and 2,341 spiking businesses respectively, and over 120,000 research spikes each. These numbers are a testament to the construction industry’s balanced focus on both government-provided social security benefits and privately managed retirement savings plans. This dual approach signifies an understanding of the importance of financial stability in retirement, ensuring that employees have access to a secure financial future through multiple avenues.

Beyond retirement-specific interests, the data also highlights a broader concern with Employee Benefits, drawing attention from 1,909 businesses on a weekly basis and nearing 99,000 research spikes. This indicates an industry-wide effort to explore a wide range of benefits, aiming not only to attract but also to retain talent by offering comprehensive packages that go beyond the traditional scope of retirement planning.

Pensions / Retirement Benefits specifically garner interest from 1,418 businesses weekly, with 73,316 research spikes, pointing towards a continued relevance of traditional pension schemes alongside newer retirement saving strategies. This diversity in research interests suggests a nuanced approach to employee benefits, recognizing the value of traditional pension schemes while also adapting to modern retirement saving tools and practices.

The construction industry’s focused research on these topics suggests several key trends:

1. A Holistic Approach to Employee Benefits:

The data indicates a shift towards more holistic employee benefits packages. By researching a broad spectrum of topics from retirement trends to employee benefits at large, the construction industry demonstrates a commitment to enhancing the overall well-being of its workforce.

2. Future-Proofing the Workforce:

The emphasis on retirement-related research reflects a strategic approach to future-proofing the workforce. In recognizing the importance of financial stability for retirees, the industry is investing in the future of its employees, ensuring they have the means to secure a comfortable retirement.

3. Adaptation to Modern Retirement Needs:

The balanced interest in both traditional pension schemes and modern retirement savings plans highlights the industry’s adaptability to the changing landscape of retirement planning. This flexibility ensures that the benefits offered are relevant and appealing to a diverse workforce.

4. Attraction and Retention of Talent:

Through comprehensive benefits packages that include a strong focus on retirement planning, the construction industry is positioning itself as a sector that values and invests in its employees. This not only aids in attracting new talent but also plays a crucial role in retaining skilled workers.

Conclusion

The construction industry’s research into benefits, particularly around retirement and employee welfare, reveals a sector that is deeply invested in the financial security and well-being of its workforce. This strategic focus not only enhances the industry’s appeal to current and prospective employees but also builds a more stable and secure future for those who are at the heart of building our physical world. As the industry continues to evolve, its dedication to researching and implementing comprehensive benefits packages will undoubtedly play a key role in shaping its success and sustainability.

Company Sample Data on Researching the Topic of Benefits in the Construction Industry

This data sheds light on a significant trend within the corporate landscape, illustrating how company size influences research intensity and areas of focus. Here’s a breakdown of the findings:

1. Micro (1 – 9 Employees): This segment shows an average of 1,572.85 spiking businesses weekly, which accounts for 11.23% of the total research activity observed. This suggests that even the smallest companies are actively engaging in research, though their share of the total activity is relatively small, likely due to their limited resources and narrower scope of operation.

2. Small (10 – 49 Employees): Small businesses display a considerably higher level of research activity, with 4,376.37 spiking businesses on average each week, making up 31.25% of the total. This jump reflects the increased capacity for research as companies grow, highlighting the importance of market research, competitive analysis, and strategic planning in this size bracket.

3. Medium-Small (50 – 199 Employees): This category sees the highest level of engagement, with 4,452.06 spiking businesses weekly, contributing to 31.79% of the overall research. The slight increase from small to medium-small companies underscores a critical point of growth, where businesses possess the resources and perhaps face the competitive pressures that necessitate deeper and more frequent research activities.

4. Medium (200 – 499 Employees): There’s a noticeable dip in research activity for medium-sized companies, with 1,756.19 spiking businesses weekly, accounting for 12.54% of the total. This reduction could be attributed to these companies having established more stable market positions, thus requiring less frequent research compared to their smaller counterparts.

5. Medium-Large (500 – 999 Employees): The trend continues to decline as company size increases, with medium-large businesses showing 773.23 spiking businesses weekly, representing 5.52% of the total research activity. This suggests that as companies grow larger, their research activities might become more targeted and less frequent, possibly due to having dedicated teams or departments that can conduct more efficient and focused research.

Why This Is a Trend

The data illustrates a clear correlation between company size and research activity, indicating a bell curve-like trend where research intensity increases from micro to medium-small companies before decreasing as company sizes grow further. This pattern can be attributed to several factors:

– Resource Allocation: Smaller companies, while limited in resources, must engage in research to identify growth opportunities and understand their market better. As companies grow, they have more resources to allocate towards comprehensive research activities.

– Strategic Needs: Medium-small companies, being at a critical growth stage, may have the most significant strategic need for research to navigate competition and market dynamics effectively.

– Efficiency and Focus: Larger companies likely have established market positions and may focus their research more narrowly on specific areas of interest or innovation, leading to a decrease in the breadth of research activity observed.

This trend reflects the evolving needs and strategic focuses of companies as they grow, highlighting the importance of adapting research strategies to match company size and market positioning.