Executive Summary: Performance Research Trends in the Construction Industry

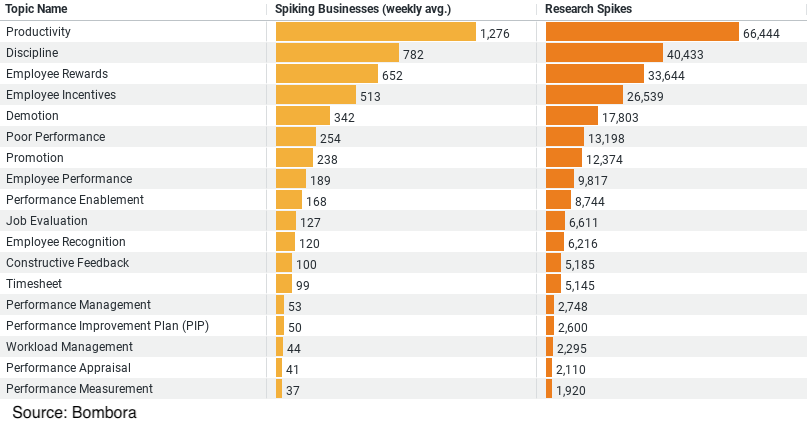

1. Dominant Topic: “Productivity” emerges as the most researched topic, with the highest average number of spiking businesses per week (approximately 1276) and the highest total number of research spikes (66444).

2. Top Concerns: Following “Productivity”, the next most significant topics based on both spiking businesses and research spikes are “Discipline” and “Employee Rewards”, indicating strong industry focus on these areas.

3. Variability in Interest: The data shows a high variance in the number of spiking businesses across different topics, with a standard deviation of about 330, reflecting a broad range of focus areas within the industry.

4. Range of Research Activity: Research spikes vary widely from 1920 to 66444, suggesting varied depth and intensity of research across different performance topics.

5. Concentration of Research: Analysis of both spiking businesses and research spikes reveals that a few key topics consistently draw the most attention, suggesting focused research efforts in these areas.

Exploring Performance: Key Research Trends in the Construction Industry

The construction industry, known for its dynamic environments and high demands on efficiency and output, continuously seeks ways to enhance performance. A recent analysis of industry data sheds light on how businesses are researching and prioritizing different aspects of performance to drive productivity and efficiency.

Intense Focus on Productivity

The standout topic from the data is “Productivity,” which has the highest average number of weekly spiking businesses, approximately 1276, and a staggering total of 66444 research spikes. This overwhelming interest in productivity highlights it as the cornerstone of industry concerns. The focus isn’t surprising, given that productivity directly impacts a project’s timeline and budget, two critical success factors in construction.

Productivity in construction can be influenced by numerous factors, including technology adoption, workforce management, and process optimization. It seems the industry is keen on discovering and implementing strategies that yield the best results in these areas. Research into productivity often covers a broad spectrum, from the latest construction technologies like Building Information Modeling (BIM) and modular construction techniques to time management and resource allocation methods.

Workforce Management: Discipline and Employee Rewards

The next topics that garnered significant attention are “Discipline” and “Employee Rewards,” with about 782 and 652 average weekly spiking businesses respectively. These topics underline the industry’s recognition of the workforce’s role in achieving high performance.

Discipline within the construction sector often pertains to adherence to safety standards, regulatory compliance, and maintaining schedules. Effective discipline ensures that projects proceed without unnecessary delays and adhere to set budgets, all while maintaining workplace safety. Research in this area likely explores best practices for training and maintaining a disciplined workforce.

Employee rewards, on the other hand, reflect the industry’s interest in employee satisfaction and retention—key aspects that contribute to overall productivity. Incentivizing employees not only boosts morale but also encourages a culture of excellence. Construction firms are researching effective reward systems that can include monetary bonuses, career advancement opportunities, and recognition programs.

Employee Incentives and the Surprising Interest in Demotion

Rounding out the top topics are “Employee Incentives” and “Demotion.” With about 513 and 342 average weekly spiking businesses respectively, these topics suggest a nuanced approach to human resource management within the construction industry. Incentives are closely tied to employee rewards but focus more on direct motivations that can improve performance on a day-to-day basis. These might include performance-linked pay, project completion bonuses, or other short-term incentives.

Demotion, while less researched compared to other topics, still presents an interesting facet of performance management. It indicates an industry grappling not just with promoting and incentivizing top performers but also with managing underperformance effectively. Research into demotion likely explores its impact on team morale and productivity, providing insights into how best to implement such measures without disrupting project continuity or team cohesion.

Conclusion

The construction industry’s intense interest in these topics points to a broad and deep commitment to enhancing performance. By understanding and acting on the insights derived from these research spikes, industry leaders can better craft strategies that not only improve productivity but also foster a motivated, efficient, and disciplined workforce. As research continues to evolve, it will be fascinating to see how new strategies and technologies are adopted to drive performance in construction to new heights.

Company Sample Data

1. Company Size: This column categorizes companies into different size groups based on the number of employees. The categories range from “Micro (1 – 9 Employees)” to “Large” and possibly beyond.

2. Spiking Businesses (weekly avg.): This column shows the average number of businesses within each size category that have demonstrated a significant spike in research interest each week.

3. Percent of Total: This column represents the percentage share of each company size category in the total number of spiking businesses.

Initial Observations

From the preview of the data, it is evident that the medium-small category (50 – 199 employees) has the highest weekly average of spiking businesses at about 945, followed by small (10 – 49 employees) and medium (200 – 499 employees) categories. The micro category, despite being the smallest in terms of company size, still shows a considerable average of about 281 spiking businesses per week.

Trends Across Company Sizes

The trend across various company sizes could reflect the differences in resources, priorities, and strategic focuses inherent to each size category:

– Micro and Small Companies: These companies might focus intensely on niche or emerging topics as they seek to find unique competitive edges in the market. Their smaller size allows for quicker decision-making and adaptability, which is reflected in their substantial representation in the data.

– Medium-Small to Medium-Large Companies: As companies grow, their focus might shift towards scaling their operations and optimizing existing processes, thus researching broader or more complex topics. This is possibly why the medium-small category leads in the number of spiking businesses.

– Larger Companies: Although not shown in the initial preview, larger companies may exhibit fewer spikes in research due to having more established practices and less frequent shifts in strategic focus. However, when they do research, it could be on a larger scale and with substantial investment.

This variation in research intensity and focus areas across different company sizes suggests that each segment may pursue knowledge and innovation in ways that best fit their operational scale and market strategy. The dataset provides valuable insights into how different types of companies prioritize and engage with new information, potentially influenced by their capacity to adapt and innovate.