Pac-Man, Bicycles, and Selling Your Business

Private equity is all over the Mechanical/HVAC space, but what does that actually mean for contractors? If you’ve ever gotten one of those calls from a PE firm, you’re not alone. And if you’ve wondered whether selling is the right move, you’re also not alone.

We sat down with David McCombie and Tito Gil of McCombie Group to talk through what’s really happening in the market, what PE firms look for, and how business owners can set themselves up for the best possible deal (or just build a stronger business).

Catch the full conversation here. And below the video is a recap.

Why HVAC? And Why Now?

David broke it down into three key reasons:

- Recession-resistant: HVAC is an essential service, meaning customers need it no matter the economic climate.

- Fragmented market: With a lot of smaller companies, there’s opportunity for consolidation.

- Growth tailwinds: Demand for HVAC is outpacing the economy, especially in the South where climate control is non-negotiable.

And as Tito pointed out, COVID was a moment of proof: “Your neighbors couldn’t come over. Grandma couldn’t visit. But the A/C repair guy? Let him in!”

That resilience made HVAC one of the hottest targets for investment in recent years. In 2019, there were around 25 national consolidators in the space. Today? Over 80.

The Emotional Side of Selling

Tito was blunt: “I had no emotional connection to my business. My three bikes in my garage? Way more sentimental value.”

But that’s not the norm. For many owners, their business isn’t just an asset—it’s their identity. Selling it is like handing over a part of themselves. And that’s why control (or perceived loss of it) is such a major concern.

David likened selling a business to getting married: “You’re going to be financially tied to this buyer for years. It’s like picking a financial spouse. So just like you’d ask big questions before marriage—kids? religion?—you need to ask those questions before selling.”

Key takeaway? It’s not just about price. It’s about fit.

"You Don’t Have a Business. You Have a Job."

David’s line hit hard: “If you can’t go to Europe for a month without getting calls, you don’t have a business. You have a job.”

Buyers don’t just look at revenue—they look at how dependent the business is on the owner. If everything runs through you, that’s a risk.

Tito framed it as a thought experiment: Would you rather work the next 10-15 years in your business or work 6-9 months on a sale and walk away with the same money?

Whether you’re selling or not, a stable, independent operation is more valuable. PE firms love businesses with strong management teams, service-based revenue, and workforce stability. If your team has been around for years instead of months, that’s a huge selling point.

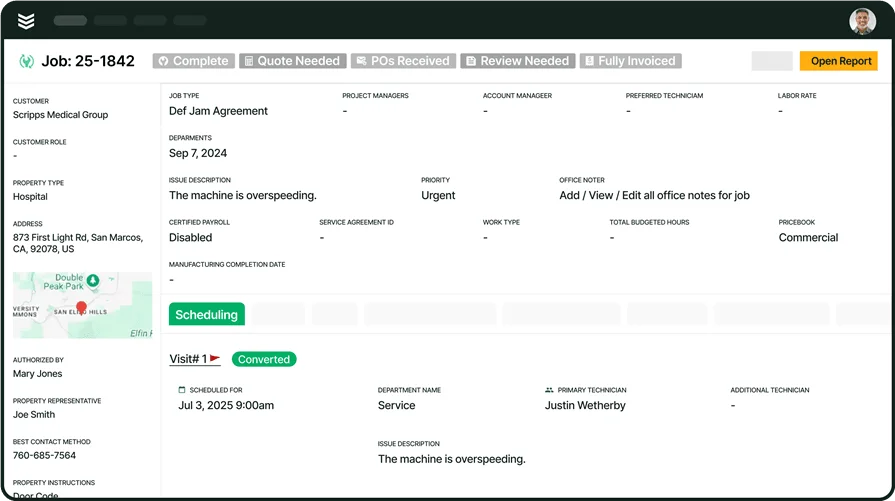

Prove PE-Ready Performance

Track margins, labor, and service KPIs buyers ask about.

PE Strategy: The Pac-Man Effect

David introduced an analogy: The PE world is basically Pac-Man.

Private equity firms buy one large company as the “platform” and then start acquiring smaller ones to build regional or national giants. If your company is small, you’re likely selling to one of these platforms. If you’re large enough, you might become the platform, attracting buyers beyond just the existing players in your area.

Either way, understanding where you fit in that picture is crucial.

The Biggest Takeaways

Tito: “Educate yourself on your company’s real-world valuation. Whether you sell or not, you need to know where you stand.”

David: “Hire an M&A advisor. PE firms buy businesses for a living. If you sell without representation, you’re leaving money on the table.”**

The kicker? Studies show sellers with representation get 25% more than those who go it alone. Even private equity firms don’t sell without an advisor.

Thinking about selling? Start by getting informed. Whether you’re years away or just starting to think about it, the right knowledge puts you in control.

And if you’re getting those cold calls from PE firms? Now you know why.

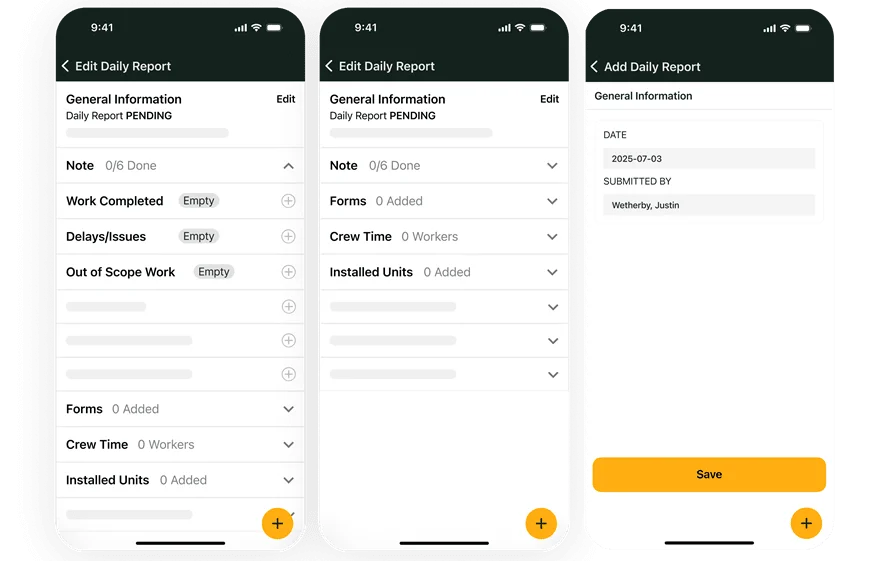

BuildOps for Mechanical and HVAC Contractors

Accurate job costing. Clean WIP. All in one platform.